|

市场调查报告书

商品编码

1858806

半固态电池市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Semi Solid State Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

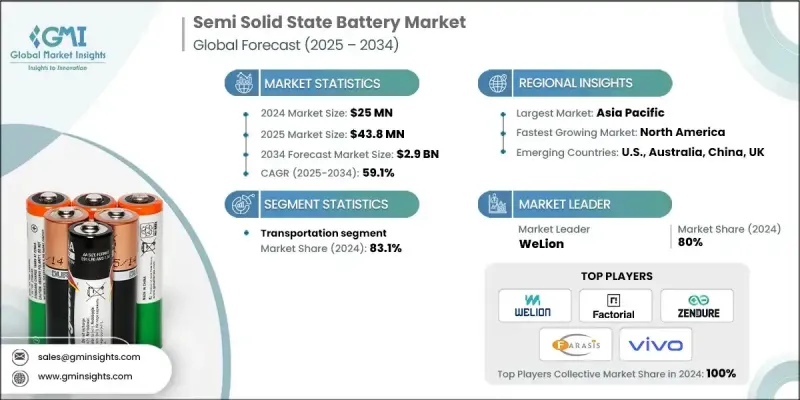

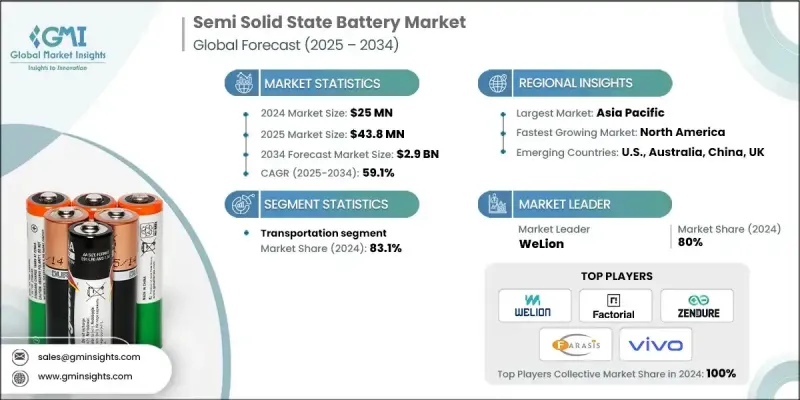

2024 年全球半固态电池市值为 2,500 万美元,预计到 2034 年将以 59.1% 的复合年增长率成长至 29 亿美元。

半固态电池相比传统锂离子电池具有许多优势,尤其是更高的能量密度,这不仅延长了电池寿命,还能实现更紧凑的设计。这些优势对于电动车、无人机和便携式电子产品等对空间和重量有严格限制的产业至关重要。随着对高效能储能解决方案的需求不断增长,半固态电池正成为各种应用领域的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2500万美元 |

| 预测值 | 29亿美元 |

| 复合年增长率 | 59.1% |

透过将固态电解质与液态组件结合,半固态电池透过降低易燃性和热失控等风险,有效解决了关键的安全问题。这种组合在提升安全性的同时,也保持了高性能,使电池非常适合用于电动车和电网储能。除了安全性之外,半固态电池还具有更快的离子传输速度,与传统锂离子电池相比,充电速度更快。这项特性对于电动车和消费性电子产品尤其重要,因为这些领域对停机时间的要求极高。随着快速充电基础设施的不断完善,预计对半固态电池的需求将持续成长。此外,这些电池还具有更长的循环寿命和更低的性能衰减,从而延长了使用寿命并降低了整体拥有成本,使其对车队营运商、再生能源系统和工业应用更具吸引力。

2024年,交通运输领域占83.1%的市场份额,预计到2034年将以56.3%的复合年增长率成长。城市交通系统需要快速週转,而半固态电池的快速充电能力正为其带来许多好处。这项技术提高了电动公车、计程车和送货车队的营运效率,从而推动了公共和商业交通网络的电气化。

预计到2034年,美国半固态电池市场规模将达到6.773亿美元。电动车和电网系统对更安全、更有效率的储能解决方案的需求是推动这一成长的主要动力。作为传统锂离子电池和全固态电池技术之间的桥樑,半固态电池兼具更高的安全性和可扩展的生产能力,使其成为各种应用领域的理想选择。凭藉在研发和试点生产方面的大力投入,美国有望成为未来电池创新领域的重要参与者。

全球半固态电池市场的主要参与者包括:赣锋锂电、LG能源解决方案、Factorial Energy、24M、Farasis Energy、宁德时代、Lithium、Tattu、Narada Power、Zendure、WeLion、青陶能源和vivo。为了巩固在全球半固态电池市场的地位,各公司正致力于加大研发投入,以提升电池效能和可扩展性。许多公司积极致力于增强电池的安全性能,同时确保更快的充电速度,以满足消费者和工业领域的需求。此外,各公司也积极寻求与汽车製造商、能源公司和其他产业领导者建立合作关係,以加速半固态电池技术的应用。同时,一些企业正在投资建造试点生产设施,以扩大生产规模,满足多个行业日益增长的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 关键材料供应链图

- 製造设备和製程要求

- 品质控制和测试基础设施

- 供应链整合机会

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 技术组件分析

- 半固态电解质

- 高能量阴极和阳极

- 分离器/电解质界面

- 投资和融资环境分析

- 新兴科技趋势和发展

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪錶板

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 创新与永续发展格局

第五章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 运输

- 储能

- 无人机与航太

- 其他的

第六章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 比利时

- 亚太地区

- 中国

- 韩国

- 日本

- 澳洲

- 世界其他地区

第七章:公司简介

- CATL

- Factorial Energy

- Farasis Energy

- Grepow Ganfeng

- Lithium

- LG Energy Solution

- Narada Power

- QingTao Energy

- Tattu

- Vivo

- WeLion

- Zendure

- 24M

The Global Semi Solid State Battery Market was valued at USD 25 million in 2024 and is estimated to grow at a CAGR of 59.1% to reach USD 2.9 billion by 2034.

Semi-solid state batteries offer several advantages over traditional lithium-ion cells, particularly higher energy density, which leads to longer battery life and more compact designs. These benefits are crucial for industries like electric vehicles, drones, and portable electronics, where space and weight limitations are significant factors. As the demand for high-performance energy storage solutions increases, semi-solid batteries are becoming the preferred option in a variety of applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Million |

| Forecast Value | $2.9 Billion |

| CAGR | 59.1% |

By integrating solid electrolytes with liquid components, semi-solid state batteries address key safety concerns by reducing risks such as flammability and thermal runaway. This combination allows for improved safety while maintaining high performance, making the batteries well-suited for use in electric vehicles and grid storage. In addition to safety, semi-solid state batteries also offer faster ion transport, resulting in quicker charging times compared to conventional lithium-ion batteries. This feature is particularly attractive for electric vehicles and consumer electronics, where shorter downtime is critical. As the infrastructure for fast charging continues to expand, demand for semi-solid batteries is expected to rise. These batteries also have a longer cycle life and reduced degradation, which extends their lifespan and lowers total ownership costs, making them more appealing to fleet operators, renewable energy systems, and industrial applications.

The transportation segment held an 83.1% share in 2024 and is projected to grow at a CAGR of 56.3% through 2034. Urban transportation systems, which require quick turnaround times, are benefiting from the faster charging capabilities of semi-solid state batteries. This technology enhances the operational efficiency of electric buses, taxis, and delivery fleets, supporting the electrification of public and commercial transport networks.

United States Semi Solid State Battery Market is expected to reach USD 677.3 million by 2034. The demand for safer, more efficient energy storage solutions in electric vehicles and grid systems is driving this growth. As a bridge between conventional lithium-ion and full solid-state technologies, semi-solid batteries combine the benefits of enhanced safety with scalable manufacturing, making them an attractive option for varied applications. With strong investments in research and development, as well as pilot production, the U.S. is poised to be a major player in the future of battery innovation.

Key companies operating in the Global Semi Solid State Battery Market include Grepow Ganfeng, LG Energy Solution, Factorial Energy, 24M, Farasis Energy, CATL, Lithium, Tattu, Narada Power, Zendure, WeLion, QingTao Energy, and Vivo. To strengthen their position in the Global Semi Solid State Battery Market, companies are focusing on strategic investments in research and development to improve battery performance and scalability. Many are actively working on enhancing the safety features of their batteries while ensuring faster charging times to meet consumer and industrial needs. Companies are also pursuing partnerships with automotive manufacturers, energy firms, and other industry leaders to accelerate the adoption of semi-solid battery technology. Additionally, some players are investing in pilot production facilities to scale up manufacturing and meet growing demand across multiple sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Critical materials supply chain mapping

- 3.1.2 Manufacturing equipment and process requirements

- 3.1.3 Quality control and testing infrastructure

- 3.1.4 Supply chain integration opportunities

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Technology component analysis

- 3.7.1 Semi solid electrolyte

- 3.7.2 High energy cathodes and anodes

- 3.7.3 Separator/electrolyte interface

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Transportation

- 5.3 Energy storage

- 5.4 UAV & aerospace

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Belgium

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 South Korea

- 6.4.3 Japan

- 6.4.4 Australia

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 CATL

- 7.2 Factorial Energy

- 7.3 Farasis Energy

- 7.4 Grepow Ganfeng

- 7.5 Lithium

- 7.6 LG Energy Solution

- 7.7 Narada Power

- 7.8 QingTao Energy

- 7.9 Tattu

- 7.10 Vivo

- 7.11 WeLion

- 7.12 Zendure

- 7.13 24M