|

市场调查报告书

商品编码

1858973

地暖市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Underfloor Heating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

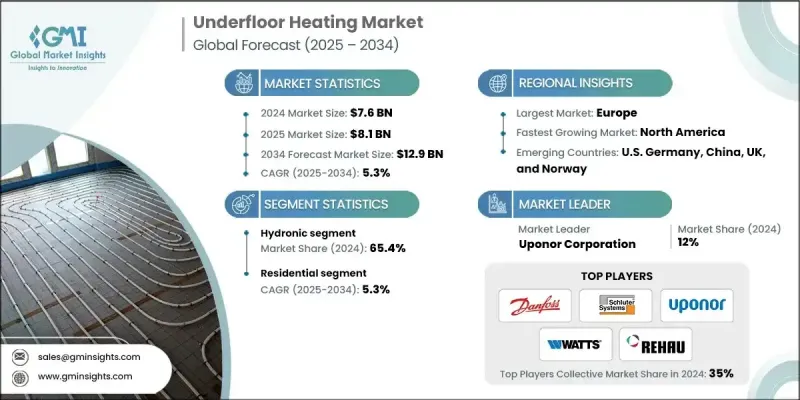

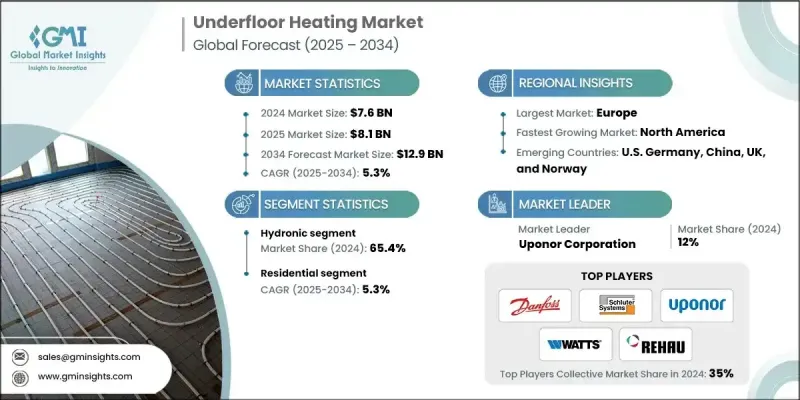

2024 年全球地暖市场价值为 76 亿美元,预计到 2034 年将以 5.3% 的复合年增长率增长至 129 亿美元。

人们日益重视减少碳排放,加上对可靠节能的室内暖气系统需求不断增长,推动了地暖系统在各个地区的广泛应用。消费者和各行各业都在转向既能提供舒适体验又符合环保标准的可持续暖气方案。地暖解决方案透过提高能源效率并与再生能源无缝衔接,有助于减少对化石燃料的依赖。随着各国气候日益寒冷,能源法规也日益严格,对电辐射供暖和水力供暖等先进供暖系统的需求正呈现强劲成长动能。这些系统不仅能提供均匀的温暖,还能帮助实现节能目标。住宅和商业领域对绿色技术的广泛追求,以及对均匀温度控制和降低营运成本的需求,正在加速地暖产品的普及。都市化进程加快、基础设施现代化以及智慧、低维护成本的暖气方案日益受到青睐,这些因素都将持续提升全球各地的市场前景。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 5.3% |

2024年,水地暖市场规模预计将达到50亿美元,这主要得益于商业和住宅领域对先进高效供暖解决方案日益增长的需求。绿色建筑实践的推广和永续建筑专案的增多,在推动产品需求方面发挥关键作用。人口的持续增长,尤其是在发展中地区,以及智慧城市的兴起,预计将为该行业的长期扩张提供支撑。

2024年,住宅领域占据了60.4%的市场份额,预计到2034年将以5.3%的复合年增长率成长。这一增长主要得益于消费者对现代家居技术和节能解决方案的日益青睐。人们对长期节能、降低维护成本和提升舒适度的认识不断提高,促使房主更快采用地暖系统。持续稳定的供暖和改善室内空气品质的优势进一步推动了住宅地暖系统在新建房屋和翻新项目中的应用。

美国地暖市场占77.9%的市场份额,预计2024年市场规模将达15亿美元。北美地区有望保持其强劲的市场地位,这主要得益于房屋翻新活动的增加、建筑规范的不断完善以及人们对节能生活方式日益增长的关注。严酷的冬季气候、不断增长的人口密度以及日益严格的能源法规,共同推动了地暖技术的普及应用。此外,人们对更舒适、更先进的解决方案的需求不断增长,加上基础设施的现代化和生活水平的提高,也为美国市场的扩张提供了支撑。

塑造地暖市场竞争格局的关键企业包括:nVent、Uponor Corporation、Warmboard, Inc.、Warmup、Schluter Systems、REHAU、ThermaRay、Watts、HEATCOM CORPORATION、Gaia Climate Solutions、Amuheat、Danfoss、Polypipe、Robert Bosch、H2O Heating、ETMAW Technologies Commercial、Thermogroup、Hemstedt、Thermo-Floor UK Limited 和 Therma-HEXX Corporation。为了巩固其在全球地暖市场的地位,领导企业正致力于创新、永续发展和区域扩张。许多企业正在加大研发投入,以提高系统效率、引进智慧暖气控制系统,并开发与再生能源相容的低能耗解决方案。与建筑公司和房地产开发商的合作有助于推动地暖技术在新住宅和商业项目中的早期应用。此外,各企业也拓展产品线,提供模组化和易于改造的解决方案,以满足老旧建筑的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 影响价值链的关键因素

- 中断

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 地暖系统成本结构分析

- 新兴机会与趋势

- 利用物联网技术实现数位转型

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 战略仪錶板

- 创新与永续发展格局

第五章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 电的

- 水力

第六章:市场规模及预测:依设施划分,2021-2034年

- 主要趋势

- 新建筑

- 改造

第七章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 单户住宅

- 多户住宅

- 商业的

- 教育

- 卫生保健

- 零售

- 物流与运输

- 办公室

- 饭店业

- 其他的

- 工业的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 芬兰

- 挪威

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第九章:公司简介

- Amuheat

- Danfoss

- ETHERMA Elektrowarme GmbH

- Gaia Climate Solutions

- H2O Heating

- HEATCOM CORPORATION

- Hemstedt

- Hunt Commercial

- nVent

- Polypipe

- REHAU

- Resideo Technologies

- Robert Bosch

- Schluter Systems

- Therma-HEXX Corporation

- ThermaRay

- Thermo-Floor UK Limited

- Thermogroup

- Uponor Corporation

- Warmboard, Inc.

- Warmup

- Watts

The Global Underfloor Heating Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 12.9 billion by 2034.

Growing emphasis on reducing carbon emissions, coupled with rising demand for reliable and energy-efficient indoor heating systems, is fueling widespread adoption across various regions. Consumers and industries alike are shifting toward sustainable heating alternatives that offer both comfort and compliance with environmental standards. Underfloor heating solutions help reduce dependence on fossil fuels by improving energy efficiency and integrating seamlessly with renewable sources. As countries face colder climates and stricter energy regulations, the demand for advanced heating systems such as electric radiant and hydronic setups is witnessing strong momentum. These systems deliver uniform warmth while contributing to energy conservation goals. The broader push for greener technologies across residential and commercial sectors, along with the trend toward uniform temperature control and reduced operational costs, is accelerating the adoption of floor heating products. Increasing urbanization, infrastructure modernization, and the growing appeal of smart, low-maintenance heating options continue to enhance the market outlook across global regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 5.3% |

The hydronic underfloor heating segment generated USD 5 billion in 2024, driven by rising demand for advanced and efficient heating solutions across commercial and residential applications. Expanding green building practices and a growing number of sustainable construction projects are playing a key role in boosting product demand. Continuous population growth, particularly in developing regions, combined with the rise of smart cities, is expected to support long-term industry expansion.

The residential segment held a 60.4% share in 2024 and will grow at a CAGR of 5.3% through 2034. This growth is primarily fueled by the increasing consumer shift toward modern home technologies and enhanced energy-saving solutions. Rising awareness of long-term savings, lower maintenance costs, and improved comfort levels is pushing homeowners to adopt underfloor heating systems at a faster rate. The appeal of consistent heating and improved indoor air quality further strengthens residential adoption across both new builds and renovation projects.

U.S. Underfloor Heating Market held 77.9% share, generating USD 1.5 billion in 2024. North America is expected to maintain its strong market position due to rising renovation activities, evolving building codes, and increased focus on energy-efficient living standards. Harsh winter conditions, in combination with rising population density and tightening energy mandates, are fueling the adoption of underfloor heating technologies. A growing preference for advanced comfort solutions, paired with modernizing infrastructure and improved living standards, supports the expansion of the U.S. market.

Key companies shaping the competitive landscape of the Underfloor Heating Market include: nVent, Uponor Corporation, Warmboard, Inc., Warmup, Schluter Systems, REHAU, ThermaRay, Watts, HEATCOM CORPORATION, Gaia Climate Solutions, Amuheat, Danfoss, Polypipe, Robert Bosch, H2O Heating, ETHERMA Elektrowarme GmbH, Resideo Technologies, Hunt Commercial, Thermogroup, Hemstedt, Thermo-Floor UK Limited, and Therma-HEXX Corporation. To strengthen their presence in the Global Underfloor Heating Market, leading players are focusing on innovation, sustainability, and regional expansion. Many are investing in R&D to enhance system efficiency, introduce smart heating controls, and develop low-energy solutions compatible with renewable power sources. Partnerships with construction firms and real estate developers help drive early adoption in new housing and commercial projects. Companies are also expanding their product lines to offer modular and retrofit-friendly solutions that cater to older buildings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Technology trends

- 2.4 Facility trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of underfloor heating systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Electric

- 5.3 Hydronic

Chapter 6 Market Size and Forecast, By Facility, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 New buildings

- 6.3 Retrofit

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.2.1 Single Family

- 7.2.2 Multi Family

- 7.3 Commercial

- 7.3.1 Education

- 7.3.2 Healthcare

- 7.3.3 Retail

- 7.3.4 Logistics & Transportation

- 7.3.5 Offices

- 7.3.6 Hospitality

- 7.3.7 Others

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Finland

- 8.3.7 Norway

- 8.3.8 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

Chapter 9 Company Profiles

- 9.1 Amuheat

- 9.2 Danfoss

- 9.3 ETHERMA Elektrowarme GmbH

- 9.4 Gaia Climate Solutions

- 9.5 H2O Heating

- 9.6 HEATCOM CORPORATION

- 9.7 Hemstedt

- 9.8 Hunt Commercial

- 9.9 nVent

- 9.10 Polypipe

- 9.11 REHAU

- 9.12 Resideo Technologies

- 9.13 Robert Bosch

- 9.14 Schluter Systems

- 9.15 Therma-HEXX Corporation

- 9.16 ThermaRay

- 9.17 Thermo-Floor UK Limited

- 9.18 Thermogroup

- 9.19 Uponor Corporation

- 9.20 Warmboard, Inc.

- 9.21 Warmup

- 9.22 Watts