|

市场调查报告书

商品编码

1858829

汽车交流发电机及起动马达市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Alternator and Starter Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

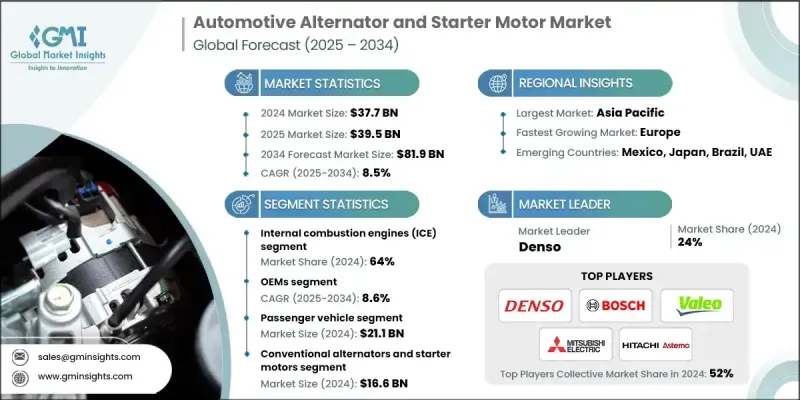

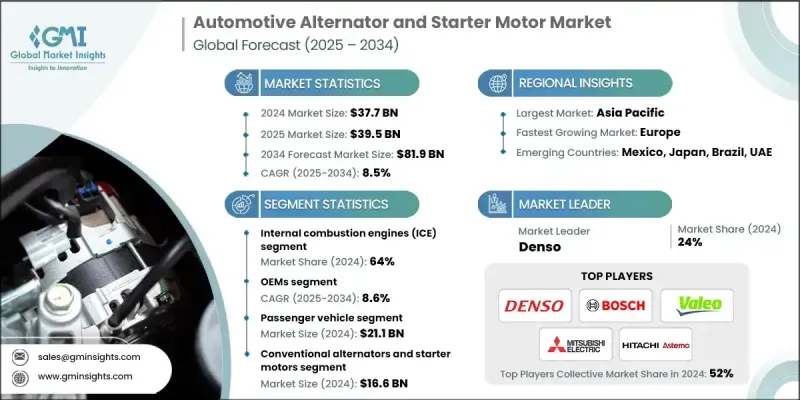

2024 年全球汽车交流发电机和起动马达市场价值为 377 亿美元,预计到 2034 年将以 8.5% 的复合年增长率增长至 819 亿美元。

随着汽车製造商积极应对日益增长的车辆电气化趋势、混合动力和电动车需求的不断攀升以及日益严格的全球排放标准,市场成长正在加速。随着电池技术的不断发展和能源效率在车辆设计中日益凸显,汽车製造商正优先考虑能够提升动力系统性能并降低排放和油耗的电气元件。整合式车辆系统对交流发电机和起动马达提出了更高的要求,促使供应商不断创新,提供符合现代出行趋势的解决方案。技术进步和智慧车辆架构也推动了这一发展势头。高效、轻量化和智慧化的系统正在取代老旧零件,以确保符合全球标准、提高可靠性并延长使用寿命。汽车製造商和供应商都在大力投资于能够支援复杂电子功能、优化引擎运作并增强现代车辆能源管理的零件,尤其是在业界向永续出行转型之际。随着这些趋势的不断发展,交流发电机和起动马达技术在车辆整体性能中的重要性日益凸显。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 377亿美元 |

| 预测值 | 819亿美元 |

| 复合年增长率 | 8.5% |

2024年,内燃机(ICE)汽车市占率仍高达64%。儘管电动车发展迅猛,但内燃机汽车在全球汽车生产和销售中仍占据主导地位。汽车製造商和车队营运商继续依赖成熟的内燃机技术,因此需要高性能的交流发电机和起动电机,以支援高效的能源利用、引擎的可靠性以及与日益电子化的动力系统的兼容性。製造商正积极响应,提供耐用且成本优化的解决方案,旨在与传统车辆系统无缝整合。

原始设备製造商(OEM)市占率占比高达 71%,预计到 2034 年将以 8.6% 的复合年增长率成长。由于汽车製造商优先考虑原厂安装的高性能交流发电机和起动电机,以满足严格的监管和能源效率标准,因此来自原始设备製造商的需求仍然强劲。重点仍然是提供符合不断变化的排放标准、支援车辆电气化并具有长期耐用性的坚固可靠的零件。原始设备製造商继续与零件供应商合作,以确保下一代车辆的品质整合、系统相容性和持续性能。

预计到2024年,北美汽车交流发电机和起动马达市场将占据81.1%的市场份额,市场规模达82亿美元。北美汽车产业规模庞大,乘用车和商用车普及率高,混合动力和电动车型的采用率不断提高,这些因素使其在北美市场中脱颖而出。围绕排放和能源效率的严格监管框架为製造商创造了新的机会,因为先进的交流发电机和智慧起动马达对于满足消费者期望和政府要求至关重要。

全球汽车交流发电机和起动马达市场的主要企业包括德尔福科技、罗伯特博世、现代摩比斯、日立阿斯泰莫、三叶、三菱电机、卢卡斯TVS、电装、法雷奥和博格华纳。这些领先企业致力于将创新、效率和与汽车製造OEM)需求的策略契合相结合,以巩固其全球市场地位。许多企业正在开发轻量化、紧凑型和高效率的零件,以满足混合动力、内燃机和轻度混合动力汽车的需求。与汽车製造商的策略合作能够实现先进系统的客製化和无缝整合。此外,智慧功能,例如自动启动/停止系统、能量回收系统和预测性诊断,也备受关注。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 汽车产量和销售量不断成长

- 电气化和混合动力趋势

- 老旧车队的售后市场需求

- 技术进步

- 产业陷阱与挑战

- 向纯电动车转型导致传统需求下降

- 高昂的研发与转型成本

- 市场机会

- 更严格的全球排放法规

- 激烈的价格竞争

- 供应链限制

- OEM整合及对整合解决方案的偏好

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 汽车电气系统的SAE标准

- 美国环保署排放标准对电力负荷的影响

- 美国国家公路交通安全管理局 (NHTSA) 电气元件安全标准

- 国际标准协调(ISO、IEC)

- 连网车辆的网路安全法规

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 智慧交流发电机开发与可变输出控制

- 48伏轻混系统集成

- 无刷技术进步

- 整合式起动发电机演变

- 能源管理与电池集成

- 预测性维护与物联网集成

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 风险评估框架

- 最佳情况情景

- 客户分析与购买行为

- OEM采购标准与决策框架

- 售后市场消费者偏好与痛点

- 品牌忠诚度模式

- 按客户群进行价格敏感度分析

- 贸易动态与关税分析

- 进出口趋势和贸易流量

- 各地区关税影响

- 贸易政策变化及其影响

- 本地内容需求

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依引擎类型划分,2021-2034年

- 主要趋势

- 内燃机(ICE)

- 油电混合发动机

- 电动车(EV)动力系统

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- SUV

- 轿车

- 掀背车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

- 两轮车

- 越野车

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 传统交流发电机和起动电机

- 智慧交流发电机和起动电机

- 再生煞车系统

第八章:市场估算与预测:依销售管道划分,2021-2034年

- 主要趋势

- 原始设备製造商

- 售后市场

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- 全球参与者

- BorgWarner

- Continental

- Delphi Technologies

- Denso

- Hitachi Astemo

- Lucas Electrical

- Mitsuba

- Mitsubishi Electric

- Robert Bosch

- Valeo

- 区域玩家

- ADVICS

- ASIMCO Technologies

- Cummins

- DB Electrical

- Guangzhou Sivco

- Hella

- Hyundai Mobis

- Lucas TVS

- Prestolite Electric

- 新兴玩家

- Broad-Ocean Technologies

- Controlled Power Technologies

- Ningbo Zhongwang AUTO Fittings

- PHINIA

- Unipoint

The Global Automotive Alternator and Starter Motor Market was valued at USD 37.7 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 81.9 billion by 2034.

Market growth is accelerating as automakers respond to increasing vehicle electrification, rising demand for hybrid and electric vehicles, and tougher global emission norms. As battery technology continues to evolve and energy efficiency becomes central to vehicle design, automotive manufacturers are prioritizing electrical components that enhance powertrain performance while reducing emissions and fuel consumption. Integrated vehicle systems are placing greater demands on alternators and starter motors, pushing suppliers to innovate and deliver solutions that align with modern mobility trends. Technological enhancements and smart vehicle architectures are also contributing to this momentum. High-efficiency, lightweight, and intelligent systems are replacing older components to ensure compliance with global standards, improve reliability, and extend operational lifespan. Both automakers and suppliers are investing heavily in components that support complex electronic functions, optimize engine operations, and enhance energy management in modern vehicles, particularly as the industry transitions toward sustainable mobility. As these trends continue to evolve, alternator and starter motor technologies are becoming more central to overall vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.7 Billion |

| Forecast Value | $81.9 Billion |

| CAGR | 8.5% |

In 2024, the internal combustion engine (ICE) segment held a 64% share. Despite the rise of electric vehicles, ICE-powered vehicles still dominate global production and sales. Automotive OEMs and fleet operators continue to rely on proven ICE technologies, requiring high-performance alternators and starter motors that support efficient energy use, engine reliability, and compatibility with increasingly electronic powertrains. Manufacturers are responding with durable and cost-optimized solutions engineered for seamless integration with traditional vehicle systems.

The OEM segment held a 71% share and is projected to grow at a CAGR of 8.6% through 2034. Demand from original equipment manufacturers remains strong, as automakers prioritize factory-installed, high-performance alternators and starter motors that meet stringent regulatory and efficiency standards. The focus remains on delivering robust, reliable components that comply with evolving emission norms, support vehicle electrification, and offer long-term durability. OEMs continue to partner with component suppliers to ensure quality integration, system compatibility, and sustained performance in next-generation vehicles.

North America Automotive Alternator and Starter Motor Market held 81.1% share in 2024, generating USD 8.2 billion. The country stands out due to its expansive automotive industry, widespread use of passenger and commercial vehicles, and increasing adoption of hybrid and electrified models. Strong regulatory frameworks around emissions and energy efficiency are creating new opportunities for manufacturers, as advanced alternators and smart starter motors become essential to meet both consumer expectations and government mandates.

Noteworthy companies in the Global Automotive Alternator and Starter Motor Market include Delphi Technologies, Robert Bosch, Hyundai Mobis, Hitachi Astemo, Mitsuba, Mitsubishi Electric, Lucas TVS, Denso, Valeo, and BorgWarner. Leading companies in the Global Automotive Alternator and Starter Motor Market are focusing on a blend of innovation, efficiency, and strategic alignment with OEM needs to strengthen their global footprint. Many are developing lightweight, compact, and high-efficiency components tailored for hybrid, ICE, and mild-hybrid vehicles. Strategic collaborations with automakers enable customization and seamless integration of advanced systems. Emphasis is also placed on smart features such as stop-start systems, regenerative energy capabilities, and predictive diagnostics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engine

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising vehicle production & sales

- 3.2.1.2 Electrification & hybridization trends

- 3.2.1.3 Aftermarket demand from aging fleets

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shifts toward full EVs reducing traditional demand

- 3.2.2.2 High R&D and transition costs

- 3.2.3 Market opportunities

- 3.2.3.1 Stricter global emission regulations

- 3.2.3.2 Intense price competition

- 3.2.3.3 Supply chain constraints

- 3.2.3.4 OEM consolidation and preference for integrated solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 SAE standards for automotive electrical systems

- 3.4.2 EPA emissions standards impact on electrical load

- 3.4.3 NHTSA safety standards for electrical components

- 3.4.4 International standards harmonization (ISO, IEC)

- 3.4.5 Cybersecurity regulations for connected vehicles

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Smart alternator development & variable output control

- 3.7.2 48v mild hybrid system integration

- 3.7.3 Brushless technology advancement

- 3.7.4 Integrated starter-alternator evolution

- 3.7.5 Energy management & battery integration

- 3.7.6 Predictive maintenance & IOT integration

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk Assessment Framework

- 3.14 Best Case Scenarios

- 3.15 Customer Analysis & Buying Behavior

- 3.15.1 OEM procurement criteria and decision frameworks

- 3.15.2 Aftermarket consumer preferences and pain points

- 3.15.3 Brand loyalty patterns

- 3.15.4 Price sensitivity analysis by customer segment

- 3.16 Trade Dynamics & Tariff Analysis

- 3.16.1 Import/export trends and trade flows

- 3.16.2 Tariff impacts by region

- 3.16.3 Trade policy changes and implications

- 3.16.4 Local content requirements

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Internal Combustion Engine (ICE)

- 5.3 Hybrid Engines

- 5.4 Electric Vehicle (EV) Powertrains

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 SUV

- 6.2.2 Sedan

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

- 6.4 Two-Wheelers

- 6.5 Off-Road Vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 Conventional Alternators and Starter Motors

- 7.3 Smart Alternators and Starter Motors

- 7.4 Regenerative Braking Systems

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 BorgWarner

- 10.1.2 Continental

- 10.1.3 Delphi Technologies

- 10.1.4 Denso

- 10.1.5 Hitachi Astemo

- 10.1.6 Lucas Electrical

- 10.1.7 Mitsuba

- 10.1.8 Mitsubishi Electric

- 10.1.9 Robert Bosch

- 10.1.10 Valeo

- 10.2 Regional players

- 10.2.1 ADVICS

- 10.2.2 ASIMCO Technologies

- 10.2.3 Cummins

- 10.2.4 DB Electrical

- 10.2.5 Guangzhou Sivco

- 10.2.6 Hella

- 10.2.7 Hyundai Mobis

- 10.2.8 Lucas TVS

- 10.2.9 Prestolite Electric

- 10.3 Emerging players

- 10.3.1 Broad-Ocean Technologies

- 10.3.2 Controlled Power Technologies

- 10.3.3 Ningbo Zhongwang AUTO Fittings

- 10.3.4 PHINIA

- 10.3.5 Unipoint