|

市场调查报告书

商品编码

1859010

物流机器人市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Logistics Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

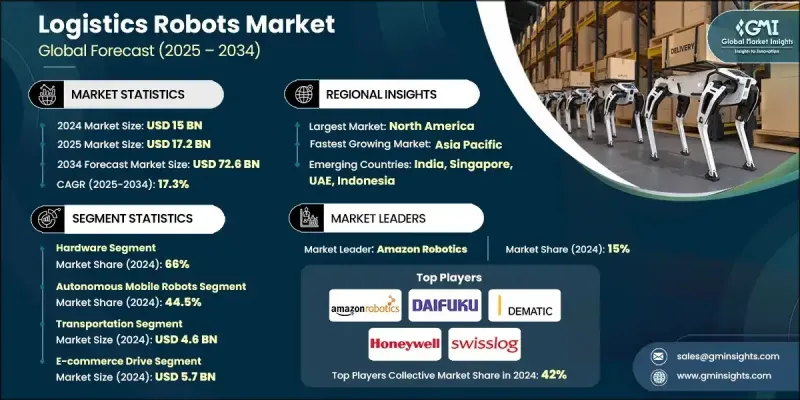

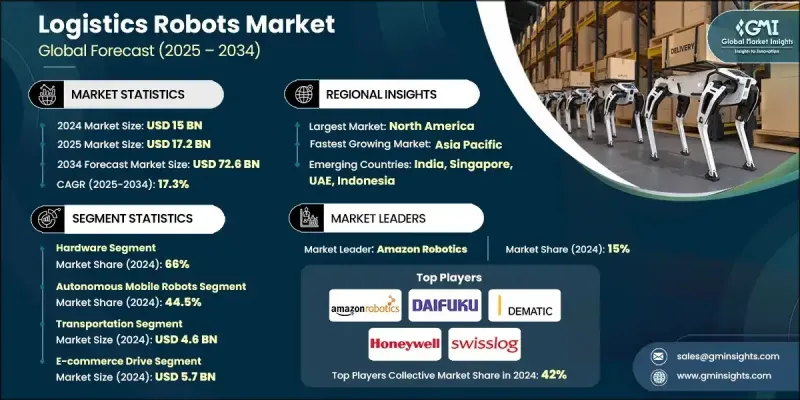

2024 年全球物流机器人市场价值为 150 亿美元,预计到 2034 年将以 17.3% 的复合年增长率增长至 726 亿美元。

物流行业正经历快速变革,其发展动力源于对自动化日益增长的需求、更紧迫的交付週期以及先进的供应链数位化。该行业的核心在于其错综复杂的生态系统,其特点是地域聚集、战略供应商关係以及强大的垂直整合。随着机器人技术的日趋成熟,物流企业正逐步向自主系统转型,以满足不断提升的消费者期望并降低营运效率。更快的投资报酬率和更短的投资回收期促使智慧机器人系统在仓库和配送中心得到更广泛的部署。这波自动化浪潮正在重塑物流基础设施,实现更高的吞吐量、更精准的配送以及更少的人力依赖,最终推动已开发市场和新兴市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 150亿美元 |

| 预测值 | 726亿美元 |

| 复合年增长率 | 17.3% |

2024年,硬体部分占据了66%的市场份额,预计到2034年将以16.4%的复合年增长率成长。机器人平台、机械组件和移动系统构成了物流机器人解决方案的基础层,使其能够在仓库和最后一公里配送环境中实现无缝运作。儘管人工参与物流运营仍然占据总成本的很大一部分,但机器人动力系统的技术进步和研究倡议正在重塑硬体成本结构。

2024年,自主移动机器人(AMR)市占率达到44.5%,预计2025年至2034年间将以17.9%的复合年增长率成长。由于采用了人工智慧、视觉SLAM和自适应感测器技术等先进的导航系统,AMR相比传统的自动导引车(AGV)具有显着的效率提升。这些功能使其能够在复杂、动态的环境中进行即时决策,从而推动该领域从试点阶段迈向大规模商业部署。

预计到2024年,美国物流机器人市场将占据65%的份额,市场规模将达到46亿美元。儘管与全球平均水平相比,美国物流机器人的渗透率相对较低,但劳动力短缺、技术成熟以及联邦政府对自动化发展的支持,都为美国物流机器人市场的成长提供了有力支撑。完善的基础设施和政府资助的创新项目持续巩固美国在全球机器人领域的地位,为物流领域大规模应用机器人解决方案创造了有利环境。

塑造全球物流机器人市场竞争格局的关键产业参与者包括ABB、安川马达、丰田/Bastian、欧姆龙、大福、亚马逊机器人、库卡/Swisslog、凯傲/德马泰克、霍尼韦尔和AutoStore。为了巩固自身地位,物流机器人公司正优先发展人工智慧驱动的自动化、即时资料分析以及针对不同物流应用场景量身定制的模组化系统设计。策略併购和合作促进了技术共享和地理扩张,而研发投入则催生了可扩展的多应用平台。领先企业也针对电子商务、第三方物流和零售仓储环境客製化机器人集群,确保客户的长期留存并提高营运投资报酬率。全球企业正透过在地化生产、扩展服务网路以及整合数位平台进一步加强其市场地位,这些平台能够实现无缝的物流协调和预测性维护。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 自主移动机器人製造商

- 自动化储存和检索系统提供者

- 机器人软体和人工智慧平台开发商

- 仓库基础设施及物料搬运设备供应商

- 系统整合商和解决方案提供商

- 成本结构

- 利润率

- 每个阶段的价值增加

- 影响供应链的因素

- 颠覆者

- 供应商格局

- 对力的影响

- 成长驱动因素

- 电子商务领域拣货应用的发展

- 机器人技术的进步

- 自动化仓库日益普及

- 物流处理中对永续发展实践的认识不断提高

- 产业陷阱与挑战

- 物流机器人的购置与实施成本高

- 员工缺乏操作和维护先进机器人系统的技能

- 市场机会

- 人工智慧和物联网在物流机器人的应用

- 协作机器人的应用

- 成长驱动因素

- 技术趋势与创新生态系统

- 目前技术

- 电脑视觉与物体识别

- 预测分析与维护

- 多功能机器人开发

- 人机协作进展

- 新兴技术

- 5G连接与通讯系统

- 数位孪生与仿真技术

- 区块链与供应链透明度

- 永续性和绿色技术整合

- 目前技术

- 成长潜力分析

- 监管环境

- 联邦安全标准框架

- ANSI/RIA R15.06 要求

- ANSI R15.08 移动机器人标准

- ISO 10218 全球协调

- OSHA合规要求

- 一般责任条款适用

- 机械及机械防护标准

- 电气安全要求

- 行业特定监管要求

- FDA医疗保健法规

- 食品安全与HACCP合规性

- 汽车业标准

- 国际标准协调

- ISO技术委员会299

- 欧洲标准一体化

- 区域适应性要求

- 联邦安全标准框架

- 成本細項分析

- 硬体成本组成部分

- 软体及整合费用

- 基础设施改造要求

- 维护和服务成本

- 波特的分析

- PESTEL 分析

- 永续性和环境方面

- 环境影响评估与生命週期分析

- 社会影响力与社区关係

- 公司治理与企业责任

- 永续技术发展

- 风险评估框架

- 互通性和标准化差距

- 遗留系统相容性挑战

- 监理与合规风险

- 金融风险缓解策略

- 性能和品质标准

- 风险评估方法

- 准确度和精密度标准

- 行业特定品质要求

- 安全测试要求

- 用例

- 亚马逊机器人实施模型

- 多SKU处理和排序

- 汽车製造一体化

- 医疗保健和製药应用

- 第三方物流优化

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 机器人平台与底盘

- 感测器和感知系统

- 执行器和操控系统

- 其他的

- 软体

- 机器人作业系统

- 车队管理软体

- 仓库管理集成

- 其他的

- 服务

- 专业的

- 管理

第六章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 自动导引车

- 自主移动机器人

- 机械手臂

- 其他的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 托盘化和拆托盘

- 拣选和放置

- 运输

- 其他的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 电子商务

- 卫生保健

- 零售

- 食品和饮料

- 汽车

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- ABB

- Amazon Robotics

- AutoStore

- Daifuku

- Honeywell

- KION/Dematic

- KUKA/Swisslog

- Omron

- Toyota/Bastian

- Yaskawa Electric

- 区域玩家

- Bastian Solutions

- Geek+

- GreyOrange

- Locus Robotics

- Vecna Robotics

- 新兴玩家

- VisionNav Robotics

- Berkshire Grey

- Covariant

- Exotec

- River Systems

The Global Logistics Robots Market was valued at USD 15 billion in 2024 and is estimated to grow at a CAGR of 17.3% to reach USD 72.6 billion by 2034.

This sector is evolving rapidly, shaped by growing demand for automation, tighter delivery timelines, and advanced supply chain digitization. The industry is defined by its intricate ecosystem, which is marked by geographic clustering, strategic supplier relationships, and strong vertical integration. As robotics technologies mature, logistics firms are increasingly transitioning toward autonomous systems to meet rising consumer expectations and reduce operational inefficiencies. Accelerated ROI and shrinking payback windows are prompting broader deployment of intelligent robotics systems across warehouse and distribution centers. This wave of automation is reshaping logistics infrastructure by enabling higher throughput, improved accuracy, and leaner workforce dependencies, ultimately fueling growth across developed and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 17.3% |

In 2024, the hardware segment held a 66% share and is expected to grow at a CAGR of 16.4% through 2034. Robotic platforms, mechanical components, and mobility systems form the foundational layer of logistics robotics solutions, enabling seamless operation in warehouse and last-mile environments. Technological advancements and research initiatives into robotics power systems are reshaping the hardware cost structures, although human involvement in logistics operations still accounts for a large portion of total expenses.

The autonomous mobile robots (AMRs) segment held a 44.5% share in 2024 and is forecasted to grow at a CAGR of 17.9% between 2025 and 2034. AMRs offer significant efficiency gains over traditional automated guided vehicles due to advanced navigation systems powered by artificial intelligence, visual SLAM, and adaptive sensor technology. These capabilities allow for real-time decision-making in complex, dynamic environments, moving the segment from pilot phases into large-scale commercial deployments.

U.S. Logistics Robots Market held 65% share in 2024, generating USD 4.6 billion. Despite relatively low penetration compared to global benchmarks, growth in the U.S. is underpinned by labor shortages, technological readiness, and federal support for automation. Robust infrastructure and government-funded innovation programs continue to strengthen the country's position in the global robotics landscape, creating a favorable environment for the large-scale implementation of robotic solutions in logistics.

Key industry players shaping the competitive landscape of the Global Logistics Robots Market include ABB, Yaskawa Electric, Toyota/Bastian, Omron, Daifuku, Amazon Robotics, KUKA/Swisslog, KION/Dematic, Honeywell, and AutoStore. To reinforce their position, logistics robotics companies are prioritizing AI-powered automation, real-time data analytics, and modular system designs tailored to various logistics use cases. Strategic mergers and partnerships are enabling technology sharing and geographic expansion, while R&D investments are yielding scalable platforms for multi-application functionality. Leading firms are also customizing robotic fleets to suit e-commerce, third-party logistics, and retail warehouse environments, ensuring long-term client retention and improved operational ROI. Global players are further strengthening their presence through localized production, expanded service networks, and integrated digital platforms that enable seamless logistics orchestration and predictive maintenance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Autonomous mobile robot manufacturers

- 3.1.1.2 Automated storage and retrieval system providers

- 3.1.1.3 Robotics software & AI platform developers

- 3.1.1.4 Warehouse infrastructure & material handling equipment suppliers

- 3.1.1.5 Systems integrators & solution provider

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Developments in e-commerce sector for picking applications

- 3.2.1.2 Advancements in robotics technology

- 3.2.1.3 Increasing popularity of autonomous warehouses

- 3.2.1.4 Growing awareness towards sustainability practices in logistic handling

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of purchasing and implementing logistics robots

- 3.2.2.2 Lack of employee skills to operate and maintain advanced robotic systems

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and IoT in logistics robots

- 3.2.3.2 Adoption of collaborative robots

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Computer vision & object recognition

- 3.3.1.2 Predictive analytics & maintenance

- 3.3.1.3 Polyfunctional robot development

- 3.3.1.4 Human-robot collaboration advancement

- 3.3.2 Emerging technologies

- 3.3.2.1 5G connectivity & communication systems

- 3.3.2.2 Digital twin & simulation technologies

- 3.3.2.3 Blockchain & supply chain transparency

- 3.3.2.4 Sustainability & green technology integration

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Federal safety standards framework

- 3.5.1.1 ANSI/RIA R15.06 requirements

- 3.5.1.2 ANSI R15.08 mobile robot standards

- 3.5.1.3 ISO 10218 global harmonization

- 3.5.2 OSHA compliance requirements

- 3.5.2.1 General duty clause application

- 3.5.2.2 Machinery & machine guarding standards

- 3.5.2.3 Electrical safety requirements

- 3.5.3 Industry-Specific Regulatory Requirements

- 3.5.3.1 FDA healthcare regulations

- 3.5.3.2 Food safety & HACCP compliance

- 3.5.3.3 Automotive industry standards

- 3.5.4 International standards harmonization

- 3.5.4.1 ISO technical committee 299

- 3.5.4.2 European standards integration

- 3.5.4.3 Regional adaptation requirements

- 3.5.1 Federal safety standards framework

- 3.6 Cost breakdown analysis

- 3.6.1 Hardware cost components

- 3.6.2 Software & integration expenses

- 3.6.3 Infrastructure modification requirements

- 3.6.4 Maintenance & service costs

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Environmental impact assessment & lifecycle analysis

- 3.9.2 Social impact & community relations

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable technological development

- 3.10 Risk assessment framework

- 3.10.1 Interoperability & standardization gaps

- 3.10.2 Legacy system compatibility challenges

- 3.10.3 Regulatory & compliance risks

- 3.10.4 Financial risk mitigation strategies

- 3.11 Performance & quality standards

- 3.11.1 Risk assessment methodologies

- 3.11.2 Accuracy & precision standards

- 3.11.3 Industry-specific quality requirements

- 3.11.4 Safety testing requirements

- 3.12 Use Cases

- 3.12.1 Amazon robotics implementation model

- 3.12.2 Multi-SKU handling & sorting

- 3.12.3 Automotive manufacturing integration

- 3.12.4 Healthcare & pharmaceutical applications

- 3.12.5 Third-party logistics optimization

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Robotic platforms & chassis

- 5.2.2 Sensors & perception systems

- 5.2.3 Actuators & manipulation systems

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Robot operating systems

- 5.3.2 Fleet management software

- 5.3.3 Warehouse management integration

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Professional

- 5.4.2 Managed

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn & Units)

- 6.1 Key trends

- 6.2 Automated guided vehicles

- 6.3 Autonomous mobile robots

- 6.4 Robot arms

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn & Units)

- 7.1 Key trends

- 7.2 Palletizing & de-palletizing

- 7.3 Pick & place

- 7.4 Transportation

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn & Units)

- 8.1 Key trends

- 8.2 E-commerce

- 8.3 Healthcare

- 8.4 Retail

- 8.5 Food & beverages

- 8.6 Automotive

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn & Units)

- 9.1 North America

- 9.1.1 US

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Belgium

- 9.2.7 Netherlands

- 9.2.8 Sweden

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 Singapore

- 9.3.6 South Korea

- 9.3.7 Vietnam

- 9.3.8 Indonesia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 South Africa

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 ABB

- 10.1.2 Amazon Robotics

- 10.1.3 AutoStore

- 10.1.4 Daifuku

- 10.1.5 Honeywell

- 10.1.6 KION/Dematic

- 10.1.7 KUKA/Swisslog

- 10.1.8 Omron

- 10.1.9 Toyota/Bastian

- 10.1.10 Yaskawa Electric

- 10.2 Regional players

- 10.2.1 Bastian Solutions

- 10.2.2 Geek+

- 10.2.3 GreyOrange

- 10.2.4 Locus Robotics

- 10.2.5 Vecna Robotics

- 10.3 Emerging players

- 10.3.1 VisionNav Robotics

- 10.3.2 Berkshire Grey

- 10.3.3 Covariant

- 10.3.4 Exotec

- 10.3.5 River Systems