|

市场调查报告书

商品编码

1859024

运输燃料电池市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Transport Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

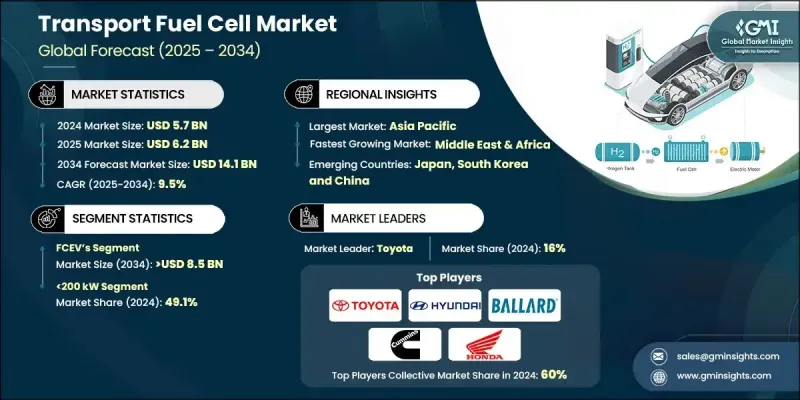

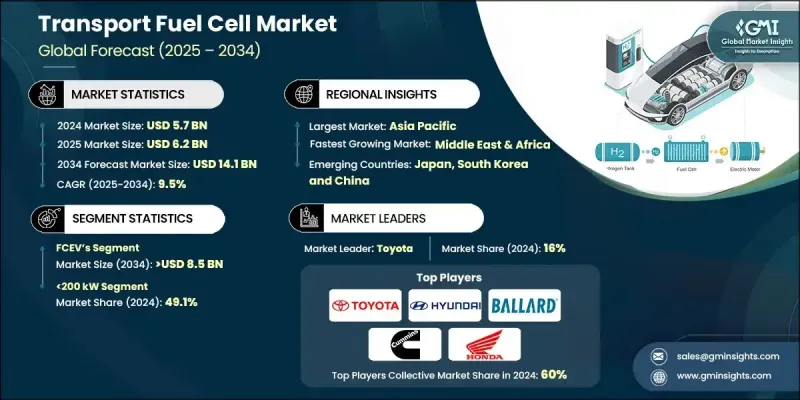

2024 年全球运输燃料电池市场价值为 57 亿美元,预计到 2034 年将以 9.5% 的复合年增长率增长至 141 亿美元。

全球交通网络对脱碳和清洁能源的日益重视推动了燃料电池技术的成长。现代燃料电池系统性能指标的提升,例如更高的耐久性、更优化的成本和更高的效率,使其成为各种交通应用领域的首选解决方案。随着氢能基础设施的不断改进以及主要经济体陆续推出国家氢能目标,燃料电池的可行性正在迅速扩大。各国政府致力于削减交通运输领域排放的政策,正促使人们大规模转向零排放解决方案,而燃料电池为之提供了强有力的替代方案,尤其适用于重型、长途和离网应用。这些系统发电驱动电动机,消除了废气排放,同时也能像内燃机一样提供稳定的输出性能。儘管发展势头强劲,但市场仍面临着前期资本成本高、极端条件下运作可靠性问题以及氢能物流发展不足等挑战,尤其是在氢能发展相对欠发达的地区。然而,持续的投资和公私合作正在努力缓解这些限制,并提高全球氢能的普及程度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 141亿美元 |

| 复合年增长率 | 9.5% |

到2034年,铁路业将以9.5%的复合年增长率成长,这主要得益于燃料电池在客运和货运领域日益广泛的应用。这些燃料电池列车能够在尚未电气化的铁路网路上实现零排放运行,从而最大限度地降低基础设施成本,并提供更低的维护成本和更安静的运行环境。对于拥有庞大铁路网且亟需进行永续改造的国家而言,这项技术尤其具有吸引力。

2024年,功率范围在200千瓦至1兆瓦的燃料电池市占率为34.7%,预计到2034年将以8.5%的复合年增长率成长。此功率范围非常适合中型商用车队、货运机车和中型船舶。它在能量输出、系统复杂性和成本之间取得了平衡,使其成为许多实际交通运输应用的理想选择。

受欧洲绿色协议和氢能基础设施巨额投资的推动,预计到2034年,欧洲交通燃料电池市场规模将达到30亿美元。该地区铁路应用领域正蓬勃发展,船舶系统的应用也不断成长。德国、挪威和荷兰等国正积极推动燃料电池交通运输领域的创新,进而提升整体产品需求和基础建设支援。

全球运输燃料电池市场的主要企业包括丰田汽车公司、巴拉德动力系统公司、现代汽车公司、本田汽车公司、博格华纳公司、斗山燃料电池公司、智慧能源有限公司、采埃孚股份公司、弗罗伊登贝格公司、瑞典PowerCel l公司、埃尔林克林格公司、爱信株式会社、Symbio公司、Nuvera燃料电池公司、Oorja燃料电池公司、AFC能源公司、康明斯公司、武汉虎牌燃料电池公司、东芝公司和Nedstack燃料电池技术公司。为了巩固在运输燃料电池产业的地位,主要企业正大力投资研发,以提高燃料电池系统的效率和使用寿命。许多公司正与汽车和轨道运输製造商建立合作关係,将其技术整合到商用车和车队中。一些公司正在扩大产能和区域製造中心,以满足全球需求并减少供应链摩擦。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系统

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 价格趋势分析,2021-2034年

- 按最终用途

- 按地区

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依产品划分,2021-2034年

- 主要趋势

- PEMFC

- 固态氧化物燃料电池

- 直接甲醇燃料电池

- 巴基斯坦足球俱乐部和亚足联

- 曼城足球俱乐部

第六章:市场规模及预测:依产能划分,2021-2034年

- 主要趋势

- 小于200千瓦

- 200千瓦 - 1兆瓦

- ≥ 1 兆瓦

第七章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 海洋

- 铁路

- 燃料电池电动车

- 其他的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 日本

- 韩国

- 中国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 南非

- 阿联酋

- 沙乌地阿拉伯

- 拉丁美洲

- 巴西

- 秘鲁

- 墨西哥

第九章:公司简介

- AISIN Corporation

- AFC Energy PLC

- BorgWarner Inc

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- ElringKlinger

- Freudenberg

- Hyundai Motor Company

- Honda Motor

- Intelligent Energy Limited

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- PowerCell Sweden

- Oorja Fuel Cells

- Symbio

- Toyota Motor Corporation

- Toshiba Corporation

- Wuhan Tiger Fuel Cell

- ZF Friedrichshafen AG

The Global Transport Fuel Cell Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 14.1 billion by 2034.

This growth trajectory is fueled by the rising push for decarbonization and clean energy adoption across global transportation networks. Enhanced performance metrics in modern fuel cell systems, such as improved durability, cost optimization, and better efficiency, are making them a preferred solution in various transport applications. As hydrogen infrastructure continues to mature and national hydrogen targets are being rolled out by leading economies, the viability of fuel cells is expanding rapidly. Government mandates focused on slashing emissions across the mobility sector are prompting a large-scale shift toward zero-emission solutions, where fuel cells offer a strong alternative, particularly for heavy-duty, long-haul, and off-grid applications. These systems generate electricity to power electric motors, eliminating tailpipe emissions while delivering consistent output performance like combustion engines. Despite clear momentum, the market still contends with high upfront capital costs, operational reliability issues in extreme conditions, and underdeveloped hydrogen logistics, particularly in less mature regions. However, ongoing investment and public-private partnerships are working to mitigate these constraints and enhance global accessibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $14.1 Billion |

| CAGR | 9.5% |

The railway segment will grow at a CAGR of 9.5% through 2034, driven by the increasing use of fuel cells in both passenger and freight transport. These fuel cell-powered trains enable emission-free operations on rail networks lacking electrification, minimizing infrastructure costs and offering lower maintenance and quieter service. The technology is proving especially attractive in countries with vast rail networks needing sustainable retrofitting.

The fuel cells in the 200 kW to 1 MW capacity segment held a 34.7% share in 2024 and are projected to grow at an 8.5% CAGR through 2034. This power band is ideally suited for medium-duty commercial fleets, freight locomotives, and mid-sized marine vessels. It strikes a balance between energy output, system complexity, and cost, making it optimal for many real-world transport applications.

Europe Transport Fuel Cell Market is expected to reach USD 3 billion by 2034, influenced by the European Green Deal and heavy investment in hydrogen infrastructure. The region is witnessing strong deployment in rail applications and growing uptake in marine systems. Countries including Germany, Norway, and the Netherlands are actively shaping fuel cell transportation innovation, boosting overall product demand and infrastructure support.

Leading companies in the Global Transport Fuel Cell Market include Toyota Motor Corporation, Ballard Power Systems, Hyundai Motor Company, Honda Motor, BorgWarner Inc., Doosan Fuel Cell, Intelligent Energy Limited, ZF Friedrichshafen AG, Freudenberg, PowerCell Sweden, ElringKlinger, AISIN Corporation, Symbio, Nuvera Fuel Cells, Oorja Fuel Cells, AFC Energy PLC, Cummins, Wuhan Tiger Fuel Cell, Toshiba Corporation, and Nedstack Fuel Cell Technology. To strengthen their position in the transport fuel cell industry, key players are heavily investing in research and development to enhance the efficiency and lifecycle of their fuel cell systems. Many companies are forming partnerships with automotive and rail manufacturers to integrate their technologies into commercial vehicles and fleets. Several firms are scaling up production capacity and regional manufacturing hubs to support global demand and reduce supply chain friction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis, 2021-2034

- 3.5.1 By end use

- 3.5.2 By region

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 SOFC

- 5.4 DMFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 <200 kW

- 6.3 200 kW - 1 MW

- 6.4 ≥ 1 MW

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Marine

- 7.3 Railways

- 7.4 FCEVs

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 UAE

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 AISIN Corporation

- 9.2 AFC Energy PLC

- 9.3 BorgWarner Inc

- 9.4 Ballard Power Systems

- 9.5 Cummins

- 9.6 Doosan Fuel Cell

- 9.7 ElringKlinger

- 9.8 Freudenberg

- 9.9 Hyundai Motor Company

- 9.10 Honda Motor

- 9.11 Intelligent Energy Limited

- 9.12 Nuvera Fuel Cells

- 9.13 Nedstack Fuel Cell Technology

- 9.14 PowerCell Sweden

- 9.15 Oorja Fuel Cells

- 9.16 Symbio

- 9.17 Toyota Motor Corporation

- 9.18 Toshiba Corporation

- 9.19 Wuhan Tiger Fuel Cell

- 9.20 ZF Friedrichshafen AG