|

市场调查报告书

商品编码

1858968

肺动脉高压市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Pulmonary Arterial Hypertension Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

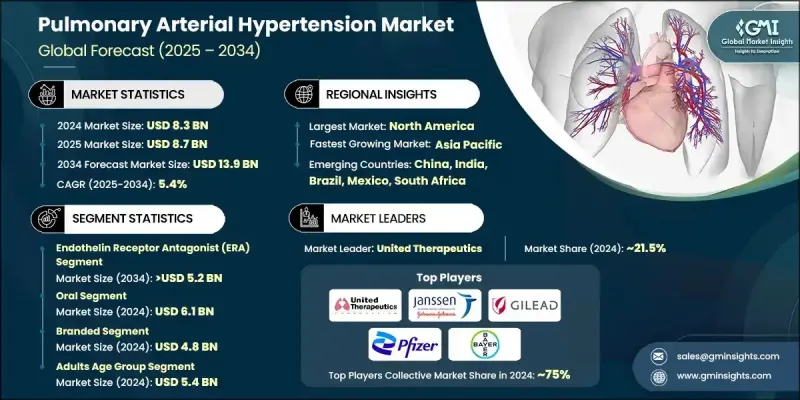

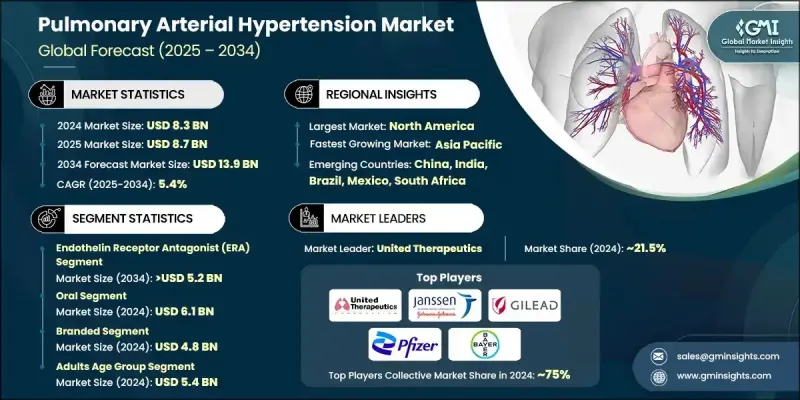

2024 年全球肺动脉高压市场价值为 83 亿美元,预计到 2034 年将以 5.4% 的复合年增长率增长至 139 亿美元。

市场需求的成长归因于全球肺动脉高压(PAH)病例数的增加、药物疗法的进步,以及美国食品药物管理局(FDA)和欧洲药品管理局(EMA)等监管机构为支持新型PAH疗法研发而持续做出的努力。随着诊断技术和生物标记筛检方法的改进,PAH的早期检测变得更加有效,有助于更好地管理疾病。医疗基础设施投资的不断增长,尤其是在亚太和拉丁美洲等新兴地区,也对扩大PAH疗法的可近性发挥了关键作用。由于医疗体系的改善和政府主导的宣传活动,中国、印度和巴西等国的疗法供应量有所提高。生物相似药的上市有助于降低治疗费用,进一步提高发展中地区的可近性。製药公司也正在利用策略性併购和合作来丰富其产品组合,并加速PAH药物研发的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 83亿美元 |

| 预测值 | 139亿美元 |

| 复合年增长率 | 5.4% |

内皮素受体拮抗剂(ERA)在2024年占据了37.3%的市场份额,预计到2034年将达到52亿美元,年复合成长率为5.4%。 ERA,例如波生坦、安立生坦和马西替坦,能够阻断内皮素-1,内皮素-1是一种参与肺动脉高压(PAH)发展的关键血管收缩剂。这些药物有助于降低肺血管阻力并提高运动能力,因此是长期疾病管理的常用选择。

2024年,口服药物市场规模达到61亿美元,因其服用方便,减少了频繁就医和使用复杂医疗设备的需求,深受众多患者的青睐。口服疗法副作用较少,且安全性较高,因此较适合长期服用,特别适用于合併其他疾病的患者。

2024年,美国肺动脉高压市场规模预计将达到40亿美元,主要受该疾病盛行率上升的推动,尤其是在老年族群和合併慢性阻塞性肺病(COPD)等其他疾病的患者中。先进的诊断方法,包括超音波心动图和生物标记检测,使得早期发现成为可能,从而增加了寻求治疗的患者群体,进而推动了对肺动脉高压治疗药物的需求。美国企业在肺动脉高压研究领域处于领先地位,引领治疗领域的创新。

活跃于全球肺动脉高压市场的主要公司包括默克集团(Merck KGaA)、拜耳(Bayer)、吉利德科学(Gilead Sciences)、葛兰素史克(GlaxoSmithKline,简称GSK)、辉瑞(Pfizer)、强生杨森製药(Janssen Pharmaceuticals)、 Technologies、Gossamer Bio、Galectin Therapeutics和诺华(Novartis)。为了巩固其在肺动脉高压市场的地位,各公司正致力于透过研发新疗法和改善患者获得治疗的途径来拓展产品组合。许多公司正透过合作、併购等方式进行投资,通常与规模较小的生技公司合作,以获取创新和后期研发资产。此外,各公司还优先考虑在新兴市场进行策略性区域投资,以降低治疗成本并提高治疗的可及性,特别是透过建立本地生产设施。这种做法不仅降低了成本,也符合生物相似药日益增长的趋势,有助于降低发展中市场的定价障碍。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 肺动脉高压及相关疾病盛行率不断上升

- 药物治疗的进展

- 个人化治疗的趋势日益增强

- 发展中国家医疗卫生基础设施的改善

- 产业陷阱与挑战

- 高昂的治疗费用

- 专家资源有限

- 监管挑战

- 市场机会

- 联合疗法的应用日益广泛

- 基因疗法与再生医学的融合日益加深

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 临床试验分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依药物类别划分,2021-2034年

- 主要趋势

- 前列环素和前列环素类似物

- 可溶性鸟苷酸环化酶(SGC)刺激剂

- 内皮素受体拮抗剂(ERA)

- 磷酸二酯酶 5 (PDE-5)

- 血管扩张剂

- 其他药物类别

第六章:市场估计与预测:依给药途径划分,2021-2034年

- 主要趋势

- 口服

- 静脉

- 吸入

第七章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 品牌

- 仿製药

第八章:市场估算与预测:依年龄组别划分,2021-2034年

- 主要趋势

- 儿科

- 成人

- 老年医学

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 专科诊所

- 其他最终用途

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Bayer

- F. Hoffmann La Roche

- GlaxoSmithKline (GSK)

- Gilead Sciences

- Gmax Biopharm

- Gossamer Bio

- Galectin Therapeutics

- Janssen Pharmaceuticals (Johnson & Johnson)

- Liquidia Technologies

- Merck KGaA

- Novartis

- Pfizer

- Resverlogix

- United Therapeutics

The Global Pulmonary Arterial Hypertension Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 13.9 billion by 2034.

The rise in market demand is attributed to the increasing number of PAH cases worldwide, advancements in drug therapies, and ongoing efforts by regulatory agencies such as the FDA and EMA to support the development of new PAH treatments. As diagnostic technologies and biomarker screening methods improve, early detection of PAH has become more effective, contributing to better management of the disease. The growing investments in healthcare infrastructure, particularly in emerging regions like Asia-Pacific and Latin America, have also played a key role in expanding access to PAH treatments. Countries such as China, India, and Brazil are seeing enhanced availability of therapies due to improvements in healthcare systems and government-driven awareness initiatives. Biosimilars entering the market are helping to make treatments more affordable, further boosting accessibility in developing regions. Pharmaceutical companies are also leveraging strategic mergers, acquisitions, and partnerships to diversify their portfolios and accelerate innovation in PAH drug development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.4% |

The endothelin receptor antagonist (ERA) segment held a 37.3% share in 2024, and it is projected to reach USD 5.2 billion by 2034, growing at a CAGR of 5.4%. ERAs, such as bosentan, ambrisentan, and macitentan, block endothelin-1, a key vasoconstrictor involved in the development of PAH. These drugs help reduce pulmonary vascular resistance and improve exercise capacity, making them a common choice for long-term disease management.

In 2024, the oral drug segment generated USD 6.1 billion, and it is preferred by many patients due to the convenience of administration, reducing the need for frequent hospital visits and complex medical equipment. Oral therapies are associated with fewer side effects and better safety profiles, which make them suitable for long-term use, especially among patients with other health conditions.

U.S. Pulmonary Arterial Hypertension Market was valued at USD 4 billion in 2024, driven by the rising prevalence of the disease, particularly among older populations and individuals with other comorbidities such as COPD. Early detection facilitated by advanced diagnostic methods, including echocardiography and biomarker testing, is contributing to a larger pool of patients seeking treatment, fueling demand for PAH therapies. U.S.-based companies are at the forefront of PAH research, driving innovation in the treatment space.

Prominent companies active in the Global Pulmonary Arterial Hypertension Market include Merck KGaA, Bayer, Gilead Sciences, GlaxoSmithKline (GSK), Pfizer, Janssen Pharmaceuticals (Johnson & Johnson), United Therapeutics, Gmax Biopharm, Resverlogix, Liquidia Technologies, Gossamer Bio, Galectin Therapeutics, and Novartis. To strengthen their position in the Pulmonary Arterial Hypertension Market, companies are focusing on expanding their product portfolios through research and development of new therapies and improving patient access to treatments. Many are investing in partnerships, mergers, and acquisitions, often with smaller biotech firms, to acquire innovative and late-stage assets. Companies are also prioritizing strategic regional investments in emerging markets to make treatments more affordable and available, especially by establishing local production facilities. This approach not only reduces costs but also aligns with the growing trend of biosimilars, which help lower pricing barriers in developing markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Type trends

- 2.2.5 Age group trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of PAH and related conditions

- 3.2.1.2 Advancement in drug therapies

- 3.2.1.3 Increasing shift toward personalized treatment

- 3.2.1.4 Improved healthcare infrastructure in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Limited access to specialists

- 3.2.2.3 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing usage of combination therapy

- 3.2.3.2 Rising integration of gene therapy and regenerative medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Prostacyclin and prostacyclin analogs

- 5.3 Soluble guanylate cyclase (SGC) stimulators

- 5.4 Endothelin receptor antagonist (ERA)

- 5.5 Phosphodiesterase 5 (PDE-5)

- 5.6 Vasodilators

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Intravenous

- 6.4 Inhalation

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatrics

- 8.3 Adult

- 8.4 Geriatrics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Bayer

- 11.2 F. Hoffmann La Roche

- 11.3 GlaxoSmithKline (GSK)

- 11.4 Gilead Sciences

- 11.5 Gmax Biopharm

- 11.6 Gossamer Bio

- 11.7 Galectin Therapeutics

- 11.8 Janssen Pharmaceuticals (Johnson & Johnson)

- 11.9 Liquidia Technologies

- 11.10 Merck KGaA

- 11.11 Novartis

- 11.12 Pfizer

- 11.13 Resverlogix

- 11.14 United Therapeutics