|

市场调查报告书

商品编码

1859005

空气处理机组市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Air Handling Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

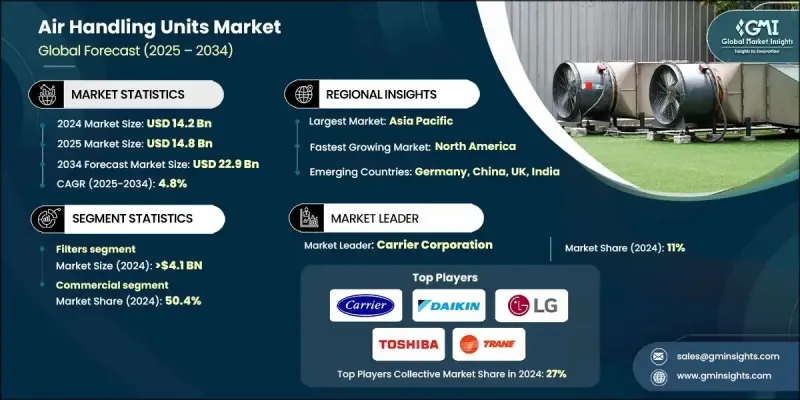

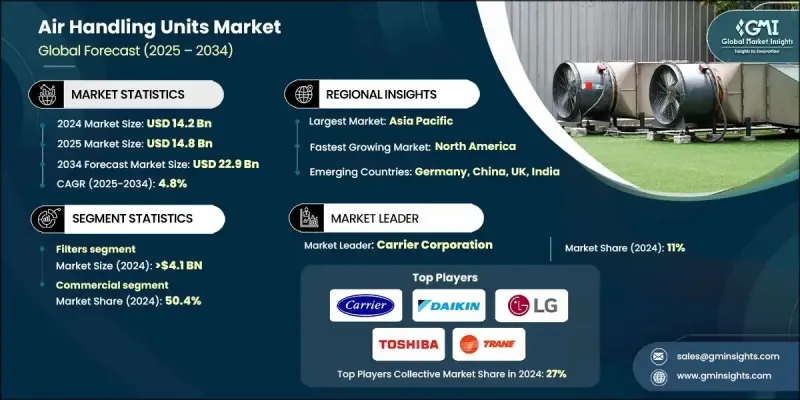

2024 年全球空气处理机组市值为 142 亿美元,预计到 2034 年将以 4.8% 的复合年增长率成长至 229 亿美元。

市场扩张的驱动力在于人们对更佳室内空气品质 (IAQ) 日益增长的需求,尤其是在医疗保健等行业,高效的空气过滤与感染控制和患者健康息息相关。随着人们对室内空气品质意识的提高,对整合高效过滤和抗菌功能的空气处理机组 (AHU) 的需求持续成长。然而,先进 AHU 的高昂初始成本仍然是其普及的一大挑战,特别是那些具备能量回收、物联网连接和变风量 (VAV) 系统等功能的机型。根据容量和功能的不同,配备能源回收技术的机组价格可能在 1 万美元到 3 万美元之间,这使得小型企业难以承担投资成本。同时,製造商正在加速研发,以提高效能并降低长期营运成本。各公司正在推出节能型机型,以满足永续发展的要求,尤其是在受严格建筑规范和能源效率标准约束的商业领域。这些创新正在重塑空气处理系统融入基础设施规划和环境合规工作的方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 142亿美元 |

| 预测值 | 229亿美元 |

| 复合年增长率 | 4.8% |

2024年,过滤组件市场规模达41亿美元。过滤在维持室内空气品质方面仍然至关重要,它能够去除空气中的污染物,例如病原体、灰尘和过敏原。在后疫情时代,人们对健康和卫生的关注度显着提高,医院、实验室和高科技设施对高效空气微粒过滤器(HEPA)、超高效空气微粒过滤器(ULPA)和活性碳过滤器的使用量也随之增加。这些过滤器不仅能够保护人体健康,还能防止颗粒物对精密设备造成损害,因此在各行各业都不可或缺。

预计到2024年,商业领域将占据50.4%的市场。为达到节能目标,监管机构的压力持续推动商业不动产开发商采用先进且高效的空气处理机组(AHU)。这些机组有助于降低能源成本,同时确保符合强制性环保标准。

2024年,美国空气处理机组市占率达78.2%。美国暖通空调市场的成熟度,加上商业和公共建筑持续不断的改造活动,推动了市场需求的稳定成长。美国和加拿大都实施了严格的室内空气品质和能源效率政策,加速了空气处理机组的普及应用。

全球空气处理机组市场的主要参与者包括开利全球公司、大金工业株式会社、博世热力技术有限公司、CIAT集团、FlaktGroup控股有限公司、特灵科技公司、TROX有限公司、Systemair AB、Zehnder集团国际股份公司、三菱电机株式会社、LG电子株式会、江伦诺克斯集团国际公司、江伦诺有限公司。为巩固市场地位,全球空气处理机组市场中的企业采取的关键策略包括:大力投资研发、拓展产品线以及整合智慧技术,以实现即时效能监控。多家製造商正在推出模组化、可扩展的空气处理机组,以满足新建项目和改造项目的需求。此外,企业与商业房地产开发商和医疗基础设施规划者的合作关係也不断加强,这有助于企业使产品开发与不断发展的建筑标准保持一致。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对暖通空调系统的需求不断增长

- 人们对室内空气品质的认识不断提高

- 都市化和基础设施发展

- 产业陷阱与挑战

- 较高的初始投资和维护成本

- 安装复杂且空间受限

- 机会

- 与智慧建筑技术的集成

- 新兴市场的扩张

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 加热或冷却盘管

- 过滤器

- 阻尼器

- 粉丝

- 空气处理机

- 鼓风机

- 其他(加湿器/除湿器、隔离器等)

第六章:市场估算与预测:依类别划分,2021-2034年

- 主要趋势

- 包装式空调机组

- 屋顶空气处理机组

- 模组化空气处理机组

- 热回收空气处理机组

- 空气处理机组 (AHU) 能量回收

- 其他(无尘室空气处理机组、室外空气处理机组等)

第七章:市场估计与预测:依产能划分,2021-2034年

- 主要趋势

- 低于 5,000 CFM

- 5,000 CFM - 10,000 CFM

- 风量超过 10,000 CFM

第八章:市场估算与预测:依控制与连结方式划分,2021-2034年

- 主要趋势

- 独立式空气处理机组

- 楼宇管理系统整合式空气处理机组

- 物联网智慧空调机组

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 工业的

第十章:市场估价与预测:依配销通路,2021-2034年

- 主要趋势

- 直接的

- 间接

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Bosch Thermotechnology GmbH

- Carrier Global Corporation

- CIAT Group

- Daikin Industries, Ltd.

- FlaktGroup Holding GmbH

- Hitachi, Ltd.

- Johnson Controls International PLC

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Munters Group AB

- Systemair AB

- Trane Technologies plc

- TROX GmbH

- Zehnder Group International AG

The Global Air Handling Units Market was valued at USD 14.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 22.9 billion by 2034.

Market expansion is driven by the growing demand for better indoor air quality (IAQ), especially in sectors like healthcare, where effective air filtration is directly tied to infection control and patient well-being. As awareness around IAQ grows, demand for AHUs integrated with high-efficiency filtration and antimicrobial features continues to rise. However, adoption remains challenged by the high initial cost of advanced AHUs, particularly those with features such as energy recovery, IoT connectivity, and variable air volume (VAV) systems. Units with energy recovery technology can cost between USD 10,000 and USD 30,000, depending on their capacity and features, making it difficult for smaller businesses to invest. At the same time, manufacturers are accelerating R&D to improve performance and reduce long-term operating costs. Companies are launching energy-optimized models to cater to sustainability requirements, particularly in commercial sectors governed by strict building codes and energy-efficiency standards. These innovations are reshaping how air handling systems are integrated into infrastructure planning and environmental compliance efforts.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $22.9 Billion |

| CAGR | 4.8% |

The filter component segment generated USD 4.1 billion in 2024, with filtration remaining essential in maintaining IAQ by removing airborne contaminants like pathogens, dust, and allergens. The post-pandemic focus on health and hygiene has led to increased use of HEPA, ULPA, and activated carbon filters across hospitals, labs, and high-tech facilities. These filters not only protect human health but also prevent particulate damage to sensitive equipment, making them indispensable across industries.

The commercial segment generated a 50.4% share in 2024. Regulatory pressure to meet energy conservation goals continues to push commercial property developers toward advanced and energy-efficient AHU installations. These units help reduce energy bills while ensuring compliance with mandatory environmental standards.

U.S. Air Handling Units Market held 78.2% share in 2024. The mature nature of the U.S. HVAC market, combined with consistent retrofitting activities across commercial and public buildings, has driven steady demand. Both the U.S. and Canada enforce rigorous IAQ and energy efficiency policies, accelerating AHU adoption.

Key players in the Global Air Handling Units Market include Carrier Global Corporation, Daikin Industries Ltd., Bosch Thermotechnology GmbH, CIAT Group, FlaktGroup Holding GmbH, Trane Technologies plc, TROX GmbH, Systemair AB, Zehnder Group International AG, Mitsubishi Electric Corporation, LG Electronics Inc., Lennox International Inc., Johnson Controls International PLC, Munters Group AB, and Hitachi Ltd. Key strategies adopted by companies in the Global Air Handling Units Market to strengthen their market position include aggressive investment in R&D, product line expansions, and integration of smart technologies to enable real-time performance monitoring and control. Several manufacturers are introducing modular, scalable AHU units tailored to fit both new builds and retrofit projects. Partnerships with commercial real estate developers and healthcare infrastructure planners are also growing, helping companies align product development with evolving building standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Category

- 2.2.4 Capacity

- 2.2.5 Control and connectivity

- 2.2.6 Application

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for HVAC systems

- 3.2.1.2 Rising awareness of IAQ

- 3.2.1.3 Urbanization and Infrastructure Development

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Complex installation and space constraints

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart building technologies

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Heating or cooling coils

- 5.3 Filters

- 5.4 Dampers

- 5.5 Fans

- 5.6 Air handlers

- 5.7 Blowers

- 5.8 Others (humidifiers/dehumidifiers, isolators, etc.)

Chapter 6 Market Estimates and Forecast, By Category, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Packaged AHU

- 6.3 Rooftop AHU

- 6.4 Modular AHU

- 6.5 Heat recovery AHU

- 6.6 Energy recovery AHU

- 6.7 Others (cleanroom AHU, outdoor AHU, etc.)

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 5,000 CFM

- 7.3 5,000 CFM - 10,000 CFM

- 7.4 Above 10,000 CFM

Chapter 8 Market Estimates and Forecast, By Control and Connectivity, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Standalone AHUs

- 8.3 BMS-Integrated AHUs

- 8.4 IoT-Enabled Smart AHUs

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bosch Thermotechnology GmbH

- 12.2 Carrier Global Corporation

- 12.3 CIAT Group

- 12.4 Daikin Industries, Ltd.

- 12.5 FlaktGroup Holding GmbH

- 12.6 Hitachi, Ltd.

- 12.7 Johnson Controls International PLC

- 12.8 Lennox International Inc.

- 12.9 LG Electronics Inc.

- 12.10 Mitsubishi Electric Corporation

- 12.11 Munters Group AB

- 12.12 Systemair AB

- 12.13 Trane Technologies plc

- 12.14 TROX GmbH

- 12.15 Zehnder Group International AG