|

市场调查报告书

商品编码

1859014

互联医疗设备市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Connected Healthcare Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

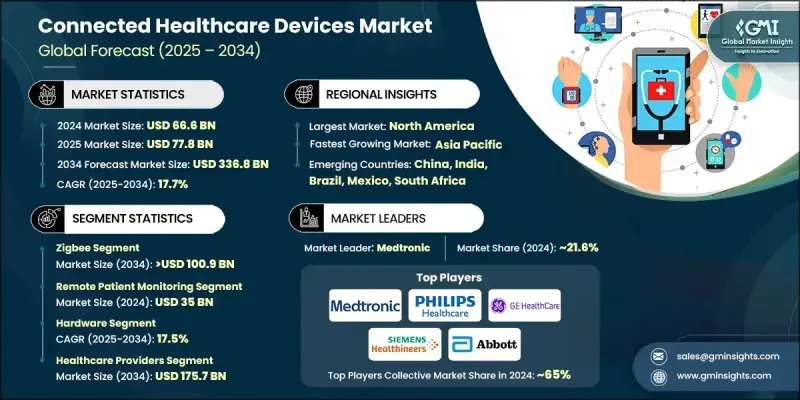

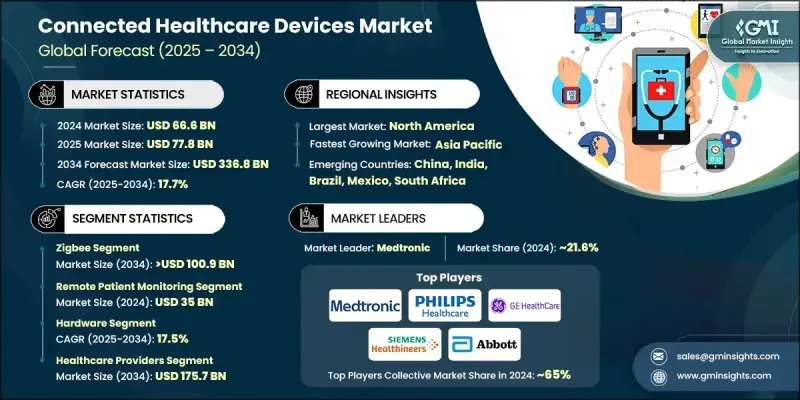

2024 年全球互联医疗设备市场价值为 666 亿美元,预计到 2034 年将以 17.7% 的复合年增长率成长至 3,368 亿美元。

高血压、糖尿病和心血管疾病等慢性健康问题的持续成长是推动这一成长的主要因素之一。这些长期疾病需要持续监测,而心电图贴片、血糖仪和智慧血压追踪器等连网医疗设备恰好能够提供这种监测。物联网、人工智慧和感测器技术的进步提高了这些设备的效率、准确性和整合能力。此外,远距医疗的快速普及扩大了连网设备在日常照护中的作用,尤其是在医疗服务资源有限的偏远地区。这些设备使医护人员能够即时监测患者的生命体征,从而改善治疗效果并减少住院次数。不断完善的数位基础设施和日益增长的以数据为中心的医疗服务模式,持续推动对符合现代医疗服务模式的连网医疗技术的需求。与传统工具不同,连网医疗设备可以透过数位网路安全地共享和接收病患资料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 666亿美元 |

| 预测值 | 3368亿美元 |

| 复合年增长率 | 17.7% |

2024年,Zigbee协议市占率达到31%,预计到2034年将达到1,009亿美元,复合年增长率(CAGR)为17.3%。 Zigbee的节能设计可延长穿戴式监视器、感测器和诊断工具等装置的电池续航力。它特别适用于家庭和诊所中使用的低功耗、常开医疗设备,因此成为一种首选技术,特别是对于需要长期持续监测的患者而言。这有助于提高依从性、减少维护并实现无缝监测。

远距患者监护 (RPM) 市场预计在 2024 年将创造 350 亿美元的收入。生物感测器、穿戴式装置和行动整合技术的持续创新,使 RPM 更有效率且普及。现代系统现已支援多生命体征监测,并透过云端平台提供即时数据。这些发展增强了临床决策能力和患者参与度,从而持续推动该市场强劲成长。

预计到2024年,北美互联医疗设备市场将占据51.4%的市场份额,引领全球数位医疗技术的应用。该地区的医疗保健系统日益依赖互联医疗解决方案来支援慢性病管理和即时诊断。对医疗资讯科技基础设施的大力投资以及行动医疗工具的日益普及,促进了互通性和资料共享,使医疗服务提供者能够大规模地提供及时、远距的医疗服务。

全球互联医疗设备市场的主要活跃企业包括 Vivify Health、霍尼韦尔国际、美敦力、西门子医疗、德康医疗、Fitbit(Google旗下)、雅培、欧姆龙、史丹利医疗、CareCloud、佳明、恩智浦半导体、Allscripts、皇家飞利浦、通用电气医疗和 AliveCloudCor。为了巩固市场地位,领导企业正积极拓展产品线,推出搭载人工智慧和整合感测器的设备,以满足广泛的临床需求。各公司正加大研发投入,致力于打造轻巧、便携、易用且电池续航力更长、资料传输更安全的医疗解决方案。与医院、医疗科技公司和保险公司建立策略合作伙伴关係,可实现产品与现有临床工作流程的无缝整合。此外,各公司也持续改善全球供应链,并建立区域分销网络,以服务新兴市场并提高产品可及性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 穿戴式科技的日益普及

- 智慧型手机普及率不断提高。

- 行动医疗应用程式的扩展

- 对个人化医疗保健的需求日益增长

- 产业陷阱与挑战

- 资料安全和隐私问题

- 设备的可靠性和准确性

- 市场机会

- 居家照护和预防性照护的需求日益增长

- 互联设备与人工智慧、云端平台和边缘运算的融合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 北美洲

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 无线上网

- 低功耗蓝牙(BLE)

- 近场通讯(NFC)

- Zigbee

- 细胞

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 远距患者监护

- 临床诊断

- 疗法

- 其他应用

第七章:市场估计与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 穿戴式健康设备

- 植入式连接设备

- 远距病人监护设备

- 其他连网医疗设备

- 软体

- 服务

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医疗保健提供者

- 医院

- 诊所

- 远距医疗平台

- 付款人

- 保险公司

- 政府卫生计划

- 患者

- 其他用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- AliveCor

- Allscripts

- CareCloud

- Dexcom

- Fitbit (Google)

- Garmin

- GE Healthcare

- Honeywell International

- Koninklijke Philips

- Medtronic

- NXP Semiconductors

- Omron Corporation

- Siemens Healthineers

- Stanley Healthcare

- Vivify Health

The Global Connected Healthcare Devices Market was valued at USD 66.6 billion in 2024 and is estimated to grow at a CAGR of 17.7% to reach USD 336.8 billion by 2034.

The steady rise in chronic health conditions such as hypertension, diabetes, and cardiovascular disorders is one of the primary drivers behind this growth. These long-term diseases demand ongoing monitoring, which connected medical devices like ECG patches, glucose monitors, and smart blood pressure trackers are uniquely suited to provide. The advancement of IoT, AI, and sensor technologies has enhanced these devices' efficiency, accuracy, and integration capabilities. Additionally, the rapid adoption of telehealth has expanded the role of connected devices in routine care, particularly in remote regions where access to clinical services is limited. These devices allow healthcare providers to monitor patient vitals in real time, improving outcomes and reducing hospitalizations. The combination of improved digital infrastructure and the growing push toward data-centric healthcare delivery continues to fuel demand for connected medical technologies that align with modern care delivery models. Connected healthcare devices, unlike traditional tools, can share and receive patient data securely over digital networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $66.6 Billion |

| Forecast Value | $336.8 Billion |

| CAGR | 17.7% |

The Zigbee protocol segment secured a 31% share in 2024 and is forecasted to reach USD 100.9 billion by 2034, with a CAGR of 17.3%. Zigbee's energy-efficient design supports longer battery life for devices like wearable monitors, sensors, and diagnostic tools. Its suitability for low-power, always-on medical devices used in homes and clinics makes it a preferred technology, especially for patients requiring continuous tracking over extended periods. This enables better compliance, reduced maintenance, and seamless monitoring.

The remote patient monitoring (RPM) segment generated USD 35 billion in 2024. Continuous innovation in biosensors, wearables, and mobile integration has made RPM more efficient and widely accessible. Modern systems now support multi-vital monitoring and provide real-time insights through cloud-based platforms. These developments enhance clinical decision-making and patient involvement, which continues to drive the segment's strong market performance.

North America Connected Healthcare Devices Market accounted for a 51.4% share in 2024, leading global adoption of digital health technologies. The region's healthcare system increasingly depends on connected medical solutions to support chronic disease management and real-time diagnostics. Strong investment in health IT infrastructure and the growing popularity of mobile health tools enable greater interoperability and data sharing, allowing providers to offer timely, remote care at scale.

Key companies active in the Global Connected Healthcare Devices Market include Vivify Health, Honeywell International, Medtronic, Siemens Healthineers, Dexcom, Fitbit (Google), Abbott Laboratories, Omron Corporation, Stanley Healthcare, CareCloud, Garmin, NXP Semiconductors, Allscripts, Koninklijke Philips, GE Healthcare, and AliveCor. To secure their positions, leading companies are actively expanding their product lines with AI-enabled and sensor-integrated devices to address a wide range of clinical needs. Firms are investing in R&D to create lightweight, portable, and user-friendly solutions with enhanced battery life and secure data transmission. Strategic partnerships with hospitals, health tech firms, and insurers allow seamless integration into existing clinical workflows. Companies are also enhancing their global supply chains and establishing regional distribution networks to serve emerging markets and increase accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 Component trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of wearable technology

- 3.2.1.2 Increased smartphone penetration

- 3.2.1.3 Expansion of mHealth apps

- 3.2.1.4 Growing demand for personalized healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data security and privacy concerns

- 3.2.2.2 Reliability and accuracy of devices

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for home-based and preventive care

- 3.2.3.2 Convergence of connected devices with AI, cloud platforms, and edge computing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wi-Fi

- 5.3 Bluetooth Low Energy (BLE)

- 5.4 Near-field Communication (NFC)

- 5.5 Zigbee

- 5.6 Cellular

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Remote patient monitoring

- 6.3 Clinical diagnostics

- 6.4 Therapeutics

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 Wearable health device

- 7.2.2 Implantable connected devices

- 7.2.3 Remote patient monitoring devices

- 7.2.4 Other connected healthcare devices

- 7.3 Software

- 7.4 Services

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Healthcare providers

- 8.2.1 Hospitals

- 8.2.2 Clinics

- 8.2.3 Telehealth platforms

- 8.3 Payers

- 8.3.1 Insurance companies

- 8.3.2 Government health programs

- 8.4 Patients

- 8.5 Other End uses

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AliveCor

- 10.3 Allscripts

- 10.4 CareCloud

- 10.5 Dexcom

- 10.6 Fitbit (Google)

- 10.7 Garmin

- 10.8 GE Healthcare

- 10.9 Honeywell International

- 10.10 Koninklijke Philips

- 10.11 Medtronic

- 10.12 NXP Semiconductors

- 10.13 Omron Corporation

- 10.14 Siemens Healthineers

- 10.15 Stanley Healthcare

- 10.16 Vivify Health