|

市场调查报告书

商品编码

1858845

车联网(V2X)安全晶片市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Vehicle-to-everything (V2X) Security Chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

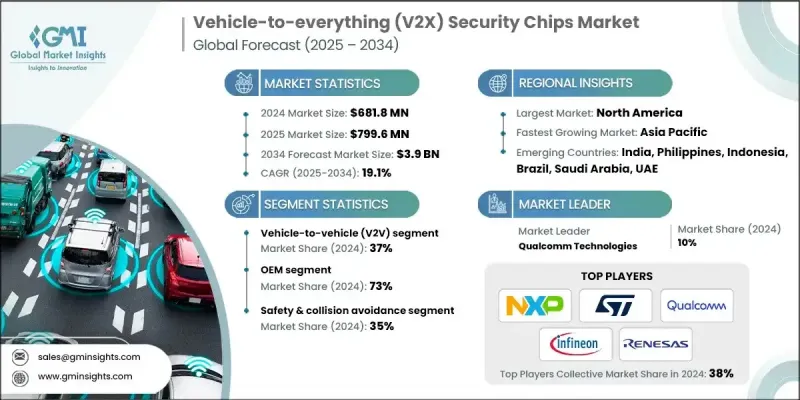

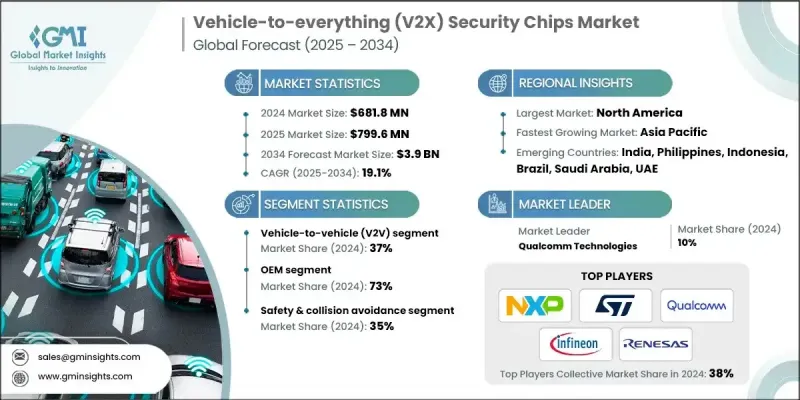

2024 年全球车联网安全晶片市场价值为 6.818 亿美元,预计到 2034 年将以 19.1% 的复合年增长率增长至 39 亿美元。

自动驾驶、连网汽车和高级驾驶辅助功能的日益普及正在迅速改变车载安全硬体的格局。汽车製造商正越来越多地将人工智慧加速器、雷达介面、讯号处理器和安全微控制器等组件嵌入车辆,以提升态势感知、决策能力和系统弹性。对合规性、网路安全和即时回应能力的日益重视,促使製造商设计具备嵌入式加密和车规级认证的晶片。新冠疫情凸显了全球晶片供应链的脆弱性,加速了区域化製造、端到端验证和可扩展安全架构的发展。随着电动车和自动驾驶车队的扩张,安全车辆通讯系统的需求持续攀升。基于订阅的加密更新、软硬体协同设计以及安全即服务 (SECaAS) 产品正被用于在不断演变的威胁环境中提供持续保护。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.818亿美元 |

| 预测值 | 39亿美元 |

| 复合年增长率 | 19.1% |

2024年,车对车(V2V)通讯系统市占率达到37%,预计到2034年将以19%的复合年增长率成长。这一增长主要受车辆间安全、快速资料交换需求日益增长的驱动。 V2V架构中的安全晶片对于保护交通资料、碰撞警报和系统指令免受网路威胁至关重要,从而确保行驶中车辆间安全可靠的通讯。

2024年,原始设备製造商(OEM)市占率达到73%,预计到2034年将以18.1%的复合年增长率成长。如此高的市场份额主要得益于在生产阶段将安全连接功能直接整合到车辆平台中。遵守ISO/SAE 21434和UNECE WP.29等标准已成为重中之重,促使汽车製造商将V2X安全机制硬编码到其係统中,以应对欺骗和未经授权的访问等威胁,同时增强用户信任和品牌信誉。

预计到2024年,美国车联网(V2X)安全晶片市场将占据86%的份额,市场规模将达到1.973亿美元。美国市场的成长动能主要得益于联邦安全法规、智慧交通系统的扩展以及自动驾驶技术的快速发展。联邦机构正在强调V2X协定的重要性,鼓励汽车製造商和零件供应商采用防篡改微控制器、硬体加密引擎和信任根框架,以确保连网车辆平台的资料流安全并符合相关法规。

全球车联网(V2X)安全晶片市场的主要企业包括电装(Denso)、高通(Qualcomm Technologies)、恩智浦半导体(NXP Semiconductors)、瑞萨电子(Renesas Electronics)、博世(Bosch)、英飞凌(Infineon Technologies)、义法半导体(Automo Technologies)、Autop Technologies)、Autox Technologies)、Autoics, Hutoics)、Autoge 是半导体(Hutoics)。和大陆集团(Continental)。这些领导企业致力于开发专用硬体安全模组、安全启动协定和空中下载(OTA)加密金钥管理系统,以保障连网车辆的通讯安全。他们积极与原始设备製造商(OEM)和一级供应商合作开发解决方案,确保晶片符合功能安全和资料保护标准。多家公司正在投资开发基于人工智慧的安全引擎,以实现边缘端的即时威胁侦测。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 连网汽车对资料保护的需求日益增长。

- 政府网路安全指令加速成长。

- 5G 和边缘运算能够实现更快、更安全的 V2X 通讯。

- 智慧城市计划促进了安全车辆通讯技术的普及。

- 产业陷阱与挑战

- V2X安全晶片的高实施成本限制了製造商的采用。

- 车辆和基础设施缺乏标准化的安全协议,为部署带来了挑战。

- 市场机会

- 自动驾驶汽车的普及增加了对先进安全技术的需求。

- 电动车的成长带动了对安全充电和通讯的需求。

- 5G汽车为晶片设计开闢了新的机会。

- V2X与智慧基础架构的整合可实现新服务。

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与技术路线图

- 新一代 V2 X 安全技术

- 量子安全V2 X通信

- 人工智慧驱动的安全威胁侦测

- 零信任 V2 X 架构

- V2 X 安全区块链集成

- 同态加密应用

- 生物特征认证集成

- 安全即服务模式

- 自动驾驶车辆安全集成

- SAE 特定等级的安全要求

- 多层次安全协调

- 人机介面安全

- 故障安全机制

- 远端操作安全

- 车队安全管理

- 边缘案例安全处理

- V2X 安全测试与验证

- 安全测试方法

- 渗透测试要求

- 脆弱性评估流程

- 真实世界攻击模拟

- 合规性测试框架

- 持续安全监控

- 第三方安全验证

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估价与预测:依车辆自动驾驶整合度划分,2021-2034年

- 主要趋势

- 硬体安全模组(HSM)

- 可信任平台模组(TPM)

- 加密加速器(片上)

- 信任之根

- 安全微控制器或安全SoC

第六章:市场估算与预测:依安全晶片划分,2021-2034年

- 主要趋势

- 分离式安全晶片

- 整合安全解决方案

- 软体定义安全

- 混合安全架构

- 支援量子运算的安全晶片

第七章:市场估算与预测:以通讯方式划分,2021-2034年

- 主要趋势

- 车对车(V2V)

- 车路协同(V2I)

- 车辆与行人(V2P)

- 车联网(V2N)

- 车联网(V2D)

第八章:市场估算与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 多用途乘用车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 安全与防碰撞

- 交通管理

- 资讯娱乐

- 导航与路线规划

- 远端诊断

- 车队管理

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- Bosch

- Broadcom

- Continental

- Denso

- Infineon

- Marvell Technology

- NXP Semiconductors

- Qualcomm Technologies

- Renesas Electronics

- STMicroelectronics

- Texas Instruments

- 区域玩家

- Analog Devices

- Giesecke+Devrient Mobile Security

- Huawei

- IDEMIA

- MediaTek

- On Semiconductor

- Rohm Semiconductor

- Samsung

- 新兴参与者

- Aptiv

- Autotalks

- Cohda Wireless

- Commsignia

- Escrypt

- Ficosa

- Inside Secure

- Microchip Technology

- Rambus

- Secure-IC SAS

The Global Vehicle-to-everything Security Chips Market was valued at USD 681.8 million in 2024 and is estimated to grow at a CAGR of 19.1% to reach USD 3.9 billion by 2034.

Rising adoption of automated driving, connected vehicles, and advanced driver-assistance features is rapidly transforming the landscape for in-vehicle security hardware. Automakers are increasingly embedding components such as AI accelerators, radar interfaces, signal processors, and secure microcontrollers to improve situational awareness, decision-making, and system resilience. A growing emphasis on regulatory compliance, cyber protection, and real-time responsiveness has pushed manufacturers to design chips with embedded encryption and automotive-grade certifications. The pandemic spotlighted the fragility of global chip supply chains, which accelerated the push for regional manufacturing, end-to-end validation, and scalable security architectures. As electric mobility and autonomous fleets expand, demand for secure vehicle communication systems continues to climb. Subscription-based encryption updates, integrated software-hardware co-design, and Security-as-a-Service (SECaAS) offerings are being used to provide ongoing protection across evolving threat landscapes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $681.8 Million |

| Forecast Value | $3.9 Billion |

| CAGR | 19.1% |

The vehicle-to-vehicle (V2V) communication systems segment accounted for a 37% share in 2024 and is expected to grow at a CAGR of 19% through 2034. This growth is driven by the increasing need for safe and responsive data exchanges between vehicles. Security chips within V2V architectures are critical for shielding traffic data, collision alerts, and system commands from cyber threats, ensuring safe and authenticated communication across vehicles in motion.

In 2024, the original equipment manufacturers (OEMs) segment held a 73% share and is projected to grow at a CAGR of 18.1% by 2034. The high share is linked to the direct integration of secure connectivity features into vehicle platforms at the production stage. Compliance with standards like ISO/SAE 21434 and UNECE WP.29 is now a priority, prompting automakers to hardwire V2X security into their systems to counter threats such as spoofing and unauthorized access, while enhancing user trust and brand integrity.

US Vehicle-to-everything (V2X) Security Chips Market held an 86% share in 2024, generating USD 197.3 million. Market momentum in the US is largely supported by federal safety regulations, the expansion of intelligent transport systems, and rapid growth in autonomous mobility. Federal bodies are reinforcing the need for V2X protocols, encouraging automakers and component suppliers to implement tamper-proof microcontrollers, hardware encryption engines, and root-of-trust frameworks to secure data flow and maintain compliance across connected vehicle platforms.

Key companies in the Global Vehicle-to-everything (V2X) Security Chips Market are Denso, Qualcomm Technologies, NXP Semiconductors, Renesas Electronics, Bosch, Infineon Technologies, STMicroelectronics, Huawei Technologies, Autotalks, and Continental. Leading firms in the Vehicle-to-everything (V2X) Security Chips Market are focusing on developing dedicated hardware security modules, secure boot protocols, and over-the-air (OTA) cryptographic key management systems to safeguard communication channels in connected vehicles. These players are actively co-developing solutions with OEMs and Tier-1 suppliers to ensure chips meet functional safety and data protection standards. Several companies are investing in AI-powered security engines capable of real-time threat detection at the edge.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle Autonomy Integration

- 2.2.3 Security Chip

- 2.2.4 Component

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising need for data protection in connected vehicles.

- 3.2.1.2 Government cybersecurity mandates accelerating growth.

- 3.2.1.3 5G and edge computing enable faster, secure V2X communication.

- 3.2.1.4 Smart city initiatives boost secure vehicle communication adoption.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High costs associated with implementing V2X security chips are limiting adoption among manufacturers

- 3.2.2.2 Lack of standardized security protocols across vehicles and infrastructure is creating deployment challenges.

- 3.2.3 Market opportunities

- 3.2.3.1 Autonomous vehicle adoption increases demand for advanced security.

- 3.2.3.2 Electric vehicle growth drives secure charging and communication needs.

- 3.2.3.3 5G-enabled vehicles open new chip design opportunities.

- 3.2.3.4 V2X integration with smart infrastructure enables new services.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By Products

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future Outlook & Technology Roadmap

- 3.13.1. Next-Generation V2 X Security Technologies

- 3.13.2. Quantum-Safe V2 X Communication

- 3.13.3 AI-Driven Security Threat Detection

- 3.13.4. Zero-Trust V2 X Architecture

- 3.13.5. Blockchain Integration for V2 X Security

- 3.13.6 Homomorphic Encryption Applications

- 3.13.7 Biometric Authentication Integration

- 3.13.8 Security-as-a-Service Models

- 3.14 Autonomous Vehicle Security Integration

- 3.14.1 SAE level-specific security requirements

- 3.14.2 Multi-level security coordination

- 3.14.3 Human-machine interface security

- 3.14.4 Fail-safe security mechanisms

- 3.14.5 Remote operation security

- 3.14.6 Fleet security management

- 3.14.7 Edge case security handling

- 3.15 V2X security testing & validation

- 3.15.1 Security testing methodology

- 3.15.2 Penetration testing requirements

- 3.15.3 Vulnerability assessment processes

- 3.15.4 Real-world attack simulation

- 3.15.5 Compliance testing frameworks

- 3.15.6 Continuous security monitoring

- 3.15.7 Third-party security validation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle Autonomy Integration, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware Security Module (HSM)

- 5.3 Trusted Platform Module (TPM)

- 5.4 Crypto accelerators (on-chip)

- 5.5 Root of Trust

- 5.6 Secure microcontrollers or secure SoCs

Chapter 6 Market Estimates & Forecast, By Security Chip, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Discrete Security Chips

- 6.3 Integrated Security Solutions

- 6.4 Software-Defined Security

- 6.5 Hybrid Security Architectures

- 6.6 Quantum-Ready Security Chips

Chapter 7 Market Estimates & Forecast, By Communication Mode, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Vehicle-to-Vehicle (V2V)

- 7.3 Vehicle-to-Infrastructure (V2I)

- 7.4 Vehicle-to-Pedestrian (V2P)

- 7.5 Vehicle-to-Network (V2N)

- 7.6 Vehicle-to-Device (V2D)

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchbacks

- 8.2.2 Sedans

- 8.2.3 SUVs

- 8.2.4 MPVs

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCVs)

- 8.3.2 Medium commercial vehicles (MCVs)

- 8.3.3 Heavy commercial vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Safety & Collision Avoidance

- 9.3 Traffic Management

- 9.4 Infotainment

- 9.5 Navigation & Routing

- 9.6 Remote Diagnostics

- 9.7 Fleet Management

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Bosch

- 12.1.2 Broadcom

- 12.1.3 Continental

- 12.1.4 Denso

- 12.1.5 Infineon

- 12.1.6 Marvell Technology

- 12.1.7 NXP Semiconductors

- 12.1.8 Qualcomm Technologies

- 12.1.9 Renesas Electronics

- 12.1.10 STMicroelectronics

- 12.1.11 Texas Instruments

- 12.2 Regional Players

- 12.2.1 Analog Devices

- 12.2.2 Giesecke+Devrient Mobile Security

- 12.2.3 Huawei

- 12.2.4 IDEMIA

- 12.2.5 MediaTek

- 12.2.6 On Semiconductor

- 12.2.7 Rohm Semiconductor

- 12.2.8 Samsung

- 12.3 Emerging Players

- 12.3.1 Aptiv

- 12.3.2 Autotalks

- 12.3.3 Cohda Wireless

- 12.3.4 Commsignia

- 12.3.5 Escrypt

- 12.3.6 Ficosa

- 12.3.7 Inside Secure

- 12.3.8 Microchip Technology

- 12.3.9 Rambus

- 12.3.10 Secure-IC S.A.S.