|

市场调查报告书

商品编码

1858809

未烘焙谷物片市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Unroasted Cereal Flakes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

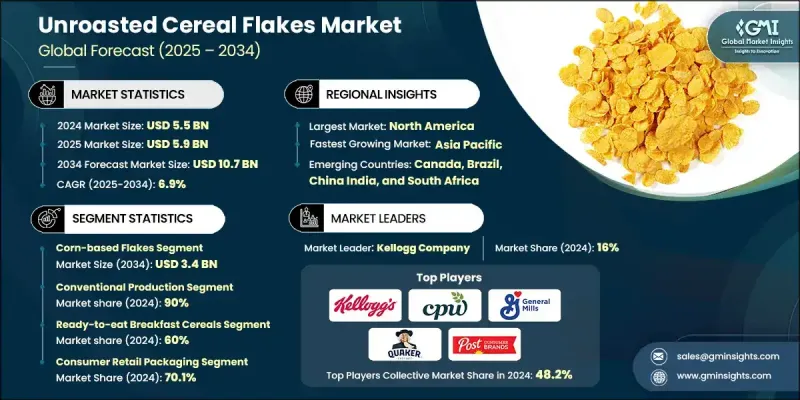

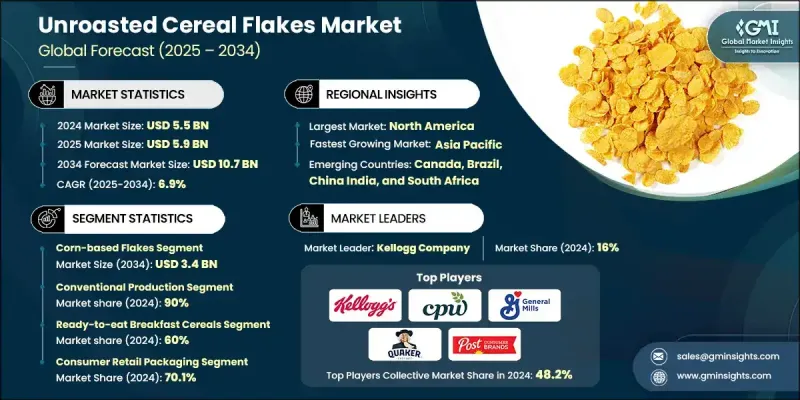

2024 年全球未烘焙谷物片市场价值为 55 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 107 亿美元。

该市场强劲的成长前景得益于消费者对加工最少、全谷物早餐产品的需求激增,这些产品符合不断发展的清洁标籤和营养透明度标准。美国食品药物管理局 (FDA) 的新规更新了「健康」的定义,纳入了特定的全谷物最低含量标准,同时限制了添加糖、饱和脂肪和钠的含量,这有力地支持了未烘焙谷物片的市场定位。全球谷物年产量持续超过 30 亿吨,稳定的原材料供应链和规模化生产能力使该行业受益匪浅,生产商能够优先考虑全谷物的采购和透明度。受膳食意识转变和政府更新的营养建议(强调膳食纤维和全谷物)的推动,消费者更倾向于选择配料清晰、成分简单、加工程度低的谷物产品。这促使产品创新不断增加,包括功能性增强和营养强化,以吸引那些既注重便利又注重营养的健康消费者。随着膳食标准的不断演变,製造商正与卫生机构更加紧密地合作,以确保其产品符合消费者对更清洁、更简单、更健康食品选择的期望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 55亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 6.9% |

有机未烘焙谷物片市场预计到2034年将以8.9%的复合年增长率成长,这主要得益于简化的认证流程以及与大规模谷物生产的紧密联繫。再生农业也正在兴起,预计复合年增长率将达到11%,这得益于品牌与倡议团体合作,建立农场层面的转型路径和可靠的验证体系。这些再生农业的宣传在专业零售领域越来越受欢迎,由于投入品可追溯性和永续性文件的完善,供应商能够获得更长期的合作协议。

即食未烘焙谷片市场占有率高达60%,预计2034年将以6.9%的复合年增长率成长。这类谷物之所以广受欢迎,是因为它们方便快捷,符合消费者的既定习惯,并且不断推陈出新,以满足不断变化的消费者偏好。它们迎合了忙碌的消费者群体,满足他们对营养丰富、易于烹饪食品的需求,并通常以“清洁标籤”和“功能性”等宣传语瞄准高端市场,旨在吸引註重健康的消费者。

北美未烘焙谷片市场占33%的份额,预计2024年市场规模将达39亿美元。该地区的成长得益于消费者对全谷物益处的广泛认知以及成熟的零售体系。美国更新的标籤法规以及机构膳食计划中降低糖分的要求,为成分更健康的谷物产品创造了有利条件。在加拿大,儘管来自加工谷物和能量棒的竞争仍然激烈,但由于高端货架空间的扩大和认证流程的简化,有机品牌正获得更高的认可。各品牌更重视永续包装和可验证的标籤声明,以赢得消费者信任并在竞争激烈的市场中脱颖而出。

未烘焙谷物片市场的主要企业包括:Nature's Path Foods、Post Consumer Brands、Food For Life Baking、Maselis NV、雀巢(Cereal Partners Worldwide)、Small Valley Milling、Bob's Red Mill、百事可乐/桂格燕麦、Hearthside Food、Organic Milling Solutions、Organicicing、Hykia, Globaler Grains、家乐氏公司以及bio-familia(瑞士)。领先企业正致力于拓展产品组合,推出符合现代健康标准和膳食法规的清洁标章、有机和全谷物谷物产品。各公司纷纷采用美国农业部有机认证,并利用联邦补贴抵销成本,加速进军高端市场。许多企业正在提高供应链的透明度,以支持再生农业声明和可追溯性,这有助于建立长期的零售合作伙伴关係。各品牌在功能性成分(如纤维、蛋白质和益生菌)方面不断创新,同时减少添加剂的使用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 健康意识和全谷物饮食指南提升了市场需求。

- 更新后的「健康」标准更倾向于加工最少的谷物。

- 电子商务和现代贸易扩大了准入范围

- 扩大有机和再生农业

- 陷阱与挑战

- 保质期限制推动包装和物流创新

- 来自加工食品和替代早餐选择的竞争压力

- 与传统谷物相比,生产成本更高

- 机会:

- 有机认证和永续性高端化

- 在清晰的框架内提出强化和功能性主张

- 功能性食品强化

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按产品规格

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 玉米片

- 小麦片

- 燕麦片

- 米片

- 大麦片

- 古代谷物片

- 多谷物混合

第六章:市场估计与预测:依农业实务划分,2021-2034年

- 主要趋势

- 传统生产方式

- 有机生产

- 再生农业

- 专业认证

第七章:市场估价与预测:依包装形式划分,2021-2034年

- 主要趋势

- 消费者零售包装

- 散装/餐饮包装

- 工业包装

- 永续包装

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 即食早餐谷物

- 热麦片/粥底

- 餐饮服务/大宗应用

- 工业/原料用途

- 格兰诺拉麦片/什锦麦片成分

- 特殊膳食应用

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 现代贸易

- 超市

- 大型超市

- 其他的

- 传统贸易

- 独立杂货店

- 其他的

- 电子商务

- 线上市场(例如亚马逊、Flipkart)

- 生鲜配送应用程式(例如,bigbasket)

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十一章:公司简介

- Kellogg Company

- Nestle (Cereal Partners Worldwide)

- General Mills

- PepsiCo/Quaker Oats

- Post Consumer Brands

- Nature's Path Foods

- Maselis NV

- Bob's Red Mill

- bio-familia (Swiss)

- King Arthur Baking

- Hearthside Food Solutions

- Organic Milling

- Small Valley Milling

- Ritika's Global Grains

- Food For Life Baking

The Global Unroasted Cereal Flakes Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 10.7 billion by 2034.

This market's strong growth outlook is supported by a surge in consumer demand for minimally processed, whole-grain breakfast products that align with evolving clean-label and nutrition transparency standards. New FDA regulations have updated the definition of "healthy" to include specific whole-grain minimums while capping added sugars, saturated fats, and sodium, which strongly supports the positioning of unroasted cereal flakes. With global cereal grain output consistently exceeding 3 billion metric tons annually, the industry benefits from stable input supply chains and scalability, allowing producers to prioritize whole grain sourcing and transparency. Consumers are favoring cereals with recognizable, limited ingredients and reduced processing, driven by shifting dietary awareness and updated government nutrition recommendations that emphasize fiber and whole grains. This has led to increased product innovation that includes functional enhancements and nutrient fortification, appealing to health-conscious shoppers seeking both convenience and nutrition. As dietary standards evolve, manufacturers are aligning more closely with health agencies to ensure their offerings meet expectations for cleaner, simpler, and more wholesome food choices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.9% |

The organic unroasted cereal flakes segment will grow at a CAGR of 8.9% through 2034, propelled by streamlined certification processes and strong links to large-scale cereal production. Regenerative agriculture is also emerging with an 11% CAGR, as brands work with advocacy groups to establish farm-level transition pathways and reliable verification systems. These regenerative claims are gaining traction in specialty retail settings, helping suppliers secure longer-term agreements due to improved input traceability and sustainability documentation.

The ready-to-eat unroasted flakes segment held 60% share and is expected to grow at a CAGR of 6.9% through 2034. These cereals are popular due to their convenience, well-established consumer habits, and continuous product innovations that address evolving preferences. They cater to a busy consumer base looking for nutritious and easy-to-prepare options, often targeting premium segments with clean-label and functional claims aimed at wellness-driven individuals.

North America Unroasted Cereal Flakes Market held a 33% share and generated USD 3.9 billion in 2024. Growth in this region is fueled by broad consumer awareness of whole grain benefits and a mature retail infrastructure. Updated U.S. labeling rules and reduced sugar mandates within institutional meal programs have created favorable conditions for cereals with cleaner profiles. In Canada, while competition from processed cereals and snack bars remains high, organic brands are seeing greater acceptance due to expanded premium shelf space and more accessible certification processes. Brands are placing greater focus on sustainable packaging and verifiable label claims to gain consumer trust and stand out in a competitive market.

Key companies in the Unroasted Cereal Flakes Market are Nature's Path Foods, Post Consumer Brands, Food For Life Baking, Maselis N.V., Nestle (Cereal Partners Worldwide), Small Valley Milling, Bob's Red Mill, PepsiCo/Quaker Oats, Hearthside Food Solutions, Organic Milling, King Arthur Baking, General Mills, Ritika's Global Grains, Kellogg Company, and bio-familia (Swiss). Leading players are focusing on expanding their product portfolios to include clean-label, organic, and whole-grain cereals to align with modern health standards and dietary regulations. Companies are adopting USDA organic certification and leveraging federal reimbursements to offset costs, accelerating entry into premium segments. Many are increasing transparency across their supply chains to support regenerative agriculture claims and traceability, which helps build long-term retail partnerships. Brands are innovative with functional ingredients like fiber, protein, and probiotics while using fewer additives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Agricultural practice trends

- 2.2.3 Application trends

- 2.2.4 Packaging format trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.1.1 Health awareness and whole-grain guidance elevate demand

- 3.2.1.2 Updated "healthy" criteria favor minimally processed cereals

- 3.2.1.3 E-commerce and modern trade broaden access

- 3.2.1.4 Expansion of organic and regenerative agriculture

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Shelf-life constraints push packaging and logistics innovation

- 3.2.2.2 Competitive pressure from processed and alt breakfast options

- 3.2.2.3 Higher production costs vs conventional cereals

- 3.2.3 Opportunities:

- 3.2.3.1 Organic certification and sustainability premiumization

- 3.2.3.2 Fortification and functional claims within clear frameworks

- 3.2.3.3 Functional food fortification

- 3.2.1 Drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based flakes

- 5.3 Wheat-based flakes

- 5.4 Oat-based flakes

- 5.5 Rice-based flakes

- 5.6 Barley-based flakes

- 5.7 Ancient grain flakes

- 5.8 Multigrain blends

Chapter 6 Market Estimates and Forecast, By Agricultural Practices, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional production

- 6.3 Organic production

- 6.4 Regenerative agriculture

- 6.5 Specialty certifications

Chapter 7 Market Estimates and Forecast, By Packaging Format, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Consumer retail packaging

- 7.3 Bulk/foodservice packaging

- 7.4 Industrial packaging

- 7.5 Sustainable packaging

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Ready-to-eat breakfast cereals

- 8.3 Hot cereal/porridge base

- 8.4 Foodservice/bulk applications

- 8.5 Industrial/ingredient use

- 8.6 Granola/muesli components

- 8.7 Specialized dietary applications

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 Modern trade

- 9.2.1 Supermarkets

- 9.2.2 Hypermarkets

- 9.2.3 Others

- 9.3 Traditional trade

- 9.3.1 Independent grocery stores

- 9.3.2 Others

- 9.4 E-commerce

- 9.4.1 Online marketplaces (e.g., amazon, flipkart)

- 9.4.2 Grocery delivery apps (e.g., bigbasket)

- 9.4.3 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Kellogg Company

- 11.2 Nestle (Cereal Partners Worldwide)

- 11.3 General Mills

- 11.4 PepsiCo/Quaker Oats

- 11.5 Post Consumer Brands

- 11.6 Nature's Path Foods

- 11.7 Maselis N.V.

- 11.8 Bob's Red Mill

- 11.9 bio-familia (Swiss)

- 11.10 King Arthur Baking

- 11.11 Hearthside Food Solutions

- 11.12 Organic Milling

- 11.13 Small Valley Milling

- 11.14 Ritika's Global Grains

- 11.15 Food For Life Baking