|

市场调查报告书

商品编码

1858994

专业医疗椅市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Specialty Medical Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

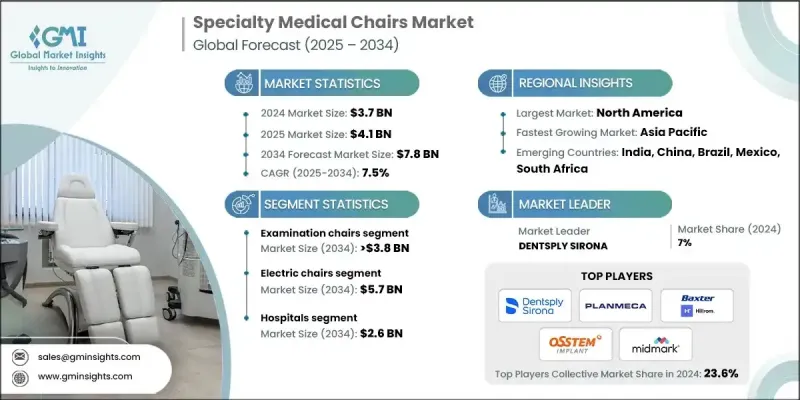

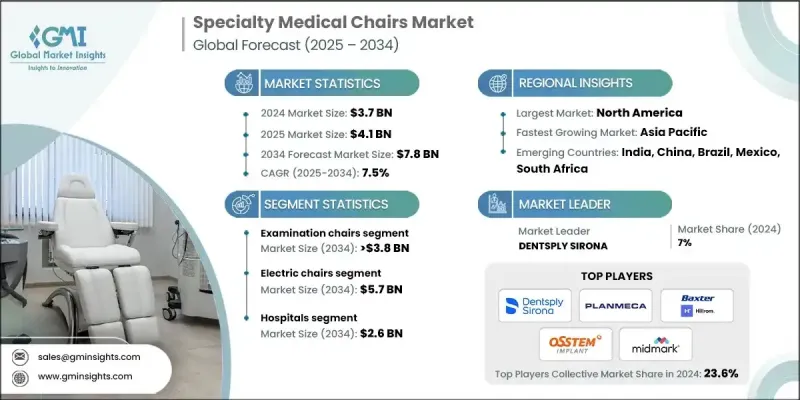

2024 年全球专业医疗椅市场价值为 37 亿美元,预计到 2034 年将以 7.5% 的复合年增长率增长至 78 亿美元。

市场扩张的驱动力在于对先进医疗设备日益增长的需求,这些设备能够提升病患照护水准和临床效率。专业医疗椅在多个医疗领域都至关重要,它们在治疗过程中能够显着提高患者的舒适度、功能性和安全性。这些医疗椅越来越多地应用于牙科、眼科、耳鼻喉科、透析和復健等诊疗流程中,从而优化工作流程并提升治疗效果。技术创新、自动化以及与数位平台的集成,已将这些医疗椅转变为智慧医疗设备,能够根据患者的特定需求进行调整。医疗服务提供者优先考虑符合现代卫生、感染控制和人体工学标准的设备。门诊服务和居家治疗方案的普及也推动了对便携式、易用型和多功能医疗椅的需求。对医疗基础设施的投资,尤其是在拉丁美洲和亚太地区,正在促进更广泛的市场应用。同时,研发工作和产品开发对于提升产品品质和符合监管要求至关重要。医疗服务提供者的目标是在医院、专科护理单位和门诊机构中,提供更优质的临床服务,并改善病患的就医体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 78亿美元 |

| 复合年增长率 | 7.5% |

2024年,电动椅市占率高达70.4%,预计到2034年将达到57亿美元。其市场主导地位反映了对电动辅助功能(如电子定位、倾斜和高度调节)日益增长的需求,这些功能显着提高了患者安全性和操作便利性。电动椅广泛应用于需要持续使用的医疗环境中,例如手术室、恢復室和物理治疗中心。它们能够支持长时间的治疗,同时最大限度地减少患者和照护者的负担,因此成为临床环境中的首选解决方案。

2024年,医院领域占据了35%的市场份额,预计到2034年将达到26亿美元。该领域的成长与医疗基础设施的扩张和医院整合趋势密切相关,尤其是在快速成长的经济体中。市场对耐用且适应性强的医用椅的需求不断增长,这些医用椅可用于心臟科、神经科、肿瘤科等多个科室,以及重症监护室和急诊。医院越来越重视能够满足高患者量环境下不断变化的临床需求的耐用设备。

预计到2024年,北美专业医疗椅市占率将达到35%。心血管疾病、关节炎和糖尿病等慢性病的持续成长推高了长期照护需求,并增加了对先进座椅解决方案的需求。在美国,不断攀升的医疗保健支出反映出医疗基础设施和服务正朝着以患者为中心的方向发展。医院投资的增加、专业设备的广泛应用以及医疗中心和诊所治疗能力的提升,都为市场成长提供了支持。

全球专业医疗椅市场的主要参与者包括 OSSTEM、Midmark、Hill Laboratories、Baxter、A-dec、MARCO、PLANMECA、CLINTON INDUSTRIES、ActiveAid、Dentsply Sirona、Champion Healthcare Solutions、Lemi MD、FRESENIUS MEDICAL C、ATMOSALEinTech ARE、ATMOSA全球专业医疗椅市场的主要企业正透过有针对性的产品开发、併购和区域扩张来提升其竞争地位。许多企业正大力投资研发,以设计出符合人体工学、配备数位控制系统和先进安全功能的座椅。与医疗服务提供者和机构建立策略合作伙伴关係,使这些公司能够使产品功能与临床需求相符。一些企业也会在新兴经济体扩大生产规模,以满足区域需求并降低对供应链的依赖。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 专科诊所、血库和急诊中心的数量不断增加

- 技术进步和对电动轮椅的需求

- 老年人口不断增长,对復健治疗的需求日益增加

- 门诊手术量不断增加

- 产业陷阱与挑战

- 专业设备成本高昂

- 有限的报销政策

- 市场机会

- 扩大门诊和家庭医疗保健服务

- 医疗旅游成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 家庭医疗保健和门诊服务机构的扩张

- 智慧互联技术的融合

- 对符合人体工学和自适应设计的需求日益增长

- 技术格局

- 当前技术趋势

- 便携式和家用专业医疗椅的成长

- 支援远端监测的数位健康平台

- 方便患者使用的可调式自动专用座椅

- 新兴技术

- 人工智慧驱动的使用分析和预测性维护

- 互联物联网专用医疗椅

- 具有个人化配置的自适应智慧座椅

- 当前技术趋势

- 2024年各地区定价分析

- 产业演变

- 价值链分析

- 客户体验转型与旅程优化

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新服务类型推出

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 考试主席

- 牙科

- 妇产科

- 透析

- 眼科

- 皮肤科

- 抽血

- 乳房X光检查

- 其他考官

- 治疗椅

- 牙科

- 眼科

- 耳鼻喉科

- 皮肤科

- 其他治疗椅

- 復健椅

- 老人专用椅

- 儿童椅

- 肥胖症患者专用椅

- 其他復健椅

第六章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 电椅

- 手动椅

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 诊所

- 门诊手术中心(ASC)

- 点滴中心

- 紧急护理

- 復健中心

- 医疗水疗中心

- 家庭护理机构

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ActiveAid

- A-dec

- ATMOS MedizinTechnik

- Baxter

- Champion Healthcare Solutions

- CLINTON INDUSTRIES

- DENTALEZ

- Dentsply Sirona

- FRESENIUS MEDICAL CARE

- Hill Laboratories

- Lemi MD

- MARCO

- Midmark

- OSSTEM

- PLANMECA

- TOPCON

The Global Specialty Medical Chairs Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 7.8 billion by 2034.

Market expansion is driven by rising demand for advanced healthcare equipment that enhances both patient care and clinical efficiency. Specialty medical chairs are essential across multiple medical disciplines, providing improved comfort, functionality, and safety during treatments. These chairs are increasingly integrated into dental, ophthalmology, ENT, dialysis, and rehabilitation procedures, optimizing workflow and supporting better therapeutic outcomes. Technological innovation, automation, and integration with digital platforms have transformed these chairs into smart medical assets, capable of adjusting to specific patient needs. Healthcare providers are prioritizing equipment that aligns with modern standards for hygiene, infection control, and ergonomic support. The shift toward outpatient services and in-home treatment options is also pushing demand for portable, user-friendly, and multi-use chairs. Investments in healthcare infrastructure, especially across Latin America and Asia-Pacific are fueling broader market adoption. Meanwhile, R&D efforts and product development are central to enhancing quality and compliance with regulatory expectations. Providers aim to deliver better clinical value while improving patient experiences across hospitals, specialty care units, and ambulatory facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.5% |

The electric chairs segment held a 70.4% share in 2024 and is projected to generate USD 5.7 billion by 2034. Their dominance reflects the rising need for power-assisted features like electronic positioning, recline, and height adjustment, which significantly enhance patient safety and operational convenience. These chairs are widely adopted in healthcare environments that demand continuous usage, including surgical suites, recovery rooms, and physical therapy centers. Their ability to support prolonged procedures with minimal strain on patients and caregivers makes them a preferred solution across clinical settings.

The hospital segment held a 35% share in 2024 and is anticipated to reach USD 2.6 billion by 2034. Growth in this segment is closely tied to the expansion of healthcare infrastructure and hospital consolidation trends, particularly in fast-growing economies. Demand is rising for durable and adaptable medical chairs that can be used across departments such as cardiology, neurology, and oncology, as well as in intensive care units and emergency services. Hospitals increasingly prioritize long-lasting equipment that meets the evolving clinical needs of high-patient-volume environments.

North America Specialty Medical Chairs Market held a 35% share in 2024. A steady rise in chronic conditions such as cardiovascular disease, arthritis, and diabetes is driving long-term care requirements and increasing the need for advanced seating solutions. In the U.S., escalating healthcare expenditures reflect a broader shift toward patient-centered infrastructure and services. Growth is supported by rising investments in hospitals, greater adoption of specialized equipment, and expanded treatment capacity across medical centers and clinics.

Key industry participants in the Global Specialty Medical Chairs Market include OSSTEM, Midmark, Hill Laboratories, Baxter, A-dec, MARCO, PLANMECA, CLINTON INDUSTRIES, ActiveAid, Dentsply Sirona, Champion Healthcare Solutions, Lemi MD, FRESENIUS MEDICAL CARE, ATMOS MedizinTechnik, DENTALEZ, and TOPCON. Major companies in the Global Specialty Medical Chairs Market are enhancing their competitive position through targeted product development, mergers, and regional expansion. Many are investing heavily in R&D to design chairs with enhanced ergonomics, digital control systems, and advanced safety features. Strategic partnerships with healthcare providers and institutions allow these firms to align product capabilities with clinical requirements. Some players are also expanding their manufacturing presence in emerging economies to meet regional demand and reduce supply chain dependencies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of specialty clinics, blood banks, and urgent care centers

- 3.2.1.2 Technological advancements and demand for powered chairs

- 3.2.1.3 Growing geriatric population and need for rehab procedures

- 3.2.1.4 Rising ambulatory surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized equipment

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and home healthcare

- 3.2.3.2 Medical tourism growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.5.1 Expansion in home healthcare and outpatient settings

- 3.5.2 Integration of smart and connected technologies

- 3.5.3 Rising demand for ergonomic and adaptive designs

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based specialty medical chairs

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly adjustable and automated specialty chairs

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-powered usage analytics and predictive maintenance

- 3.6.2.2 Connected and IoT-enabled specialty medical chairs

- 3.6.2.3 Adaptive and smart chairs with personalized configurations

- 3.6.1 Current technological trends

- 3.7 Pricing analysis, by region, 2024

- 3.8 Industry evolution

- 3.9 Value chain analysis

- 3.10 Customer experience transformation & journey optimization

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Examination chairs

- 5.2.1 Dental

- 5.2.2 OB/GYN

- 5.2.3 Dialysis

- 5.2.4 Ophthalmic

- 5.2.5 Dermatology

- 5.2.6 Blood drawing

- 5.2.7 Mammography

- 5.2.8 Other examination chairs

- 5.3 Treatment chairs

- 5.3.1 Dental

- 5.3.2 Ophthalmic

- 5.3.3 ENT

- 5.3.4 Dermatology

- 5.3.5 Other treatment chairs

- 5.4 Rehabilitation chairs

- 5.4.1 Geriatric chairs

- 5.4.2 Pediatric chairs

- 5.4.3 Bariatric chairs

- 5.4.4 Other rehabilitation chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electric chairs

- 6.3 Manual chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Infusion center

- 7.6 Urgent care

- 7.7 Rehabilitation centers

- 7.8 Medical spa

- 7.9 Home care settings

- 7.10 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ActiveAid

- 9.2 A-dec

- 9.3 ATMOS MedizinTechnik

- 9.4 Baxter

- 9.5 Champion Healthcare Solutions

- 9.6 CLINTON INDUSTRIES

- 9.7 DENTALEZ

- 9.8 Dentsply Sirona

- 9.9 FRESENIUS MEDICAL CARE

- 9.10 Hill Laboratories

- 9.11 Lemi MD

- 9.12 MARCO

- 9.13 Midmark

- 9.14 OSSTEM

- 9.15 PLANMECA

- 9.16 TOPCON