|

市场调查报告书

商品编码

1858866

用于热疗的磁性奈米粒子市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Magnetic Nanoparticles for Hyperthermia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

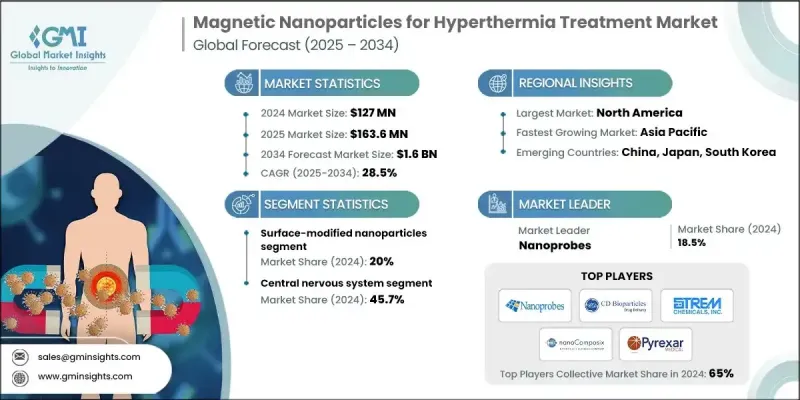

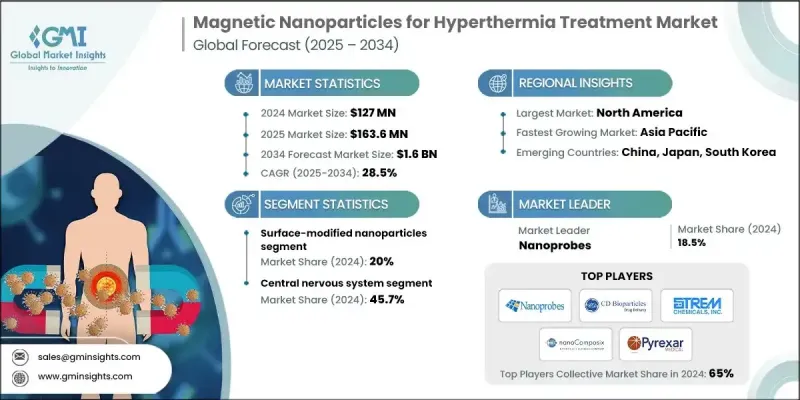

2024 年全球用于热疗的磁性奈米粒子市场价值为 1.27 亿美元,预计到 2034 年将以 28.5% 的复合年增长率增长至 16 亿美元。

磁热疗利用超顺磁性氧化铁奈米颗粒(SPIONs)和其他工程颗粒,这些颗粒在交变磁场作用下会产生热。这种可控的热能用于破坏肿瘤组织,同时保护健康细胞,使其成为传统肿瘤治疗的强效替代或辅助疗法。抗药性癌症类型的日益增加以及对标靶、非侵入性疗法的需求不断增长是推动该技术发展的关键因素。随着全球医学界寻求精准干预,研究力度不断增加,尤其是在具有挑战性的肿瘤治疗应用方面。磁性奈米颗粒能够穿过生物屏障并到达肿瘤深层部位,这引起了临床医生的极大兴趣。儘管复杂的生产流程和监管障碍仍然存在,但表面功能化、双药联合疗法和试验设计方面的进展正推动该技术走向更广泛的临床应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.27亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 28.5% |

2024年,磁热疗市占率达45.7%。这一主导地位与神经肿瘤学领域对非侵入性治疗方法的需求密切相关。基于磁性奈米颗粒的系统可透过磁振造影相容的递送方式实现高度局部化的加热,从而能够更精准地制定脑肿瘤治疗方案。均匀加热和神经保护策略的创新正引领着目前的研究,并保持着该领域的高关注度。针对侵袭性和復发性肿瘤的治疗方案不断推动中枢神经系统相关技术的投资和应用。

由于其安全性高、磁性能可重复且与医学成像相容,超顺磁性氧化铁奈米颗粒(SPIONs)在2024年占据了70.1%的市场份额。这些奈米颗粒因其可预测的加热能力和稳定的比吸收率(SAR)而被广泛应用于临床和研究领域。小型化、均匀磁芯和增强磁化特性等方面的进展显着改善了临床疗效。 SPIONs,特别是尺寸在10至15奈米之间的最佳化尺寸,因其良好的生物分布和热控制效率而备受青睐,使其成为大多数早期应用的首选。

2024年,欧洲用于热疗的磁性奈米颗粒市占率将达到35%,其中德国、法国、英国、西班牙和义大利等国在应用方面处于领先地位。这一区域成长得益于成熟的精准肿瘤学体系和有利的医疗政策,这些因素促进了新兴疗法的顺利整合。欧洲各地的肿瘤中心已开始采用导管引导系统和磁振造影相容的热疗平台。协调的临床试验网络和采购系统有助于缩短临床验证和广泛应用之间的时间,为医院系统更广泛地接受该技术奠定了基础。

全球用于热疗的磁性奈米颗粒产业的主要企业包括nanoComposix、Spherotech、Nanoprobes、Strem Chemicals、BSD Medical Corporation、Pyrexar Medical和CD Bioparticles。为了巩固市场地位,这些主要企业正大力投资研发,以提高奈米颗粒的效率、磁响应性和生物相容性。各公司致力于改进颗粒合成方法、降低批次差异,并改进表面修饰以支持联合疗法。与学术机构和临床中心的策略合作正在推动方案製定和试验验证。此外,各公司也正在努力整合即时成像功能和患者个人化治疗方案。同时,各公司也积极与卫生监管机构进行早期沟通,以简化监管审批流程。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依奈米颗粒类型划分,2021-2034年

- 主要趋势

- 超顺磁性氧化铁奈米粒子(SPIONS)

- 磁铁矿(Fe3O4)芯材配方

- 磁赤铁矿(γ-Fe2O3)基体系

- 核壳型氧化铁结构

- 表面改质奈米粒子

- 工程奈米颗粒系统

- 用于组织穿透的尺寸优化颗粒(10-100 nm)

- 具有成像功能的多功能奈米粒子

- 采用可生物降解配方,提高安全性

第六章:市场规模及预测:依癌症应用领域划分,2021-2034年

- 主要趋势

- 中枢神经系统癌症

- 多形性胶质母细胞瘤(GBM)治疗

- 復发性脑肿瘤 CE 标誌先例

- 泌尿生殖系统癌症

- 摄护腺癌局部热疗

- 子宫颈癌合併放射治疗

- 乳癌和妇科癌症

- 表浅性乳癌

- 卵巢癌腹膜

- 其他的

第七章:市场规模及预测:依治疗方式划分,2021-2034年

- 主要趋势

- 独立式磁热疗

- 联合放射疗法

- 合併化疗

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Nanoprobes

- CD Bioparticles

- Strem Chemicals

- BSD Medical Corporation

- Pyrexar Medical

- nanoComposix

- Spherotech

The Global Magnetic Nanoparticles for Hyperthermia Treatment Market was valued at USD 127 million in 2024 and is estimated to grow at a CAGR of 28.5% to reach USD 1.6 billion by 2034.

Magnetic hyperthermia therapy uses superparamagnetic iron oxide nanoparticles (SPIONs) and other engineered particles that generate heat when exposed to alternating magnetic fields. This controlled thermal energy is used to damage tumor tissue while preserving healthy cells, positioning this approach as a powerful alternative or adjunct to conventional oncology treatments. The increasing prevalence of resistant cancer types and the rising demand for targeted, non-invasive therapies are key growth drivers. Research efforts have intensified, particularly in challenging oncologic applications, as the global medical community seeks precision-based interventions. The ability of magnetic nanoparticles to navigate biological barriers and reach deep tumor sites has sparked significant clinical interest. Although complex manufacturing processes and regulatory barriers persist, developments in surface functionalization, dual-therapy combinations, and trial design are pushing the technology toward broader clinical readiness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $127 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 28.5% |

In 2024, the magnetic hyperthermia segment held a 45.7% share. This dominance is tied to the need for non-invasive approaches in neuro-oncology. Magnetic nanoparticle-based systems offer highly localized heating through MR-compatible delivery methods, allowing for more accurate therapeutic planning in brain tumors. Innovations in homogeneous heating and neuroprotection strategies are guiding ongoing research and maintaining high interest in this segment. Treatment protocols for aggressive and recurrent tumors continue to drive investment and adoption in CNS-focused technologies.

The SPIONs segment held 70.1% share in 2024, owing to their well-established safety, repeatable magnetic performance, and compatibility with medical imaging. These nanoparticles are widely used in clinical and research settings due to their predictable heating capabilities and stable specific absorption rates (SAR). Progress in smaller engineering, uniform cores and enhancing magnetization profiles has significantly improved clinical outcomes. SPIONs, particularly with optimized sizes between 10 and 15 nm, are known for their biodistribution and thermal control efficiency, which has made them the preferred choice in most early-stage deployments.

Europe Magnetic Nanoparticles for Hyperthermia Treatment Market held 35% share in 2024, with countries such as Germany, France, the UK, Spain, and Italy leading in adoption. This regional growth is supported by established precision oncology frameworks and favorable health policies that enable smoother integration of emerging treatments. Oncology centers across Europe have begun adopting catheter-guided systems and MR-compatible hyperthermia platforms. Coordinated trial networks and procurement systems help shorten the time between clinical validation and widespread availability, setting the stage for broader acceptance across hospital systems.

Key companies operating in the Global Magnetic Nanoparticles for Hyperthermia Treatment Industry include nanoComposix, Spherotech, Nanoprobes, Strem Chemicals, BSD Medical Corporation, Pyrexar Medical, and CD Bioparticles. To strengthen their presence, key players in the magnetic nanoparticles for hyperthermia treatment market are investing heavily in R&D to enhance nanoparticle efficiency, magnetic responsiveness, and biocompatibility. Companies are focused on refining particle synthesis methods, reducing batch variability, and improving surface modification to support combination therapies. Strategic collaborations with academic institutions and clinical centers are helping drive protocol development and trial validation. Firms are also working to integrate real-time imaging compatibility and patient-specific treatment planning. In parallel, efforts to streamline regulatory approval processes are underway through early engagement with health authorities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Nanoparticle Type

- 2.2.2 Cancer Application

- 2.2.3 Treatment Modality

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Nanoparticle Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Superparamagnetic iron oxide nanoparticles (SPIONS)

- 5.2.1 Magnetite (fe3o4) core formulations

- 5.2.2 Maghemite (γ-fe2o3) based systems

- 5.2.3 Core-shell iron oxide structures

- 5.3 Surface-modified nanoparticles

- 5.4 Engineered nanoparticle systems

- 5.4.1 Size-optimized particles (10-100 nm) for tissue penetration

- 5.4.2 Multi-functional nanoparticles with imaging capabilities

- 5.4.3 Biodegradable formulations for enhanced safety

Chapter 6 Market Size and Forecast, By Cancer Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Central nervous system cancers

- 6.2.1 Glioblastoma multiforme (GBM) treatment

- 6.2.2 Recurrent brain tumor CE marking precedent

- 6.3 Genitourinary cancers

- 6.3.1 Prostate cancer localized hyperthermia

- 6.3.2 Cervical carcinoma with radiation therapy combinations

- 6.4 Breast & gynecological cancers

- 6.4.1 Superficial breast cancer

- 6.4.2 Ovarian cancer peritoneal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Treatment Modality, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Standalone magnetic hyperthermia

- 7.3 Combination with radiation therapy

- 7.4 Combination with chemotherapy

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Nanoprobes

- 9.2 CD Bioparticles

- 9.3 Strem Chemicals

- 9.4 BSD Medical Corporation

- 9.5 Pyrexar Medical

- 9.6 nanoComposix

- 9.7 Spherotech