|

市场调查报告书

商品编码

1844377

重型起重设备市场机会、成长动力、产业趋势分析及2025-2034年预测Heavy Lifting Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

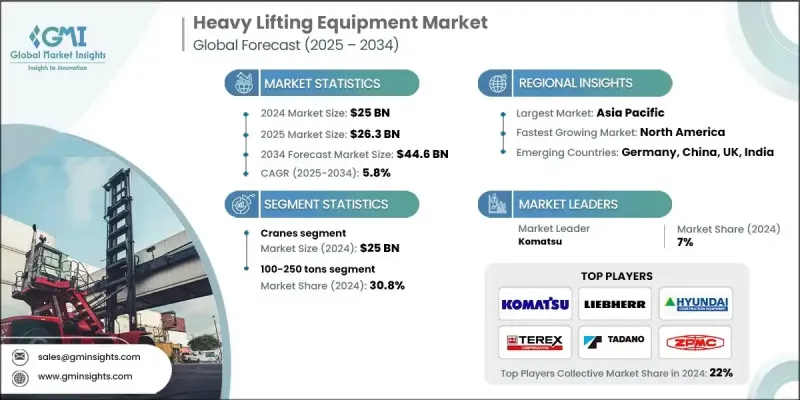

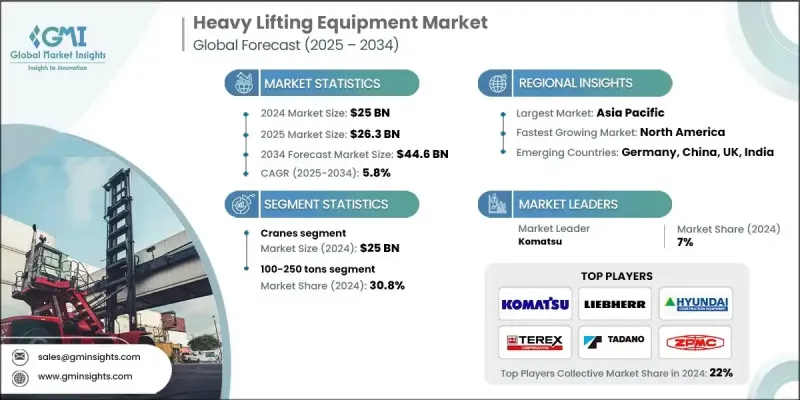

2024 年全球重型起重设备市场价值为 250 亿美元,预计到 2034 年将以 5.8% 的复合年增长率增长至 446 亿美元。

全球快速的城市化、工业扩张和不断增加的基础设施投资推动了市场的成长。重型起重设备在大型专案建设、高效采矿作业、发电以及无缝运输和物流管理中发挥关键作用。由于自动化、电气化以及物联网和远端资讯处理等数位技术的进步,起重机、提昇机和运输机等重型起重设备的需求显着增长,这些技术提高了操作安全性、效率和维护性。此外,随着各行各业致力于减少排放并遵守更严格的环境法规,电动和混合动力重型起重设备的采用正在加速。这种转变在欧洲和北美等製定了积极永续发展目标的地区尤为明显,这些地区的政府政策和企业的环境、社会和治理 (ESG) 承诺正在推动从柴油驱动机械向柴油驱动机械的转变。先进的电池系统、再生煞车和节能液压系统的整合使企业能够降低营运成本,同时提高环境绩效。此外,远端诊断、预测性维护和远端资讯处理监控等创新技术使这些机器即使在复杂的工业环境中也能更加安全、高效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 250亿美元 |

| 预测值 | 446亿美元 |

| 复合年增长率 | 5.8% |

2024年,100-250吨级起重机市场占有30.8%的份额。此重量级起重机在中型至重型起重应用中发挥至关重要的作用,广泛应用于基础设施扩建、采矿作业和大型工业专案。这些起重机在机动性和起重能力之间实现了良好的平衡,非常适合执行诸如桥樑段定位、风力涡轮机安装以及超大型工业设备运输等复杂任务。它们既能适应人口稠密的城区,也能适应偏远地区,这进一步增加了其在各种作业环境中日益增长的需求。

2024年,起重机细分市场产值达250亿美元,凸显了其在重型起重设备领域的重要性。此细分市场涵盖各种专用机械,例如履带起重机、塔式起重机、移动式起重机、龙门起重机和桥式起重机,每种机械均经过量身定制,以满足製造、航运、能源和建筑等行业的不同需求。这些机械经过精心设计,可提供精确的起重能力,确保在严苛的专案条件下安全高效地处理重物。

到2034年,亚太地区重型起重设备市场的复合年增长率将达到6.5%,这得益于中国、印度和东南亚地区大规模的基础设施建设项目,以及为解决劳动力短缺问题而日益普及的自动化和半自动化设备。全球和本地企业的参与,加上经济高效的创新,正在加速该地区的市场渗透。

影响重型起重设备市场的关键参与者包括多田野、科尼起重机、上海振华重工(ZPMC)、萨伦斯、帕尔菲格、三一重工、马尼托瓦克公司、森尼博根、小松、利勃海尔、特雷克斯、卡哥特科、玛姆特、JASO工业起重机和德马格起重机及零部件。这些公司正在投资开发更智慧、更安全、更环保的起重解决方案,以满足全球各行各业不断变化的需求。随着数位转型和环保意识持续影响设备采购决策,重型起重设备市场可望在未来十年实现强劲持续的成长。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 加强基础建设

- 采矿业和石油天然气产业的成长

- 风能项目扩张

- 产业陷阱与挑战

- 初期投资及维护成本高

- 熟练劳动力短缺

- 机会

- 新兴经济体的基础建设发展

- 自动化及智慧装备集成

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 编码 - 8428)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按设备类型,2021 - 2034 年

- 主要趋势

- 起重机

- 移动式起重机

- 全地面起重机

- 履带起重机

- 越野轮胎起重机

- 车载起重机

- 固定起重机

- 塔式起重机

- 桥式起重机

- 龙门起重机

- 单轨起重机

- 船舶和港口起重机

- 移动式起重机

- 起重机

- 电动葫芦

- 油压提昇机

- 手动葫芦

- 运输者

- 自行式模组化运输车(SPMTS)

- 重型拖车

- 专用运输车辆

第六章:市场估计与预测:按重量容量,2021 - 2034 年

- 主要趋势

- 100-250吨

- 251-500吨

- 501-1000吨

- 1000吨以上

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 建造

- 石油和天然气

- 矿业

- 航运和港口运营

- 海洋与造船业

- 船厂营运

- 海上建筑

- 船舶维护和修理

- 海军建设

- 发电

- 常规电力

- 再生能源

- 製造业

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Cargotec

- Demag Cranes & Components

- JASO Industrial Cranes

- Komatsu

- Konecranes

- Liebherr

- Mammoet

- Manitowoc Company

- Palfinger

- SANY

- Sarens

- Sennebogen

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Tadano

- Terex

The Global Heavy Lifting Equipment Market was valued at USD 25 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 44.6 billion by 2034.

Market growth is driven by rapid urbanization, industrial expansion, and increasing infrastructure investments worldwide. Heavy lifting equipment plays a critical role in enabling the construction of large-scale projects, efficient mining operations, power generation, and seamless shipping and logistics management. The demand for heavy lifting equipment such as cranes, hoists, and transporters has seen significant growth due to advances in automation, electrification, and digital technologies like IoT and telematics, which enhance operational safety, efficiency, and maintenance. In addition, the adoption of electric and hybrid-powered heavy lifting equipment is accelerating as industries aim to reduce emissions and comply with stricter environmental regulations. This shift is particularly evident in regions with aggressive sustainability targets, such as Europe and North America, where government policies and corporate ESG commitments are pushing the transition away from diesel-powered machinery. The integration of advanced battery systems, regenerative braking, and energy-efficient hydraulics is enabling companies to lower operational costs while enhancing environmental performance. Furthermore, innovations such as remote diagnostics, predictive maintenance, and telematics-enabled monitoring are making these machines safer and more productive, even in complex industrial settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Billion |

| Forecast Value | $44.6 Billion |

| CAGR | 5.8% |

The 100-250 tons crane segment held a 30.8% share in 2024. Cranes in this weight class play a vital role in medium to heavy lifting applications and are widely used in infrastructure expansion, mining operations, and large-scale industrial projects. With their strong balance between mobility and lifting strength, these cranes are ideal for complex tasks such as positioning bridge sections, installing wind turbines, and transporting oversized industrial equipment. Their adaptability to function in both densely populated urban zones and remote locations adds to their growing demand across a wide range of operational environments.

In 2024, the cranes segment generated USD 25 billion, underscoring its significance within the heavy lifting equipment sector. This segment includes a variety of specialized machines, such as crawler cranes, tower cranes, mobile cranes, gantry cranes, and overhead cranes, each tailored to serve distinct needs in industries like manufacturing, shipping, energy, and construction. These machines are engineered to deliver precise lifting capabilities, ensuring safe and efficient handling of heavy loads in demanding project conditions.

Asia-Pacific Heavy Lifting Equipment Market will grow at a CAGR of 6.5% through 2034, attributed to massive infrastructure development projects in China, India, and Southeast Asia, alongside increasing adoption of automation and semi-autonomous equipment to address labor shortages. The presence of both global and local players, combined with cost-efficient innovations, is accelerating market penetration in the region.

Key players shaping the Heavy Lifting Equipment Market include Tadano, Konecranes, Shanghai Zhenhua Heavy Industries (ZPMC), Sarens, Palfinger, SANY, Manitowoc Company, Sennebogen, Komatsu, Liebherr, Terex, Cargotec, Mammoet, JASO Industrial Cranes, and Demag Cranes & Components. These companies are investing in the development of smarter, safer, and greener lifting solutions to meet the evolving demands of industries worldwide. As digital transformation and environmental awareness continue to influence equipment purchasing decisions, the heavy lifting equipment market is poised for robust and sustained growth throughout the next decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Weight Capacity

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing infrastructure development

- 3.2.1.2 Growth in mining and oil & gas sectors

- 3.2.1.3 Expansion of wind energy projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Skilled labour shortage

- 3.2.3 Opportunities

- 3.2.3.1 Infrastructure development in emerging economies

- 3.2.3.2 Automation and smart equipment integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 8428)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Cranes

- 5.2.1 Mobile cranes

- 5.2.1.1 All-terrain cranes

- 5.2.1.2 Crawler cranes

- 5.2.1.3 Rough terrain cranes

- 5.2.1.4 Truck-mounted cranes

- 5.2.2 Fixed cranes

- 5.2.2.1 Tower cranes

- 5.2.2.2 Overhead cranes

- 5.2.2.3 Gantry cranes

- 5.2.2.4 Monorail cranes

- 5.2.3 Marine & port cranes

- 5.2.1 Mobile cranes

- 5.3 Hoists

- 5.3.1 Electric hoists

- 5.3.2 Hydraulic hoists

- 5.3.3 Manual hoists

- 5.4 Transporters

- 5.4.1 Self-propelled modular transporters (SPMTS)

- 5.4.2 Heavy haul trailers

- 5.4.3 Specialized transport vehicles

Chapter 6 Market Estimates and Forecast, By Weight Capacity, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 100-250 Tons

- 6.3 251-500 Tons

- 6.4 501-1000 Tons

- 6.5 Above 1000 Tons

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Oil & gas

- 7.4 Mining

- 7.5 Shipping & port operations

- 7.6 Marine and Shipbuilding

- 7.6.1 Shipyard Operations

- 7.6.2 Offshore Construction

- 7.6.3 Vessel Maintenance and Repair

- 7.6.4 Naval Construction

- 7.7 Power generation

- 7.7.1 Conventional power

- 7.7.2 Renewable energy

- 7.8 Manufacturing

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Cargotec

- 10.2 Demag Cranes & Components

- 10.3 JASO Industrial Cranes

- 10.4 Komatsu

- 10.5 Konecranes

- 10.6 Liebherr

- 10.7 Mammoet

- 10.8 Manitowoc Company

- 10.9 Palfinger

- 10.10 SANY

- 10.11 Sarens

- 10.12 Sennebogen

- 10.13 Shanghai Zhenhua Heavy Industries (ZPMC)

- 10.14 Tadano

- 10.15 Terex