|

市场调查报告书

商品编码

1859018

呼吸防护设备市场机会、成长驱动因素、产业趋势分析及预测(2024-2032年)Respiratory Protective Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

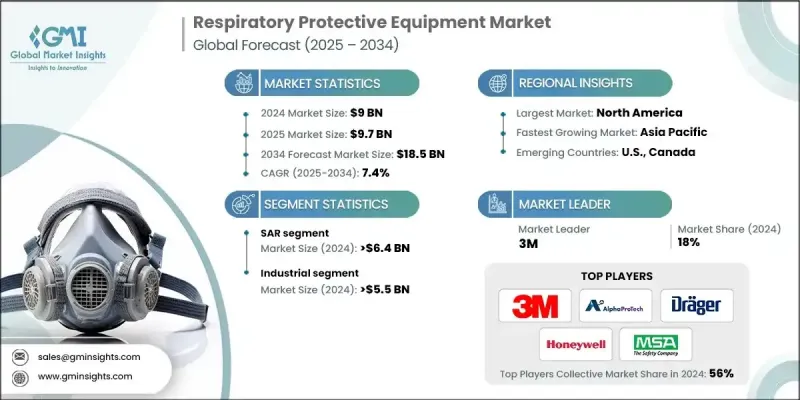

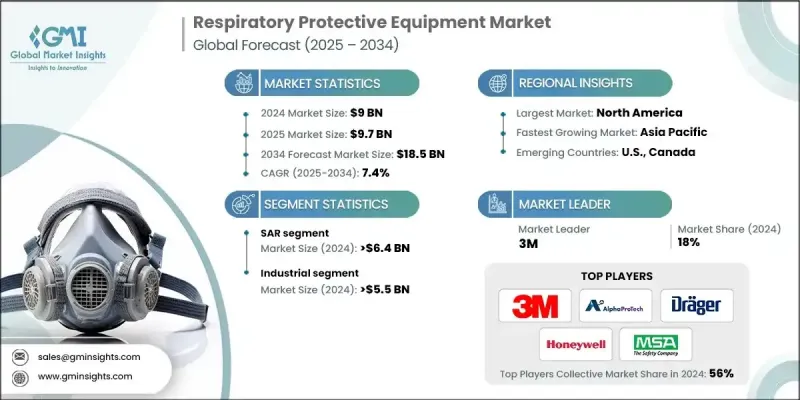

2024 年全球呼吸防护设备市场价值为 90 亿美元,预计到 2034 年将以 7.4% 的复合年增长率增长至 185 亿美元。

呼吸防护设备市场的成长主要源自于人们对空气污染物相关健康风险的日益关注,以及呼吸系统疾病患者人数的不断增加。此外,越来越多的产业和环境中的工人会接触到有害粉尘、烟雾、蒸气和传染性病原体,这也推动了呼吸防护设备需求的持续成长。医疗保健、製造业、建筑业和紧急服务等行业都是该市场的主要驱动力。随着全球工作场所安全法规的日益严格,各行业都在大力投资高品质的呼吸防护设备,进一步促进了市场扩张。呼吸防护设备对于维护职业健康至关重要,尤其是在有害物质普遍存在的行业。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 90亿美元 |

| 预测值 | 185亿美元 |

| 复合年增长率 | 7.4% |

2024年,供气式呼吸器(SAR)市场规模达到64亿美元,预计2025年至2034年将以7.6%的复合年增长率成长。供气式呼吸器通常用于密闭空间、危险化学品处理和消防等特殊应用领域。儘管供气式呼吸器提供卓越的防护性能,但与其他类型的呼吸器相比,其维护和操作的复杂性使其不太适合日常工业用途。

2024 年,工业领域的市场规模达到 55 亿美元。该领域的各行业正在加大对可重复使用空气净化呼吸器的投资,这种呼吸器经济实惠且灵活,适用于经常接触粉尘和化学品的环境。

2024年,美国呼吸防护设备市场占86.5%的市场份额,市场规模达27亿美元。凭藉其先进的工业体系和严格的安全法规,美国市场仍然是呼吸防护设备的主要驱动力。石油天然气、航太和化学製造等行业都依赖高品质的呼吸器来保护员工安全。美国职业安全与健康管理局(OSHA)和国家职业安全与健康研究所(NIOSH)等监管机构透过制定严格的呼吸防护标准发挥着至关重要的作用,这促使了更先进的设备(例如具有即时监测功能的智慧型呼吸器)的研发。

全球呼吸防护设备产业的主要参与者包括霍尼韦尔国际公司 (Honeywell International Inc.)、桑德斯特罗姆安全公司 (Sundstrom Safety AB)、莱克兰工业公司 (Lakeland Industries, Inc.)、德尔格公司 (Dragerwerk AG & Co. KGaA)、RPB Safety LLC、Bullard (Bullard)、Ataak、矿山安全公司 (Mta Plus)、Bull Plus公司 (Bull,公司Group)、阿尔法普罗科技公司 (Alpha Pro Tech)、雅芳防护系统公司 (Avon Protection Systems)、格森公司 (The Gerson Company) 和3B医疗公司 (3B Medical, Inc.)。为了巩固市场地位,呼吸防护设备产业的公司正致力于持续创新,尤其是在智慧技术和改良材料的应用方面。许多公司优先开发即时监控、无线连接和增强过滤系统等先进功能,以满足消费者对更安全、更有效率呼吸器日益增长的需求。此外,他们还在拓展全球分销网络,并与医疗保健和危险环境等需要特殊防护的行业建立战略合作伙伴关係。各公司也在投资永续材料,以吸引具有环保意识的消费者,从而进一步提升其在竞争激烈的市场中的份额。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 健康意识日益增强

- 转向可重复使用的呼吸器

- 智慧科技的融合

- 注重舒适性和人体工学

- 产业陷阱与挑战

- 供应链中断

- 高昂的设备成本

- 市场机会

- 医疗保健产业现代化

- 环保产品开发

- 新兴经济体的扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 年利率

- 无动力

- 一次性过滤半面罩

- 可重复使用的半面罩

- 全脸面罩

- 动力

- 半脸面罩

- 全脸面罩

- 头盔、兜帽和麵罩

- 无动力

- SAR

- 自给式呼吸器

- 航空呼吸器

- 其他的

- 年利率

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 工业的

- 医疗保健

- 军事与航空

- 公共服务

- 消费者

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东其他地区

第八章:公司简介

- 3B Medical, Inc.

- 3M

- Alpha Pro Tech

- Avon Protection Systems

- Bullard

- Delta Plus Group

- Dragerwerk AG & Co. KGaA

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Mine Safety Appliances (MSA)

- RPB Safety LLC

- Sundstrom Safety AB

- The Gerson Company

The Global Respiratory Protective Equipment Market was valued at USD 9 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 18.5 billion by 2034.

The growth is driven by heightened awareness of health risks associated with airborne contaminants and the increasing number of individuals suffering from respiratory diseases. Moreover, the demand for RPE continues to rise due to the growing number of industries and environments where workers are exposed to harmful dust, fumes, vapors, and infectious agents. Sectors such as healthcare, manufacturing, construction, and emergency services are all key drivers of this market. As workplace safety regulations tighten globally, industries are investing heavily in high-quality respiratory protection, further fueling market expansion. Respiratory protective equipment is critical for maintaining occupational health, especially in industries where hazardous substances are prevalent.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9 Billion |

| Forecast Value | $18.5 Billion |

| CAGR | 7.4% |

The supplied-air respirators (SAR) segment reached USD 6.4 billion in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2034. SARs are typically used in specialized applications such as confined spaces, hazardous chemical handling, and firefighting. Though SARs offer superior protection, their maintenance and operational complexity make them less suited for everyday industrial use compared to other types of respirators.

The industrial segment accounted for USD 5.5 billion in 2024. Industries in this segment are increasingly investing in reusable air-purifying respirators, which are cost-effective and flexible for environments where exposure to dust and chemicals is common.

U.S. Respiratory Protective Equipment Market held 86.5% share and generated USD 2.7 billion in 2024. The U.S. market remains a key driver for respiratory protective equipment due to its advanced industrial sectors and stringent safety regulations. Industries like oil and gas, aerospace, and chemical manufacturing rely on high-quality respirators to safeguard their workforce. Regulatory bodies such as OSHA and NIOSH play a crucial role by setting strict standards for respiratory protection, which has led to the development of more advanced devices, such as smart respirators with real-time monitoring capabilities.

Prominent players in the Global Respiratory Protective Equipment Industry include Honeywell International Inc., Sundstrom Safety AB, Lakeland Industries, Inc., Dragerwerk AG & Co. KGaA, RPB Safety LLC, Bullard, Mine Safety Appliances (MSA), 3M, Delta Plus Group, Alpha Pro Tech, Avon Protection Systems, The Gerson Company, and 3B Medical, Inc. To strengthen their presence, companies in the respiratory protective equipment sector are focusing on continuous innovation, especially through the integration of smart technologies and improved materials. Many firms are prioritizing the development of advanced features such as real-time monitoring, wireless connectivity, and enhanced filtration systems to meet the growing demand for safer and more efficient respirators. Additionally, they are expanding their global distribution networks and forging strategic partnerships with industries that require specialized protection, such as healthcare and hazardous environments. Companies are also investing in sustainable materials to appeal to eco-conscious consumers, further enhancing their market share in the competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health awareness

- 3.2.1.2 Shift toward reusable respirators

- 3.2.1.3 Integration of smart technologies

- 3.2.1.4 Focus on comfort and ergonomics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 High equipment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Healthcare sector modernization

- 3.2.3.2 Eco-friendly product development

- 3.2.3.3 Expansion in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Billion, Units)

- 5.1 Key trends

- 5.1.1 APR

- 5.1.1.1 Unpowered

- 5.1.1.1.1 Disposable filtering half mask

- 5.1.1.1.2 Reusable half mask

- 5.1.1.1.3 Full-face mask

- 5.1.1.2 Powered

- 5.1.1.2.1 Half face mask

- 5.1.1.2.2 Full-face mask

- 5.1.1.2.3 Helmets, hoods & visors

- 5.1.1.1 Unpowered

- 5.1.2 SAR

- 5.1.2.1 SCBA

- 5.1.2.2 Airline respirator

- 5.1.3 Others

- 5.1.1 APR

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Units)

- 6.1 Key trends

- 6.2 Industrial

- 6.3 Medical & healthcare

- 6.4 Military & aviation

- 6.5 Public service

- 6.6 Consumer

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East Asia

Chapter 8 Company Profiles

- 8.1 3B Medical, Inc.

- 8.2 3M

- 8.3 Alpha Pro Tech

- 8.4 Avon Protection Systems

- 8.5 Bullard

- 8.6 Delta Plus Group

- 8.7 Dragerwerk AG & Co. KGaA

- 8.8 Honeywell International Inc.

- 8.9 Lakeland Industries, Inc.

- 8.10 Mine Safety Appliances (MSA)

- 8.11 RPB Safety LLC

- 8.12 Sundstrom Safety AB

- 8.13 The Gerson Company