|

市场调查报告书

商品编码

1858816

单细胞分析市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Single-cell Analysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

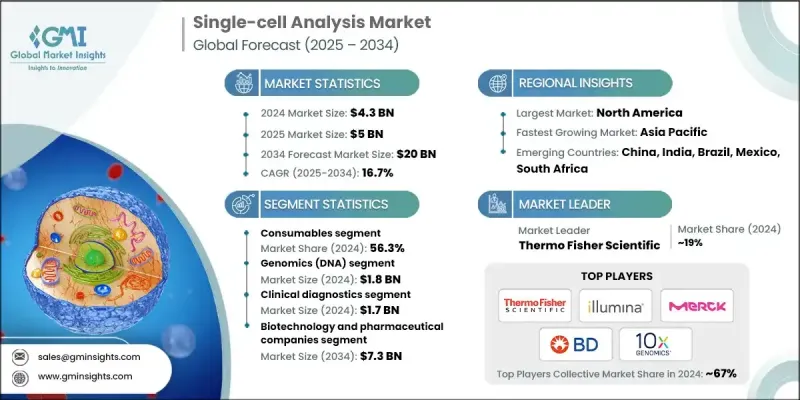

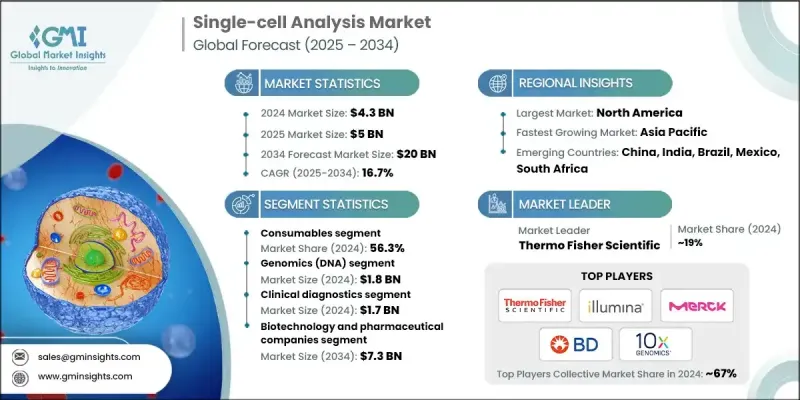

2024 年全球单细胞分析市场价值为 43 亿美元,预计到 2034 年将以 16.7% 的复合年增长率增长至 200 亿美元。

强劲的成长动力源自于人们对个人化医疗日益增长的兴趣,以及转录组学和基因组学技术的不断进步。单细胞分析使科学家能够研究复杂细胞群中单一细胞的独特行为,从而更深入地了解疾病进展、抗药性、免疫反应和转移。该技术在检测罕见癌细胞、评估治疗反应和揭示细胞异质性方面发挥着至关重要的作用。与传统的批量分析不同,单细胞技术能够提供高解析度资料,这对于研究肿瘤演变、罕见遗传疾病和细胞发育至关重要。由于样本量小且灵敏度高,这些方法依赖高度精确的操作流程。在单细胞层面整合转录组学、表观基因组学、蛋白质组学和代谢组学等多组学数据,有助于全面了解细胞功能。此外,3D空间组学技术的进步使研究人员能够在细胞的天然组织环境中探索细胞相互作用和环境讯号,从而更深入地了解生物系统,并推动其在诊断、药物研发和再生医学等领域的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 200亿美元 |

| 复合年增长率 | 16.7% |

2024年,耗材市场占据56.3%的市场份额,预计到2034年将达到114亿美元,年复合成长率达16.9%。该市场涵盖试剂、磁珠、检测试剂盒和微流控晶片等单细胞工作流程的关键产品。由于这些产品在每次实验中都会消耗,且需要定期补充,因此需求持续强劲。干细胞生物学、免疫疗法和肿瘤学等领域的研究日益增多,尤其是在学术和商业环境中研究人员扩大实验规模的情况下,进一步推动了耗材的需求。

基因组学(DNA)应用领域预计在2024年创造18亿美元的市场规模。单细胞基因组学提供了一种强大的方法来检测单一细胞之间的遗传差异,从而深入了解染色体变异、突变和克隆演化。这项技术对于在精细层面研究疾病机制、识别残留病灶以及发现可能在批量DNA分析中被忽略的罕见遗传变异至关重要。它在追踪肿瘤亚群和了解复杂组织的遗传组成方面尤其有价值。

2024年,北美单细胞分析市占率达45.1%。该地区的领先地位源于其在研发领域的强劲投入,尤其是在美国,众多大型生物技术和製药公司的存在为持续创新提供了有力支撑。高额的医疗保健支出使医疗机构能够采用尖端技术,而学术研究中心和临床试验网络则积极支持单细胞技术在广泛治疗领域的应用。

全球单细胞分析市场的主要参与者包括Illumina、Takara Bio、10X Genomics、Sartorius、Oxford Nanopore Technologies、Thermo Fisher Scientific、Merck KGaA、Agilent Technologies、华大基因、Fluidigm Corporation(Standard Bio Tools)、NanoString Technologies、诺禾源、Bio-Vaborator, Laborator, Gaborator. (NVKelator, Gaborator, Gaborator, Gaborator)。为了巩固其在单细胞分析市场的地位,领先企业正在拓展产品线,将基因组学、蛋白质组学和太空技术整合到多组学平台中。许多企业正与学术机构和生物製药公司建立合作关係,以支持大规模研究计画。研发投入仍是企业的核心重点,微流控、定序技术和自动化工具领域持续创新。此外,各公司也正在透过加强分销网络和建立新设施来扩大其全球影响力,以满足不断增长的市场需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对个人化医疗的需求日益增长

- 基因组学和转录组学技术的进步

- 癌症研究领域中日益增长的应用

- 增加政府和私人资金投入

- 产业陷阱与挑战

- 仪器和试剂成本高昂

- 复杂资料分析与解读

- 市场机会

- 临床诊断领域的不断扩张

- 生物技术和製药合作的成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前技术趋势

- 新兴技术

- 管道分析

- 定价分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 消耗品

- 试剂

- 检测试剂盒

- 仪器

- 显微镜

- 血球计数器

- 流式细胞仪

- 下一代定序

- 高内涵筛选系统

- 其他乐器

第六章:市场估算与预测:依分析类型划分,2021-2034年

- 主要趋势

- 基因组学(DNA)

- 转录组学

- 表观基因组学

- 多组学整合

- 其他分析类型

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 临床诊断

- 研究

- 药物发现与开发

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 学术和研究实验室

- 生物技术和製药公司

- 医院和诊断实验室

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 10X Genomics

- Agilent Technologies

- Becton, Dickinson & Company (BD)

- Bio-Rad Laboratories

- BGI Genomics

- Fluidigm Corporation (Standard Bio Tools)

- Illumina

- Merck KGaA

- NanoString Technologies

- Novogene

- Oxford Nanopore Technologies

- QIAGEN NV

- Sartorius

- Takara Bio

- Thermo Fisher Scientific

The Global Single-cell Analysis Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 20 billion by 2034.

The strong growth is driven by increasing interest in personalized medicine and continued advances in transcriptomics and genomics technologies. Single-cell analysis allows scientists to examine the unique behavior of individual cells within complex populations, offering a deeper understanding of disease progression, drug resistance, immune responses, and metastasis. The technology plays a vital role in detecting rare cancer cells, assessing treatment responses, and uncovering cellular heterogeneity. Unlike conventional bulk analysis, single-cell techniques deliver high-resolution data that is crucial for studying tumor evolution, rare genetic disorders, and cellular development. Due to the low volume and sensitivity of samples, these methods rely on highly precise protocols. The integration of multi-omics covering transcriptomics, epigenomics, proteomics, and metabolomics at the single-cell level helps deliver a comprehensive picture of cell function. Additionally, advancements in 3D spatial omics technologies allow researchers to explore cellular interactions and environmental cues in their native tissue context, unlocking deeper insights into biological systems and advancing applications in diagnostics, drug discovery, and regenerative medicine.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $20 Billion |

| CAGR | 16.7% |

The consumables segment held a 56.3% share in 2024 and is forecasted to reach USD 11.4 billion by 2034, growing at a CAGR of 16.9%. This segment includes reagents, beads, assay kits, and microfluidic cartridges that are critical for single-cell workflows. As these products are consumed in every experiment and must be replenished regularly, they create ongoing demand. The increasing frequency of studies in fields like stem cell biology, immunotherapy, and oncology is fueling the need for consumables, especially as researchers scale up experiments in academic and commercial settings.

The genomics (DNA) application segment generated USD 1.8 billion in 2024. Single-cell genomics provides a powerful way to detect genetic differences between individual cells, offering insight into chromosomal variations, mutations, and clonal evolution. This technology is instrumental in studying disease mechanisms at a granular level, identifying residual disease, and uncovering rare genetic variants that may be overlooked in bulk DNA analysis. It is especially valuable in tracking tumor subpopulations and understanding the genetic makeup of complex tissues.

North America Single-cell Analysis Market held a 45.1% share in 2024. The region's leadership stems from strong investments in R&D, particularly in the U.S., where the presence of major biotech and pharmaceutical companies supports continued innovation. High healthcare spending enables institutions to adopt sophisticated technologies, while academic research hubs and clinical trial networks actively support the growth of single-cell technologies across a wide range of therapeutic areas.

Key players in the Global Single-cell Analysis Market include Illumina, Takara Bio, 10X Genomics, Sartorius, Oxford Nanopore Technologies, Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, BGI Genomics, Fluidigm Corporation (Standard Bio Tools), NanoString Technologies, Novogene, Bio-Rad Laboratories, QIAGEN NV, and Becton, Dickinson & Company (BD). To solidify their position in the Single-cell Analysis Market, leading companies are expanding their product lines to include multi-omics platforms that integrate genomic, proteomic, and spatial technologies. Many are forging partnerships with academic institutions and biopharma firms to support large-scale research projects. Investment in R&D remains a core focus, with continuous innovation in microfluidics, sequencing technologies, and automation tools. Firms are also increasing their global footprint by enhancing distribution networks and establishing new facilities to meet growing demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for personalized medicine

- 3.2.1.2 Advancement in genomics and transcriptomics technologies

- 3.2.1.3 Growing applications in cancer research

- 3.2.1.4 Increasing government and private funding

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of instruments and reagents

- 3.2.2.2 Complex data analysis and interpretation

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing expansion in clinical diagnostics

- 3.2.3.2 Growth in biotech and pharma collaborations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.2.1 Reagents

- 5.2.2 Assay Kits

- 5.3 Instruments

- 5.3.1 Microscopes

- 5.3.2 Hemocytometers

- 5.3.3 Flow cytometers

- 5.3.4 Next generation sequencing

- 5.3.5 High-content screening system

- 5.3.6 Other instruments

Chapter 6 Market Estimates and Forecast, By Analysis Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Genomics (DNA)

- 6.3 Transcriptomics

- 6.4 Epigenomics

- 6.5 Multiomics integration

- 6.6 Other analysis types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical diagnostics

- 7.3 Research

- 7.4 Drug discovery & development

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Academic and research laboratories

- 8.3 Biotechnology and pharmaceutical companies

- 8.4 Hospitals and diagnostic laboratories

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 10X Genomics

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson & Company (BD)

- 10.4 Bio-Rad Laboratories

- 10.5 BGI Genomics

- 10.6 Fluidigm Corporation (Standard Bio Tools)

- 10.7 Illumina

- 10.8 Merck KGaA

- 10.9 NanoString Technologies

- 10.10 Novogene

- 10.11 Oxford Nanopore Technologies

- 10.12 QIAGEN NV

- 10.13 Sartorius

- 10.14 Takara Bio

- 10.15 Thermo Fisher Scientific