|

市场调查报告书

商品编码

1858870

连续製造市场机会、成长驱动因素、产业趋势分析及2025-2034年预测Continuous Manufacturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

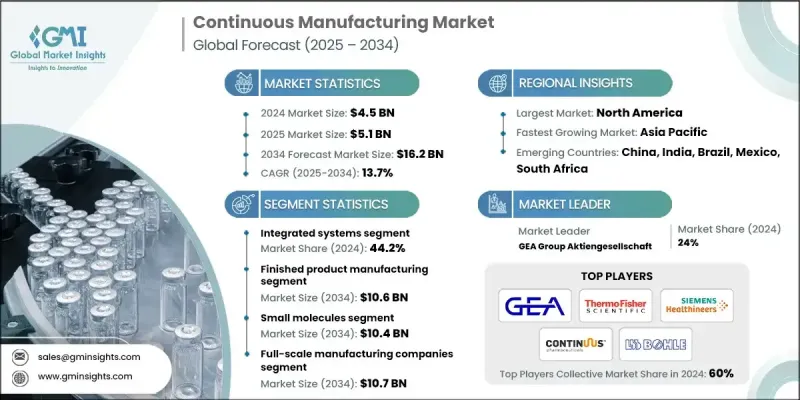

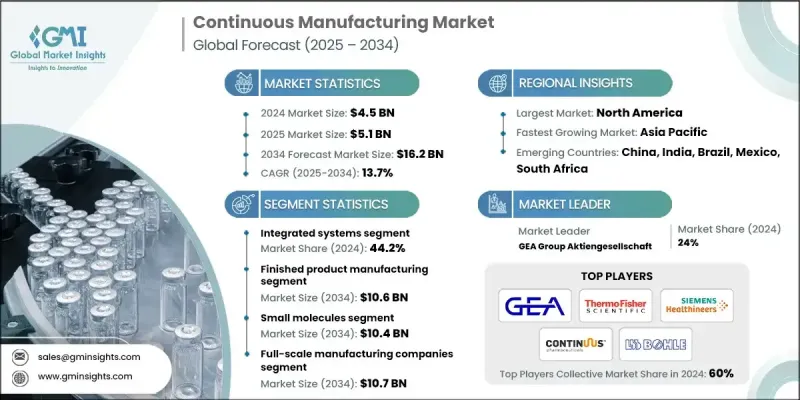

2024 年全球连续製造市场价值为 45 亿美元,预计到 2034 年将以 13.7% 的复合年增长率增长至 162 亿美元。

随着製药企业转向更快、可扩展且更可靠的生产系统,市场正在扩张。连续生产在监管鼓励和对更灵活的药物生产流程需求不断增长的背景下,正获得强劲发展势头。企业正从传统的间歇式生产系统转向连续技术,以期获得更佳的製程控制、更低的浪费和更短的生产週期。随着个人化医疗和小批量治疗药物需求的增长,能够快速适应并更有效率运作的生产模式变得至关重要。这项技术能够实现即时监控、简化操作流程并提高合规性,从而迅速改变药物的生产方式。小分子药物和生物製剂的生产都因这些创新而发生革命性变化,因为该行业越来越重视成本效益、速度和品质。随着企业不断优先考虑更快的市场交付速度和更严格的营运控制,连续生产正迅速成为整个製药生产领域的新标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 162亿美元 |

| 复合年增长率 | 13.7% |

预计到2034年,成品药生产领域市场规模将达106亿美元。该领域的成长主要得益于连续生产技术在最终药品生产中的日益普及,这些技术有助于製造商缩短生产週期并减少营运瓶颈。连续生产平台能够提高产品一致性,实现自动化、高通量生产,大幅减少人为干预,并透过线上控制增强品质保证。这些整合系统在口服製剂和注射的生产中正变得至关重要,能够显着提高成本效益和製程可靠性。

预计到2034年,小分子药物市场规模将达到104亿美元。其市场主导地位源自于肿瘤、传染病和慢性病等治疗领域对小分子药物的广泛需求。由于生产方法成熟、结构简单且生产规模庞大,这些化合物与连续生产过程高度契合。随着製药公司寻求优化生产线,小分子药物在连续生产应用方面处于领先地位,因为它们能够在不牺牲品质或可扩展性的前提下实现高效生产。

2024年,美国连续生产市场规模预计将达18亿美元。该市场正受益于监管支持的更新、对弹性生产模式的日益重视以及对数位製造技术的巨额投资而蓬勃发展。美国在全球药品生产中扮演着至关重要的角色,而连续生产作为一种增强供应链稳健性和维持高生产标准的策略,其吸引力与日俱增。随着美国本土製造商寻求简化工作流程和降低营运风险,连续生产流程的应用也不断普及。

推动全球连续製造市场转型的主要企业包括:Munson Machinery、Thermo Fisher Scientific、Syntegon Technology、Siemens Healthineers、STEER World、Gericke、FREUND CORPORATION、LB Bohle Maschinen und Verfahren、KORSCH、Continuus Pharmaceuticals、Scott Equip Company、und Verfahren、KORSCH、Continuus Pharmaceuticals、Scott Equip Companym. GmbH、Glatt 和 Gebruder Lodige Maschinenbau。全球连续製造市场的企业正透过多种针对性策略提升其市场地位。其中一个重点是开发模组化和可扩展的系统,以灵活应用于各种製药领域。製造商正在投资自动化和即时资料集成,以加强生产控制并满足严格的监管标准。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 连续生产监理支持

- 营运效率和成本降低

- 即时品质控制和过程监控

- 对个人化和小批量疗法的需求不断增长

- 产业陷阱与挑战

- 高初始资本投入

- 熟练劳动力有限

- 市场机会

- 生物製剂和大分子药物生产领域的扩张

- 合约製造服务成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 整合系统

- 半连续系统

- 连续式造粒机

- 连续涂布机

- 连续式搅拌机

- 连续式干燥机

- 连续式压缩机

- 其他半连续系统

- 软体

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 成品製造

- 固体剂量

- 半固体剂型

- 液体剂量

- API生产

第七章:市场估计与预测:依治疗类型划分,2021-2034年

- 主要趋势

- 小分子

- 大分子

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 研发部门

- 研究机构

- 合约研究组织(CRO)

- 全规模製造业

- 合约生产组织(CMO)

- 製药和生物技术公司

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Continuus Pharmaceuticals

- Coperion GmbH

- FREUND CORPORATION

- GEA Group Aktiengesellschaft

- Gebruder Lodige Maschinenbau

- Gericke

- Glatt

- KORSCH

- LB Bohle Maschinen und Verfahren

- Munson Machinery

- Scott Equipment company

- Siemens Healthineers

- STEER World

- Sturtevant Inc

- Syntegon Technology

- Thermo Fisher Scientific

The Global Continuous Manufacturing Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 13.7% to reach USD 16.2 billion by 2034.

The market is undergoing expansion as pharmaceutical manufacturers pivot toward faster, scalable, and more reliable production systems. Continuous manufacturing is gaining strong momentum with growing regulatory encouragement and rising demand for more agile drug manufacturing processes. Companies are transitioning away from conventional batch-based systems in favor of continuous technologies that provide improved process control, lower waste, and reduced lead times. As personalized medicine and small-batch therapeutics grow in demand, the need for production models that can adapt quickly and operate more efficiently has become critical. This technology enables real-time monitoring, streamlined operations, and better compliance factors that are rapidly transforming how drugs are produced. Both small molecule and biologics manufacturing are being revolutionized through these innovations, as the industry places greater emphasis on cost-efficiency, speed, and quality. As companies continue to prioritize faster market delivery and tighter operational control, continuous manufacturing is quickly becoming the new standard across the pharmaceutical production landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 13.7% |

The finished product manufacturing segment is projected to reach USD 10.6 billion by 2034. This segment's expansion is fueled by the growing implementation of continuous technologies in the production of final drug products, helping manufacturers achieve quicker production timelines and reduced operational bottlenecks. Continuous platforms improve consistency and enable automated, high-throughput processes, significantly minimizing human intervention while enhancing quality assurance through in-line controls. These integrated systems are becoming essential in manufacturing oral dosage forms and injectable products with greater cost-effectiveness and process reliability.

The small molecules segment is forecasted to hit USD 10.4 billion by 2034. Its dominance stems from the widespread demand for small-molecule drugs across therapeutic areas like oncology, infectious diseases, and chronic illnesses. These compounds are highly compatible with continuous processes due to their well-established production methods, structural simplicity, and volume-driven manufacturing needs. As pharma companies look to optimize production lines, small molecules are at the forefront of continuous manufacturing adoption because they support high-efficiency production without compromising quality or scalability.

United States Continuous Manufacturing Market was valued at USD 1.8 billion in 2024. The market is advancing due to updated regulatory support, increased focus on resilient production models, and heavy investments in digitalized manufacturing technologies. The US plays a critical role in global pharmaceutical output, with continuous manufacturing becoming increasingly attractive as a strategy for enhancing supply chain robustness and maintaining high production standards. As domestic manufacturers seek to streamline workflows and reduce operational risks, adoption of continuous processes continues to gain ground.

Key players driving this transformation in the Global Continuous Manufacturing Market include Munson Machinery, Thermo Fisher Scientific, Syntegon Technology, Siemens Healthineers, STEER World, Gericke, FREUND CORPORATION, L.B. Bohle Maschinen und Verfahren, KORSCH, Continuus Pharmaceuticals, Scott Equipment Company, Sturtevant Inc., GEA Group Aktiengesellschaft, Coperion GmbH, Glatt, and Gebruder Lodige Maschinenbau. Companies in the Global Continuous Manufacturing Market are enhancing their market position through several targeted strategies. A key focus is on developing modular and scalable systems that offer flexibility across a range of pharmaceutical applications. Manufacturers are investing in automation and real-time data integration to boost production control and meet stringent regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Therapeutic type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory support for continuous manufacturing

- 3.2.1.2 Operational efficiency and cost reduction

- 3.2.1.3 Real-time quality control and process monitoring

- 3.2.1.4 Rising demand for personalized and small-batch therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited skilled workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in biologics and large molecule manufacturing

- 3.2.3.2 Growth in contract manufacturing services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Integrated systems

- 5.3 Semi-continuous systems

- 5.3.1 Continuous granulators

- 5.3.2 Continuous coaters

- 5.3.3 Continuous blenders

- 5.3.4 Continuous dryers

- 5.3.5 Continuous compressors

- 5.3.6 Other semi-continuous systems

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Finished product manufacturing

- 6.2.1 Solid dosage

- 6.2.2 Semi solid dosage

- 6.2.3 Liquid dosage

- 6.3 API manufacturing

Chapter 7 Market Estimates and Forecast, By Therapeutic Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small molecule

- 7.3 Large molecules

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 R&D departments

- 8.2.1 Research institutes

- 8.2.2 Contract research organizations (CROs)

- 8.3 Full-scale manufacturing companies

- 8.3.1 Contract manufacturing organizations (CMOs)

- 8.3.2 Pharmaceutical and biotechnological companies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Continuus Pharmaceuticals

- 10.2 Coperion GmbH

- 10.3 FREUND CORPORATION

- 10.4 GEA Group Aktiengesellschaft

- 10.5 Gebruder Lodige Maschinenbau

- 10.6 Gericke

- 10.7 Glatt

- 10.8 KORSCH

- 10.9 L.B. Bohle Maschinen und Verfahren

- 10.10 Munson Machinery

- 10.11 Scott Equipment company

- 10.12 Siemens Healthineers

- 10.13 STEER World

- 10.14 Sturtevant Inc

- 10.15 Syntegon Technology

- 10.16 Thermo Fisher Scientific