|

市场调查报告书

商品编码

1858832

空间电源市场机会、成长驱动因素、产业趋势分析及预测Space Power Supply Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast |

||||||

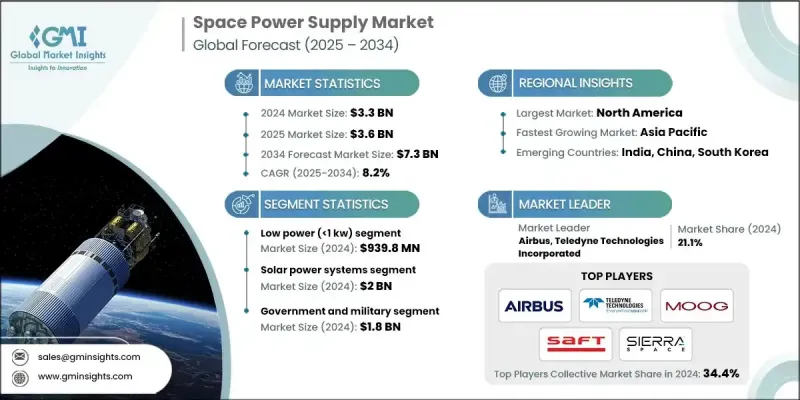

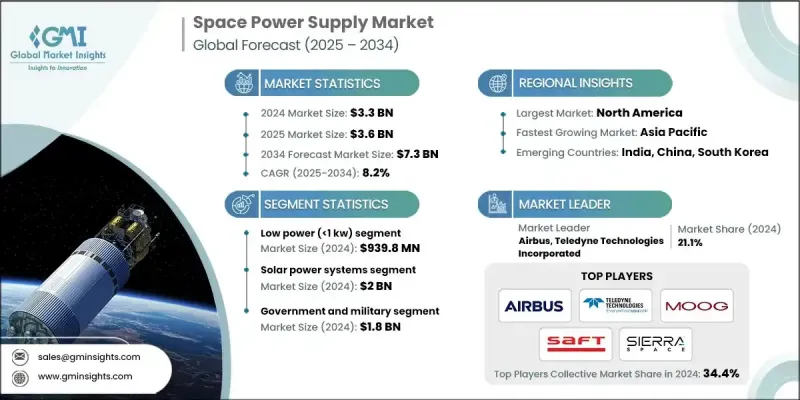

2024 年全球空间电源市场价值为 33 亿美元,预计到 2034 年将以 8.2% 的复合年增长率增长至 73 亿美元。

卫星发射数量的增加、光伏技术的进步、对立方体卫星和小卫星需求的成长以及对永续发展的日益重视,共同推动了市场成长。商业任务的加速推进以及为支援各类卫星运作而对高效电力系统的需求,持续创造着长期的市场机会。卫星的快速部署,特别是用于通讯、地球监测和导航等应用的大型星座,进一步刺激了市场需求。北美凭藉其先进的航太生态系统、雄厚的资金支持、前沿的研究投资以及在国防基础设施中率先采用人工智慧技术,在全球市场中处于领先地位。公共机构与私人航太技术开发商之间的策略合作也为市场带来了正面影响。政府对人工智慧集成,尤其是在国防和情报系统中的投资,巩固了该地区在下一代航太技术和未来航太资产保障方面的领先地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 73亿美元 |

| 复合年增长率 | 8.2% |

2024年,低功率(1度)电源市场规模达9.398亿美元。由于其与小型卫星和短期任务的兼容性,该类别持续蓬勃发展。它提供了一种轻巧且经济高效的电源解决方案,使其成为资源受限的商业和科学任务的理想选择。製造商正致力于提高功率密度和效率,同时控制系统成本。对于面向立方体卫星和学术应用的开发人员而言,设计可靠、紧凑的系统仍然是重中之重。

到2024年,太阳能发电系统市场规模将达20亿美元。这一增长与清洁能源的日益普及、光伏技术的日趋成熟以及太空持续不断的太阳能照射优势密切相关。这些系统正越来越多地应用于通讯、国防和科研任务。各公司正致力于提高太阳能板的效率、减轻重量并增强系统耐久性,以应对严苛的太空环境。这些进步对于延长任务寿命和降低整体部署成本至关重要。

2024年,美国太空电源市场规模达12亿美元。这一增长得益于太空基础设施的快速升级、对电池回收日益重视、太空法规的不断完善以及对在轨服务(例如燃料补给)需求的增加。製造商正透过专注于可持续、模组化和先进的电源技术来调整其设计,以满足不断变化的需求。这些发展旨在支持长期任务,简化监管过渡,并创造一个面向未来的太空环境,同时高度重视任务灵活性和环境保护。

推动全球空间电源市场创新和成长的领导企业包括:L3Harris Technologies, Inc.、瑞萨电子株式会社、GomSpace、Moog Inc.、Rocket Lab USA、空中客车公司、NanoAvionics、EnerSys、VPT, Inc.、DHVcorp Technology、Modular Devices Inc.、ET SPACE POWER, 材. Defence GmbH、GSYuasa Lithium Power、EaglePicher Technologies、AAC Clyde Space、Spectrolab 和 AZUR SPACE Solar Power GmbH。这些企业正透过创新、永续发展以及与全球太空任务的策略合作不断取得进步。许多企业正大力投资研发,以开发适用于小型和大型太空船的高效轻量化电源系统。研发重点在于提升光伏性能、延长电池寿命、降低高辐射环境下的热负荷。模组化系统设计正被广泛采用,以支援在轨维修和可重复使用性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 增加卫星部署

- 太阳能板技术的进步

- 小型卫星和立方体卫星的成长

- 对永续能源解决方案的需求日益增长

- 商业航太任务的扩展

- 产业陷阱与挑战

- 高昂的开发和部署成本

- 技术挑战和可靠性问题

- 市场机会

- 电池技术的进步

- 电力系统小型化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 定价策略

- 新兴商业模式

- 合规要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 关键国防现代化项目

- 预算预测(2025-2034 年)

- 对产业成长的影响

- 各国国防预算

- 供应链韧性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 併购和策略合作格局

- 风险评估与管理

- 主要合约授予情况(2021-2024 年)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 对主要参与者进行竞争基准分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导人

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估算与预测:依电源类型划分,2021-2034年

- 主要趋势

- 太阳能发电系统

- 核电系统

- 电池系统

- 燃料电池

- 混合系统

第六章:市场估算与预测:依电力容量划分,2021-2034年

- 主要趋势

- 低功率(<1千瓦)

- 中等功率(1-20千瓦)

- 高功率(20-100千瓦)

- 功率极高(>100千瓦)

第七章:市场估计与预测:依平台划分,2021-2034年

- 主要趋势

- 低地球轨道 (LEO)

- 中地球轨道 (MEO)

- 地球同步轨道(GEO)

- 深空

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 卫星

- 沟通

- 地球观测

- 导航(GNSS)

- 科学与气象监测

- 其他的

- 太空站/居住舱

- 国际太空站和计划中的商业太空站

- 月球门户

- 其他的

- 太空船/深空探测器

- 行星际探测器

- 流浪者队

- 运载火箭

- 其他的

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 政府和军队

- 商业营运商

- 研究机构

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十一章:公司简介

- 全球关键参与者

- Airbus

- L3 Harris Technologies, Inc.

- Moog Inc.

- EnerSys

- Rocket Lab USA

- 区域关键参与者

- 北美洲

- Teledyne Technologies Incorporated

- GSYuasa Lithium Power

- EaglePicher Technologies

- VPT, Inc.

- 欧洲

- AAC Clyde Space

- AZUR SPACE Solar Power GmbH

- Apcon AeroSpace & Defence GmbH

- DHV Technology

- Saft

- NanoAvionics

- Modular Devices Inc.

- 8 XP Semiconductor

- Asia-Pacific

- Renesas Electronics Corporation

- GomSpace

- 北美洲

- 颠覆者/小众玩家

- Sierra Space Corporation

- Spectrolab

- ET SPACE POWER, INC.

The Global Space Power Supply Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 7.3 billion by 2034.

The market growth is propelled by increasing satellite launches, improvements in photovoltaic technologies, rising demand for CubeSats and small satellites, and the growing push toward sustainability. The acceleration of commercial missions and the demand for efficient power systems to support various types of satellite operations continue to create long-term opportunities. Rapid satellite deployment, especially in the form of large constellations for applications in communication, earth monitoring, and navigation, further fuels demand. North America leads the global landscape, owing to its advanced aerospace ecosystem, substantial funding support, cutting-edge research investments, and early adoption of AI in national defense infrastructure. The market is also gaining from strategic collaborations between public agencies and private space technology developers. Government investment in AI integration, especially in defense and intelligence systems, reinforces the region's leadership in next-generation space technologies and futureproofing of space assets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 8.2% |

The low power (1 kW) segment accounted for USD 939.8 million in 2024. This category continues to thrive due to its compatibility with compact satellites and short-term missions. It offers a lightweight and cost-efficient power solution, making it ideal for commercial and scientific missions operating under constrained resources. Manufacturers are focusing on enhancing power density and efficiency while keeping system costs under control. The design of reliable, compact systems remains a critical priority for developers targeting CubeSats and academic applications.

The solar power systems segment reached USD 2 billion in 2024. This growth is linked to the rising use of clean energy sources, maturing photovoltaic technologies, and the advantage of uninterrupted solar exposure in space. These systems are increasingly integrated into communication, defense, and research missions. Companies are focusing efforts on improving solar panel efficiency, reducing mass, and boosting system durability to handle harsh space conditions. These advances are key to extending mission lifespans and lowering overall deployment costs.

United States Space Power Supply Market generated USD 1.2 billion in 2024. This growth is supported by rapid upgrades in space infrastructure, rising emphasis on battery recycling, progressive space regulations, and increased demand for in-orbit services such as refueling. Manufacturers are aligning their designs to meet evolving needs by focusing on sustainable, modular, and advanced power technologies. These developments aim to support long-duration missions, ease regulatory transitions, and enable a future-ready space environment with a strong emphasis on mission flexibility and environmental stewardship.

Leading players driving innovation and growth in the Global Space Power Supply Market include L3Harris Technologies, Inc., Renesas Electronics Corporation, GomSpace, Moog Inc., Rocket Lab USA, Airbus, NanoAvionics, EnerSys, VPT, Inc., DHV Technology, Modular Devices Inc., ET SPACE POWER, INC., Teledyne Technologies Incorporated, Saft, Sierra Space Corporation, Apcon AeroSpace & Defence GmbH, GSYuasa Lithium Power, EaglePicher Technologies, AAC Clyde Space, Spectrolab, and AZUR SPACE Solar Power GmbH. Companies operating in the Space Power Supply Market are advancing through innovation, sustainability, and strategic alignment with global space missions. Many are investing heavily in R&D to develop high-efficiency, lightweight power systems suitable for both small and large spacecraft. A strong focus is placed on enhancing photovoltaic performance, increasing battery life, and reducing thermal loads in high-radiation environments. Modular system design is being embraced to support in-orbit servicing and reusability.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Power source trends

- 2.2.2 Power capacity trends

- 2.2.3 Platform trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Satellite Deployments

- 3.2.1.2 Advancements in Solar Panel Technology

- 3.2.1.3 Growth of Small Satellites and CubeSats

- 3.2.1.4 Rising Demand for Sustainable Energy Solutions

- 3.2.1.5 Expansion of Commercial Space Missions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Development and Deployment Costs

- 3.2.2.2 Technical Challenges and Reliability Issues

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in Battery Technologies

- 3.2.3.2 Miniaturization of Power Systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Defense Budget Analysis

- 3.13 Global Defense Spending Trends

- 3.14 Regional Defense Budget Allocation

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Middle East and Africa

- 3.14.5 Latin America

- 3.15 Key Defense Modernization Programs

- 3.16 Budget Forecast (2025-2034)

- 3.16.1 Impact on Industry Growth

- 3.16.2 Defense Budgets by Country

- 3.17 Supply Chain Resilience

- 3.18 Geopolitical Analysis

- 3.19 Workforce Analysis

- 3.20 Digital Transformation

- 3.21 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.22 Risk Assessment and Management

- 3.23 Major Contract Awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solar power systems

- 5.3 Nuclear power systems

- 5.4 Battery systems

- 5.5 Fuel cells

- 5.6 Hybrid systems

Chapter 6 Market Estimates and Forecast, By Power Capacity, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low power (<1 kw)

- 6.3 Medium power (1-20 kw)

- 6.4 High power (20-100 kw)

- 6.5 Very high power (>100 kw)

Chapter 7 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEO (low earth orbit)

- 7.3 MEO (medium earth orbit)

- 7.4 GEO (geostationary orbit)

- 7.5 Deep space

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Satellites

- 8.1.1 Communication

- 8.1.2 Earth observation

- 8.1.3 Navigation (GNSS)

- 8.1.4 Scientific & weather monitoring

- 8.1.5 Others

- 8.2 Space stations / habitats

- 8.2.1 ISS and planned commercial stations

- 8.2.2 Lunar gateway

- 8.2.3 Others

- 8.3 Spacecraft / deep-space probes

- 8.3.1 Interplanetary probes

- 8.3.2 Rovers

- 8.4 Launch vehicles

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Government and military

- 9.2 Commercial operators

- 9.3 Research institutions

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company profiles

- 11.1 Global Key Players

- 11.1.1 Airbus

- 11.1.2. L3 Harris Technologies, Inc.

- 11.1.3 Moog Inc.

- 11.1.4 EnerSys

- 11.1.5 Rocket Lab USA

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Teledyne Technologies Incorporated

- 11.2.1.2 GSYuasa Lithium Power

- 11.2.1.3 EaglePicher Technologies

- 11.2.1.4 VPT, Inc.

- 11.2.2 Europe

- 11.2.2.1 AAC Clyde Space

- 11.2.2.2 AZUR SPACE Solar Power GmbH

- 11.2.2.3 Apcon AeroSpace & Defence GmbH

- 11.2.2.4 DHV Technology

- 11.2.2.5 Saft

- 11.2.2.6 NanoAvionics

- 11.2.2.7 Modular Devices Inc.

- 11.2.2. 8 XP Semiconductor

- 11.2.3 Asia-Pacific

- 11.2.3.1 Renesas Electronics Corporation

- 11.2.3.2 GomSpace

- 11.2.1 North America

- 11.3 Disruptors / Niche Players

- 11.3.1 Sierra Space Corporation

- 11.3.2 Spectrolab

- 11.3.3 ET SPACE POWER, INC.