|

市场调查报告书

商品编码

1858860

资料湖库市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Data Lakehouse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

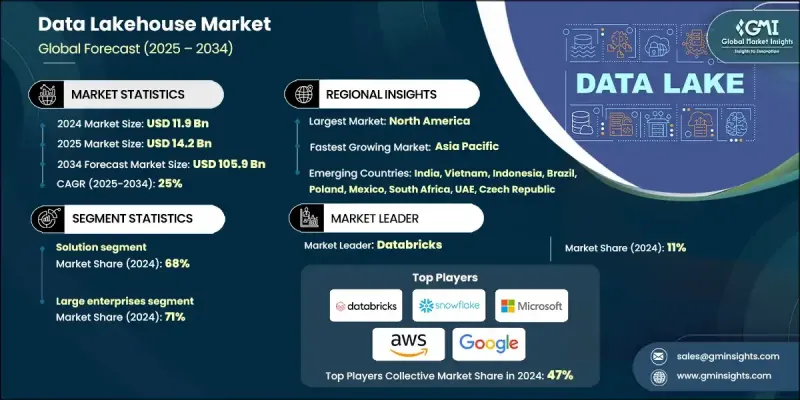

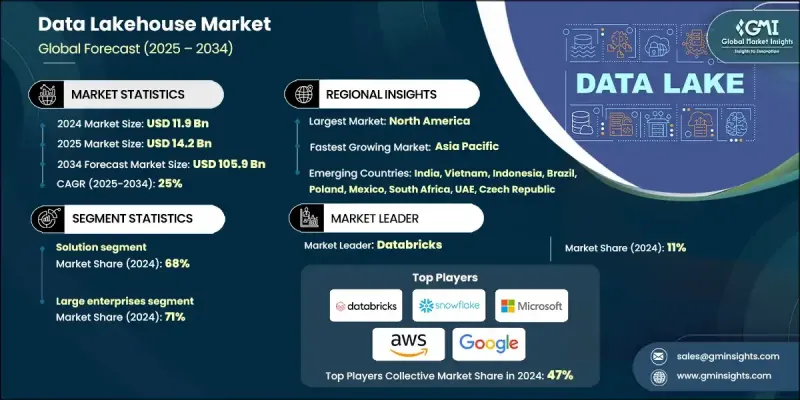

2024 年全球资料湖市场价值为 119 亿美元,预计到 2034 年将以 25% 的复合年增长率成长至 1,059 亿美元。

这种显着成长源自于企业日益寻求将资料湖的经济性与传统资料仓储的分析能力结合。湖屋架构提供统一访问,从而实现可扩展的分析、即时洞察以及增强的人工智慧和机器学习性能。企业正在优先考虑能够减少资料孤岛、改善治理并支援混合云端和本地环境的平台,尤其是在医疗保健和银行、金融服务和保险 (BFSI) 等受监管行业。随着无程式码工具和自助式 BI 平台的日益普及,IT 部门以外的业务使用者和资料专业人员现在可以独立利用这些系统。培训生态系统也不断扩展,越来越多的供应商强调教育和技能提升,以确保企业能够自信地部署和扩展湖屋平台。随着混合云和多云部署成为常态,湖屋为企业提供了更高的敏捷性、集中式资料存取和长期成本效益,从而推动了其在北美、欧洲和亚太地区的广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 119亿美元 |

| 预测值 | 1059亿美元 |

| 复合年增长率 | 25% |

到2024年,解决方案领域将占据68%的市场份额,并将在2034年之前以23.6%的复合年增长率成长。各组织正在采用现代化的湖仓式资料中心技术,将资料储存、治理和分析整合到单一平台中。这项转变的主要驱动力是对提升营运效率、简化基础设施以及支援人工智慧和机器学习等高需求工作负载的需求。企业倾向于采用具有弹性运算、无伺服器架构以及储存和运算分离等特性的云端原生系统,以提高效率并降低成本。

大型企业在2024年占据了71%的市场份额,预计在2025年至2034年期间将以24.5%的复合年增长率成长。这些公司正在将多个传统平台整合到统一的湖仓式环境中,以集中管理、改善协作并减少冗余工作流程。湖仓式模型使大型组织能够扩展人工智慧/机器学习专案、提升分析能力并确保更好的资料合规性。由于混合云和多云环境的灵活性,企业范围内的采用正在加速,这些环境也增强了弹性并控制了成本。

2024年,美国资料湖库市场规模预计达35亿美元。北美地区在湖库应用方面仍处于领先地位,其中美国占据最高的区域市场份额。快速的数位转型、广泛的云端运算应用以及领先技术供应商的入驻,推动了对即时资料处理、整合分析和企业级人工智慧解决方案的需求。 IT、金融服务、医疗保健和零售等产业在强大的云端基础设施和高技能人才的支持下,持续引领市场需求。

全球资料湖库市场的主要竞争者包括Google、Databricks、微软、Starburst Data、Dremio、IBM、亚马逊网路服务(AWS)、Snowflake、Cloudera 和 Teradata。为了巩固其在资料湖库领域的地位,各公司正致力于透过人工智慧整合、无伺服器架构以及增强对多云部署的支援来扩展其平台功能。主要供应商正大力投资于培训机构、认证和社群建立项目,以提升企业用户的技能并增强客户忠诚度。他们也积极寻求与云端服务供应商、技术合作伙伴以及产业特定服务整合商建立策略联盟,以扩大覆盖范围并提高互通性。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 资料湖与资料仓储的融合

- 人工智慧/机器学习与即时分析需求

- 云端供应商生态系统扩展

- 数据民主化与自助式商业智能

- 产业陷阱与挑战

- 高昂的实施和迁移成本

- 互通性和合规性挑战

- 市场机会

- 混合云端和多云部署

- 业界专属湖畔别墅解决方案

- 政府主导的数位转型和技能提升计划

- 与生成式人工智慧和高级分析技术的集成

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 企业资料架构现代化趋势

- 遗留系统迁移模式

- 云端优先与混合部署策略

- 资料整合与统一计划

- 多云资料策略演进

- 组织能力与技能发展

- 数据工程人才市场分析

- 培训和认证计划的采用

- 外包与内部开发趋势

- 变革管理与使用者采纳策略

- 效能和可扩展性要求

- 总拥有成本分析框架

- 云端成本管理和财务营运采用

- 资源利用最佳化模式

- 价值实现与商业案例开发

- 供应商选择与合作策略

- 多供应商模式与单供应商模式分析

- 开源解决方案与专有解决方案的比较

- 供应商锁定缓解策略

- 策略伙伴关係与联盟模式

- 安全与风险管理框架

- 零信任架构实作

- 资料加密和存取控制策略

- 威胁侦测与反应能力

- 合规性审计和报告要求

- 投资与融资分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 市场集中度分析

- 服务交付模式比较

- 专业服务生态系分析

- 託管服务提供者格局

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 解决方案

- 资料储存

- 数据集成

- 分析与商业智能

- 治理与安全

- 机器学习/人工智慧工具

- 服务

- 专业服务

- 系统整合

- 培训与咨询

- 支援与维护

- 託管服务

- 专业服务

第六章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- 现场

- 基于云端的

- 杂交种

第七章:市场估算与预测:依企业规模划分,2021-2034年

- 主要趋势

- 大型企业

- 中小企业

第八章:市场估算与预测:依产业垂直领域划分,2021-2034年

- 主要趋势

- 金融服务业

- 资讯科技与电信

- 零售与电子商务

- 卫生保健

- 製造业

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 波兰

- 捷克共和国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Global companies

- Amazon Web Services (AWS)

- Databricks

- IBM

- Microsoft

- Oracle

- Palantir Technologies

- Snowflake

- Regional companies

- Alteryx

- Cloudera

- HPE (Hewlett Packard Enterprise)

- Informatica

- Qlik Technologies

- SAP

- SAS Institute

- Teradata

- Emerging companies

- CelerData

- Dremio

- Firebolt Analytics

- Kyvos Insights

- Onehouse

- Starburst Data

- StarTree

- Tabular Technologies

The Global Data Lakehouse Market was valued at USD 11.9 billion in 2024 and is estimated to grow at a CAGR of 25% to reach USD 105.9 billion by 2034.

This remarkable growth stems from organizations increasingly seeking to merge the affordability of data lakes with the analytical capabilities of traditional data warehouses. Lakehouse architecture delivers unified access, enabling scalable analytics, real-time insights, and enhanced AI and machine learning performance. Businesses are prioritizing platforms that reduce silos, improve governance, and support hybrid cloud and on-premises environments, especially in regulated sectors like healthcare and BFSI. With the rising adoption of no-code tools and self-service BI platforms, business users and data professionals beyond IT can now leverage these systems independently. Training ecosystems have also expanded, with more providers emphasizing education and upskilling to ensure organizations feel confident deploying and scaling lakehouse platforms. As hybrid and multi-cloud deployments become the norm, lakehouses are offering enterprises increased agility, centralized data access, and long-term cost efficiency, driving widespread adoption across North America, Europe, and APAC.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $105.9 Billion |

| CAGR | 25% |

In 2024, the solutions segment held a 68% share and will grow at a CAGR of 23.6% through 2034. Organizations are adopting modern lakehouse technologies that integrate data storage, governance, and analytics into a single platform. This transition is largely driven by the demand for improved operational performance, simplified infrastructure, and support for high-demand workloads like AI and ML. Businesses are favoring cloud-native systems that feature elastic compute, serverless architecture, and separation of storage and compute to increase efficiency while lowering costs.

The large enterprises segment held a 71% share in 2024 and is projected to grow at a CAGR of 24.5% during 2025-2034. These companies are consolidating multiple legacy platforms into unified lakehouse environments to centralize governance, improve collaboration, and reduce redundant workstreams. The lakehouse model allows large organizations to scale AI/ML initiatives, improve analytics capabilities, and ensure better data compliance. Enterprise-wide adoption is accelerating due to the flexibility of hybrid and multi-cloud environments, which also enhance resiliency and cost control.

US Data Lakehouse Market was valued at USD 3.5 billion in 2024. North America remains at the forefront of lakehouse adoption, with the US accounting for the highest regional share. Rapid digital transformation, widespread cloud adoption, and the presence of leading technology vendors have fueled demand for real-time data processing, integrated analytics, and enterprise-scale AI solutions. Sectors like IT, financial services, healthcare, and retail continue to lead demand, supported by robust cloud infrastructure and a highly skilled workforce.

Key players shaping the competitive landscape in the Global Data Lakehouse Market include Google, Databricks, Microsoft, Starburst Data, Dremio, IBM, Amazon Web Services, Snowflake, Cloudera, and Teradata. To strengthen their position in the data lakehouse sector, companies are focusing on expanding their platform capabilities through AI integration, serverless architecture, and enhanced support for multi-cloud deployments. Major vendors are investing heavily in training academies, certifications, and community-building initiatives to upskill enterprise users and deepen customer loyalty. Strategic alliances with cloud providers, technology partners, and industry-specific service integrators are being pursued to expand reach and improve interoperability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Enterprise size

- 2.2.5 Industry vertical

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Convergence of data lakes & warehouses

- 3.2.1.2 AI/ML and real-time analytics demand

- 3.2.1.3 Cloud vendor ecosystem expansion

- 3.2.1.4 Data democratization & self-service BI

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation & migration costs

- 3.2.2.2 Interoperability & compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Hybrid & multi-cloud deployments

- 3.2.3.2 Industry-specific lakehouse solutions

- 3.2.3.3 Government-led digital transformation & skilling initiatives

- 3.2.3.4 Integration with generative AI & advanced analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Enterprise data architecture modernization trends

- 3.11.1 Legacy system migration patterns

- 3.11.2 Cloud-first vs hybrid adoption strategies

- 3.11.3 Data consolidation & unification initiatives

- 3.11.4 Multi-cloud data strategy evolution

- 3.12 Organizational capability & skills development

- 3.12.1 Data engineering talent market analysis

- 3.12.2 Training & certification program adoption

- 3.12.3 Outsourcing vs in-house development trends

- 3.12.4 Change management & user adoption strategies

- 3.13 Performance & scalability requirements

- 3.13.1 Total cost of ownership analysis framework

- 3.13.2 Cloud cost management & FinOps adoption

- 3.13.3 Resource utilization optimization patterns

- 3.13.4 Value realization & business case development

- 3.14 Vendor selection & partnership strategies

- 3.14.1 Multi-vendor vs single-vendor approach analysis

- 3.14.2 Open source vs proprietary solution evaluation

- 3.14.3 Vendor lock-in mitigation strategies

- 3.14.4 Strategic partnership & alliance patterns

- 3.15 Security & risk management framework

- 3.15.1 Zero trust architecture implementation

- 3.15.2 Data encryption & access control strategies

- 3.15.3 Threat detection & response capabilities

- 3.15.4 Compliance audit & reporting requirements

- 3.16 Investment & funding analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Market concentration analysis

- 4.8 Service delivery model comparison

- 4.9 Professional services ecosystem analysis

- 4.10 Managed services provider landscape

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Data storage

- 5.2.2 Data integration

- 5.2.3 Analytics & BI

- 5.2.4 Governance & security

- 5.2.5 ML/AI tools

- 5.3 Services

- 5.3.1 Professional services

- 5.3.1.1 System integration

- 5.3.1.2 Training & consulting

- 5.3.1.3 Support & maintenance

- 5.3.2 Managed services

- 5.3.1 Professional services

Chapter 6 Market Estimates & Forecast, By Deployment mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 Small & medium enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By Industry vertical, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 IT & Telecom

- 8.4 Retail & E-commerce

- 8.5 Healthcare

- 8.6 Manufacturing

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Czech Republic

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 Amazon Web Services (AWS)

- 10.1.2 Databricks

- 10.1.3 Google

- 10.1.4 IBM

- 10.1.5 Microsoft

- 10.1.6 Oracle

- 10.1.7 Palantir Technologies

- 10.1.8 Snowflake

- 10.2 Regional companies

- 10.2.1 Alteryx

- 10.2.2 Cloudera

- 10.2.3 HPE (Hewlett Packard Enterprise)

- 10.2.4 Informatica

- 10.2.5 Qlik Technologies

- 10.2.6 SAP

- 10.2.7 SAS Institute

- 10.2.8 Teradata

- 10.3 Emerging companies

- 10.3.1 CelerData

- 10.3.2 Dremio

- 10.3.3 Firebolt Analytics

- 10.3.4 Kyvos Insights

- 10.3.5 Onehouse

- 10.3.6 Starburst Data

- 10.3.7 StarTree

- 10.3.8 Tabular Technologies