|

市场调查报告书

商品编码

1858803

特种纤维作物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Specialty Fiber Crops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

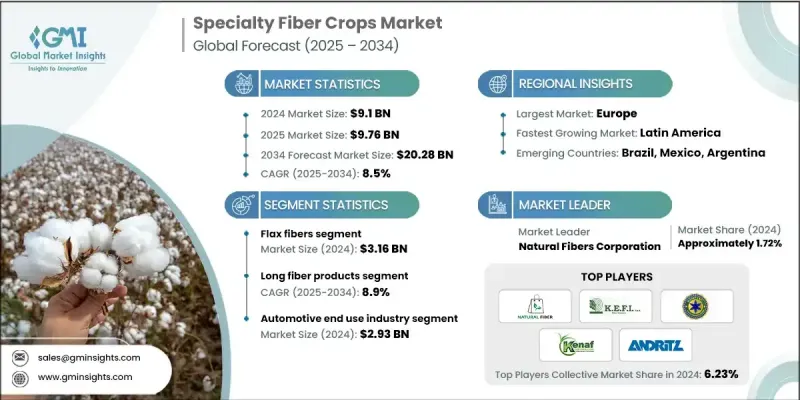

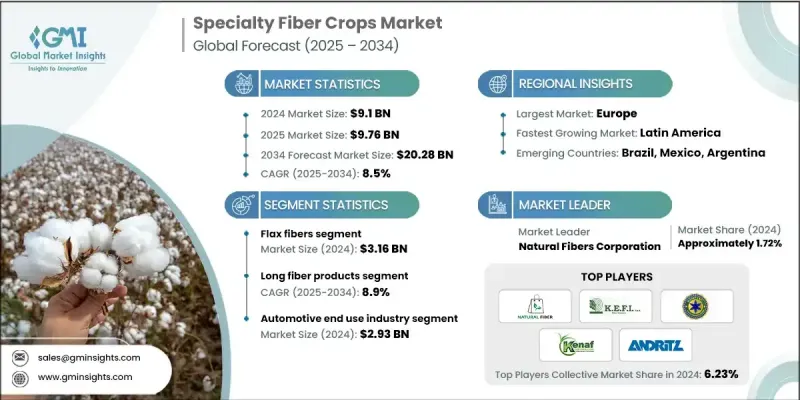

2024 年全球特种纤维作物市场价值为 91 亿美元,预计到 2034 年将以 8.5% 的复合年增长率增长至 202.8 亿美元。

全球各行各业对环保再生原料的需求不断成长,推动了这个市场的稳定扩张。随着环保意识的日益增强,製造商和消费者都开始转向黄麻、亚麻、剑麻和麻等天然纤维,因为它们具有可生物降解、可再生和环境影响小的优点。此外,多个地区的监管机构鼓励永续农业发展,同时限制合成材料的使用,进一步加速了更环保替代品的转变。这些监管措施持续推动特种纤维作物产业的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 202.8亿美元 |

| 复合年增长率 | 8.5% |

为了吸引日益增长的注重永续发展的消费者群体,纺织服装製造商正越来越多地将有机纤维融入其产品线。加工和纤维混纺技术的进步也提升了这些天然纤维的品质和应用范围,使其在耐用性、强度和质感方面更具竞争力,足以与合成纤维相媲美。除了时尚领域,特种纤维的应用也扩展到了汽车、建筑和复合材料等非传统产业,显着扩大了其市场份额。

2024年,亚麻纤维市场规模达31.6亿美元,预计2025年至2034年将以8.2%的复合年增长率成长。亚麻和麻纤维需求的激增源于其强度高、使用寿命长且环境影响小,使其在复合材料、纺织品和建筑材料领域日益受到青睐。棉花和洋麻等特殊纤维也因其可生物降解的特性以及在包装、造纸和高端纺织品领域的应用而得到更广泛的应用。此外,椰壳纤维、香蕉纤维和剑麻纤维等叶类和果类纤维因其可持续性和广泛的可用性,正成为环保包装、家用纺织品和土工织物的理想材料。

2024年,汽车终端应用领域市场规模达到29.3亿美元,预计在2025年至2034年期间将以8.7%的复合年增长率成长,占32.2%的市场。这些天然纤维越来越多地应用于汽车内装和复合材料中,为合成材料提供了一种轻质高强的替代方案。建筑业也因其强度高和环保特性,将这些纤维应用于保温板和增强构件中。

2024年,北美特种纤维作物市场规模预计将达22.4亿美元。随着建筑、汽车和纺织等行业转向使用永续材料,该地区的需求正在稳步增长。环保意识的增强、消费者对永续产品需求的不断增长以及政府鼓励环保耕作方式的激励措施,都进一步推动了这一转变。此外,纤维加工和复合材料开发领域的持续创新也促进了北美市场的扩张,这些创新正在为特种纤维开闢新的应用领域。

全球特种纤维作物市场的主要参与者包括Natural Fibers Corporation、Kenaf Partners USA、KEFISpA(义大利)、ANDRITZ Group和Hemp Inc.等。为了巩固自身地位,全球特种纤维作物市场的各公司正采取多种策略措施。许多公司正在扩大产能,以满足全球对永续材料日益增长的需求。研发投入的重点在于透过混纺、加工和复合材料工程的创新来提高纤维品质并拓展其应用范围。与建筑、汽车和纺织公司的合作,有助于製造商更顺畅地将特种纤维整合到终端产品中。此外,企业也正在探索垂直整合模式,以确保稳定的供应链并提高成本效益。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 供应链的复杂性

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 大麻纤维

- 韧皮纤维製品

- 赫德和核心产品

- 亚麻纤维

- 洋麻纤维

- 棉特种纤维

- 叶和果实纤维

- 剑麻和蕉麻製品

- 椰壳纤维及乳草製品

- 其他纤维

第六章:市场估算与预测:依加工形式划分,2021-2034年

- 主要趋势

- 长纤维产品

- 短纤维产品

- 核心和障碍产品

- 纤维粉末和细粉

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 汽车

- 室内面板应用

- 行李箱衬垫和复合材料部件

- 建筑施工

- 绝缘材料

- 生物复合材料应用

- 纸张和包装

- 特种纸应用

- 证券和货币纸

- 香烟纸

- 包装材料

- 纺织服装

- 技术纺织品

- 消费服装

- 家用纺织品

- 奢华和高级纺织品

- 环境与农业

- 侵蚀控制应用

- 动物垫料

- 园艺产品

- 其他终端用户产业

- 化妆品和个人护理

- 工业过滤

- 海军陆战队和国防部门

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- KEFISpA (Italy)

- Natural Fibers Corporation

- Mississippi Delta Fiber Cooperative

- Kenaf Partners USA

- ANDRITZ Group

- Formation AG

- Hempflax Group

- Canadian Greenfield Technologies

- Hemp Inc.

- Others

The Global Specialty Fiber Crops Market was valued at USD 9.10 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 20.28 billion by 2034.

This steady market expansion is driven by rising global demand for eco-conscious and renewable raw materials across a range of industries. With increasing environmental concerns, both manufacturers and consumers are turning toward natural fibers such as jute, flax, sisal, and hemp due to their biodegradability, renewability, and reduced environmental impact. In addition, regulatory bodies in multiple regions are encouraging sustainable agriculture while imposing restrictions on synthetic materials, further accelerating the shift toward greener alternatives. This regulatory push continues to support the growth trajectory of the specialty fiber crops sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.10 Billion |

| Forecast Value | $20.28 Billion |

| CAGR | 8.5% |

Textile and apparel manufacturers are increasingly incorporating organic fibers into their product lines to appeal to a growing segment of sustainability-focused consumers. Advances in processing and fiber blending technologies have also elevated the quality and application range of these natural fibers, making them more competitive with synthetic counterparts in terms of durability, strength, and texture. Beyond fashion, the adoption of specialty fibers has grown in non-traditional industries, including automotive, construction, and composites, expanding their market footprint significantly.

The flax fiber segment was valued at USD 3.16 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2034. The surge in demand for both flax and hemp fibers stems from their strength, longevity, and low environmental impact, making them increasingly preferred for use in composites, textiles, and building materials. Specialty fibers derived from cotton and kenaf are also witnessing greater usage due to their biodegradable properties and application across packaging, paper, and premium textile segments. Additionally, leaf and fruit-based fibers such as coir, banana, and sisal are becoming viable materials for eco-friendly packaging, domestic textiles, and geotextile uses due to their sustainability and wide availability.

In 2024, the automotive end-use segment reached USD 2.93 billion in value and is expected to grow at an 8.7% CAGR, representing a 32.2% share during the 2025-2034 period. These natural fibers are increasingly used in vehicle interiors and composite materials, offering a lightweight and strong alternative to synthetics. The building and construction sector is also integrating these fibers in insulation panels and reinforcement components, owing to their strength and green credentials.

North America Specialty Fiber Crops Market generated USD 2.24 billion in 2024. The demand across this region is rising steadily as industries such as construction, automotive, and textiles move toward integrating sustainable materials. The shift is further supported by greater environmental awareness, growing consumer demand for sustainable products, and government incentives promoting eco-friendly farming practices. The expansion of the North American market is also facilitated by ongoing innovations in fiber processing and composite development, which are unlocking new applications for specialty fibers.

Prominent players leading the Global Specialty Fiber Crops Market include Natural Fibers Corporation, Kenaf Partners USA, and K.E.F.I. S.p.A. (Italy), ANDRITZ Group, and Hemp Inc., among others. To strengthen their presence, companies in the Global Specialty Fiber Crops Market are adopting a variety of strategic approaches. Many are expanding their production capacities to meet growing global demand for sustainable materials. R&D investments are focused on enhancing fiber quality and broadening applications through innovations in blending, processing, and composite engineering. Partnerships with construction, automotive, and textile companies are helping manufacturers integrate specialty fibers into end-use products more seamlessly. In addition, businesses are exploring vertical integration models to secure consistent supply chains and improve cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Processing Form

- 2.2.4 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021- 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Hemp fibers

- 5.2.1 Bast fiber products

- 5.2.2 Hurd and core products

- 5.3 Flax fibers

- 5.4 Kenaf fibers

- 5.5 Cotton specialty fibers

- 5.6 Leaf and fruit fibers

- 5.6.1 Sisal and abaca products

- 5.6.2 Coir and milkweed products

- 5.7 Other fibers

Chapter 6 Market Estimates and Forecast, By Processing Form, 2021 - 2034 (USD Billion, , Kilo Tons)

- 6.1 Key trends

- 6.2 Long fiber products

- 6.3 Short fiber products

- 6.4 Core and hurd products

- 6.5 Fiber powders and fines

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Interior panel applications

- 7.2.2 Trunk liners and composite parts

- 7.3 Construction and building

- 7.3.1 Insulation materials

- 7.3.2 Biocomposite applications

- 7.4 Paper and packaging

- 7.4.1 Specialty paper applications

- 7.4.2 Security and currency paper

- 7.4.3 Cigarette paper

- 7.4.4 Packaging material

- 7.5 Textile and fashion

- 7.5.1 Technical textiles

- 7.5.2 Consumer apparel

- 7.5.3 Home textiles

- 7.5.4 Luxury and premium textiles

- 7.6 Environmental and agricultural

- 7.6.1 Erosion control applications

- 7.6.2 Animal bedding

- 7.6.3 Horticultural products

- 7.7 Other End use industries

- 7.7.1 Cosmetics and personal care

- 7.7.2 Industrial filtration

- 7.7.3 Marine and defense

- 7.7.4 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 K.E.F.I. S.p.A. (Italy)

- 9.2 Natural Fibers Corporation

- 9.3 Mississippi Delta Fiber Cooperative

- 9.4 Kenaf Partners USA

- 9.5 ANDRITZ Group

- 9.6 Formation AG

- 9.7 Hempflax Group

- 9.8 Canadian Greenfield Technologies

- 9.9 Hemp Inc.

- 9.10 Others