|

市场调查报告书

商品编码

1871077

生物基化学品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Biobased Chemical Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

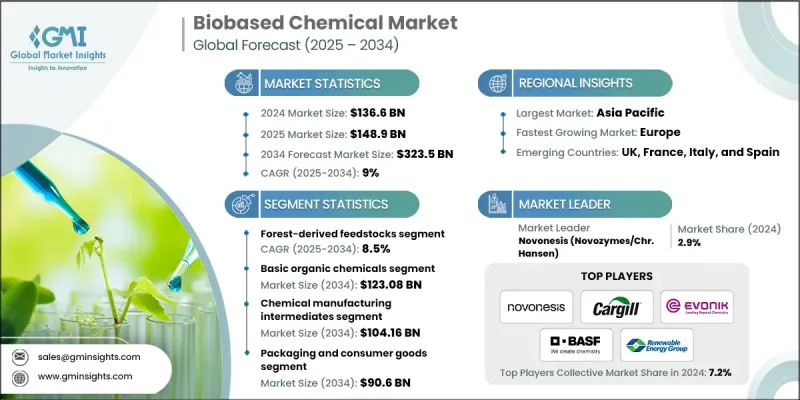

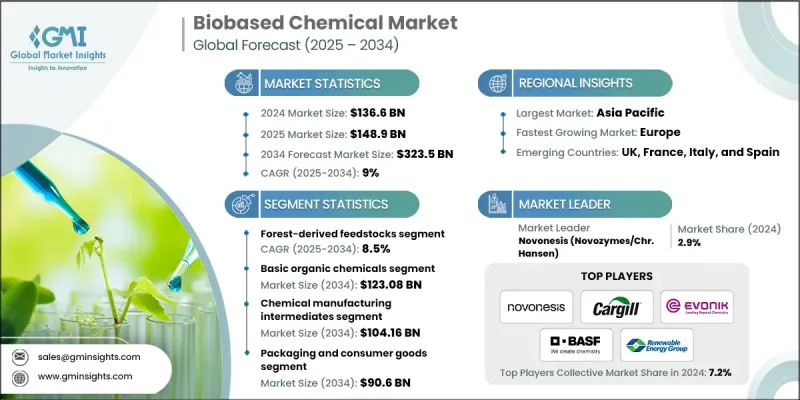

2024年全球生物基化学品市场价值为1,366亿美元,预计到2034年将以9%的复合年增长率成长至3,235亿美元。

全球范围内向永续工业流程的转型、政府对碳中和解决方案的激励措施以及生物技术和绿色化学的突破,共同推动了市场的发展。生物基化学品由农业残余物、林业生物质和藻类等再生资源生产,正日益取代包装、汽车、建筑、纺织和农业等行业的化石基原料。日益严格的环境法规和消费者对环保产品的需求加速了可生物降解塑胶、生物基界面活性剂和再生溶剂的普及应用。在农业领域,生物农药、肥料和土壤改良剂正被用于支持再生农业实践并最大限度地减少对生态环境的影响。此外,市场还受益于技术创新,包括PLA升级回收和FDCA基聚合物的进步,这些技术提高了效率并减少了碳足迹,使生物基解决方案的性能能够达到甚至超过石油基替代品,同时促进循环经济原则的实施。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1366亿美元 |

| 预测值 | 3235亿美元 |

| 复合年增长率 | 9% |

农业衍生原料,包括传统作物和专用能源作物,仍然是最大的细分市场,占 52% 的份额,这得益于其丰富的储量、成本效益以及与工业生物工艺的兼容性,凸显了它们在既有和新兴生产途径中的主导地位。

包装和消费品行业是领先的终端用户市场,涵盖食品包装和日常消费品。在永续生物基包装材料使用量不断增长的推动下,该细分市场预计将从2024年的382亿美元增长到2034年的906亿美元。

2024年北美生物基化学品市场规模达382亿美元,预计2034年将以9%的复合年增长率成长。在美国和加拿大等国家,由于永续发展方面的监管要求、企业绿色环保措施以及可再生原料技术的进步,生物基化学品在包装、汽车和农业等领域得到广泛应用。市场对高性能生物塑胶、生物润滑剂以及兼具环保效益和功能性的工业解决方案的需求仍然强劲。

全球生物基化学品市场的主要参与者包括帝斯曼-菲美意 (DSM-Firmenich)、布拉斯科 (Braskem)、Amyris、嘉吉 (Cargill)、诺维信 (Novozymes)、Green Biologics、赢创 (Evonik)、Gevo、Genomatica、Novamont、Ecovative、可再生能源集团 (Reablebable、Acovative Threads、LanzaTech、Corbion、巴斯夫 (BASF)、Modern Meadow 和 Zymergen。这些公司正优先考虑创新、策略合作和永续发展实践,以扩大市场份额。他们大力投资研发,以开发高性能生物基聚合物、溶剂和特殊化学品。与原料供应商和技术提供者的合作确保了稳定的原料供应和製程最佳化。许多公司正在建立合资企业和许可协议,以进入新的地域市场并实现产品组合多元化。监管合规性和永续性认证是他们重视的方面,旨在提升信誉和客户信任。此外,各公司也专注于强调环境效益、生物降解性和循环经济概念的行销策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依原料来源划分,2021-2034年

- 主要趋势

- 森林来源原料

- 农业衍生原料

- 废弃物衍生原料

- 海洋和藻类原料

第六章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 基础有机化学品

- 生物基乙烯及其衍生物

- 生物基丙烯及其衍生物

- 生物基芳烃(BTX)

- 有机酸(乳酸、琥珀酸)

- 乙醇与发酵

- 工业生物乙醇

- 胺基酸和蛋白质

- 维生素和营养保健品

- 特种生物基化学品

- 工业酵素

- 生物催化剂和生物表面活性剂

- 生物基溶剂

- 环状及中间体化学品

- 生物基单体

- 可再生芳烃

- 特种中间体

- 生物聚合物前驱

- PLA前驱

- PHA前驱

- 生物基聚酰胺前驱

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 化学製造中间体

- 聚合物生产

- 医药中间体

- 精细化学合成

- 塑胶材料及树脂生产

- 可生物降解塑料

- 生物基工程塑料

- 复合材料

- 个人护理和清洁产品

- 生物基界面活性剂

- 天然防腐剂

- 化妆品成分

- 油漆、涂料和黏合剂应用

- 生物基涂料

- 天然黏合剂

- 木材处理化学品

- 农业化学品应用

- 生物基肥料

- 生物农药与作物保护

- 土壤改良剂

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 包装及消费品

- 农业和食品加工

- 汽车与运输

- 建筑材料

- 纺织品和服装

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Amyris, Inc.

- BASF SE

- BioAmber Inc.

- Bolt Threads, Inc.

- Braskem SA

- Cargill, Incorporated

- Corbion NV

- DSM-firmenich

- Ecovative Design LLC

- Evonik Industries AG

- Genomatica, Inc.

- Gevo, Inc.

- Green Biologics Ltd.

- LanzaTech, Inc.

- Modern Meadow, Inc.

- Novamont SpA

- Novozymes A/S

- Renewable Energy Group, Inc.

- Solugen, Inc.

- Zymergen Inc.

The Global Biobased Chemical Market was valued at USD 136.6 Billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 323.5 Billion by 2034.

The market is driven by the worldwide shift toward sustainable industrial processes, government incentives for carbon-neutral solutions, and breakthroughs in biotechnology and green chemistry. Biobased chemicals, produced from renewable resources such as agricultural residues, forestry biomass, and algae, are increasingly replacing fossil-derived raw materials across sectors like packaging, automotive, construction, textiles, and agriculture. Rising environmental regulations and consumer demand for eco-friendly products have accelerated the adoption of biodegradable plastics, bio-based surfactants, and renewable solvents. In agriculture, biopesticides, fertilizers, and soil-enhancing solutions are being used to support regenerative practices and minimize ecological impact. The market is also benefiting from technological innovations, including advances in PLA upcycling and FDCA-based polymers, which enhance efficiency and reduce carbon footprints, enabling bio-based solutions to meet or exceed the performance of petroleum-based alternatives while promoting circular economy principles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.6 Billion |

| Forecast Value | $323.5 Billion |

| CAGR | 9% |

Agriculture-derived feedstocks, including conventional crops and dedicated energy crops, remain the largest segment, holding a 52% share due to their abundance, cost-effectiveness, and compatibility with industrial bioprocesses, highlighting their dominance in both established and emerging production pathways.

The packaging and consumer goods sector is the leading end-user market, encompassing food packaging and everyday consumer products. This segment is expected to grow from USD 38.2 Billion in 2024 to USD 90.6 Billion by 2034, driven by the increasing use of sustainable, bio-based packaging materials.

North America Biobased Chemical Market generated USD 38.2 Billion in 2024, growing at a CAGR of 9% through 2034. In countries like the U.S. and Canada, biobased chemicals are widely adopted in packaging, automotive, and agriculture due to regulatory mandates for sustainability, corporate green initiatives, and technological advancements in renewable feedstocks. Demand remains strong for high-performance bioplastics, bio-lubricants, and industrial solutions that provide environmental benefits without compromising functionality.

Key players in the Global Biobased Chemical Market include DSM-Firmenich, Braskem, Amyris, Cargill, Novozymes, Green Biologics, Evonik, Gevo, Genomatica, Novamont, Ecovative, Renewable Energy Group, BioAmber, Solugen, Bolt Threads, LanzaTech, Corbion, BASF, Modern Meadow, and Zymergen. Companies in the Global Biobased Chemical Market are prioritizing innovation, strategic partnerships, and sustainable practices to expand their market footprint. They invest heavily in research and development to create high-performance bio-based polymers, solvents, and specialty chemicals. Collaborations with feedstock suppliers and technology providers ensure a stable raw material supply and process optimization. Many firms are establishing joint ventures and licensing agreements to enter new geographies and diversify product portfolios. Regulatory compliance and sustainability certifications are emphasized to enhance credibility and customer trust. Companies are also focusing on marketing strategies that highlight environmental benefits, biodegradability, and circular economy alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Feedstock Source

- 2.2.3 Product Type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Feedstock Source, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Forest-derived feedstocks

- 5.3 Agriculture-derived feedstocks

- 5.4 Waste-derived feedstocks

- 5.5 Marine & algae-based feedstocks

Chapter 6 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Basic organic chemicals

- 6.2.1 Bio-based ethylene & derivatives

- 6.2.2 Bio-based propylene & derivatives

- 6.2.3 Bio-based aromatics (BTX)

- 6.2.4 Organic acids (lactic, succinic)

- 6.3 Ethyl alcohol & fermentation

- 6.3.1 Industrial bioethanol

- 6.3.2 Amino acids & proteins

- 6.3.3 Vitamins & nutraceuticals

- 6.4 Specialty biobased chemicals

- 6.4.1 Industrial enzymes

- 6.4.2 Biocatalysts & biosurfactants

- 6.4.3 Bio-based solvents

- 6.5 Cyclic & intermediate chemicals

- 6.5.1 Bio-based monomers

- 6.5.2 Renewable aromatics

- 6.5.3 Specialty intermediates

- 6.6 Biopolymer precursors

- 6.6.1 PLA precursors

- 6.6.2 PHA precursors

- 6.6.3 Bio-based polyamide precursors

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Chemical manufacturing intermediates

- 7.2.1 Polymer production

- 7.2.2 Pharmaceutical intermediates

- 7.2.3 Fine chemical synthesis

- 7.3 Plastic material & resin production

- 7.3.1 Biodegradable plastics

- 7.3.2 Bio-based engineering plastics

- 7.3.3 Composite materials

- 7.4 Personal care & cleaning products

- 7.4.1 Bio-based surfactants

- 7.4.2 Natural preservatives

- 7.4.3 Cosmetic ingredients

- 7.5 Paint, coating & adhesive applications

- 7.5.1 Bio-based paints & coatings

- 7.5.2 Natural adhesives

- 7.5.3 Wood treatment chemicals

- 7.6 Agricultural chemical applications

- 7.6.1 Bio-based fertilizers

- 7.6.2 Biopesticides & crop protection

- 7.6.3 Soil conditioners

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Packaging & consumer goods

- 8.3 Agriculture & food processing

- 8.4 Automotive & transportation

- 8.5 Construction & building materials

- 8.6 Textiles & apparel

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Amyris, Inc.

- 10.2 BASF SE

- 10.3 BioAmber Inc.

- 10.4 Bolt Threads, Inc.

- 10.5 Braskem S.A.

- 10.6 Cargill, Incorporated

- 10.7 Corbion N.V.

- 10.8 DSM-firmenich

- 10.9 Ecovative Design LLC

- 10.10 Evonik Industries AG

- 10.11 Genomatica, Inc.

- 10.12 Gevo, Inc.

- 10.13 Green Biologics Ltd.

- 10.14 LanzaTech, Inc.

- 10.15 Modern Meadow, Inc.

- 10.16 Novamont S.p.A.

- 10.17 Novozymes A/S

- 10.18 Renewable Energy Group, Inc.

- 10.19 Solugen, Inc.

- 10.20 Zymergen Inc.