|

市场调查报告书

商品编码

1858826

重力储能市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Gravity Based Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

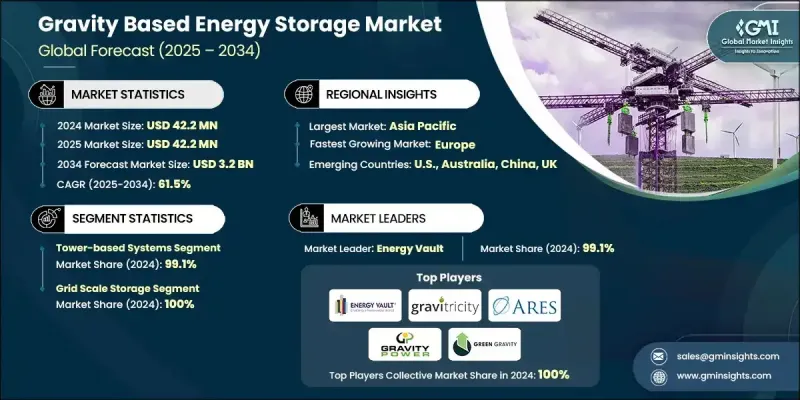

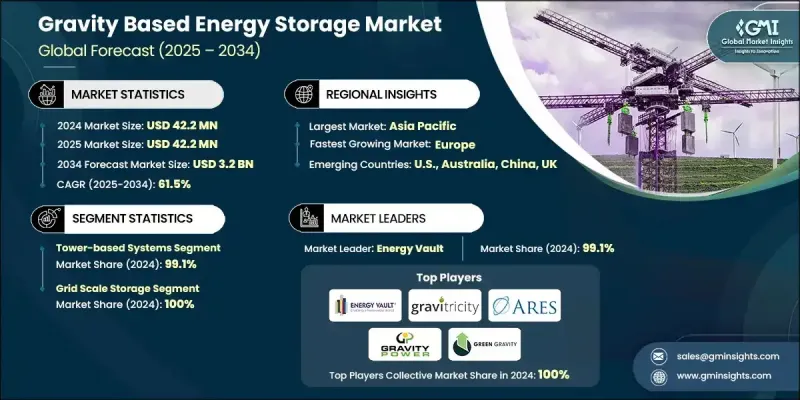

2024 年全球重力储能市场价值为 4,220 万美元,预计到 2034 年将以 61.5% 的复合年增长率增长至 32 亿美元。

全球对永续、长时储能解决方案的迫切需求推动了这一成长,这些解决方案能够支援再生能源併网、增强电网韧性并实现脱碳目标。与传统的化学电池不同,重力储能係统具有使用寿命长、性能衰减小、环境友善等优点,使其成为清洁能源转型的重要动力。随着世界各国政府实施更严格的净零排放目标,公用事业公司和开发商正越来越多地将重力储能作为锂离子储能係统的补充。这些系统利用简单而有效的物理原理,透过提升和降低重物来实现可靠、可扩展且经济高效的储能。此外,它们还可以改造废弃矿井、铁路系统或工业用地进行部署,这进一步提升了其永续性,并符合循环经济原则和全球脱碳策略。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4220万美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 61.5% |

2024年,塔式储能係统市占率高达99.1%。塔式储能係统凭藉其模组化可扩展性、简易的工程设计以及在低维护需求下提供数小时放电循环的成熟能力,正迅速发展。这些解决方案对公用事业规模的专案极具吸引力,与化学品储存相比,它们具有性能可预测、使用寿命长、运行风险低等优点。地下储能係统也正在成为一种具有竞争力的替代方案,它利用废弃矿井和竖井进行储能,具有高密度和低视觉影响的优点。

预计2034年,再生能源併网领域规模将达15亿美元。其可扩展性使其尤其适用于混合能源项目,能够与太阳能发电厂、离岸风电场和社区规模的可再生能源微电网无缝衔接。电网级储能虽然在2024年规模略小,但随着电力公司采用重力储能係统进行负载平衡、黑启动以及频率和电压调节等辅助服务,预计其规模将快速成长。重力储能同时支持再生能源和电网基础设施,巩固了其作为未来能源格局核心支柱的地位。

到2034年,中国重力储能市场规模将达到9.643亿美元。中国政府支持的各项倡议,包括与再生能源部署挂钩的储能强制规定,加速了大型重力储能专案的商业化进程。另一方面,澳洲率先对传统采矿基础设施进行适应性再利用,在降低资本成本的同时,创造了环境永续的解决方案。

全球重力储能市场的主要参与者包括Energy Vault、Gravitricity、Green Gravity Energy、ARES North America、GRAVIENT、Gravity Power、Gravity Storage和RheEnergise Limited。这些公司正透过合作、试点专案和创新工程方法来推进商业化进程。例如,Energy Vault已占据市场主导地位,预计到2024年其装置容量将达到99.1%的份额;而Gravitricity和Green Gravity等公司则正在利用独特的应用,例如矿井改造和压缩土块技术。这些创新者共同塑造了一个充满活力、竞争激烈的市场格局,将永续性与大规模能源韧性结合在一起。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 价格趋势分析,2021-2034年

- 按地区

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪錶板

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 创新与永续发展格局

第五章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 基于塔架的系统

- 地下系统

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 网格规模存储

- 再生能源併网

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 芬兰

- 亚太地区

- 中国

- 澳洲

- 世界其他地区

第八章:公司简介

- ARES北美

- Energy Vault

- GRAVIENT

- Gravitricity

- Gravity Power

- Gravity Storage

- Green Gravity Energy Pty

- Renewell Energy

- RheEnergise Limited

- Terrament

The Global Gravity Based Energy Storage Market was valued at USD 42.2 million in 2024 and is estimated to grow at a CAGR of 61.5% to reach USD 3.2 billion by 2034.

This surge is fueled by the urgent global demand for sustainable, long-duration storage solutions that support renewable integration, grid resilience, and decarbonization goals. Gravity-based systems, unlike conventional chemical batteries, offer long operational lifespans, minimal degradation, and environmental compatibility, making them a vital enabler of the clean energy transition. With governments worldwide imposing stricter net-zero mandates, utilities and developers are increasingly turning to gravity storage as a complement to lithium-ion systems. These systems harness simple yet effective physics, lifting and lowering heavy weights to deliver reliable, scalable, and cost-effective energy storage. Their ability to repurpose abandoned mines, rail systems, or industrial sites for deployment further enhances their sustainability profile, aligning with circular economy principles and global decarbonization strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.2 Million |

| Forecast Value | $3.2 Billion |

| CAGR | 61.5% |

The tower-based systems segment held a 99.1% share in 2024. Tower-based systems are gaining momentum due to their modular scalability, straightforward engineering, and proven ability to provide multi-hour discharge cycles with low maintenance requirements. These solutions are attractive for utility-scale projects, where they offer predictable performance, long service life, and reduced operational risks compared to chemical storage. Underground systems are also emerging as a competitive alternative, leveraging decommissioned mines and vertical shafts for energy storage, providing high density and low visual impact.

The renewable integration segment is expected to reach USD 1.5 billion by 2034. Their scalability makes them particularly suitable for hybrid energy projects, pairing seamlessly with solar farms, offshore wind installations, and community-scale renewable microgrids. Grid-scale storage, while slightly smaller in 2024, is projected to grow rapidly as utilities adopt gravity systems for load balancing, black-start capabilities, and ancillary services such as frequency and voltage regulation. This dual role supporting both renewables and grid infrastructure cements gravity storage as a central pillar of the future energy landscape.

China Gravity-Based Energy Storage Market will reach USD 964.3 million by 2034. China's government-backed initiatives, including storage mandates tied to renewable deployment, have accelerated the commercialization of large-scale gravity projects. Australia, on the other hand, has pioneered the adaptive reuse of legacy mining infrastructure, cutting capital costs while creating environmentally sustainable solutions.

Key players in the Global Gravity-Based Energy Storage Market include Energy Vault, Gravitricity, Green Gravity Energy, ARES North America, GRAVIENT, Gravity Power, Gravity Storage, and RheEnergise Limited. These companies are advancing commercialization through partnerships, pilot projects, and innovative engineering approaches. Energy Vault, for instance, has achieved dominance with a 99.1% share of installed capacity in 2024, while firms like Gravitricity and Green Gravity are leveraging unique applications such as mine-shaft repurposing and compressed-earth block technologies. Collectively, these innovators are shaping a dynamic, competitive landscape that blends sustainability with large-scale energy resilience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Price trend analysis, 2021 - 2034

- 3.2.1 By region

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Tower-based systems

- 5.3 Underground systems

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Grid scale storage

- 6.3 Renewable integration

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Finland

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 ARES North America

- 8.2 Energy Vault

- 8.3 GRAVIENT

- 8.4 Gravitricity

- 8.5 Gravity Power

- 8.6 Gravity Storage

- 8.7 Green Gravity Energy Pty

- 8.8 Renewell Energy

- 8.9 RheEnergise Limited

- 8.10 Terrament