|

市场调查报告书

商品编码

1844371

智慧烤箱市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Ovens Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

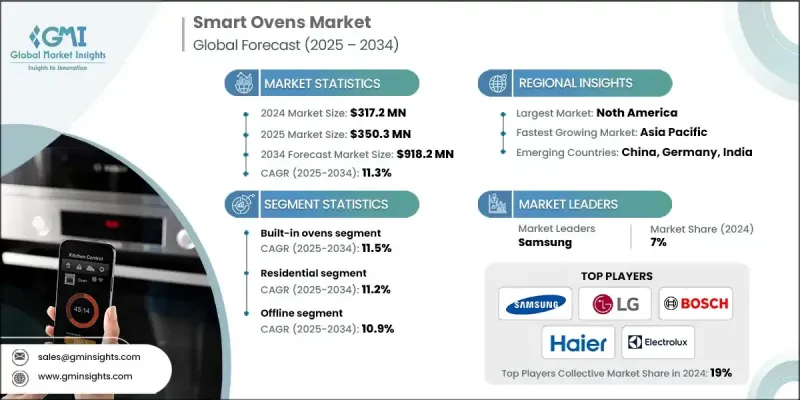

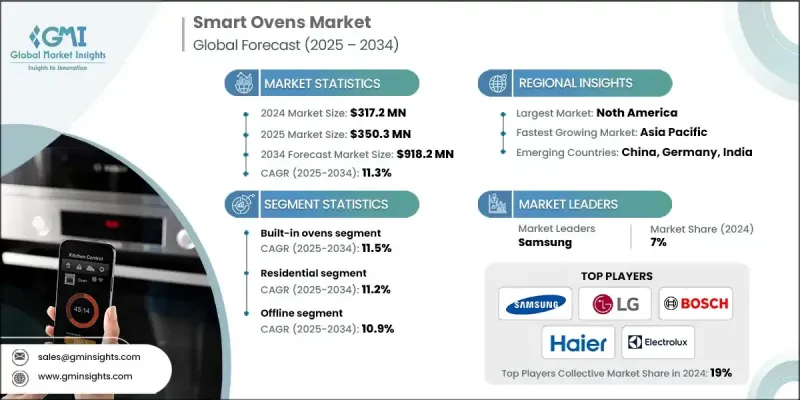

2024 年全球智慧烤箱市场价值为 3.172 亿美元,预计将以 11.3% 的复合年增长率成长,到 2034 年达到 9.182 亿美元。

智慧家庭技术的日益融合以及人们对自动化、省时的厨房解决方案日益增长的需求,推动了智慧烤箱的快速成长。消费者越来越青睐能够连接Wi-Fi、与语音助理同步并提供远端存取的电器——而这些正是当今智慧烤箱的关键功能。对能源效率和永续性的追求也促使消费者选择能够优化用电并最大程度减少食物浪费的烤箱。这些电器提供精准的控制和智慧功能,吸引了注重能源使用和便利性的消费者。这种需求也与不断变化的消费习惯密切相关,尤其是在城市中心,快节奏的生活方式要求人们有效率地准备食物。人们开始青睐支持气炸锅、烧烤和蒸煮等健康烹饪技巧的多功能烤箱。线上零售平台的激增进一步扩大了产品的曝光度,使消费者能够研究规格、比较价格并做出明智的决定。电子商务在推动已开发市场和新兴市场的认知度和普及度方面发挥着重要作用,支持智慧烤箱产业的持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.172亿美元 |

| 预测值 | 9.182亿美元 |

| 复合年增长率 | 11.3% |

2024年,嵌入式烤箱类别的市场规模达到2.079亿美元,预计到2034年将以11.5%的复合年增长率成长。该细分市场受益于对无缝整合厨房设计日益增长的需求。嵌入式烤箱因其美观和节省空间的特性而日益受到欢迎,尤其是在现代都市家庭中。它们通常配备智慧连接、节能功能和直觉的操控,这与当前消费者的期望相符。市场领导者正大力提升使用者介面、自动化程度和设计灵活性,使这些烤箱在现代厨房中更具吸引力。材料、触控萤幕和模组化配置方面的创新正在帮助製造商满足住宅买家不断变化的需求。

2024年,家用电器市场占据了85%的市场份额,预计2025年至2034年的复合年增长率将达到11.2%。这一主导地位的驱动力在于家庭对智慧多功能厨房电器的需求不断增长。随着可支配收入的增加和智慧生活的兴起,消费者越来越重视便利性和性能。语音控制、智慧型手机连接和能源优化等功能对精通科技的房主尤其有吸引力。此外,人们对家庭烹饪和烘焙的兴趣日益浓厚,为兼具多功能性和易用性的烤箱创造了强劲的市场。随着人们居家时间的增加以及希望在家庭环境中复製专业烹饪体验的愿望,这一趋势更加明显。

2024年,美国智慧烤箱市场规模达8,350万美元,占77%的市占率。美国在智慧家庭普及方面的领先地位,加上对节能和互联家电的需求不断增长,在智慧烤箱销售成长中发挥了关键作用。美国各地对智慧基础设施和家庭自动化的投资不断增加,进一步推动了消费者对高性能烹饪电器的需求。消费者越来越多地将智慧烤箱融入新房和厨房装修中,使其成为许多智慧家庭生态系统的标准配备。

全球智慧烤箱市场的主要参与者包括惠而浦、通用电器、三星、夏普、UNOX、LG 电子、KitchenAid、June Oven、伊莱克斯、Breville、Alto-Shaam、BSH 家电、Nuwave、海尔和 Fagor Professional。为了巩固其在全球智慧烤箱市场的地位,领先公司正专注于持续创新和增强连接功能。许多品牌正在推出具有应用程式整合、即时食谱指导和人工智慧驱动的烹饪自动化功能的先进型号,以提升用户体验。对节能技术和语音助理相容性的策略性投资也帮助品牌脱颖而出。与智慧家庭生态系统供应商和电子商务平台的合作正在扩大他们的数位足迹。此外,製造商透过产品差异化、直觉的介面和为现代城市生活量身定制的模组化厨房解决方案,瞄准高端和中端市场。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 嵌入式烤箱

- 檯面烤箱

- 独立式烤箱

第六章:市场估计与预测:依配置类型,2021 - 2034 年

- 主要趋势

- 单炉

- 双炉

第七章:市场估计与预测:按烹饪技术,2021 - 2034 年

- 主要趋势

- 对流

- 传统的

- 蒸气喷射

- 其他(Advantium等)

第八章:市场估计与预测:依价格区间,2021 - 2034 年

- 主要趋势

- 低于1000美元

- 1000-2000美元

- 2000美元以上

第九章:市场估计与预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- HoReCa

- 办公室

- 饭店业

- 卫生保健

- 其他(度假村和游轮等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 专业零售店

- 其他(独立零售商等)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Alto-Shaam

- Breville

- BSH Home Appliances

- Electrolux

- Fagor Professional

- GE Appliances

- Haier

- June Oven

- KitchenAid

- LG Electronics

- Nuwave

- Samsung

- Sharp

- UNOX

- Whirlpool

The Global Smart Ovens Market was valued at USD 317.2 million in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 918.2 million by 2034.

The rapid growth is fueled by the rising integration of smart home technology and the growing desire for automated, time-saving kitchen solutions. Consumers are increasingly seeking appliances that can connect to Wi-Fi, sync with voice assistants, and provide remote access-all key features of today's smart ovens. The push toward energy efficiency and sustainability is also motivating buyers to opt for ovens that optimize power usage and minimize food waste. These appliances offer precise control and intelligent features that appeal to consumers who are conscious of energy use and convenience. The demand is also closely linked to evolving consumer habits, especially in urban centers where fast-paced lifestyles demand efficient meal preparation. People are turning to multifunctional ovens that support healthy cooking techniques like air frying, grilling, and steaming. The surge in online retail platforms has further expanded product visibility, enabling customers to research specifications, compare prices, and make informed decisions. E-commerce is playing a significant role in driving awareness and adoption across both developed and emerging markets, supporting the continued growth of the smart ovens industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $317.2 Million |

| Forecast Value | $918.2 Million |

| CAGR | 11.3% |

The built-in oven category segment generated USD 207.9 million in 2024 and is projected to grow at a CAGR of 11.5% throughout 2034. This segment benefits from the rising demand for seamless, integrated kitchen designs. Built-in ovens are gaining popularity for their aesthetic appeal and space-saving attributes, especially in modern urban homes. They are often equipped with smart connectivity, energy-saving features, and intuitive controls, which align well with current consumer expectations. Market leaders are focusing heavily on enhancing user interface, automation, and design flexibility, making these ovens even more attractive for contemporary kitchens. Innovations in materials, touchscreens, and modular configurations are helping manufacturers keep up with the evolving needs of residential buyers.

The residential segment held an 85% share in 2024 and is anticipated to grow at a CAGR of 11.2% from 2025 to 2034. This dominance is driven by rising household demand for intelligent, multifunctional kitchen appliances. As disposable incomes rise and smart living gains traction, consumers are prioritizing convenience and performance. Features such as voice control, smartphone connectivity, and energy optimization are particularly appealing to tech-savvy homeowners. In addition, the growing interest in home cooking and baking has created a strong market for ovens that offer both versatility and ease of use. The trend is amplified by the increased time spent at home and the desire to replicate professional cooking experiences in domestic settings.

United States Smart Ovens Market generated USD 83.5 million and held a 77% share in 2024. The country's leadership in smart home adoption, coupled with rising demand for energy-efficient and connected appliances, has played a key role in boosting smart oven sales. Increased investment in smart infrastructure and home automation across the U.S. is further driving consumer demand for high-performance cooking appliances. Consumers are increasingly incorporating smart ovens into new homes and kitchen renovations, making them a standard feature in many smart home ecosystems.

Key players in the Global Smart Ovens Market include Whirlpool, GE Appliances, Samsung, Sharp, UNOX, LG Electronics, KitchenAid, June Oven, Electrolux, Breville, Alto-Shaam, BSH Home Appliances, Nuwave, Haier, and Fagor Professional. To strengthen their position in the global smart ovens market, leading companies are focusing on continuous innovation and enhanced connectivity features. Many brands are introducing advanced models with app integration, real-time recipe guidance, and AI-driven cooking automation to elevate the user experience. Strategic investments in energy-efficient technologies and voice assistant compatibility are also helping brands stand out. Partnerships with smart home ecosystem providers and e-commerce platforms are expanding their digital footprint. Additionally, manufacturers are targeting premium and mid-range segments through product differentiation, intuitive interfaces, and modular kitchen solutions tailored for modern urban living.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Configuration type

- 2.2.4 Cooking technology

- 2.2.5 Price range

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Built-in ovens

- 5.3 Countertop ovens

- 5.4 Freestanding ovens

Chapter 6 Market Estimates & Forecast, By Configuration Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Single ovens

- 6.3 Double ovens

Chapter 7 Market Estimates & Forecast, By Cooking Technology, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Convection

- 7.3 Traditional

- 7.4 Steam injection

- 7.5 Others (advantium etc.)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Below $1000

- 8.3 $1000-$2000

- 8.4 Above $2000

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 HoReCa

- 9.3.2 Offices

- 9.3.3 Hospitality

- 9.3.4 Healthcare

- 9.3.5 Others (resort & cruise etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets/hypermarket

- 10.3.2 Specialty retail stores

- 10.3.3 Others (independent retailer etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Alto-Shaam

- 12.2 Breville

- 12.3 BSH Home Appliances

- 12.4 Electrolux

- 12.5 Fagor Professional

- 12.6 GE Appliances

- 12.7 Haier

- 12.8 June Oven

- 12.9 KitchenAid

- 12.10 LG Electronics

- 12.11 Nuwave

- 12.12 Samsung

- 12.13 Sharp

- 12.14 UNOX

- 12.15 Whirlpool