|

市场调查报告书

商品编码

1858875

用于 5G/6G 天线的超材料市场机会、成长驱动因素、产业趋势分析及 2025-2034 年预测Metamaterials for 5G/6G Antennas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

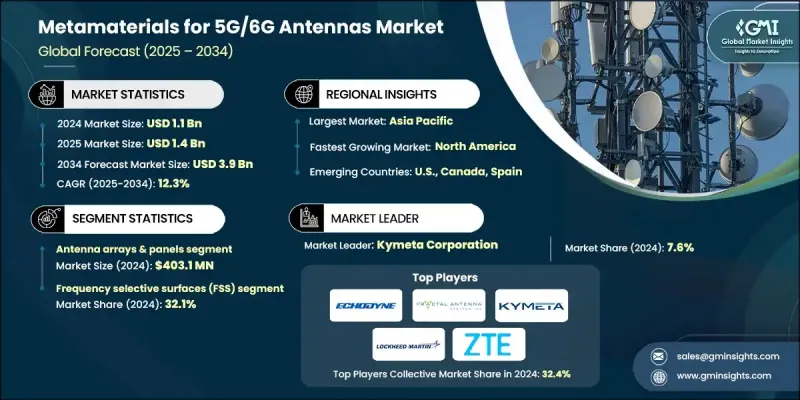

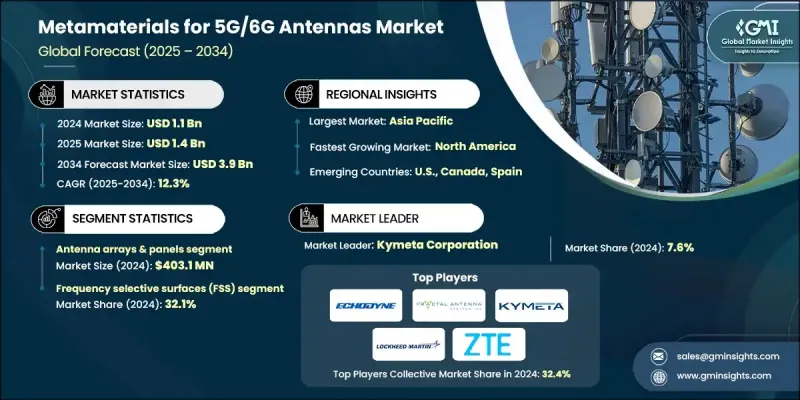

2024 年全球 5G/6G 天线超材料市场价值为 11 亿美元,预计到 2034 年将以 12.3% 的复合年增长率增长至 39 亿美元。

成长的驱动力在于对紧凑型、高性能无线系统日益增长的需求,而下一代天线需要更高的频宽、更小的体积和更低延迟的讯号传输。超材料经过工程改造,展现出自然界中不存在的电磁特性,透过改善讯号传播和更有效地引导电磁波,从而实现这些功能。围绕数位基础设施发展的支援性政策框架,例如专注于智慧城市和物联网扩展的政策,进一步加速了对这些先进材料的需求。拥有强而有力的5G部署计画和高科技投资的国家,尤其是在亚洲和北美,正处于采用超材料技术的前沿。北美正在经历快速成长,这得益于其强大的研发生态系统、政府资金支持以及智慧节能天线在电信、汽车、航太和医疗等领域的日益普及。向6G和太赫兹通讯的推进也促进了新型材料的应用,这些材料能够在人口密集的城市环境中提供高频性能,同时符合不断发展的监管标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 39亿美元 |

| 复合年增长率 | 12.3% |

2024年,天线阵列和麵板市场规模达4.031亿美元,凭藉其精确的波束成形能力、讯号方向性和频宽效率,引领市场。它们在优化讯号品质方面发挥着至关重要的作用,尤其是在人口密集的城市地区,使其成为现代无线网路的骨干。与超材料的整合进一步增强了这些特性,同时满足了紧凑型基础设施的美观性和空间利用率要求。

频率选择表面(FSS)在2024年占据了32.1%的市场份额,并继续在该技术领域占据主导地位。这些结构能够过滤特定频段,从而提高讯号完整性并最大限度地减少干扰。它们在实现高频谱效率方面发挥着不可或缺的作用,使其成为5G和未来6G天线设计中不可或缺的一部分。此外,它们对现有电信架构的适应性也支援在不断扩展的数位环境中进行可扩展部署。

预计到2034年,北美5G/6G天线超材料市场将以12.3%的复合年增长率成长。该地区正着力发展可持续和节能的通讯技术。超材料领域的进步主要集中在轻质高性能复合材料上,旨在与下一代基础设施无缝集成,尤其是在人口稠密的大都市地区。监管机构对绿色技术的需求也推动了该领域的创新。

全球5G/6G天线超材料市场的主要参与者包括Meta Material Inc.、Pivotal Commware、洛克希德马丁公司、中兴通讯股份有限公司、Echodyne、Kymeta Corporation、Fractal Antenna Systems Inc.和TeraView Limited。这些公司在5G/6G天线超材料市场中竞相采取以创新为中心的策略,以保持领先地位。与电信业者、研究机构和政府机构的策略合作有助于加快原型製作速度,并取得专用的高频材料。许多公司正在加大内部研发投入,以改进设计演算法并提升超材料在实际应用条件下的性能。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 5G网路密集化和毫米波部署要求

- 6G研究计划与太赫兹频率探索

- 物联网设备的激增和小型化需求

- 产业陷阱与挑战

- 製造成本高且加工製程复杂

- 标准化和互通性问题有限

- 市场机会

- 人工智慧驱动的可重构智慧表面

- 卫星星座部署及太空应用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 天线阵列和麵板

- 晶胞和构建模组

- 上层基质和下层基质

- 吸收器和护盾

- 透射阵列和反射阵列

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 频率选择表面(FSS)

- 可重构智慧表面(RIS)

- 超材料增强型天线

- 全像超表面

- 电磁带隙(EBG)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 基地台天线

- 大规模MIMO与波束成形集成

- 小型蜂巢式和分散式天线系统

- 用户设备天线

- 智慧型手机和行动装置集成

- 使用者驻地设备 (CPE)

- 穿戴式和物联网设备

- 卫星通讯天线

- LEO、MEO 和 GEO 星座支持

- 地面终端和行动卫星应用

- Ku、Ka 和 V 波段频率集成

- 汽车天线

- V2X通讯系统

- 自动驾驶汽车互联

- 车载娱乐和远端资讯处理

- 物联网和穿戴式天线

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Echodyne

- Fractal Antenna Systems Inc

- Kymeta Corporation

- Lockheed Martin Corporation

- Meta Material Inc

- Pivotal Commware

- TeraView Limited

- ZTE Corporation

The Global Metamaterials for 5G/6G Antennas Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 3.9 billion by 2034.

Growth is driven by increasing demand for compact, high-performance wireless systems, where next-generation antennas require enhanced bandwidth, miniaturization, and low-latency signal transmission. Metamaterials engineered to display electromagnetic behaviors not found in nature enable these capabilities by improving signal propagation and directing electromagnetic waves more efficiently. Supportive policy frameworks around digital infrastructure development, such as those focused on smart cities and IoT expansion, further accelerate demand for these advanced materials. Countries with strong 5G rollout plans and high-tech investments, particularly in Asia and North America, are at the forefront of adopting metamaterial-enabled technologies. North America is experiencing rapid expansion, supported by a robust R&D ecosystem, government funding, and rising integration of smart, energy-efficient antennas into telecom, automotive, aerospace, and medical sectors. The push toward 6G and terahertz communication is also encouraging the adoption of novel materials that can deliver high-frequency performance in dense urban environments while aligning with evolving regulatory standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 12.3% |

The antenna arrays and panels segment generated USD 403.1 million in 2024, leading the market due to their precise beamforming abilities, signal directivity, and bandwidth efficiency. Their critical role in optimizing signal quality, especially in dense urban areas, positions them as the backbone of modern wireless networks. Integration with metamaterials enhances these features while supporting aesthetic and space-related requirements in compact infrastructures.

The frequency selective surfaces segment held a 32.1% share in 2024 and continues to dominate the technology category. These structures filter specific frequency bands, improving signal integrity and minimizing interference. Their role in achieving high spectral efficiency makes them indispensable in 5G and future 6G antenna designs. Additionally, their adaptability to existing telecom setups supports scalable deployment across expanding digital landscapes.

North America Metamaterials for 5G/6G Antennas Market is projected to grow at a CAGR of 12.3% through 2034. This region is emphasizing sustainable and energy-conscious communication technologies. Metamaterial advancements are focusing on lightweight, high-performance composites designed for seamless integration into next-gen infrastructure, especially in highly populated metropolitan areas. Regulatory pressure for greener technologies also encourages innovation in this space.

Key players in the Global Metamaterials for 5G/6G Antennas Market include Meta Material Inc., Pivotal Commware, Lockheed Martin Corporation, ZTE Corporation, Echodyne, Kymeta Corporation, Fractal Antenna Systems Inc., and TeraView Limited. Companies competing in the metamaterials for 5G/6G antennas market are pursuing innovation-centric strategies to stay ahead. Strategic collaborations with telecom providers, research institutions, and government agencies allow faster prototyping and access to specialized high-frequency materials. Many are investing in in-house R&D to advance design algorithms and improve metamaterial performance under real-world conditions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 5G network densification & mmwave deployment requirements

- 3.2.1.2 6G research initiatives & terahertz frequency exploration

- 3.2.1.3 IoT device proliferation & miniaturization demands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs & fabrication complexity

- 3.2.2.2 Limited standardization & interoperability issues

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven reconfigurable intelligent surfaces

- 3.2.3.2 Satellite constellation deployment & space applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Antenna arrays & panels

- 5.3 Unit cells & building blocks

- 5.4 Superstrates & substrates

- 5.5 Absorbers & shields

- 5.6 Transmitarrays & reflectarrays

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Frequency selective surfaces (FSS)

- 6.3 Reconfigurable intelligent surfaces (RIS)

- 6.4 Metamaterial-enhanced antennas

- 6.5 Holographic metasurfaces

- 6.6 Electromagnetic bandgap (EBG)

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Base station antennas

- 7.2.1 Massive MIMO & beamforming integration

- 7.2.2 Small cell & distributed antenna systems

- 7.3 User equipment antennas

- 7.3.1 Smartphone & mobile device integration

- 7.3.2 Customer premises equipment (CPE)

- 7.3.3 Wearable & IoT device

- 7.4 Satellite communication antennas

- 7.4.1 LEO, MEO & GEO constellation support

- 7.4.2 Ground terminal & mobile satellite applications

- 7.4.3 Ku, Ka & V-band frequency integration

- 7.5 Automotive antennas

- 7.5.1 V2X communication systems

- 7.5.2 Autonomous vehicle connectivity

- 7.5.3 In-vehicle entertainment & telematics

- 7.6 IoT & wearable antennas

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Echodyne

- 9.2 Fractal Antenna Systems Inc

- 9.3 Kymeta Corporation

- 9.4 Lockheed Martin Corporation

- 9.5 Meta Material Inc

- 9.6 Pivotal Commware

- 9.7 TeraView Limited

- 9.8 ZTE Corporation