|

市场调查报告书

商品编码

1858970

神经刺激设备市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Neurostimulation Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

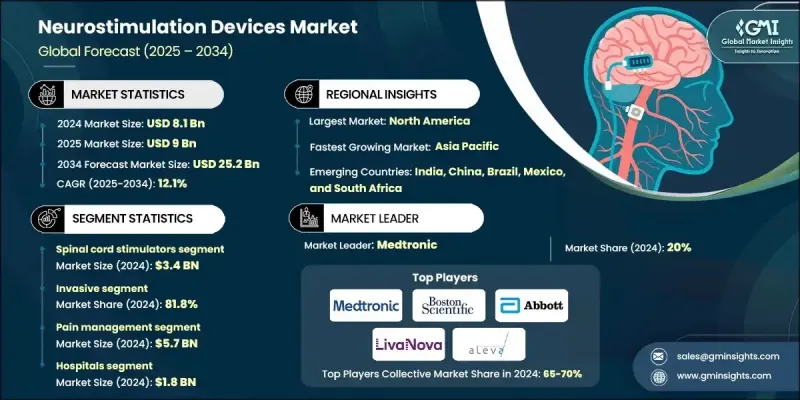

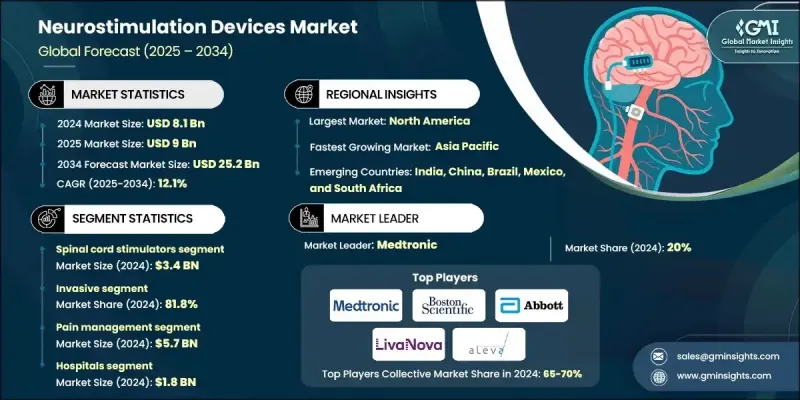

2024 年全球神经刺激设备市场价值为 81 亿美元,预计到 2034 年将以 12.1% 的复合年增长率增长至 252 亿美元。

受微创手术需求不断增长(尤其是在已开发地区)以及神经系统疾病盛行率日益上升的推动,该市场正快速发展。帕金森氏症、癫痫、慢性疼痛和其他神经系统疾病老年患者数量的激增,显着推动了对神经刺激设备的需求。这些技术为传统疗法提供了标靶性强且对患者友好的替代方案,符合人们对可扩展且高效疗法的日益增长的需求。神经刺激技术的进步也提高了植入式和非侵入式设备的安全性、有效性和精确性,使其备受医疗服务提供者和患者的青睐。研发投入的增加和数位平台的整合进一步推动了市场发展,实现了即时资料追踪和治疗方案的个人化客製化。随着医疗系统不断优先考虑慢性神经系统疾病的个人化和长期管理,神经刺激设备正成为现代临床实践的重要组成部分,也是医疗器材领域的关键成长驱动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 81亿美元 |

| 预测值 | 252亿美元 |

| 复合年增长率 | 12.1% |

神经刺激装置是一种专门设计的系统,旨在向特定神经或神经系统区域发送电讯号。这些讯号有助于控制症状,改善多种疾病患者的治疗效果,包括忧郁症、运动障碍和难治性慢性疼痛。根据所治疗的疾病,神经刺激装置可以戴在身上,也可以透过手术植入。

2024年,脊髓刺激器市场规模达34亿美元。这些植入式设备透过向脊髓输送微弱的电脉衝来阻断疼痛讯号,对那些对标准疗法无效的慢性疼痛患者非常有效。深部脑部刺激也发挥着至关重要的作用,它利用策略性地植入脑电极来调节异常的神经活动。

2024年,侵入性治疗市占率达81.8%。迷走神经刺激器、脊髓刺激器和深部脑部刺激器等侵入性设备因其在治疗慢性神经系统疾病方面的高效性而持续受到关注。基于临床成功和长期安全性资料,这些设备通常被认为是目前最可靠的治疗选择。其日益普及反映了临床医师在治疗难治性神经系统疾病时,更倾向于选择经过验证、实证有效的技术。

预计到2024年,北美神经刺激设备市占率将达到41.2%。神经系统疾病盛行率的上升以及人口老化,巩固了该地区强劲的市场地位。凭藉日益普及的先进医疗保健服务、对医疗技术的大力投资以及对创新疗法的早期应用,北美已成为全球神经刺激设备研发和应用的中心。

推动全球神经刺激设备市场发展的关键企业包括雅培实验室、美敦力、Innovative Health Solutions、Laborie、Aleva Neurotherapeutics、Synapse Biomedical、LivaNova、BioControl Medical、Endostim、ElectroCore、MicroTransponder、Neuronetics、RS Medical、tVNS Technologies Technologies Technologies (Cerbomed)、波士顿和波士顿 (Helb)、科学和波士顿 (Cerlingmedas)。这些企业正积极实施一系列策略以巩固其市场地位。大多数企业都在大力投资研发,以开发精度更高、体积更小、电池续航力更长的设备。透过策略性併购以及与医疗机构和研究机构建立合作关係,这些企业正在拓展其全球业务,并加速产品创新。各公司致力于推出以患者为中心的设备,这些设备整合了数位平台,可实现远端监测和即时调整。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 已开发国家对微创手术的需求日益增长

- 神经系统疾病盛行率不断上升

- 神经刺激装置的技术进步

- 患有神经系统疾病的老年患者数量不断增加

- 全球各地公司和组织的投资

- 产业陷阱与挑战

- 神经刺激装置相关併发症

- 缺乏熟练的医护人员

- 市场机会

- 与数位医疗和人工智慧的融合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术格局

- 未来市场趋势

- 差距分析

- 定价分析

- 报销方案

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略仪錶板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 脊髓刺激器

- 深部脑部刺激器

- 荐神经刺激器

- 迷走神经刺激器

- 胃电刺激器

- 经皮神经电刺激(TENS)

- 其他产品

第六章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 入侵性

- 非侵入性

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 疼痛管理

- 尿失禁和粪便失禁

- 帕金森氏症

- 癫痫

- 原发性震颤

- 胃轻瘫

- 沮丧

- 肌张力失调

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 其他用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Aleva Neurotherapeutics

- BioControl Medical

- Boston Scientific

- ElectroCore

- Endostim

- Helbling Holding

- Innovative Health Solutions

- Laborie

- LivaNova

- Medtronic

- MicroTransponder

- Neuronetics

- Parasym

- RS Medical

- Synapse Biomedical

- tVNS Technologies (Cerbomed)

The Global Neurostimulation Devices Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 25.2 billion by 2034.

This market is advancing rapidly, fueled by the rising need for minimally invasive procedures, especially in developed regions, and the increasing prevalence of neurological disorders. A surge in elderly patients suffering from Parkinson's disease, epilepsy, chronic pain, and other neurological conditions is significantly driving demand for neurostimulation devices. These technologies provide targeted and patient-friendly alternatives to traditional treatments, aligning with the growing demand for scalable and effective therapies. Advancements in neurostimulation technology have also enhanced the safety, efficacy, and precision of both implantable and non-invasive devices, making them highly desirable for both healthcare providers and patients. The market is further supported by increased R&D efforts and the integration of digital platforms, enabling real-time data tracking and therapy customization. As healthcare systems continue prioritizing personalized and long-term management of chronic neurological conditions, neurostimulation devices are becoming a vital part of modern clinical practice and a key growth driver in the medical device landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $25.2 Billion |

| CAGR | 12.1% |

Neurostimulation devices are specialized systems designed to send electrical signals to specific nerves or regions of the nervous system. These signals help control symptoms and improve patient outcomes across a range of conditions, including depression, movement disorders, and treatment-resistant chronic pain. They are either externally worn or surgically implanted, depending on the condition being treated.

The spinal cord stimulators segment generated USD 3.4 billion in 2024. These implantable devices block pain signals by delivering mild electrical pulses to the spinal cord, proving highly effective in patients with chronic pain who do not respond to standard treatments. Deep brain stimulation also plays a crucial role by regulating abnormal neural activity using strategically placed brain electrodes.

The invasive segment held an 81.8% share in 2024. Invasive devices such as vagus nerve stimulators, spinal cord stimulators, and deep brain stimulators continue to gain traction due to their high efficacy in treating chronic neurological conditions. These devices are often regarded as the most reliable therapeutic option based on clinical success and long-standing safety data. Their growing adoption reflects a preference among clinicians for proven, evidence-based technologies in managing refractory neurological diseases.

North America Neurostimulation Devices Market held a 41.2% share in 2024. Rising neurological disease prevalence, coupled with an aging population, underpins the region's strong market position. With increased access to advanced healthcare, robust investment in medical technology, and early adoption of innovative therapies, North America is positioned as a global hub for neurostimulation device development and adoption.

Key companies driving the Global Neurostimulation Devices Market include Abbott Laboratories, Medtronic, Innovative Health Solutions, Laborie, Aleva Neurotherapeutics, Synapse Biomedical, LivaNova, BioControl Medical, Endostim, ElectroCore, MicroTransponder, Neuronetics, RS Medical, tVNS Technologies (Cerbomed), Helbling Holding, Boston Scientific, and Parasym. Companies operating in the Neurostimulation Devices Market are implementing a range of strategies to strengthen their market position. Most are heavily investing in R&D to develop devices with enhanced precision, smaller form factors, and improved battery life. Strategic mergers, acquisitions, and partnerships with healthcare providers and research institutions are expanding their global reach and accelerating product innovation. Firms are focusing on launching patient-centric devices with integrated digital platforms that allow remote monitoring and real-time adjustments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for minimally invasive surgery in developed countries

- 3.2.1.2 Increasing prevalence of neurological disorders

- 3.2.1.3 Technological advancements in neurostimulation devices

- 3.2.1.4 Increasing number of elderly patients with neurological disorders

- 3.2.1.5 Investments by companies and organizations across the globe

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with neurostimulation devices

- 3.2.2.2 Lack of skilled healthcare practitioners

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health and AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Spinal cord stimulator

- 5.3 Deep brain stimulator

- 5.4 Sacral nerve stimulator

- 5.5 Vagus nerve stimulator

- 5.6 Gastric electric stimulator

- 5.7 Transcutaneous electrical nerve stimulation (tens)

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Invasive

- 6.3 Non-invasive

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pain management

- 7.3 Urinary and fecal incontinence

- 7.4 Parkinson's disease

- 7.5 Epilepsy

- 7.6 Essential tremor

- 7.7 Gastroparesis

- 7.8 Depression

- 7.9 Dystonia

- 7.10 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgery centers

- 8.4 Specialty clinics

- 8.5 Other End uses

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 1.1.1 U.S.

- 1.1.2 Canada

- 9.3 Europe

- 1.1.3 Germany

- 1.1.4 UK

- 1.1.5 France

- 1.1.6 Spain

- 1.1.7 Italy

- 1.1.8 Netherlands

- 9.4 Asia Pacific

- 1.1.9 China

- 1.1.10 Japan

- 1.1.11 India

- 1.1.12 Australia

- 1.1.13 South Korea

- 9.5 Latin America

- 1.1.14 Brazil

- 1.1.15 Mexico

- 1.1.16 Argentina

- 9.6 Middle East and Africa

- 1.1.17 South Africa

- 1.1.18 Saudi Arabia

- 1.1.19 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Aleva Neurotherapeutics

- 10.3 BioControl Medical

- 10.4 Boston Scientific

- 10.5 ElectroCore

- 10.6 Endostim

- 10.7 Helbling Holding

- 10.8 Innovative Health Solutions

- 10.9 Laborie

- 10.10 LivaNova

- 10.11 Medtronic

- 10.12 MicroTransponder

- 10.13 Neuronetics

- 10.14 Parasym

- 10.15 RS Medical

- 10.16 Synapse Biomedical

- 10.17 tVNS Technologies (Cerbomed)