|

市场调查报告书

商品编码

1858972

復健机器人市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Rehabilitation Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

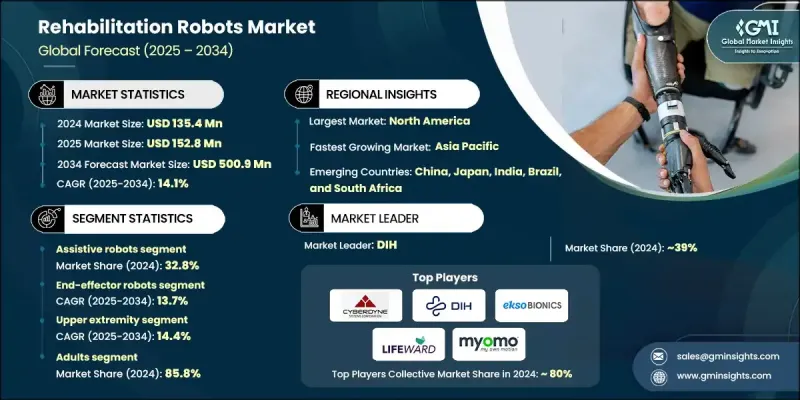

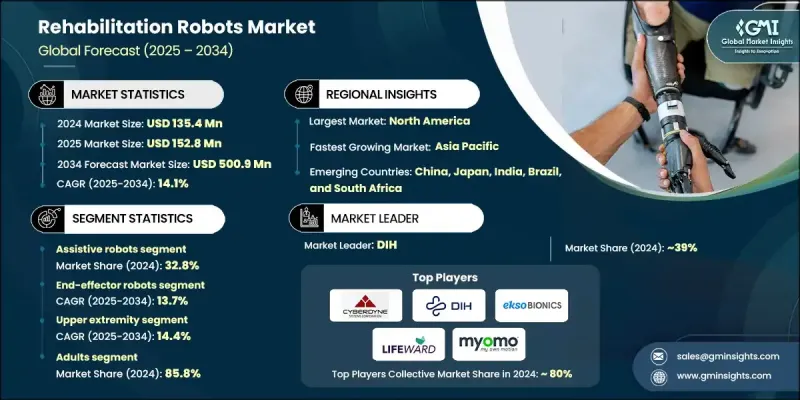

2024 年全球康復机器人市场价值为 1.354 亿美元,预计到 2034 年将以 14.1% 的复合年增长率增长至 5.009 亿美元。

推动市场扩张的因素包括:肢体残疾人数的增加、老年人口的增长、神经系统疾病和创伤相关病例的增多,以及临床和家庭环境中对机器人復健治疗的激增需求。復健机器人正在重塑神经系统疾病、脊髓损伤、手术或与年龄相关的行动障碍后的復健方式。这些机器人系统日益被门诊中心、医院和家庭护理机构所采用,提供针对性的治疗,从而增强运动功能和行动能力。感测器整合、即时运动追踪、人工智慧驱动的响应机制以及云端治疗资料的不断改进,正将传统的復健方式转变为高度个人化和高效的流程。与远距医疗平台和电子病历系统的集成,也使治疗师和临床医生能够远端客製化和监测治疗方案。随着需求的成长,各公司正在推出更多符合人体工学、以患者为中心的机器人设备,这些设备采用生物相容性材料製造,并拥有更完善的使用者介面设计。资金投入的增加、有利的医疗保健政策以及持续的产品创新,将继续支持已开发经济体和新兴经济体的长期成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.354亿美元 |

| 预测值 | 5.009亿美元 |

| 复合年增长率 | 14.1% |

至2034年,上肢復健市场将以14.4%的复合年增长率成长。推动其成长的主要因素是机器人辅助復健在改善肢体协调性和力量方面的显着成效。这些系统正被广泛应用于临床和復健机构,以支持手臂、肩膀和手部的更快、更有针对性的復原。其日益普及与人们对个人化治疗益处以及中风和骨科復健效果提升的认识不断提高密切相关。

预计到2034年,外骨骼机器人市场将以14.8%的复合年增长率成长。人们对用于辅助行动的可穿戴机器人系统的日益关注,以及脊髓损伤和神经系统疾病发病率的不断上升,正在推动外骨骼的普及应用。这些系统能够增强力量、步态训练和姿势支撑,其在老年护理、物理治疗和伤后復健中的应用正在稳步增长。轻量化材料设计和自适应人工智慧技术的快速发展,使得外骨骼更容易广泛应用于临床实践。

2024年,北美康復机器人市占率达43.8%。该地区受益于先进的医疗保健生态系统、对机器人创新的高额投资以及对机器人疗法益处的广泛认知。美国在这一区域主导地位中发挥关键作用,这得益于其庞大的保险覆盖范围、不断上升的神经肌肉疾病发病率以及将机器人技术融入康復计画的强有力的製度支持。技术开发商与医学研究机构之间的合作不断推动技术突破,而机器人技术在长期照护和门诊机构的广泛应用也进一步增强了市场成长动能。

全球康復机器人市场的主要企业包括 Cyberdyne、DIH、REX BIONICS、myomo、KINOVA、Ekso Bionics、FOURIER、tyromotion、BioXtreme、LIFEWARD、BIONIK、LEADERS REHAB ROBOT 和 Rehab-Robotics。这些企业致力于产品创新,透过整合人工智慧演算法、智慧感测器和云端连接平台,提供个人化和数据驱动的治疗方案。领先企业正透过与医疗服务提供者、研究机构和经销商建立策略合作伙伴关係,拓展其全球业务版图。研发投入仍是重中之重,旨在开发紧凑、易用且价格合理的设备,以满足各种復健需求。许多公司正在加强其居家照护服务,并专注于老龄化人口和长期照护市场。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 脑部疾病盛行率上升

- 肢体残障患者数增加

- 技术进步

- 全球老年人口激增,加上创伤病例不断增加,使得全球经济面临严峻挑战。

- 产业陷阱与挑战

- 设备成本高

- 发展中国家缺乏意识

- 市场机会

- 拓展新兴市场

- 人工智慧的整合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 目前技术

- 新兴技术

- 未来市场趋势

- 消费者行为分析

- 2021-2034年各地区復健机器人(单元)数量

- 管道分析

- 投资环境

- 创业场景

- 2024年定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 辅助机器人

- 治疗机器人

第六章:市场估算与预测:依机器人结构划分,2021-2034年

- 主要趋势

- 末端执行器机器人

- 外骨骼机器人

第七章:市场估计与预测:依极端情况划分,2021-2034年

- 主要趋势

- 上肢

- 下肢

第八章:市场估算与预测:依病患划分,2021-2034年

- 主要趋势

- 成年人

- 儿科

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 神经復健

- 脊髓损伤

- 其他应用

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 復健中心

- 其他最终用途

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- BIONIK

- BioXtreme

- Cyberdyne

- DIH

- Ekso Bionics

- FOURIER

- KINOVA

- LEADERS REHAB ROBOT

- LIFEWARD

- myomo

- Rehab-Robotics

- REX BIONICS

- tyromotion

The Global Rehabilitation Robots Market was valued at USD 135.4 million in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 500.9 million by 2034.

The market's expansion is being driven by the rising number of individuals with physical impairments, a growing elderly population, increasing neurological and trauma-related cases, and the surging demand for robotic rehabilitation across clinical and home settings. Rehabilitation robots are reshaping how recovery is delivered after neurological disorders, spinal cord injuries, surgeries, or age-related mobility challenges. These robotic systems are increasingly adopted in outpatient centers, hospitals, and home care settings, offering targeted therapy that enhances motor recovery and mobility. Continuous improvements in sensor integration, real-time motion tracking, AI-driven response mechanisms, and cloud-enabled therapy data are transforming traditional rehabilitation into a highly personalized and effective process. Integration with telehealth platforms and electronic medical systems is also enabling therapists and clinicians to tailor and monitor treatments remotely. As demand grows, companies are introducing more ergonomic, patient-centric robotic devices built with biocompatible materials and enhanced user interface designs. Increased funding, favorable healthcare policies, and ongoing product innovations continue to support long-term growth across developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $135.4 Million |

| Forecast Value | $500.9 Million |

| CAGR | 14.1% |

The upper extremity segment will grow at a CAGR of 14.4% through 2034. Its growth is propelled by the effectiveness of robotic-assisted rehabilitation in improving limb coordination and strength. These systems are being widely implemented in clinical and residential settings to support quicker and more targeted recovery of the arms, shoulders, and hands. Their growing popularity is closely tied to rising awareness of personalized therapy benefits and improved outcomes in stroke and orthopedic rehabilitation.

The exoskeleton robots segment is expected to grow at a CAGR of 14.8% during 2034. Increasing focus on wearable robotic systems for mobility support, coupled with the growing incidence of spinal cord injuries and neurological conditions, is pushing the adoption of exoskeletons. These systems offer enhanced strength, gait training, and posture support, and their use is steadily rising in aging care, physical therapy, and post-injury rehabilitation. Rapid advancements in lightweight material design and adaptive AI capabilities are making them more accessible for widespread clinical deployment.

North America Rehabilitation Robots Market held 43.8% share in 2024. The region benefits from an advanced healthcare ecosystem, high investment in robotics innovation, and broad awareness of robotic therapy's benefits. The United States plays a key role in this regional dominance, with substantial insurance coverage, rising rates of neuromuscular disorders, and strong institutional support for integrating robotic technologies into rehabilitation programs. Partnerships between technology developers and medical research institutions continue to foster breakthroughs, while expanding use in long-term care and outpatient facilities further drives market momentum.

Leading companies in the Global Rehabilitation Robots Market are Cyberdyne, DIH, REX BIONICS, myomo, KINOVA, Ekso Bionics, FOURIER, tyromotion, BioXtreme, LIFEWARD, BIONIK, LEADERS REHAB ROBOT, and Rehab-Robotics. Companies in the Rehabilitation Robots Market are focusing on product innovation by integrating AI algorithms, smart sensors, and cloud-connected platforms to deliver personalized and data-driven therapy. Leading players are expanding their global footprint through strategic partnerships with healthcare providers, research institutions, and distributors. Investment in R&D remains a top priority to develop compact, user-friendly, and affordable devices suitable for diverse rehabilitation needs. Many firms are strengthening their home care offerings, targeting aging populations and long-term care markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Robotic structure trends

- 2.2.4 Extremity trends

- 2.2.5 Patient trends

- 2.2.6 Application trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of brain-related disorders

- 3.2.1.2 Increase in the number of patients with physical disabilities

- 3.2.1.3 Technological advancements

- 3.2.1.4 Surging geriatric population, coupled with increasing trauma cases globally

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High device cost

- 3.2.2.2 Lack of awareness in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration of AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Number of rehabilitation robots (units), by region, 2021 - 2034

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Assistive robot

- 5.3 Therapy robot

Chapter 6 Market Estimates and Forecast, By Robotic Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 End-effector robots

- 6.3 Exoskeleton robots

Chapter 7 Market Estimates and Forecast, By Extremity, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Upper extremity

- 7.3 Lower extremity

Chapter 8 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adults

- 8.3 Pediatric

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Neurological rehabilitation

- 9.3 Spinal cord injuries

- 9.4 Other applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals & clinics

- 10.3 Rehabilitation centers

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 BIONIK

- 12.2 BioXtreme

- 12.3 Cyberdyne

- 12.4 DIH

- 12.5 Ekso Bionics

- 12.6 FOURIER

- 12.7 KINOVA

- 12.8 LEADERS REHAB ROBOT

- 12.9 LIFEWARD

- 12.10 myomo

- 12.11 Rehab-Robotics

- 12.12 REX BIONICS

- 12.13 tyromotion