|

市场调查报告书

商品编码

1858851

离子液体在电池应用领域的市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Ionic Liquids for Battery Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

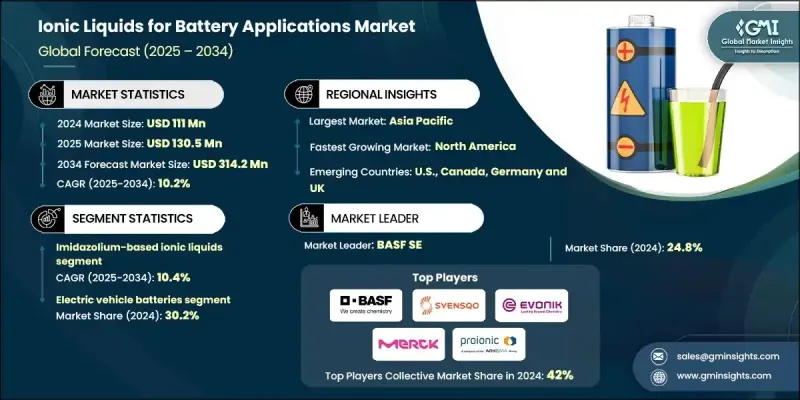

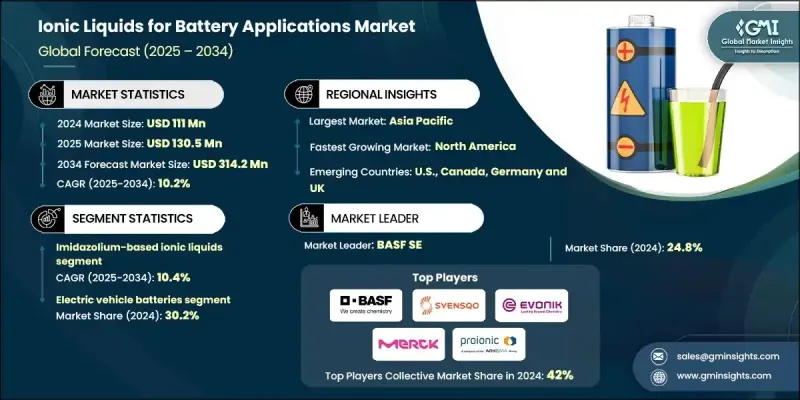

2024 年全球电池应用离子液体市场价值为 1.11 亿美元,预计到 2034 年将以 10.2% 的复合年增长率成长至 3.142 亿美元。

对先进储能係统日益增长的需求正在推动市场扩张。离子液体,即低温下呈液态的有机盐,以其卓越的离子电导率、高热稳定性、低挥发性和宽广的电化学窗口而闻名。这些特性使其成为各种电池类型(包括锂离子电池、钠离子电池和固态电池)的理想电解质。离子液体能够在高压下运作并在宽温度范围内保持性能,使其在电动车、再生能源储存和便携式电子产品领域具有独特的价值。电动车的日益普及和电网中再生能源使用量的不断增长,推动了对更安全、更长寿命电池的需求,进一步提升了离子液体电解质的重要性。持续的创新致力于提高电导率和降低製造成本,这将继续促进市场加速发展。随着越来越多的行业寻求可靠、高性能的电池技术,离子液体因其能够延长电池寿命并提高各种应用场景下的安全性而备受关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.11亿美元 |

| 预测值 | 3.142亿美元 |

| 复合年增长率 | 10.2% |

2024年,咪唑基离子液体占了高达45.2%的市场。其广泛的商业化应用和可扩展的生产能力使其在维持成本效益和稳定供应方面具有显着优势。这些因素,加上持续的研发投入,正助力咪唑化合物在多种电池化学系统中保持其主导地位。预计在持续的研发支援下,该领域将获得进一步发展动力,旨在提升储能係统的效率和多功能性。

预计到2024年,电动车电池市占率将达到30.2%。这一成长主要得益于汽车产业持续向电动出行转型以及消费者对安全性的日益增长的需求。电动车产量的扩大、监管框架的日益严格以及消费者对更高性能电池的偏好,都推动了该细分市场的成长。随着新一代电池技术的研发,许多汽车製造商正投入大量资源,致力于采用离子液体电解质来提升电池的安全性和功能性。

预计到2024年,北美电池用离子液体市场份额将达到28.2%,这主要得益于该地区对电池相关离子液体的需求持续成长。电动车的广泛普及、清洁能源的併网以及对电网稳定性的日益重视,都推动了这一成长。此外,技术创新以及政府支持先进储能基础设施的倡议,也促进了离子液体应用的持续成长。该地区对新能源技术的积极响应,为市场的可持续发展创造了有利条件。

积极推动全球电池应用离子液体市场发展的关键企业包括:Solvionic SA、Merck KGaA、Richman Chemical Inc.、Syensqo、NOHMs Technologies, Inc.、Evonik Industries AG、BASF SE、Proionic GmbH - Arkema Group、东京化学工业株式会社以及IoLiSF SE、Proionic GmbH - Arkema Group、东京化学工业株式会社以及IoLiTec Technologies* IHonic LiquiTec - IHonic。为巩固市场地位,各企业正致力于拓展产品组合,例如开发针对不同电池化学体系定製配方的离子液体。许多企业优先考虑透过製程创新和扩大生产规模来降低成本,从而提高商业可行性。此外,各企业也积极与电池开发商和原始设备製造商 (OEM) 合作研发,以加速离子液体在新兴电池技术中的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 透过申请

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码说明:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依离子液体类型划分,2021-2034年

- 主要趋势

- 咪唑基离子液体

- 吡咯烷基离子液体

- 鏻基离子液体

- 季铵盐基离子液体

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 电动汽车电池

- 汽车牵引电池

- 油电混合车系统

- 快速充电应用

- 电网储能

- 公用事业规模储能係统

- 频率调节应用

- 长期储存解决方案

- 消费性电子产品

- 智慧型手机应用程式

- 笔记型电脑和便携式设备

- 穿戴式科技

- 航太与国防

- 卫星电池系统

- 军事应用

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- BASF SE

- Syensqo

- Evonik Industries AG

- Merck KGaA

- Proionic GmbH - Arkema Group

- Solvionic SA

- IoLiTec - Ionic Liquids Technologies GmbH

- Tokyo Chemical Industry Co., Ltd.

- NOHMs Technologies, Inc.

- Richman Chemical Inc.

The Global Ionic Liquids for Battery Applications Market was valued at USD 111 million in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 314.2 million by 2034.

Rising demand for advanced energy storage systems is fueling market expansion. Ionic liquids, known as organic salts in liquid form at low temperatures, are recognized for their outstanding ionic conductivity, high thermal stability, low volatility, and broad electrochemical windows. These properties make them highly suitable as electrolytes in various battery types, including lithium-ion, sodium-ion, and solid-state formats. Their ability to enable high-voltage operation and maintain performance across wide temperature ranges makes them especially valuable in electric vehicles, renewable energy storage, and portable electronics. Growing adoption of electric mobility and the increasing use of renewables in the power grid are driving the need for safer, longer-lasting batteries further elevating the relevance of ionic liquid electrolytes. Ongoing innovations are focusing on improving conductivity and reducing manufacturing costs, which continues to support market acceleration. As more industries seek reliable, high-performance battery technologies, ionic liquids are gaining significant traction for their ability to extend battery lifespan and enhance safety across diverse use cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $111 Million |

| Forecast Value | $314.2 Million |

| CAGR | 10.2% |

The imidazolium-based ionic liquids segment held a substantial 45.2% share in 2024. Their widespread commercial availability and production scalability give them a distinct edge in maintaining cost efficiency and reliable supply. These factors, along with ongoing research investments, are helping imidazolium compounds maintain their dominance across multiple battery chemistries. The segment is expected to receive further momentum through consistent R&D support aimed at unlocking even greater efficiency and versatility in energy storage systems.

The electric vehicle batteries segment held a 30.2% share in 2024. This share is driven by the continued transition to e-mobility and heightened safety expectations within the automotive sector. The expansion of EV production, stricter regulatory frameworks, and consumer preferences for better battery performance are all contributing to growth in this segment. With next-generation battery technologies under development, many automotive manufacturers are allocating significant resources toward adopting ionic liquid electrolytes to improve battery safety and functionality.

North America Ionic Liquids for Battery Applications Market held a 28.2% share in 2024, as demand for battery-related ionic liquids continues to rise across the region. This growth is being propelled by the widespread adoption of electric vehicles, integration of clean energy sources, and an increasing emphasis on grid stability. Technological innovation, alongside government initiatives to support advanced energy storage infrastructure, is contributing to the rising use of ionic liquids. The region remains highly responsive to new energy technologies, creating favorable conditions for sustained market development.

Key companies actively shaping the Global Ionic Liquids for Battery Applications Market include Solvionic SA, Merck KGaA, Richman Chemical Inc., Syensqo, NOHMs Technologies, Inc., Evonik Industries AG, BASF SE, Proionic GmbH - Arkema Group, Tokyo Chemical Industry Co., Ltd., and IoLiTec - Ionic Liquids Technologies GmbH. To strengthen their position, companies are focusing on key strategies such as expanding their product portfolios with custom-formulated ionic liquids tailored to different battery chemistries. Many are prioritizing cost reduction through process innovation and scaling production to improve commercial viability. Collaborative R&D initiatives with battery developers and OEMs are also being pursued to speed up the integration of ionic liquids into emerging battery technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Ionic liquids type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By application

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Ionic Liquids Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Imidazolium-based ionic liquids

- 5.3 Pyrrolidinium-based ionic liquids

- 5.4 Phosphonium-based ionic liquids

- 5.5 Quaternary ammonium-based ionic liquids

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Electric vehicle batteries

- 6.2.1 Automotive traction batteries

- 6.2.2 Hybrid vehicle systems

- 6.2.3 Fast charging applications

- 6.3 Grid energy storage

- 6.3.1 Utility-scale storage systems

- 6.3.2 Frequency regulation applications

- 6.3.3 Long-duration storage solutions

- 6.4 Consumer electronics

- 6.4.1 Smartphone applications

- 6.4.2 Laptop & portable devices

- 6.4.3 Wearable technology

- 6.5 Aerospace & defense

- 6.5.1 Satellite battery systems

- 6.5.2 Military applications

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 BASF SE

- 8.2 Syensqo

- 8.3 Evonik Industries AG

- 8.4 Merck KGaA

- 8.5 Proionic GmbH - Arkema Group

- 8.6 Solvionic SA

- 8.7 IoLiTec - Ionic Liquids Technologies GmbH

- 8.8 Tokyo Chemical Industry Co., Ltd.

- 8.9 NOHMs Technologies, Inc.

- 8.10 Richman Chemical Inc.