|

市场调查报告书

商品编码

1850617

干式真空帮浦市场机会、成长动力、产业趋势分析及2025-2034年预测Dry Vacuum Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

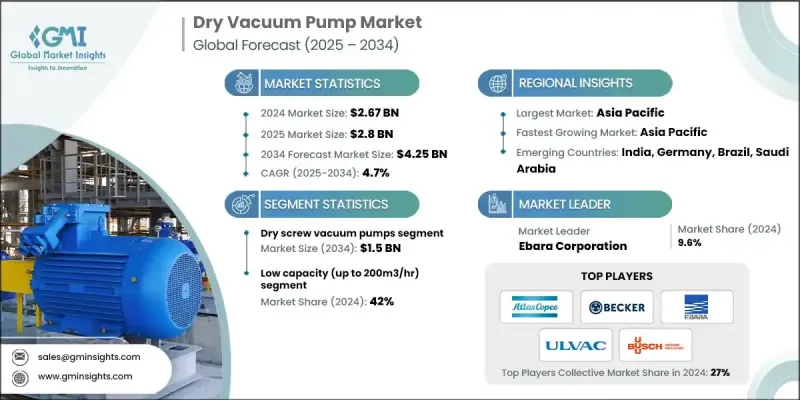

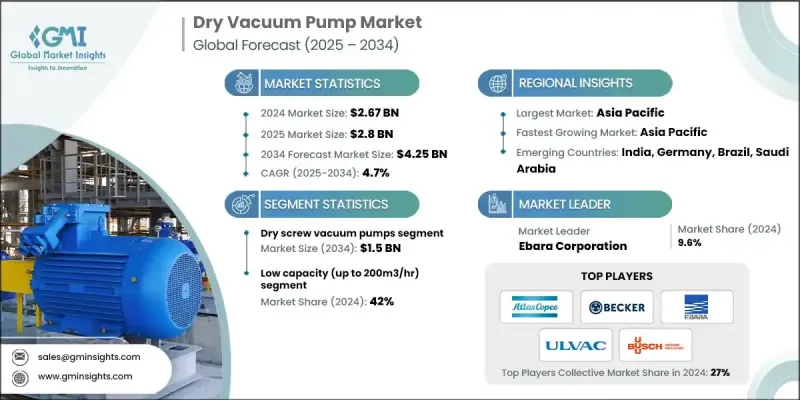

2024 年全球干式真空帮浦市场价值为 26.7 亿美元,预计到 2034 年将以 4.7% 的复合年增长率成长至 42.5 亿美元。

电子、航太和汽车等工业製造领域的激增持续推动着干式真空泵在成型、涂层和材料运输等製程的需求。製药和生物技术产业推动了市场成长,因为这些帮浦在灭菌、冷冻干燥和溶剂回收操作中至关重要。食品和饮料行业也在推动采用,因为真空包装和食品加工对清洁、无油系统的需求日益增长。同时,化学公司青睐干式真空解决方案,因为它们易于维护的设计和无污染的操作。向自动化和数位化的转变日益加剧,促使製造商在真空系统中整合智慧功能,提供即时监控、资料分析和预测性维护,以提高正常运行时间和效率。两级系统在需要更深真空度的应用上越来越受欢迎。干式真空帮浦因其节能、耐用和环保运作而在多种应用中取代了油基系统,使其成为寻求更清洁、更可靠真空技术的各行各业的有吸引力的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26.7亿美元 |

| 预测值 | 42.5亿美元 |

| 复合年增长率 | 4.7% |

预计到2034年,干式螺桿真空帮浦市场将实现15亿美元的产值,这得益于半导体製造、冶金和化学生产领域的广泛应用。这类帮浦可提供高真空度和快速抽速,且无污染。其节能运作是其关键优势,尤其适用于那些致力于降低功耗和营运成本的工厂。其坚固耐用的设计和更长的维护间隔可减少维护需求并延长正常运行时间,使其成为大量、连续使用应用的理想选择。此细分市场的成长反映出,在高需求环境中,人们对永续高效设备的偏好日益增长。

低流量(最高 200 立方公尺/小时)泵浦市场在 2024 年占据了 42% 的份额,这得益于其应用领域对精确、紧凑和节能解决方案的需求。此领域广泛应用于实验室、小规模製药生产、分析仪器和电子製造领域。其受欢迎程度源自于其在污染控制和可靠性至关重要的环境中能够提供清洁、无油的性能。紧凑的设计、低维护成本和经济高效的运行使这些泵浦非常适合有限空间的安装和间歇性使用场景。

预计到2034年,北美干式真空帮浦市场规模将达到10.7亿美元。製药和生物技术领域是推动该市场发展的主要动力,其中冷冻干燥和无菌包装等製程需要无污染的环境。严格的行业法规合规性以及该地区生物製剂生产的扩张,正在增强对这些系统的需求。高生产标准、不断增长的研发投入以及对製程完整性的高度重视是支撑北美各工厂成长的关键因素。

影响干式真空帮浦产业的关键製造商包括 Edwards Vacuum、Ebara Corporation、ULVAC、Becker Vacuum Pumps、Atlas Copco、Welch Vacuum、Agilent Technologies、Grundfos、Alfa Laval、Leybold GmbH、KNF Neuberger、Flowserve Corporation、Tuthill Corporation、DEKKER。为了巩固其地位,领先的干式真空帮浦製造商正专注于节能技术创新并扩展其产品线以满足不断变化的行业需求。许多公司正在投资具有自动化功能的智慧型帮浦系统,使用户能够存取即时性能资料和预测性维护工具。公司也正在建立策略联盟和合作伙伴关係,以增强分销网络,特别是在高成长地区。持续的研发努力正在开发具有更高真空度、运作更安静和使用寿命更长的泵浦。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按泵类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 编码-841410)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按泵类型,2021-2034

- 主要趋势

- 干式螺桿真空泵

- 干式涡旋真空泵

- 干式隔膜泵

- 干爪和钩泵

- 其他的

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 低(最高 200m3/小时)

- 中(200-500 立方米/小时)

- 高(超过 500 立方米/小时)

第七章:市场估计与预测:依最终用途产业,2021-2034

- 主要趋势

- 电子和半导体

- 製药

- 化工和石化

- 石油和天然气

- 食品和饮料

- 其他的

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Agilent Technologies

- Atlas Copco

- Becker Vacuum Pumps

- Busch Vacuum Solutions

- Ebara Corporation

- Flowserve Corporation

- Graham Corporation

- Ingersoll Rand Inc

- Kashiyama Industries

- Orion Machinery

- Osaka Vacuum

- Schmalz Group

- Shinko Seiki

- ULVAC

- Unozawa

The Global Dry Vacuum Pumps Market was valued at USD 2.67 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 4.25 billion by 2034.

The surge in industrial manufacturing across electronics, aerospace, and automotive continues to fuel demand for dry vacuum pumps in processes such as molding, coating, and material transport. Pharmaceutical and biotech industries boost market growth, as these pumps are essential in sterilization, freeze-drying, and solvent recovery operations. The food and beverage sector is also driving adoption due to growing requirements for clean, oil-free systems in vacuum packaging and food processing. Meanwhile, chemical companies favor dry vacuum solutions for their maintenance-friendly designs and contamination-free operation. The increasing shift toward automation and digitalization pushes manufacturers to integrate smart features in vacuum systems, offering real-time monitoring, data analytics, and predictive maintenance to improve uptime and efficiency. Two-stage systems are gaining popularity in applications needing deeper vacuum levels. Dry vacuum pumps replace oil-based systems in several applications due to their energy efficiency, durability, and environmentally friendly operation, making them an attractive choice across industries seeking cleaner and more reliable vacuum technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.67 Billion |

| Forecast Value | $4.25 Billion |

| CAGR | 4.7% |

The dry screw vacuum pumps segment is expected to generate USD 1.5 billion by 2034, fueled by high adoption across semiconductor fabrication, metallurgy, and chemical production. These pumps deliver high vacuum levels and fast pumping speeds without contamination. Their energy-efficient operation is a key benefit, especially for facilities aiming to reduce power consumption and operational expenses. The robust design and extended service intervals lead to reduced maintenance needs and enhanced uptime, making them ideal for high-volume, continuous-use applications. This segment's growth reflects an increasing preference for sustainable and efficient equipment in high-demand environments.

The low (up to 200m3/hr) segment held a 42% share in 2024 owing to the applications requiring precise, compact, and energy-efficient solutions. This segment is widely adopted across laboratories, small-scale pharmaceutical production, analytical instrumentation, and electronics manufacturing. Its popularity stems from the pumps' ability to deliver clean, oil-free performance in environments where contamination control and reliability are critical. Compact design, low maintenance, and cost-effective operation make these pumps suitable for limited-space installations and intermittent-use scenarios.

North America Dry Vacuum Pumps Market is projected to reach USD 1.07 billion by 2034. The pharmaceutical and biotechnology landscape is a major driver, where processes like freeze-drying and aseptic packaging require contamination-free environments. Compliance with stringent industry regulations and the expansion of biologics manufacturing in the region are strengthening demand for these systems. High production standards, rising R&D investments, and a strong focus on process integrity are key factors supporting growth across North American facilities.

The key manufacturers shaping the Dry Vacuum Pumps Industry include Edwards Vacuum, Ebara Corporation, ULVAC, Becker Vacuum Pumps, Atlas Copco, Welch Vacuum, Agilent Technologies, Grundfos, Alfa Laval, Leybold GmbH, KNF Neuberger, Flowserve Corporation, Tuthill Corporation, DEKKER Vacuum Technologies, and Graham Corporation. To strengthen their position, leading dry vacuum pump manufacturers are focusing on innovation in energy-efficient technologies and expanding their product lines to meet evolving industry demands. Many are investing in smart pump systems with automation features, enabling users to access real-time performance data and predictive maintenance tools. Companies are also entering strategic alliances and partnerships to enhance distribution networks, particularly in high-growth regions. Continuous R&D efforts are developing pumps with improved vacuum levels, quieter operation, and longer service life.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump type

- 2.2.3 Capacity

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By pump type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-841410)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Dry screw vacuum pump

- 5.3 Dry scroll vacuum pump

- 5.4 Dry diaphragm pump

- 5.5 Dry claw and hook pumps

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low (Up to 200m3/hr)

- 6.3 Mid (200-500 m3/hr)

- 6.4 High (More than 500 m3/hr)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Electronics and semiconductors

- 7.3 Pharmaceutical

- 7.4 Chemical and petrochemical

- 7.5 Oil and gas

- 7.6 Food and beverages

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Atlas Copco

- 10.3 Becker Vacuum Pumps

- 10.4 Busch Vacuum Solutions

- 10.5 Ebara Corporation

- 10.6 Flowserve Corporation

- 10.7 Graham Corporation

- 10.8 Ingersoll Rand Inc

- 10.9 Kashiyama Industries

- 10.10 Orion Machinery

- 10.11 Osaka Vacuum

- 10.12 Schmalz Group

- 10.13 Shinko Seiki

- 10.14 ULVAC

- 10.15 Unozawa