|

市场调查报告书

商品编码

1858967

药物基因体学市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Pharmacogenomics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

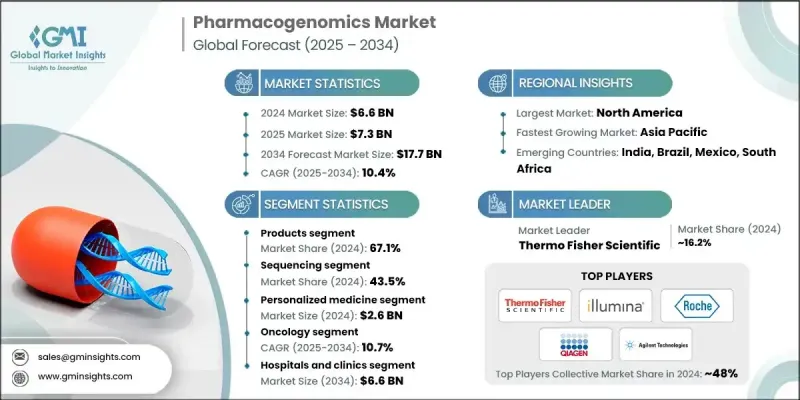

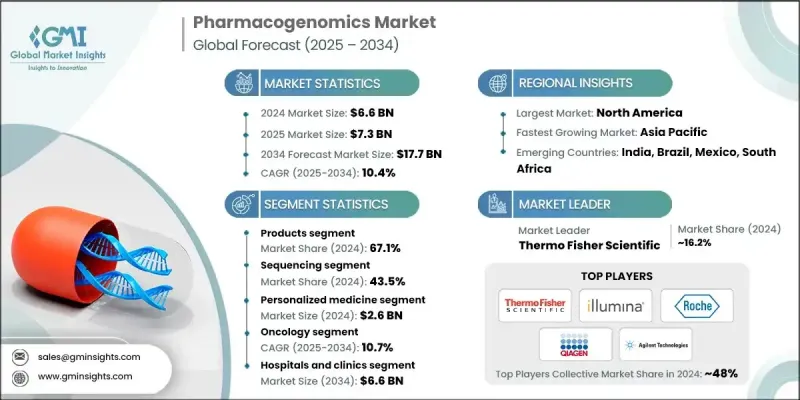

2024 年全球药物基因组学市场价值为 66 亿美元,预计到 2034 年将以 10.4% 的复合年增长率增长至 177 亿美元。

标靶治疗需求的不断增长以及基因组技术的持续发展推动了药物基因组学的稳定增长。随着全球医疗体係不断推进个人化治疗方案,药物基因组学检测在临床和研究领域的应用日益广泛。癌症、心血管疾病和传染病等慢性疾病的沉重负担进一步推动了基因组学在决策中发挥越来越重要的作用。药物基因组学专注于了解个体的基因如何影响其药物反应,使临床医生能够优化剂量和治疗方案,提高安全性和有效性。向数位化医疗解决方案的持续转型,以及人工智慧驱动的临床决策工具和真实世界资料分析的融合,不断推动该领域的发展。市场的发展与个人化医疗的广泛趋势以及在提高治疗效果的同时减少药物不良反应的需求密切相关。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 66亿美元 |

| 预测值 | 177亿美元 |

| 复合年增长率 | 10.4% |

2024年,产品板块占据67.1%的市场份额,主要受个人化医疗工具需求成长的推动。该板块涵盖仪器、耗材以及各种基因检测试剂盒和试剂,这些产品对临床和研究应用至关重要。定序试剂盒、基于PCR的试剂、微阵列和其他诊断工具等细分领域广泛应用于心臟病学、肿瘤学、精神病学和传染病学等多个专科。治疗决策中对精准解决方案的需求不断增长,并持续推动药物基因组学产品的需求。

2024年,个人化医疗市场规模预计将达26亿美元。其快速成长归功于先进基因组工具的普及、诊断技术的进步以及资料分析在常规医疗实践中的应用。国家基因组学计画正积极推动将药物基因组学资料纳入日常临床实践。监管机构透过批准相关生物标记来支持这项转型,从而实现更安全的用药和个人化治疗。伴随诊断和人工智慧技术的日益普及,也使得个人化医疗更具规模化优势,并被更广泛地接受。

2024年,北美药物基因组学市占率达到48.6%。美国和加拿大市场扩张得益于对基因组创新的高度重视、高昂的医疗保健支出以及先进的数位基础设施。医院和诊所对基因组检测和个人化治疗的日益普及,得益于有利的报销政策,从而推动了药物基因组学检测在临床实践中的广泛应用。定序工具和人工智慧诊断技术的不断进步正在改善临床疗效,并推动区域市场渗透。

药物基因组学市场的领导者正透过策略性研发投资、合作以及产品多元化来扩大市场份额。例如,赛默飞世尔科技、安捷伦科技、Illumina 和 Qiagen 等公司致力于开发能够实现更快、更精准基因分析的综合试剂盒、试剂和定序平台。与医疗机构和研究机构的合作有助于这些公司共同开发满足临床需求的客製化解决方案。此外,企业也积极寻求併购,以增强技术实力并拓展地域覆盖范围。同时,各企业也高度重视监管审批和合规性,以确保产品的临床相关性和市场准入。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 增加研发投资

- 癌症发生率不断上升

- 精准医疗方法的日益普及

- 药物不良反应负担日益加重

- 产业陷阱与挑战

- 成本和报销方面的挑战

- 遗传资料的复杂性解读

- 市场机会

- 基于微生物组和荷尔蒙标靶疗法的创新

- 多基因检测板和伴随诊断的开发

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 专利分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 产品

- 试剂盒和试剂

- 定序试剂盒和试剂

- PCR试剂盒和试剂

- 微阵列试剂盒和试剂

- 其他试剂盒和试剂

- 仪器和耗材

- 试剂盒和试剂

- 服务

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 定序

- PCR

- 微阵列

- 其他技术

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 个人化医疗

- 临床研究

- 药物发现与临床前开发

- 其他应用

第八章:市场估计与预测:依疾病领域划分,2021-2034年

- 主要趋势

- 肿瘤学

- 心血管疾病

- 神经系统疾病

- 传染病

- 心理健康

- 其他疾病领域

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 学术和研究机构

- 製药和生物技术公司

- 合约研究组织(CRO)

- 其他最终用途

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 23andMe

- Admera Health

- Agilent Technologies

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Charles River Laboratories

- Danaher

- Eurofins Scientific

- F. Hoffmann-La Roche

- Genelex

- Genomind

- Illumina

- Laboratory Corporation of America Holdings

- Novogene

- OneOme

- Qiagen

- Revvity

- Takara Bio

- Thermo Fisher Scientific

The Global Pharmacogenomics Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 17.7 billion by 2034.

The steady growth is fueled by increasing demand for targeted therapies and the ongoing development of genomic technologies. As healthcare systems worldwide push for more personalized treatment approaches, pharmacogenomic testing is seeing wider adoption across clinical and research settings. The expanding role of genomics in decision-making is further propelled by the burden of chronic diseases such as cancer, cardiovascular diseases, and infectious conditions. Pharmacogenomics focuses on understanding how a person's genetic code influences their drug response, allowing clinicians to fine-tune dosages and treatment options for improved safety and efficacy. The ongoing shift toward digital health solutions, combined with the integration of AI-powered clinical decision tools and real-world data analytics, continues to advance the field. The market's progress is directly tied to the broader move toward personalized medicine and the need to reduce adverse drug reactions while enhancing therapeutic outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 10.4% |

In 2024, the products segment held a 67.1% share, driven by rising demand for tools supporting personalized care. This category includes instruments, consumables, and a wide range of genetic testing kits and reagents, which are essential for clinical and research use. Subsegments such as sequencing kits, PCR-based reagents, microarrays, and other diagnostic tools are widely used across various specialties, including cardiology, oncology, psychiatry, and infectious diseases. The increasing need for precision-driven solutions in therapeutic decision-making continues to boost demand for pharmacogenomic product offerings.

The personalized medicine segment generated USD 2.6 billion in 2024. Its rapid growth is attributed to the expansion of access to advanced genomic tools, improved diagnostics, and the integration of data analytics into routine care. Programs focused on national genomics initiatives are encouraging the inclusion of pharmacogenomic data into everyday clinical practice. Regulatory bodies are supporting this transition by approving relevant biomarkers that enable safer drug use and individualized therapy. Growing use of companion diagnostics and AI-powered technologies has made personalized medicine more scalable and widely accepted.

North America Pharmacogenomics Market held a 48.6% share in 2024. Market expansion in the U.S. and Canada is supported by a strong focus on genomic innovation, high healthcare expenditure, and advanced digital infrastructure. The increased adoption of genomic testing and personalized treatments across hospitals and clinics has been backed by favorable reimbursement policies, contributing to the widespread implementation of pharmacogenomic panels into clinical practice. Ongoing advancements in sequencing tools and AI-enabled diagnostics are enhancing clinical outcomes and driving regional market penetration.

Leading players in the Pharmacogenomics Market are expanding their market presence through strategic R&D investments, partnerships, and product diversification. Companies such as Thermo Fisher Scientific, Agilent Technologies, Illumina, and Qiagen are focused on developing comprehensive kits, reagents, and sequencing platforms that enable faster and more accurate genetic profiling. Collaborations with healthcare providers and research institutions help these firms co-develop custom solutions tailored to clinical needs. Mergers and acquisitions are being pursued to strengthen technological capabilities and widen geographic reach. Additionally, players are emphasizing regulatory approvals and compliance to ensure clinical relevance and market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Offering trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 Disease area trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing research and development investments

- 3.2.1.2 Increasing prevalence of cancer

- 3.2.1.3 Increasing adoption of precision medicine approaches

- 3.2.1.4 Rising burden of adverse drug reactions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost and reimbursement challenges

- 3.2.2.2 Complexity and interpretation of genetic data

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in microbiome-based and hormone-targeted therapies

- 3.2.3.2 Development of multi-gene panels and companion diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Offerings, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Products

- 5.2.1 Kits and reagents

- 5.2.1.1 Sequencing kits and reagents

- 5.2.1.2 PCR kits and reagents

- 5.2.1.3 Microarray kits and reagents

- 5.2.1.4 Other kits and reagents

- 5.2.2 Instrument and consumables

- 5.2.1 Kits and reagents

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Sequencing

- 6.3 PCR

- 6.4 Microarray

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Personalized medicine

- 7.3 Clinical research

- 7.4 Drug discovery and preclinical development

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Disease Area, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Cardiovascular diseases

- 8.4 Neurological diseases

- 8.5 Infectious diseases

- 8.6 Mental health

- 8.7 Other disease areas

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Academic and research institutions

- 9.4 Pharmaceutical and biotechnology companies

- 9.5 Contract research organization (CROs)

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 23andMe

- 11.2 Admera Health

- 11.3 Agilent Technologies

- 11.4 Becton, Dickinson and Company

- 11.5 Bio-Rad Laboratories

- 11.6 Charles River Laboratories

- 11.7 Danaher

- 11.8 Eurofins Scientific

- 11.9 F. Hoffmann-La Roche

- 11.10 Genelex

- 11.11 Genomind

- 11.12 Illumina

- 11.13 Laboratory Corporation of America Holdings

- 11.14 Novogene

- 11.15 OneOme

- 11.16 Qiagen

- 11.17 Revvity

- 11.18 Takara Bio

- 11.19 Thermo Fisher Scientific