|

市场调查报告书

商品编码

1858991

瓦楞纸箱製造机市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Corrugated Box Making Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

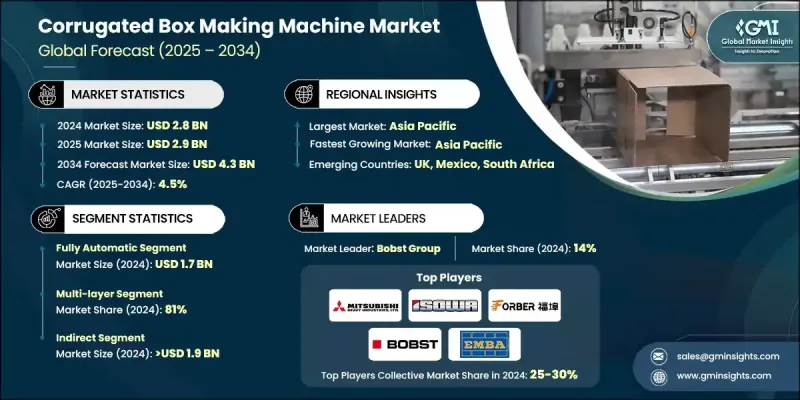

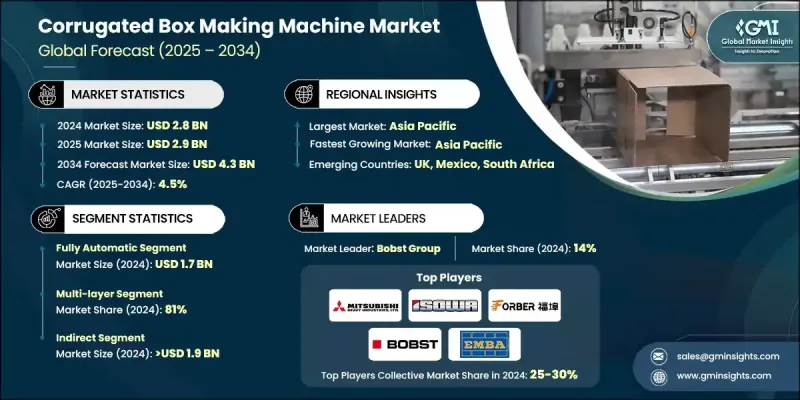

2024 年全球瓦楞纸箱製造机市场价值为 28 亿美元,预计到 2034 年将以 4.5% 的复合年增长率成长至 43 亿美元。

电子、食品饮料、个人护理和製药等行业的强劲需求正显着推动市场扩张。瓦楞纸箱凭藉其耐用性、轻盈性和可回收性,仍然是最受欢迎的包装解决方案。随着发展中经济体推动城市化和工业发展,对能够高速生产多种规格纸箱的包装机械的需求日益增长。电子商务已成为一股关键力量,透过对客製化、防护性和品牌化纸箱解决方案的更高要求,改变了包装需求。个人化包装的兴起促使企业加大对能够进行多层生产、客製化模切和先进印刷的机器的投资。製造商正积极回应,开发采用更智慧、更节能设计的模组化机器,以提高纸箱质量,同时提升产量和营运效率。这种发展趋势为瓦楞纸箱机械领域的自动化和创新创造了新的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 43亿美元 |

| 复合年增长率 | 4.5% |

全自动包装机市场预计在2024年将创造17亿美元的收入,凭藉其每分钟可精准稳定地生产数百个包装盒的能力,占据市场主导地位。这些系统对于物流和食品服务等高产量行业至关重要,因为在这些行业中,性能和降低缺陷率是关键。全自动包装机在黏合、折迭和尺寸控制方面的精准性提高了产品质量,并确保了在高要求的生产週期中稳定输出。

2024年,多层纸箱包装机占了81%的市场。这类机器专为生产两层或多层瓦楞纸包装而设计,具有更高的结构强度和更佳的产品保护性能。多层包装在处理易碎或重型物品的行业中备受青睐,例如汽车、电子产品和重型工业工具。在那些重视运输安全和长途运输包装的行业中,对这类系统的需求正在不断增长。

2024年,美国瓦楞纸箱製造机械市场规模达5.5亿美元,市占率高达88.7%。其领先地位得益于强大的製造基础设施和统一的包装标准。自动化程度的不断提高以及节能智慧技术的应用,使得生产速度更快、营运成本更低,并更容易整合到高速生产线中。电子商务和高科技製造等行业的需求持续推动着美国市场的成长。

瓦楞纸箱製造机市场的主要参与者包括EMBA Machinery、ISOWA、Bobst Group、Packsize International、三菱重工、Shrink Machine、Serpa Packaging Solutions、ACME Machinery、Zemat Technology Group、河北胜利纸箱设备有限公司、KOLBUS、Saro Packaging Machine Industries、Fosber、温州中科包装机械工业有限公司。为了巩固市场地位,瓦楞纸箱製造机产业的企业正优先考虑产品创新、模组化系统开发和数位化整合。领先的製造商正在推出具备远端监控、物联网连接和人工智慧诊断功能的机器,以提高效率。对研发和节能係统的策略性投资有助于满足客户对自动化、减少停机时间和永续性的不断变化的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 增加消费品产量

- 电子商务扩张

- 自动化与智慧製造

- 产业陷阱与挑战

- 高昂的初始投资成本

- 维护和维修成本

- 机会

- 工业4.0集成

- 永续性与环保包装

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 半自动

- 全自动

第六章:市场估价与预测:依包装盒类型划分,2021-2034年

- 主要趋势

- 单层

- 多层

第七章:市场估计与预测:依产能划分,2021-2034年

- 主要趋势

- 低吨位(1-3吨)

- 中型(3-5吨)

- 高(超过5吨)

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 餐饮

- 电子产品和消费品

- 居家及个人用品

- 纺织品

- 其他的

第九章:市场估算与预测:依配销通路,2021-2034年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- ACME Machinery

- Bobst Group

- EMBA Machinery

- Fosber

- ISOWA

- KOLBUS

- Mitsubishi Heavy Industries

- Packsize International

- Saro Packaging Machine Industries.

- Serpa packaging Solutions

- Shanghai Printyoung International Industry

- Hebei Shengli Carton Equipment

- Shrink Machine

- Wenzhou Zhongke Packaging Machinery

- Zemat Technology Group

The Global Corrugated Box Making Machine Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 4.3 billion by 2034.

The surge in demand across industries like electronics, food & beverage, personal care, and pharmaceuticals is significantly driving market expansion. Corrugated boxes continue to be the most favored packaging solution, thanks to their durability, lightweight structure, and recyclability. As developing economies push forward with urbanization and industrial growth, demand for packaging machinery that delivers high-speed, multi-format box production has intensified. E-commerce has become a pivotal force, transforming packaging needs through increased requirements for custom, protective, and brandable box solutions. The shift toward personalized packaging has led to more investment in machines capable of multi-layer production, custom die-cutting, and advanced printing. Manufacturers are responding by developing modular machines with smarter, energy-efficient designs to improve box quality while boosting throughput and operational efficiency. This evolution is creating new opportunities for automation and innovation within the corrugated box machinery space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 4.5% |

The fully automatic machines segment generated USD 1.7 billion in 2024, dominating demand due to their ability to produce hundreds of boxes per minute with precision and consistency. These systems are critical to high-volume sectors like logistics and food services, where performance and reduced defect rates are key. Their precision in gluing, folding, and size control improves product quality and ensures reliable output in demanding production cycles.

The multi-layer box machine category held an 81% share in 2024. Designed to produce packaging with two or more fluted layers, these machines offer higher structural strength and greater product protection. Multi-layer packaging is highly valued in sectors handling fragile or heavyweight items, such as automotive, electronics, and heavy industrial tools. Demand for these systems is rising in industries that prioritize transportation safety and secure long-haul packaging.

U.S. Corrugated Box Making Machine Market generated USD 550 million and held 88.7% share in 2024. Its leadership is backed by a robust manufacturing infrastructure and consistent packaging standards. The growing influence of automation and the adoption of energy-efficient and smart technologies are enabling faster production, lower operational costs, and easier integration into high-speed production lines. Demand from sectors like e-commerce and high-tech manufacturing continues to drive growth in the U.S. market.

Key players in the Corrugated Box Making Machine Market include EMBA Machinery, ISOWA, Bobst Group, Packsize International, Mitsubishi Heavy Industries, Shrink Machine, Serpa Packaging Solutions, ACME Machinery, Zemat Technology Group, Hebei Shengli Carton Equipment, KOLBUS, Saro Packaging Machine Industries, Fosber, Wenzhou Zhongke Packaging Machinery, and Shanghai Printyoung International Industry. To strengthen their market position, companies in the corrugated box making machine industry are prioritizing product innovation, modular system development, and digital integration. Leading manufacturers are introducing machines with remote monitoring, IoT connectivity, and AI-based diagnostics to boost efficiency. Strategic investments in R&D and energy-efficient systems help meet evolving customer expectations for automation, reduced downtime, and sustainability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Box type

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer goods production

- 3.2.1.2 E-commerce expansion

- 3.2.1.3 Automation & smart manufacturing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and repair costs

- 3.2.3 Opportunities

- 3.2.3.1 Industry 4.0 integration

- 3.2.3.2 Sustainability and ecofriendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automatic

- 5.3 Fully-automatic

Chapter 6 Market Estimates and Forecast, By Box Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single-layer

- 6.3 Multi-layer

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (1-3 tons)

- 7.3 Mid (3-5 tons)

- 7.4 High (above 5 tons)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Electronics & consumer goods

- 8.4 Home & personal goods

- 8.5 Textile goods

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ACME Machinery

- 11.2 Bobst Group

- 11.3 EMBA Machinery

- 11.4 Fosber

- 11.5 ISOWA

- 11.6 KOLBUS

- 11.7 Mitsubishi Heavy Industries

- 11.8 Packsize International

- 11.9 Saro Packaging Machine Industries.

- 11.10 Serpa packaging Solutions

- 11.11 Shanghai Printyoung International Industry

- 11.12 Hebei Shengli Carton Equipment

- 11.13 Shrink Machine

- 11.14 Wenzhou Zhongke Packaging Machinery

- 11.15 Zemat Technology Group