|

市场调查报告书

商品编码

1858983

脑磁图市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Magnetoencephalography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

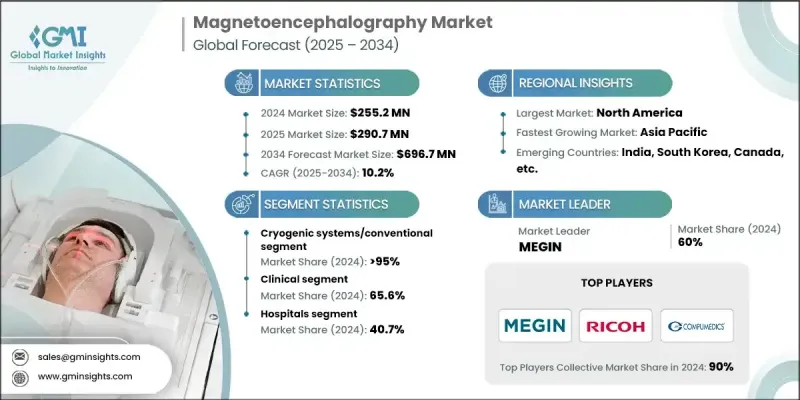

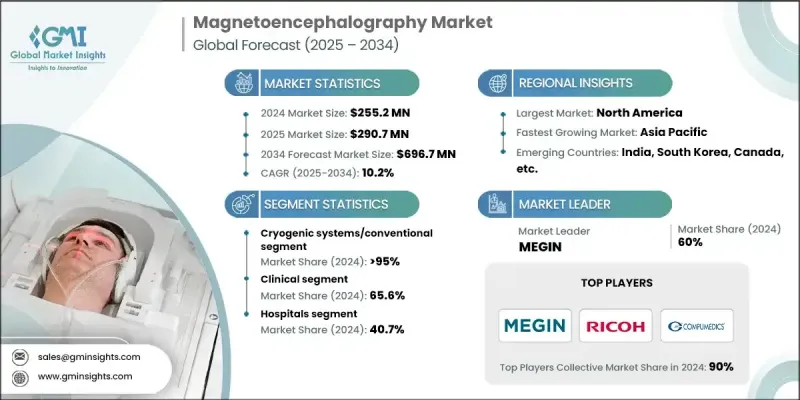

2024 年全球脑磁图市场价值为 2.552 亿美元,预计到 2034 年将以 10.2% 的复合年增长率增长至 6.967 亿美元。

由于神经系统疾病发病率上升、人口老化以及对先进诊断工具的依赖性增强,脑磁图(MEG)的需求正在加速成长。临床和研究机构越来越多地采用MEG来提高神经系统评估的精确度和速度。该技术能够即时追踪脑部活动,这在癫痫、阿兹海默症和帕金森氏症等疾病的诊断和治疗中发挥着至关重要的作用。除了临床应用外,MEG系统在脑功能研究、精神病学评估和神经发育研究等领域也得到了更广泛的应用。技术进步和对脑部网路连结的更深入理解不断推动医疗保健生态系统的创新和整合。由于医疗基础设施的完善和对神经科学计画的资金支持,已开发地区的MEG应用尤为显着。製造商正致力于透过改进分销策略和降低成本来扩大MEG系统的普及范围,尤其是在新兴市场。个人化治疗和早期诊断的趋势预计将进一步推动全球对脑磁图系统的长期市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.552亿美元 |

| 预测值 | 6.967亿美元 |

| 复合年增长率 | 10.2% |

到2034年,光泵磁力计(OPM)系统市场将以24.9%的复合年增长率成长,成为神经影像领域的变革性进步。这些系统采用光泵磁力计,可在室温下高效运行,无需复杂的低温组件。其紧凑的可穿戴设计允许感测器直接放置在头皮上,从而提高空间分辨率并实现自然运动过程中的资料收集。基于OPM的脑磁图(MEG)系统具有灵活性、更低的营运成本和更强的实际应用适应性,使其在儿科和动态监测领域特别引人注目。其可扩展性和便携性正日益受到临床和神经科学研究中心的青睐。

2024年,临床应用领域占了65.6%的市占率。神经系统疾病患者群体的不断增长,以及对早期诊断日益重视,共同促成了该领域的领先地位。 MEG透过精确定位异常脑活动,在术前定位和疾病管理中发挥关键作用。其非侵入性和高解析度的特性使其在癫痫、肿瘤和神经退化性疾病的治疗中特别有用,因为在这些疾病中,精确定位对于手术计划和患者预后至关重要。

2024年,北美脑磁图(MEG)市占率达39.5%。该地区受益于强大的医学研究基础、广泛的医疗保健服务以及脑部疾病患者数量的不断增长。 MEG早期在临床上的应用以及与医院实践的整合,促进了其在诊断领域的应用。区域政府也发挥了重要作用,资助神经科学计画并支持脑图谱研究计画。这些因素使北美在MEG系统的技术部署和临床应用方面均处于领先地位。

全球脑磁图(MEG)市场的主要活跃企业包括FieldLine Inc.、理光(Ricoh)、Cerca Magnetics Limited、Compumedics Limited、MAG4Health、MEGIN和CTF MEG NEURO INNOVATIONS, INC.。脑磁图领域的企业正透过对研发的策略投资和全球扩张来巩固其市场地位。创新仍然是核心,重点在于开发下一代MEG系统,例如基于光功率管理(OPM)的解决方案,以增强移动性和可及性。各公司正透过瞄准新兴市场并改善服务基础设施来拓展地理范围。与研究机构和医院的合作有助于加速临床验证和产品应用。此外,各公司也在努力简化系统整合并降低操作复杂性,使MEG更适用于常规临床应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 神经系统疾病盛行率不断上升

- 脑磁图领域的技术快速发展

- 在临床诊断和研究领域的应用日益广泛

- 产业陷阱与挑战

- 替代神经影像技术的可用性

- 脑磁图系统成本高昂

- 机会

- 便携式和可穿戴式脑磁图系统

- 人工智慧整合与自动化分析

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 技术路线图与创新格局

- SQUID技术演进

- OPM技术进步

- 量子感测器开发

- AI/ML整合时间表

- 2024年各地区定价分析

- MEG 相对于 fMRI 和 EEG 的优势

- 管道分析

- 全球MEG装置数量,按地区和国家划分

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚太地区

- 中国

- 日本

- 北美洲

- 品牌分析

- 报销方案

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪錶板

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 低温系统/常规

- OPM系统

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 临床

- 癫痫

- 自闭症

- 失智

- 中风

- 创伤性脑损伤(TBI)

- 其他应用

- 研究

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 影像中心

- 学术和研究机构

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚太地区

- 中国

- 日本

- 世界其他地区(RoW)

第九章:公司简介

- Cerca Magnetics Limited

- Compumedics Limited

- CTF MEG NEURO INNOVATIONS, INC.

- FieldLine Inc.

- MAG4Health

- MEGIN

- Ricoh

The Global Magnetoencephalography Market was valued at USD 255.2 million in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 696.7 million by 2034.

The demand for magnetoencephalography (MEG) is accelerating due to rising incidences of neurological disorders, an aging population, and increased reliance on advanced diagnostic tools. Clinical and research institutions are increasingly adopting MEG to enhance the precision and speed of neurological assessments. The technology's ability to deliver real-time tracking of brain activity is proving vital in the diagnosis and management of conditions like epilepsy, Alzheimer's disease, and Parkinson's disease. In addition to clinical use, MEG systems are seeing broader application in brain function research, psychiatric evaluation, and neurodevelopmental studies. Technological progress and a deeper understanding of brain network connectivity continue to drive innovation and integration across healthcare ecosystems. Strong adoption is especially noted in developed regions due to improved healthcare infrastructure and supportive funding for neuroscience initiatives. Manufacturers are working on expanding access to MEG systems through enhanced distribution strategies and lower-cost models, particularly in emerging markets. The rising trend toward personalized treatment and early-stage diagnosis is further expected to fuel long-term market demand for magnetoencephalography systems worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $255.2 Million |

| Forecast Value | $696.7 Million |

| CAGR | 10.2% |

The OPM systems segment will grow at a CAGR of 24.9% through 2034, establishing itself as a transformative advancement in neuroimaging. These systems are built using optically pumped magnetometers, which operate efficiently at room temperature, eliminating the need for complex cryogenic components. Their compact, wearable format allows sensors to be positioned directly on the scalp, enhancing spatial resolution and enabling data capture during natural movements. The flexibility, lower operational costs, and real-world adaptability of OPM-based MEG systems have made them especially attractive for pediatric use and ambulatory monitoring. Their scalability and portability continue to gain traction across both clinical settings and neuroscience research centers.

In 2024, the clinical segment held a 65.6% share. The growing patient base suffering from neurological disorders, combined with increasing emphasis on early-stage diagnostics, is contributing to the segment's dominance. MEG plays a key role in presurgical mapping and disease management by precisely localizing abnormal brain activity. Its non-invasive and high-resolution capability makes it particularly useful in treating epilepsy, tumors, and degenerative neurological diseases, where accurate mapping is crucial for surgical planning and patient outcomes.

North America Magnetoencephalography Market held 39.5% share in 2024. The region benefits from a strong foundation in medical research, widespread healthcare access, and increasing patient numbers diagnosed with brain-related conditions. Early clinical adoption and integration of MEG into hospital practices have helped expand its application in diagnostics. Regional governments have also played a significant role by funding neuroscience projects and supporting brain mapping research initiatives. These factors have positioned North America as a frontrunner in both technology deployment and clinical outcomes using MEG systems.

Key companies active in the Global Magnetoencephalography Market include FieldLine Inc., Ricoh, Cerca Magnetics Limited, Compumedics Limited, MAG4Health, MEGIN, and CTF MEG NEURO INNOVATIONS, INC. Companies in the magnetoencephalography space are strengthening their market positions through strategic investments in R&D and global expansion. Innovation remains central, with a focus on next-generation MEG systems like OPM-based solutions that enhance mobility and accessibility. Firms are expanding geographically by targeting installations in emerging markets and improving service infrastructure. Collaborations with research institutions and hospitals are helping accelerate clinical validation and product adoption. Additionally, efforts are being made to simplify system integration and reduce operational complexity, making MEG more viable for routine clinical use.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of neurological disorders

- 3.2.1.2 Rapid technology advancements in the field of magnetoencephalography

- 3.2.1.3 Growing applications in clinical diagnosis and research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative neuroimaging technologies

- 3.2.2.2 High cost of magnetoencephalography systems

- 3.2.3 Opportunities

- 3.2.3.1 Portable & wearable MEG systems

- 3.2.3.2 AI integration & automated analysis

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology roadmap & innovation landscape

- 3.5.1 SQUID technology evolution

- 3.5.2 OPM technology advancement

- 3.5.3 Quantum sensor development

- 3.5.4 AI/ML integration timeline

- 3.6 Pricing analysis, by region, 2024

- 3.7 Advantages of MEG over fMRI and EEG

- 3.8 Pipeline analysis

- 3.9 Worldwide MEG installations, by region and country

- 3.9.1 North America

- 3.9.1.1 U.S.

- 3.9.1.2 Canada

- 3.9.2 Europe

- 3.9.2.1 Germany

- 3.9.2.2 UK

- 3.9.2.3 France

- 3.9.3 Asia Pacific

- 3.9.3.1 China

- 3.9.3.2 Japan

- 3.9.1 North America

- 3.10 Brand analysis

- 3.11 Reimbursement scenario

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Future market trends

- 3.15 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Cryogenic systems/Conventional

- 5.3 OPM systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical

- 6.2.1 Epilepsy

- 6.2.2 Autism

- 6.2.3 Dementia

- 6.2.4 Stroke

- 6.2.5 Traumatic brain injury (TBI)

- 6.2.6 Other applications

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Imaging centres

- 7.4 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.5 Rest of the world (RoW)

Chapter 9 Company Profiles

- 9.1 Cerca Magnetics Limited

- 9.2 Compumedics Limited

- 9.3 CTF MEG NEURO INNOVATIONS, INC.

- 9.4 FieldLine Inc.

- 9.5 MAG4Health

- 9.6 MEGIN

- 9.7 Ricoh