|

市场调查报告书

商品编码

1858858

印刷电子导电油墨市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Conductive Inks for Printed Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

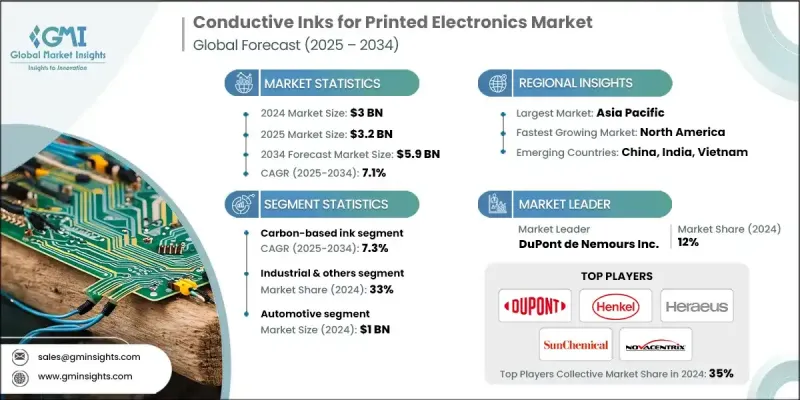

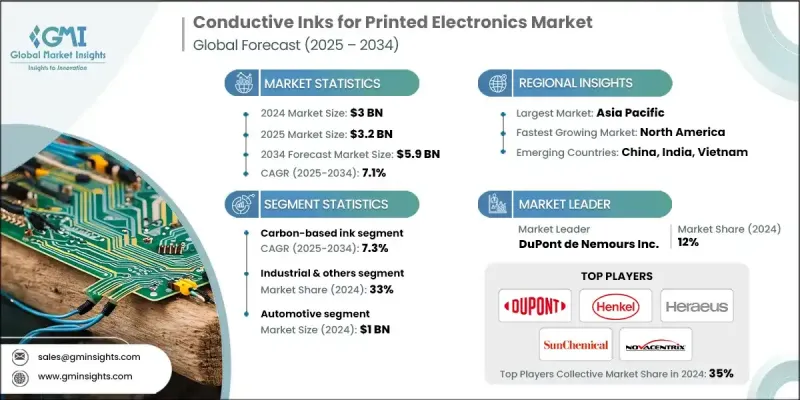

2024 年全球印刷电子导电油墨市场价值为 30 亿美元,预计到 2034 年将以 7.1% 的复合年增长率增长至 59 亿美元。

这一成长归功于市场对柔性穿戴电子产品日益增长的需求,这类产品在各行各业都越来越受欢迎。同时,产品设计也越来越注重小型化和永续性。因此,製造商和消费者都在转向环保、低VOC(挥发性有机化合物)的导电油墨,这类油墨具有广泛的基材相容性,例如纸张、聚合物和纺织品。为了满足这些需求,新的生产方法应运而生,并利用添加剂来最大限度地减少浪费,同时有效地扩大生产规模。一些公司推出了采用银奈米颗粒、铜片、石墨烯和碳奈米管等材料的先进配方,旨在满足RFID标籤、印刷感测器、柔性电路和太阳能电池等高性能应用的需求。此外,由于光子烧结油墨和紫外光固化油墨适用于低温加工(这对敏感材料至关重要),因此对这类油墨的需求也不断增长。导电油墨也被用于各种新兴应用,包括印刷加热器、物联网设备和用于医疗保健的一次性生物感测器,所有这些都促进了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 7.1% |

2024年,银浆市占率达80%。这主要归功于其优异的导电性,使其成为高性能应用的理想选择。银浆的导电率通常接近金属银的80%,因此非常适合光伏金属化、RFID天线生产和精密电路印刷等领域。

2024年,工业应用领域占了33%的市场。这一成长主要得益于太阳能技术的进步,尤其是在薄膜太阳能电池领域,导电油墨对于光伏电池的金属化至关重要。这些油墨用于印刷正面栅格线、背面触点和互连繫统,而这些对于太阳能组件的效率和可扩展性至关重要。

2024年,北美印刷电子导电油墨市占率达30.2%。该地区的成长主要得益于技术进步,包括先进5G系统的部署以及汽车电气化和航太应用领域的快速发展。北美对优质油墨配方的需求不断增长,因为这些油墨具有卓越的性能。此外,政府为促进再生能源和电动车基础设施建设的措施也正在重塑市场竞争格局,为导电油墨供应商创造了有利的市场环境。

印刷电子导电油墨市场的主要参与者包括汉高股份公司 (Henkel AG & Co. KGaA)、杜邦电子与工业公司 (DuPont Electronics & Industrial)、SPGPrints BV、NovaCentrix、贺利氏控股有限公司 (Heraeus Holding GmbH)、Advanced Nano Products. Nano Inc.、Electroninks Incorporated、爱克发-吉华集团 (Agfa-Gevaert Group) 等。为了巩固市场地位,印刷电子导电油墨市场的企业正致力于开发环保高性能产品。许多公司加大研发投入,开发创新油墨配方,以满足包括再生能源和穿戴式技术在内的特定应用需求。策略合作也十分普遍,有助于企业开拓新市场并扩展产品组合。为了满足日益增长的永续发展需求,一些公司正在推出低挥发性有机化合物 (VOC) 和可回收油墨系统。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 5G和毫米波技术普及加速

- 柔性电子产品和穿戴式装置的普及

- 汽车电气化和智慧车辆集成

- 产业陷阱与挑战

- 白银价格波动与原物料成本压力

- 导电性和耐久性的技术限制

- 市场机会

- 铜墨开发及成本降低潜力

- 永续和可回收材料创新

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 透过技术

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 银基油墨

- 碳基油墨

- 铜墨

- 特种油墨

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 工业及其他

- 柔性电子

- 卫生保健

- 汽车

- 光电发电

- 物联网与连接

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 汽车

- 医疗保健及医疗器材

- 电信

- 包装产业

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- DuPont Electronics & Industrial

- Henkel AG & Co. KGaA

- Heraeus Holding GmbH

- Sun Chemical Corporation

- NovaCentrix

- Agfa-Gevaert Group

- Voltera Inc.

- XTPL SA

- Advanced Nano Products (ANP)

- Copprint Technologies

- Electroninks Incorporated

- SPGPrints BV

- C3 Nano Inc.

The Global Conductive Inks for Printed Electronics Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 5.9 billion by 2034.

The growth is attributed to the increasing demand for flexible and wearable electronics, which are becoming increasingly popular across various industries. At the same time, there is a growing focus on miniaturization and sustainability in product design. As a result, both manufacturers and consumers are turning toward eco-friendly, low-VOC conductive inks that offer broad substrate compatibility, such as with paper, polymers, and textiles. To align with these needs, new production methods have emerged, utilizing additives to minimize waste while scaling up production efficiently. Companies have introduced advanced formulations with materials like silver nanoparticles, copper flakes, graphene, and carbon nanotubes, targeting high-performance applications such as RFID tags, printed sensors, flexible circuits, and solar cells. Additionally, the demand for photonic sintering and UV-curable inks is rising due to their suitability for low-temperature processing, which is crucial for sensitive materials. Conductive inks are also used in various emerging applications, including printed heaters, IoT devices, and disposable biosensors for healthcare, all contributing to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 7.1% |

In 2024, the silver ink segment held an 80% share. This is due to its excellent electrical conductivity, which makes it ideal for high-performance applications. Silver inks typically achieve conductivities close to 80% of that of metallic silver, making them highly suitable for uses like photovoltaic metallization, RFID antenna production, and precision circuit printing.

The industrial applications segment held a 33% share in 2024. This growth is driven by advancements in solar energy, particularly in thin-film solar cells, where conductive inks are crucial for metallizing photovoltaic cells. These inks are used to print the front-side grid lines, back-side contacts, and interconnection systems, which are critical for the efficiency and scalability of solar modules.

North America Conductive Inks for Printed Electronics Market held a 30.2% share in 2024. The region's growth is largely driven by technological advancements, including the deployment of advanced 5G systems and the push toward automotive electrification and aerospace applications. North America's demand for premium ink formulations is rising, as these inks are needed for their superior performance characteristics. Additionally, the competitive environment is being shaped by government initiatives aimed at promoting renewable energy and the infrastructure of electric vehicles, creating a favorable market for conductive ink suppliers.

Leading players in the Conductive Inks for Printed Electronics Market include Henkel AG & Co. KGaA, DuPont Electronics & Industrial, SPGPrints B.V., NovaCentrix, Heraeus Holding GmbH, Advanced Nano Products (ANP), Voltera Inc., Sun Chemical Corporation, XTPL S.A., Copprint Technologies, C3 Nano Inc., Electroninks Incorporated, Agfa-Gevaert Group, and others. To bolster their presence, companies in the conductive inks for printed electronics market are focusing on developing eco-friendly and high-performance products. Many companies are investing in R&D to create innovative ink formulations that cater to specific applications, including renewable energy and wearable technology. Strategic partnerships and collaborations are also common, helping businesses access new markets and expand their product portfolios. To meet growing sustainability demands, some companies are introducing low-VOC and recyclable ink systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 5G & mmWave technology adoption acceleration

- 3.2.1.2 Flexible electronics & wearable device proliferation

- 3.2.1.3 Automotive electrification & smart vehicle integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Silver price volatility & raw material cost pressures

- 3.2.2.2 Technical limitations in conductivity & durability

- 3.2.3 Market opportunities

- 3.2.3.1 Copper ink development & cost reduction potential

- 3.2.3.2 Sustainable & recycled material innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Silver-based inks

- 5.3 Carbon-based inks

- 5.4 Copper inks

- 5.5 Specialty inks

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Industrial & others

- 6.3 Flexible electronics

- 6.4 Healthcare

- 6.5 Automotive

- 6.6 Photovoltaics

- 6.7 IoT & connectivity

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Healthcare & medical device

- 7.4 Telecommunications

- 7.5 Packaging industry

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 DuPont Electronics & Industrial

- 9.2 Henkel AG & Co. KGaA

- 9.3 Heraeus Holding GmbH

- 9.4 Sun Chemical Corporation

- 9.5 NovaCentrix

- 9.6 Agfa-Gevaert Group

- 9.7 Voltera Inc.

- 9.8 XTPL S.A.

- 9.9 Advanced Nano Products (ANP)

- 9.10 Copprint Technologies

- 9.11 Electroninks Incorporated

- 9.12 SPGPrints B.V.

- 9.13 C3 Nano Inc.