|

市场调查报告书

商品编码

1859007

长条音箱市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Soundbars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

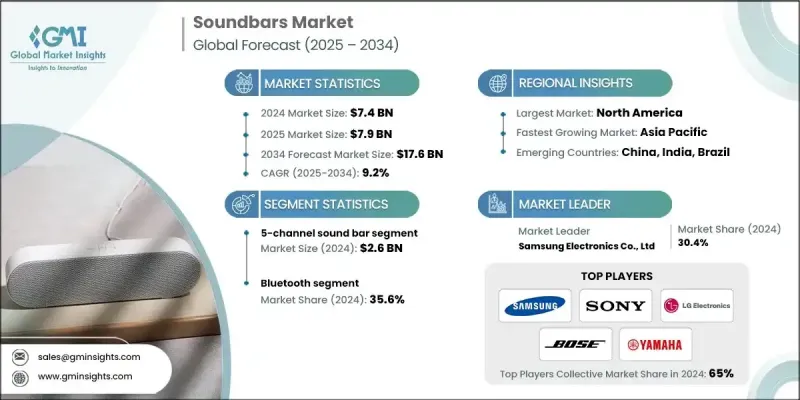

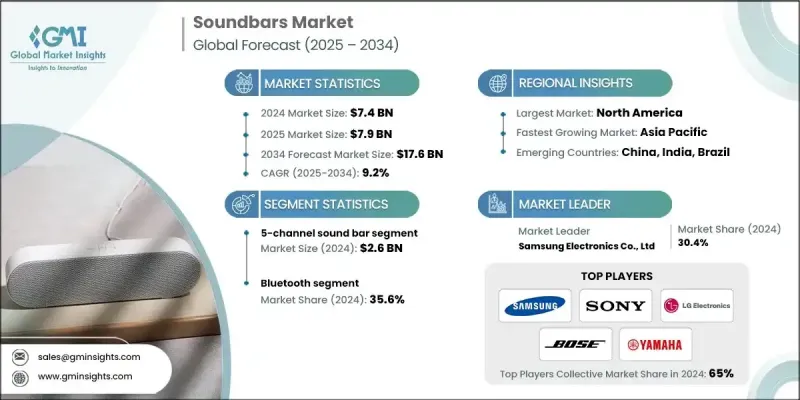

2024 年全球条形音箱市场价值为 74 亿美元,预计到 2034 年将以 9.2% 的复合年增长率增长至 176 亿美元。

强劲的成长反映了消费者娱乐习惯的转变以及对简洁音讯解决方案日益增长的需求。随着越来越多的家庭在家中享受沉浸式娱乐体验,能够提供高品质音效的紧凑型音响系统正迅速崛起。条形音箱凭藉其时尚的外观、便捷的安装以及无需传统复杂设置即可提供影院级体验的优势,已成为热门之选。串流媒体服务的蓬勃发展不断提升着人们对家庭音响系统的期望,使用者希望找到能够与当今智慧电视的视觉清晰度相匹配的音讯产品。条形音箱配备了包括杜比全景声 (Dolby Atmos) 和 DTS 格式在内的尖端技术,吸引了许多追求极致音质和简约设计的消费者。随着人们对无需笨重设备即可获得更佳音效的需求不断增长,条形音箱以其实用、高效且美观的外形填补了市场空白。随着消费者不断升级家庭娱乐系统,选择小巧强大的音响产品,该品类正持续保持成长动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 176亿美元 |

| 复合年增长率 | 9.2% |

2024年,5声道长条音箱市场规模达26亿美元,凭藉其丰富的多维音讯表现,持续维持市场领先地位。它们能够带来深沉的环绕声体验,使其成为现代家居环境的理想之选。消费者越来越重视音讯装置的智慧功能,进一步推动了市场需求。从语音控製到无线操作和智慧家庭集成,这些功能持续吸引追求无缝连接和高级功能的科技达人。

2024年,蓝牙长条音箱市占率达到35.6%,凸显了消费者对无线音响系统灵活性的日益增长的需求。这些条形音箱使用户能够轻鬆与手机、笔记型电脑和其他智慧型装置配对,简化了串流媒体播放体验。居家环境中对极简主义和无线生态系统的追求,推动了蓝牙长条音箱的普及,反映出消费者对简洁易用的音讯解决方案的需求。

2024年,美国条形音箱市场占有率预计将达到78.2%,主要得益于消费者对创新、节省空间的音讯技术的强劲需求。该地区对优质音质、智慧整合和家庭自动化的重视正在推动条形音箱的普及。随着智慧电视和订阅式串流平台的日益普及,高性能条形音箱正成为家庭娱乐的重要组成部分。北美完善的基础设施建立了分销管道,而熟练的劳动力则进一步促进了生产规模的扩大,并有效地满足了客户需求。

塑造全球条形音箱市场的关键企业包括索尼、雅马哈、LG电子、先锋、三星电子、夏普、Devialet、安桥、天龙、宝华韦健、Vizio、Bose、小米、Sonos、TCL、哈曼国际、Klipsch、飞利浦、松下和Polk Audio。领先的条形音箱製造商正透过功能丰富的多声道系统扩展其产品线,这些系统支援先进的音讯格式,并能轻鬆整合到智慧家庭生态系统中。各公司也加大研发投入,以提升音讯清晰度、降低延迟,并添加人工智慧驱动的功能,例如自适应声音模式。与智慧电视和串流媒体服务供应商的策略联盟有助于提高相容性并扩大市场覆盖范围。为了提升用户体验,各品牌正在整合直觉的介面、行动应用程式控制和无缝的语音助理功能。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 家庭娱乐系统需求不断成长

- 技术进步和智慧功能的集成

- 平面电视的普及率不断提高

- 产业陷阱与挑战

- 激烈的竞争和对价格的敏感性

- 依赖电视销售和市场状况。

- 机会

- 电子商务成长

- 在饭店和零售等行业的商业应用

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易分析(HS编码851989)

- 十大进口国

- 十大出口国

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 双声道长条音箱

- 3声道长条音箱

- 5声道长条音箱

- 7声道长条音箱

第六章:市场估算与预测:以连结方式划分,2021-2034年

- 主要趋势

- 蓝牙

- 辅助的

- 无线上网

- 其他介面(HDMI、光纤等)

第七章:市场估算与预测:依安装类型划分,2021-2034年

- 主要趋势

- 壁挂式

- 桌面

- 独立式

第八章:市场估算与预测:依扬声器功率划分,2021-2034年

- 主要趋势

- 最高可达 200 瓦

- 功率介于 200-800 瓦之间

- 超过 800 瓦

第九章:市场估算与预测:依价格区间划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

第十章:市场规模估算与预测(2021-2034年)

- 主要趋势

- 小于30英寸

- 30-60英寸

- 超过 60 英寸

第十一章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 饭店餐饮业(饭店、餐厅)

- 零售商店

- 办公室/会议室

- 教育机构

- 娱乐场所(电影院、剧院)

第十二章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 大型超市/超市

- 专卖店

- 品牌专卖店

- 其他零售商店(例如百货公司、当地电子产品商店)

第十三章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十四章:公司简介

- Bose

- Bowers & Wilkins

- Denon

- Devialet

- Harman International (JBL)

- Klipsch

- LG Electronics

- Onkyo

- Panasonic

- Philips

- Pioneer

- Polk Audio

- Samsung Electronics

- Sharp

- Sonos

- Sony

- TCL

- VIZIO

- Xiaomi

- Yamaha

The Global Soundbars Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 17.6 billion by 2034.

The strong growth reflects shifting consumer entertainment habits and the increasing demand for streamlined audio solutions. As more households embrace immersive entertainment at home, compact audio systems that deliver high-quality sound are gaining ground. Soundbars have become a top choice due to their sleek profiles, ease of installation, and ability to provide a cinematic experience without the complexity of traditional setups. The expansion of streaming services continues to elevate expectations for home sound systems, with users seeking audio products that can match the visual clarity of today's smart TVs. Equipped with cutting-edge technologies, including Dolby Atmos and DTS formats, soundbars are appealing to a wide spectrum of consumers who want advanced sound performance in a minimalistic design. As the need for enhanced audio without bulky setups rises, soundbars are filling the gap with practical, efficient, and aesthetically pleasing alternatives. The category is seeing continued momentum as consumers upgrade their home entertainment systems with compact yet powerful audio products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $17.6 Billion |

| CAGR | 9.2% |

In 2024, the 5-channel soundbars segment generated USD 2.6 billion, remaining the market leader due to their capacity to offer rich, multidimensional audio. Their ability to deliver deep, surround-sound experiences makes them ideal for modern home setups. Consumers are increasingly prioritizing smart-enabled features in audio equipment, further accelerating demand. From voice control to wireless operation and smart home integration, these features continue to attract tech-savvy users looking for seamless connectivity and advanced functionality.

The Bluetooth-enabled soundbars segment held a 35.6% share in 2024, highlighting the growing preference for wireless flexibility in audio systems. These soundbars allow users to easily pair with mobile phones, laptops, and other smart devices, simplifying the streaming experience. The trend toward minimalism and wireless ecosystems in home setups has pushed Bluetooth soundbars into mainstream adoption, reflecting a demand for clutter-free, easily accessible audio options.

U.S. Soundbars Market accounted for 78.2% share in 2024, thanks to strong consumer interest in innovative, space-saving audio technologies. The region's focus on premium sound quality, smart integrations, and home automation is driving adoption. With the increasing use of smart TVs and subscription-based streaming platforms, high-performance soundbars are becoming a key component of home entertainment. North America's robust infrastructure established distribution channels, and a skilled labor force further contributes to scaling production and servicing customer needs effectively.

Key players shaping the Global Soundbars Market include Sony, Yamaha, LG Electronics, Pioneer, Samsung Electronics, Sharp, Devialet, Onkyo, Denon, Bowers & Wilkins, Vizio, Bose, Xiaomi, Sonos, TCL, Harman International, Klipsch, Philips, Panasonic, and Polk Audio. Leading soundbar manufacturers are expanding their product lines with feature-rich, multi-channel systems that support advanced audio formats and integrate easily with smart home ecosystems. Companies are also investing in R&D to enhance audio clarity, reduce latency, and add AI-powered features like adaptive sound modes. Strategic alliances with smart TV and streaming service providers are helping to boost compatibility and expand market reach. To improve user engagement, brands are incorporating intuitive interfaces, mobile app controls, and seamless voice assistant functionality.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Connectivity

- 2.2.4 Installation type

- 2.2.5 Speaker wattage

- 2.2.6 Price range

- 2.2.7 Size

- 2.2.8 Application

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for home entertainment systems

- 3.2.1.2 Technological advancements and integration of smart features

- 3.2.1.3 Growing adoption of flat panels TVs

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Intense competition and price sensitivity

- 3.2.2.2 Dependence on TV sales and market situation.

- 3.2.3 Opportunities

- 3.2.3.1 E-commerce growth

- 3.2.3.2 Commercial applications in sectors such as hospitality and retail

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade analysis (HS code 851989)

- 3.8.1 Top 10 import countries

- 3.8.2 Top 10 export countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 2 channel soundbars

- 5.3 3 channel soundbars

- 5.4 5 channel soundbars

- 5.5 7 channel soundbars

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Bluetooth

- 6.3 Auxiliary

- 6.4 Wi-Fi

- 6.5 Others (HDMI, optical, etc.)

Chapter 7 Market Estimates & Forecast, By Installation Type, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Wall mounted

- 7.3 Tabletop

- 7.4 Free standing

Chapter 8 Market Estimates & Forecast, By Speaker Wattage, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Up to 200 Watts

- 8.3 Between 200-800 Watts

- 8.4 Above 800 Watts

Chapter 9 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Size, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Under 30 inches

- 10.3 30-60 inches

- 10.4 Above 60 inches

Chapter 11 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial

- 11.3.1 Hospitality (hotels, restaurants)

- 11.3.2 Retail stores

- 11.3.3 Offices/conference rooms

- 11.3.4 Educational institutions

- 11.3.5 Entertainment venues (cinemas, theaters)

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Online

- 12.2.1 E-commerce

- 12.2.2 Company websites

- 12.3 Offline

- 12.3.1 Hypermarkets/supermarkets

- 12.3.2 Specialty stores

- 12.3.3 Brand outlets

- 12.3.4 Other retail stores (e.g., department stores, local electronics shops)

Chapter 13 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 Japan

- 13.4.3 India

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Bose

- 14.2 Bowers & Wilkins

- 14.3 Denon

- 14.4 Devialet

- 14.5 Harman International (JBL)

- 14.6 Klipsch

- 14.7 LG Electronics

- 14.8 Onkyo

- 14.9 Panasonic

- 14.10 Philips

- 14.11 Pioneer

- 14.12 Polk Audio

- 14.13 Samsung Electronics

- 14.14 Sharp

- 14.15 Sonos

- 14.16 Sony

- 14.17 TCL

- 14.18 VIZIO

- 14.19 Xiaomi

- 14.20 Yamaha