|

市场调查报告书

商品编码

1871087

阻火器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Flame Arrestors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

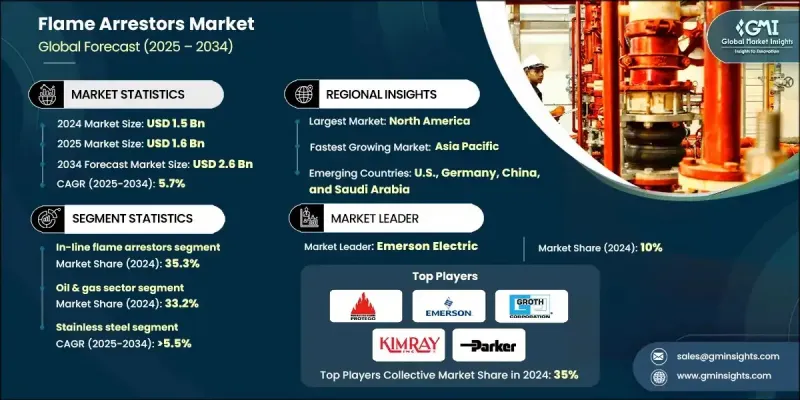

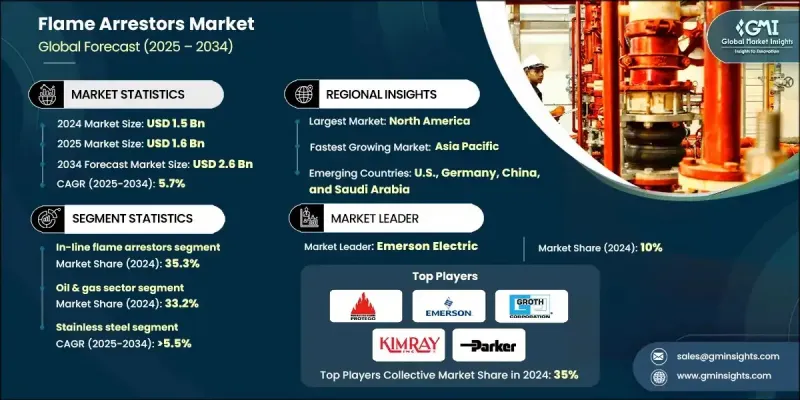

2024 年全球阻火器市场价值为 15 亿美元,预计到 2034 年将以 5.7% 的复合年增长率增长至 26 亿美元。

对工业安全合规性的日益重视,以及石化、炼油和仓储行业监管的加强,正推动市场稳步扩张。发展中国家燃料和化学品储存设施建设的不断增加,以及与空气排放相关的环境审查日益严格,并持续影响市场前景。阻火器是一种关键的安全装置,它透过吸热元件(通常由金属网或多孔材料构成)抑制火焰锋面,从而防止含有易燃气体或蒸气混合物的系统中火焰蔓延。这种设计将火焰冷却到燃点以下,有效阻止燃烧。在严格的防爆和安全标准的推动下,工业设施中氢气利用和混合活动的激增,正在推动市场成长。工业基础设施的不断进步、蒸汽回收和排放控制技术的集成,以及对可靠通风解决方案日益增长的需求,进一步促进了产品的推广应用。不断扩大的海上支援作业和海上加油活动,以及日益严格的船舶安全要求,也为全球市场的发展势头做出了贡献。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 5.7% |

2024年,管道式阻火器市占率达到35.3%,预计到2034年将以5.5%的复合年增长率成长。这些装置对于维护工业管道网路的製程安全至关重要,能够阻止火焰向上游和下游方向蔓延。由于高风险环境中对持续双向保护的需求,管道式阻火器在化学、石化和流程製造设施中的应用日益广泛。其可靠性和对复杂製程系统的适应性使其成为现代工业运作中不可或缺的组件,这些运作旨在预防爆炸并确保製程完整性。

2024年,石油天然气产业占33.2%的市场份额,预计2025年至2034年间将以5.5%的复合年增长率成长。该产业的成长主要得益于上游、中游和下游业务的持续扩张,而这些业务都需要可靠的阻燃技术。在生产、钻井和加工作业中,阻火器用于在日常和紧急情况下保护设施免受碳氢化合物蒸气的点燃。整个能源价值链对营运安全和合规性的持续关注仍然是影响产品需求的关键因素。

2024年,美国阻火器市场规模预计将达到4.17亿美元。该国市场成长主要得益于炼油、石化和发电设施的现代化改造,以及职业安全和消防安全法规执行的加强。液化天然气设施和氢气掺混专案的投资增加,进一步加速了阻火器在工业应用中的部署。此外,企业越来越多地采用基于风险的维护计划和资产完整性管理策略,从而主动用先进合规的系统取代老旧的阻火设备。

全球阻火器市场的主要参与者包括派克汉尼汾 (Parker Hannifin)、艾尔马克科技 (Elmac Technologies)、艾默生电气 (Emerson Electric)、Protectoseal 公司、PROTEGO、Sunflow Technologies、D-KTC 流体控制、L&J Technologies、Cashco、Kimray、GrTT-GASETEC、GrTT. Innovations、Cochin Steel、Paradox IP、Aager 和 Mott。阻火器市场的关键企业正在实施多元化的策略,以巩固其市场地位并提升竞争力。领先的製造商正加大研发投入,开发符合不断更新的安全标准且能在极端工业条件下运作的高性能阻火器。他们积极寻求策略併购、合作与联盟,以拓展产品组合併扩大地域覆盖范围。此外,各公司也致力于利用先进材料和自动化技术来提高生产效率。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 阻火器的成本结构分析

- 新兴机会与趋势

- 数位化和物联网集成

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- Key partnerships & collaborations

- Major M&A activities

- Product innovations & launches

- Market expansion strategies

- 策略倡议

- 竞争性标竿分析

- 创新与技术格局

第五章:市场规模及预测:依产品划分,2021-2034年

- 主要趋势

- 直列式阻火器

- 管线末端阻火器

- 爆燃抑制器

- 防爆器

- 其他的

第六章:市场规模及预测:依材料划分,2021-2034年

- 主要趋势

- 不銹钢

- 碳钢

- 铝

- 其他的

第七章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 石油和天然气

- 化学品

- 製药

- 炼油厂

- 发电厂

- 矿业

- 废水处理

- 其他的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- PROTEGO

- Aager

- Amarama Engineers

- BS&B Innovations

- Cashco

- Cochin Steel

- D-KTC Fluid Control

- Elmac Technologies

- Emerson Electric

- Essex Industries

- Fidicon Devices

- Groth Corporation

- Kimray

- L&J Technologies

- Mott

- Paradox IP

- Parker Hannifin

- Sunflow Technologies

- The Protectoseal Company

- WITT-GASETECHNIK

The Global Flame Arrestors Market was valued at USD 1.5 Billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2.6 Billion by 2034.

Growing emphasis on industrial safety compliance, coupled with stronger regulatory mandates across petrochemical, refining, and storage sectors, is driving steady market expansion. Increasing construction of fuel and chemical storage facilities in developing economies, along with rising environmental scrutiny related to air emissions, continues to shape the business outlook. A flame arrestor is a critical safety device that prevents the spread of flames in systems containing flammable gas or vapor mixtures by quenching the flame front through a heat-absorbing element, often composed of metal mesh or porous materials. This design cools the flame below its ignition temperature, effectively halting combustion. The surge in hydrogen utilization and blending activities within industrial facilities, driven by stringent explosion prevention and safety standards, is propelling market growth. Continuous advancements in industrial infrastructure, the integration of vapor recovery and emission control technologies, and the rising demand for reliable venting solutions are further enhancing product deployment. Expanding offshore support operations and maritime fueling activities, together with reinforced shipboard safety requirements, are also contributing to global market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.7% |

The in-line flame arrestor segment held 35.3% share in 2024 and is forecast to grow at a CAGR of 5.5% through 2034. These devices are essential for maintaining process safety in industrial piping networks by preventing flame travel in both upstream and downstream directions. Their growing application across chemical, petrochemical, and process manufacturing facilities is fueled by the need for continuous bidirectional protection in high-risk environments. Their reliability and adaptability to complex process systems make them indispensable components for modern industrial operations focused on explosion prevention and process integrity.

The oil & gas sector held a 33.2% share in 2024 and is expected to grow at a CAGR of 5.5% between 2025 and 2034. Growth in this sector is driven by ongoing expansion across upstream, midstream, and downstream operations, each requiring dependable flame prevention technologies. Applications within production, drilling, and processing operations rely on flame arrestors to safeguard facilities from the ignition of hydrocarbon vapors during routine and emergency scenarios. The continuous focus on operational safety and regulatory compliance across the energy value chain remains a key factor influencing product demand.

United States Flame Arrestors Market generated USD 417 million in 2024. Market growth in the country is supported by the modernization of refining, petrochemical, and power generation assets, accompanied by heightened enforcement of occupational and fire safety regulations. Expanding investments in LNG facilities and hydrogen blending initiatives are further accelerating the deployment of flame arrestors in industrial applications. Additionally, companies are increasingly adopting risk-based maintenance programs and asset integrity management strategies, resulting in proactive replacement of outdated flame protection equipment with advanced, compliant systems.

Prominent players operating in the Global Flame Arrestors Market include Parker Hannifin, Elmac Technologies, Emerson Electric, The Protectoseal Company, PROTEGO, Sunflow Technologies, D-KTC Fluid Control, L&J Technologies, Cashco, Kimray, WITT-GASETECHNIK, Essex Industries, Groth Corporation, Amarama Engineers, Fidicon Devices, BS&B Innovations, Cochin Steel, Paradox IP, Aager, and Mott. Key companies in the Flame Arrestors Market are implementing diverse strategies to strengthen their market position and enhance competitiveness. Leading manufacturers are investing in R&D to develop high-performance arrestors that meet evolving safety standards and can operate under extreme industrial conditions. Strategic mergers, partnerships, and collaborations are being pursued to expand product portfolios and extend geographic reach. Companies are also focusing on production efficiency using advanced materials and automation in manufacturing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Material trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of flame arrestors

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization and IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 In-line flame arrestors

- 5.3 End-of-line flame arrestors

- 5.4 Deflagration arrestors

- 5.5 Detonation arrestors

- 5.6 Others

Chapter 6 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Carbon steel

- 6.4 Aluminum

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Chemicals

- 7.4 Pharmaceutical

- 7.5 Refineries

- 7.6 Power plants

- 7.7 Mining

- 7.8 Wastewater treatment

- 7.9 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 PROTEGO

- 9.2 Aager

- 9.3 Amarama Engineers

- 9.4 BS&B Innovations

- 9.5 Cashco

- 9.6 Cochin Steel

- 9.7 D-KTC Fluid Control

- 9.8 Elmac Technologies

- 9.9 Emerson Electric

- 9.10 Essex Industries

- 9.11 Fidicon Devices

- 9.12 Groth Corporation

- 9.13 Kimray

- 9.14 L&J Technologies

- 9.15 Mott

- 9.16 Paradox IP

- 9.17 Parker Hannifin

- 9.18 Sunflow Technologies

- 9.19 The Protectoseal Company

- 9.20 WITT-GASETECHNIK