|

市场调查报告书

商品编码

1858886

藻类ω-3生产系统市场机会、成长驱动因素、产业趋势分析及预测Algae-Based Omega-3 Production Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast |

||||||

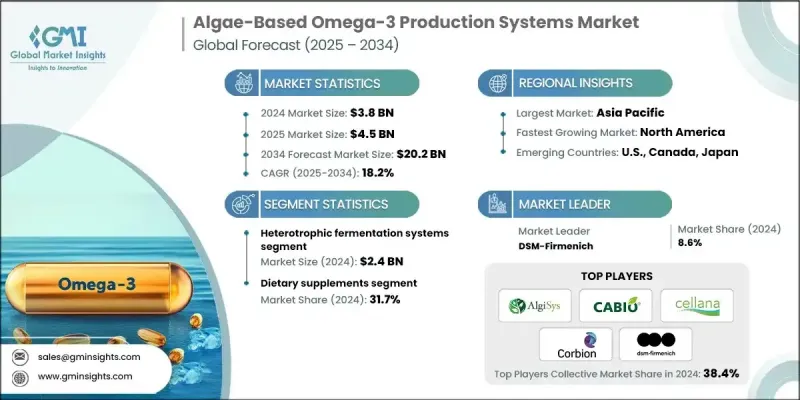

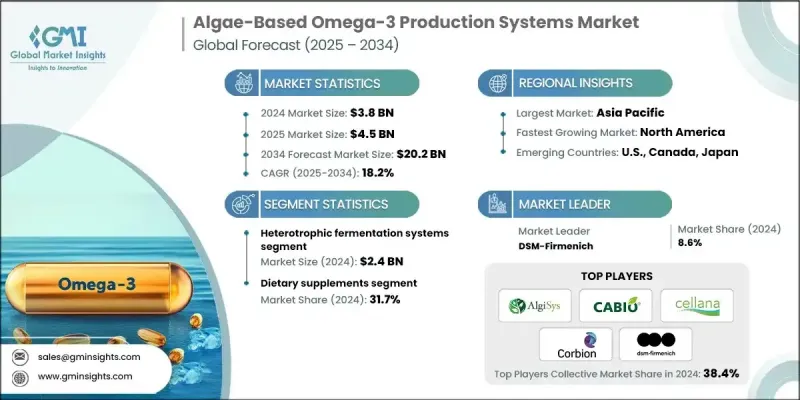

2024 年全球藻类基 Omega-3 生产系统市场价值为 38 亿美元,预计到 2034 年将以 18.2% 的复合年增长率增长至 202 亿美元。

这一增长主要源于消费者对可持续的植物基omega-3脂肪酸的需求不断增长,将其作为传统鱼油的替代品。随着健康意识、环境问题和饮食限制的日益普及,越来越多的人开始选择藻类来源的omega-3,这类产品符合清洁标籤标准,且不含过敏原。藻类生物技术的进步,包括闭环系统和光生物反应器,显着提高了生产效率和规模化能力。这些系统能够实现更高的生物质产量,并提供可控的环境,最大限度地降低污染风险,确保产品一致性。消费者正敦促企业提供透明、无过敏原且符合环保价值的产品。草药和植物性保健品的日益流行在美国尤为明显,草药类产品的年增长率高达5.4%,这持续支撑着对藻类来源omega-3的需求。随着全球健康趋势的不断增强,各公司正竞相在技术和产品配方方面进行创新,以满足不断增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 202亿美元 |

| 复合年增长率 | 18.2% |

异养发酵系统市占率高达64.4%,预计2034年将维持18.2%的复合年增长率。这些系统已被证明是商业化生产藻类ω-3脂肪酸最可行、最具规模化的潜力。在受控条件下,异养发酵使藻类能够代谢葡萄糖、蔗糖或工业副产品等碳水化合物来源,从而获得最佳的ω-3脂肪酸产量。其工业规模相容性和降低环境污染风险的特性,使其成为主要产业参与者生产的核心技术。

2024年,膳食补充剂市占率达到31.7%,随着越来越多的消费者重视植物性健康产品,该领域正蓬勃发展。强大的零售网络、值得信赖的品牌以及可观的利润率,使该领域成为藻类来源的omega-3脂肪酸的主要应用领域。人们对omega-3脂肪酸健康益处的认识不断提高,尤其是在心血管、认知和发炎健康方面,进一步推动了补充剂的消费。

受健康意识增强的消费者群体和植物性生活方式日益普及的推动,北美藻类ω-3生产系统市场预计将在2025年至2034年间以18.3%的复合年增长率增长。以非基因改造、有机和环保配方为中心的创新产品持续吸引寻求永续健康解决方案的消费者的注意。

全球藻类ω-3生产系统市场的主要企业包括DSM-Firmenich、Fermentalg、Cellana Inc.、Algatech、CABIO Biotech、Evonik Industries AG、Nuseed、Corbion NV、Algisys、Qualitas Health和Mara Renewables Corporation。这些企业正采取多种策略来巩固和扩大市场占有率。主要参与者正大力投资研发,以改善菌株选择并提高脂质产量,同时优化异养发酵等生产技术,以实现成本效益高的规模化生产。与营养品和製药品牌的合作有助于拓展分销管道,并提高产品知名度。此外,各公司也在努力取得清洁标籤认证,并符合非基因改造、无过敏原和纯素食标准,以抢占细分市场。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对永续omega-3替代品的需求日益增长

- 水产养殖业的成长

- 海洋鱼类资源枯竭与海洋保护

- 产业陷阱与挑战

- 技术转移与商业化差距

- 原料供应及品质稳定性

- 市场机会

- 废弃物製ω-3生产系统

- 人工智慧驱动的流程优化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 透过生产技术

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:贸易统计仅针对重点国家提供)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依生产技术划分,2021-2034年

- 主要趋势

- 异养发酵系统

- 光养培养系统

- 杂交栽培系统

- 先进的光生物反应器系统

- 其他的

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 婴儿配方奶粉

- 膳食补充剂

- 胶囊和软胶囊

- 液体和粉末补充剂

- 功能性食品和饮料

- 水产饲料

- 鱼饲料

- 虾子和甲壳类动物

- 动物饲料和宠物食品

- 牲畜营养

- 饲料添加剂

- 製药

- 医学营养与治疗

- 临床试验

- 药物递送与製剂

- 化妆品及个人护理

- 抗老化与皮肤健康

- 头髮护理与头皮健康

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- Algatech

- Algisys

- CABIO Biotech

- Cellana Inc

- Corbion NV

- DSM-Firmenich

- Evonik Industries AG

- Fermentalg

- Mara Renewables Corporation

- Nuseed

- Qualitas Health

The Global Algae-Based Omega-3 Production Systems Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 18.2% to reach USD 20.2 billion by 2034.

This growth is driven by rising consumer demand for sustainable, plant-based omega-3 fatty acids as alternatives to traditional fish oil. With increasing health awareness, environmental concerns, and dietary restrictions, more individuals are turning toward algae-derived omega-3s, which meet clean-label standards and avoid allergens. Advances in algal biotechnology, including closed-loop systems and photobioreactors, are significantly enhancing production efficiency and scalability. These systems enable higher biomass yields and offer a controlled environment that minimizes contamination risks and ensures product consistency. Consumers are pushing companies to deliver transparent, allergen-free products that align with eco-conscious values. The rising popularity of herbal and plant-based health supplements is evident in the U.S., with an annual 5.4% growth in the herbals category, which continues to support demand for algae-derived omega-3. As the global wellness trend grows stronger, companies are racing to innovate in both technology and product formulation to meet this rising demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 18.2% |

The heterotrophic fermentation systems segment held 64.4% share and is projected to maintain a CAGR of 18.2% through 2034. These systems have proven to be the most viable and scalable method for commercial algae-based omega-3 production. Operating under controlled conditions, heterotrophic fermentation allows algae to metabolize carbohydrate sources such as glucose, sucrose, or industrial byproducts for optimal omega-3 yield. Their industrial-scale compatibility and reduced risk of environmental contamination have positioned them as the backbone of production for key industry players.

The dietary supplements segment held a 31.7% share in 2024 and is gaining traction as more consumers prioritize plant-based health products. This segment benefits from strong retail networks, trusted brand names, and attractive margins, which make it a primary application area for algae-derived omega-3s. The increased awareness of omega-3's health benefits, particularly in cardiovascular, cognitive, and inflammatory health, is further supporting supplement uptake.

North America Algae-Based Omega-3 Production Systems Market is forecast to grow at a CAGR of 18.3% between 2025 and 2034, driven by a health-conscious consumer base and increasing adoption of plant-forward lifestyles. Innovations centered around non-GMO, organic, and environmentally friendly formulations continue to attract attention from consumers seeking sustainable wellness solutions.

Leading companies operating in the Global Algae-Based Omega-3 Production Systems Market include DSM-Firmenich, Fermentalg, Cellana Inc., Algatech, CABIO Biotech, Evonik Industries AG, Nuseed, Corbion N.V., Algisys, Qualitas Health, and Mara Renewables Corporation. Companies in the Global Algae-Based Omega-3 Production Systems Market are pursuing multiple strategies to secure and grow their market share. Key players are heavily investing in R&D to improve strain selection and boost lipid yield, while optimizing production technologies like heterotrophic fermentation for cost-effective scalability. Collaborations with nutrition and pharmaceutical brands help expand distribution channels and increase product visibility. Firms are also working toward obtaining clean-label certifications and aligning with non-GMO, allergen-free, and vegan-friendly standards to capture niche markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Production technology trends

- 2.2.2 Application trends

- 2.2.3 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable omega-3 alternatives

- 3.2.1.2 Rising aquaculture industry growth

- 3.2.1.3 Depletion of marine fish stocks & ocean conservation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technology transfer & commercialization gaps

- 3.2.2.2 Feedstock availability & quality consistency

- 3.2.3 Market opportunities

- 3.2.3.1 Waste-to-omega-3 production systems

- 3.2.3.2 AI-driven process optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By production technology

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Heterotrophic fermentation systems

- 5.3 Phototrophic cultivation systems

- 5.4 Hybrid cultivation systems

- 5.5 Advanced photobioreactor systems

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Infant formula

- 6.3 Dietary supplements

- 6.3.1 Capsule & softgel

- 6.3.2 Liquid & powder supplement

- 6.4 Functional foods & beverages

- 6.5 Aquaculture feed

- 6.5.1 Fish feed

- 6.5.2 Shrimp & crustacean

- 6.6 Animal feed & pet food

- 6.6.1 Livestock nutrition

- 6.6.2 Feed additive

- 6.7 Pharmaceutical

- 6.7.1 Medical nutrition & therapeutic

- 6.7.2 Clinical trial

- 6.7.3 Drug delivery & formulation

- 6.8 Cosmetics & personal care

- 6.8.1 Anti-aging & skin health

- 6.8.2 Hair care & scalp health

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Algatech

- 8.2 Algisys

- 8.3 CABIO Biotech

- 8.4 Cellana Inc

- 8.5 Corbion N.V.

- 8.6 DSM-Firmenich

- 8.7 Evonik Industries AG

- 8.8 Fermentalg

- 8.9 Mara Renewables Corporation

- 8.10 Nuseed

- 8.11 Qualitas Health