|

市场调查报告书

商品编码

1871108

形状记忆陶瓷在致动器应用领域的市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Shape Memory Ceramics for Actuator Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

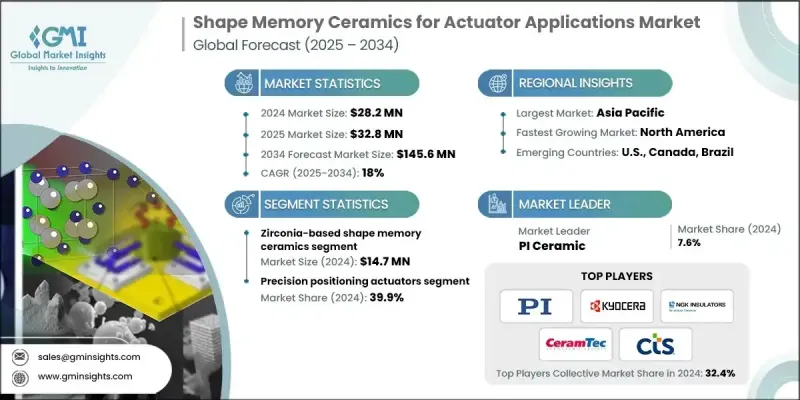

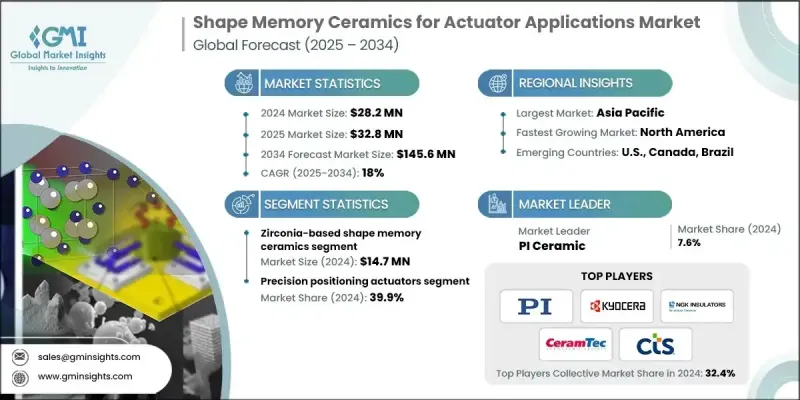

2024 年全球形状记忆陶瓷致动器应用市场价值为 2,820 万美元,预计到 2034 年将以 18% 的复合年增长率增长至 1.456 亿美元。

形状记忆陶瓷正迅速成为致动器技术领域最具创新性的智慧材料之一,它能够在应力、温度或电场等特定外部刺激下改变并恢復自身形状。其高可靠性、优异的耐久性和高效性使其在包括航太、汽车、国防和医疗保健在内的现代工业中发挥着至关重要的作用。自动化、机器人和智慧製造技术的快速发展,进一步推动了对轻质、耐腐蚀且能够在极端条件下工作的致动器的需求。与传统的金属致动器相比,这些陶瓷具有更优异的机械和热性能,能够在更长的使用寿命内保持稳定的运作。政府对先进材料和製造技术的扶持,以及不断增长的研发投入,正在推动技术创新。此外,形状记忆陶瓷在生物医学设备和基于微机电系统(MEMS)的组件等新兴领域的应用,凸显了其在下一代工程应用中日益重要的作用。随着各行业寻求能够在严苛的运作环境中提供高精度、高重复性和高韧性的高效高性能致动器材料,形状记忆陶瓷的重要性也与日俱增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2820万美元 |

| 预测值 | 1.456亿美元 |

| 复合年增长率 | 18% |

2024年,氧化锆基形状记忆陶瓷的市场规模达到1,470万美元,占据最大的市场份额。氧化锆优异的抗拉强度、高断裂韧性和卓越的热稳定性使其成为在极端温度和压力条件下应用的理想选择。这些特性使得氧化锆基材料能够在维持形状记忆特性的同时,克服陶瓷材料通常存在的脆性问题,从而确保其在航太、工业和能源应用中的稳定性能。

2024年,精密定位执行器市占率达39.9%。其主导地位主要得益于其在半导体製造、光学系统和先进仪器等需要亚微米级精度的产业中的重要角色。对能够在高温下提供稳定运动控制和高精度的执行器的需求不断增长,并持续推动此类执行器的应用。此外,陶瓷基执行器在超过300°C的高温环境中也日益受到重视,因为传统的金属形状记忆合金在这种高温下往往会失去功能,这使得陶瓷基执行器成为航太和工业自动化系统的首选解决方案。

2025年至2034年间,北美形状记忆陶瓷驱动器市场将以18.1%的复合年增长率成长。该地区市场成长的主要驱动力是航太、汽车和医疗器材製造等行业对精密高性能驱动器日益增长的需求。陶瓷成分技术的进步提高了其机械强度和反应速度,使其适用于在严苛环境下连续运作。此外,该地区对自动化、机器人和智慧製造的重视也加速了陶瓷驱动器系统的应用,这些系统具有更快、更耐用、更有效率的特性。

全球形状记忆陶瓷驱动器应用市场的主要参与者包括京瓷株式会社、富士陶瓷株式会社、CeramTec集团、摩根先进材料公司、CTS株式会社、太阳诱电株式会社、东曹株式会社、先进陶瓷材料公司、NGK绝缘体公司、Niterra株式会社、PI Ceramic和Piezo。这些公司正实施多元化的策略,以巩固其市场地位和竞争优势。许多公司正投入大量资金进行研发,以开发具有更高耐热性和机械强度的先进氧化锆和氧化铝基配方。与航太、医疗和工业製造商的合作有助于拓展应用领域。此外,各公司也着力扩大产能,以满足关键产业对精密驱动器日益增长的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 航太工业对高性能执行器的需求

- MEMS和微型致动器系统的小型化趋势

- 优异的耐化学腐蚀性能

- 产业陷阱与挑战

- 高昂的製造成本和复杂的加工要求

- 脆性和断裂韧性限制

- 市场机会

- 混合金属-陶瓷复合材料的开发

- 用于环境合规的无铅铁电系统

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 氧化锆基形状记忆陶瓷

- 铈掺杂氧化锆(CeO2-ZrO2)

- 氧化钇稳定四方氧化锆

- 掺杂异价掺杂剂的改质氧化锆

- 铁电形状记忆陶瓷

- 锆钛酸铅(PZT)

- 无铅铁电陶瓷

- 氧化铪(HfO2)薄膜

- 复合形状记忆陶瓷

- 金属基复合材料

- 氧化锆增韧氧化铝(ZTA)

- 有机-无机杂化复合材料

- 其他的

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 精密定位执行器

- 奈米级光学定位系统

- MEMS和微型致动器应用

- 快速转向镜和光学指向

- 高温致动器

- 航太发动机控制系统

- 深井及极端环境应用

- 工业高温製程控制

- 射频和微波致动器

- 可重构天线系统

- 超材料和超表面应用

- 立方体卫星和太空通讯系统

- 微流控和晶片实验室致动器

- 微型阀和微型帮浦系统

- 微型机器人应用

- 生物医学设备集成

- 其他的

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 航太与国防

- 飞机变形机翼结构

- 航天器可展开机构

- 军用精密光学系统

- 汽车

- 引擎热管理系统

- 自适应悬吊和振动控制

- 电池热管理

- 工业自动化与机器人

- 精密製造设备

- 机器人系统执行器

- 过程控制与流程管理

- 电子与半导体

- 微机电系统及微机电系统

- 光交换和光纤定位

- 半导体加工设备

- 医学与生物医学

- 手术器械驱动器

- 晶片实验室诊断设备

- 生物相容性驱动系统

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Advanced Ceramic Material

- CeramTec Group

- CTS Corporation

- FUJI CERAMICS CORPORATION

- Kyocera Corporation

- Morgan Advanced Materials

- NGK Insulators

- Niterra Co., Ltd.

- PI Ceramic

- Piezo Direct

- TAIYO YUDEN CO., LTD.

- Tosoh Corporation

The Global Shape Memory Ceramics for Actuator Applications Market was valued at USD 28.2 million in 2024 and is estimated to grow at a CAGR of 18% to reach USD 145.6 million by 2034.

Shape memory ceramics are emerging as one of the most innovative smart materials in actuator technology, capable of changing and restoring their shape under specific external stimuli such as stress, temperature, or electric fields. Their ability to offer high reliability, excellent durability, and efficiency makes them vital in modern industries, including aerospace, automotive, defense, and healthcare. The rapid expansion of automation, robotics, and smart manufacturing technologies is amplifying the demand for actuators that are lightweight, corrosion-resistant, and capable of functioning under extreme conditions. Compared with conventional metallic actuators, these ceramics deliver superior mechanical and thermal performance, allowing consistent operation over extended lifecycles. Increasing R&D investments, supported by government initiatives focused on advanced materials and manufacturing, are fueling technological innovation. Furthermore, the integration of shape memory ceramics into emerging fields such as biomedical devices and MEMS-based components highlights their expanding role in next-generation engineering applications. Their significance continues to rise as industries seek efficient and high-performance actuator materials that deliver precision, repeatability, and resilience in demanding operational environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.2 million |

| Forecast Value | $145.6 million |

| CAGR | 18% |

The zirconia-based shape memory ceramics generated USD 14.7 million in 2024, accounting for the largest share of the market. Zirconia's superior tensile strength, high fracture toughness, and remarkable thermal stability make it a preferred choice for applications operating in extreme temperature and pressure conditions. These properties allow zirconia-based materials to retain shape memory characteristics while addressing the brittleness typically associated with ceramic materials, ensuring stable performance in aerospace, industrial, and energy applications.

The precision positioning actuator segment held a 39.9% share in 2024. This dominance is driven by their critical use in industries requiring sub-micrometer accuracy, such as semiconductor manufacturing, optical systems, and advanced instrumentation. The growing demand for actuators that provide consistent motion control and high accuracy under elevated temperatures continues to boost adoption. Ceramic-based actuators are also gaining prominence in high-temperature environments exceeding 300°C, where conventional metallic shape memory alloys tend to lose functionality, positioning them as the preferred solution for aerospace and industrial automation systems.

North America Shape Memory Ceramics for Actuator Applications Market will grow at a CAGR of 18.1% between 2025 and 2034. Regional growth is driven by the increasing need for precise and high-performance actuators across aerospace, automotive, and medical device manufacturing sectors. Technological advancements in ceramic compositions have improved their mechanical strength and response time, making them suitable for continuous operation in challenging environments. Additionally, the region's emphasis on automation, robotics, and smart manufacturing is accelerating the adoption of ceramic-based actuator systems that offer faster, more durable, and efficient performance.

Key players operating in the Global Shape Memory Ceramics for Actuator Applications Market include Kyocera Corporation, FUJI CERAMICS CORPORATION, CeramTec Group, Morgan Advanced Materials, CTS Corporation, TAIYO YUDEN CO., LTD., Tosoh Corporation, Advanced Ceramic Material, NGK Insulators, Niterra Co., Ltd., PI Ceramic, and Piezo Direct. Companies in the Global Shape Memory Ceramics for Actuator Applications Market are implementing diverse strategies to reinforce their market foothold and competitive edge. Many are channeling significant investments into R&D to develop advanced zirconia and alumina-based formulations with enhanced thermal endurance and mechanical strength. Partnerships and collaborations with aerospace, medical, and industrial manufacturers are helping broaden application portfolios. Firms are also emphasizing capacity expansion to meet the growing demand for precision actuators across critical industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 End use industry trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aerospace industry demand for high-performance actuators

- 3.2.1.2 Miniaturization trends in mems & microactuator systems

- 3.2.1.3 Superior chemical & corrosion resistance properties

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs & complex processing requirements

- 3.2.2.2 Brittleness & fracture toughness limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Hybrid metal-ceramic composite development

- 3.2.3.2 Lead-free ferroelectric systems for environmental compliance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Zirconia-based shape memory ceramics

- 5.2.1 Ceria-doped zirconia (CeO2-ZrO2)

- 5.2.2 Yttria-stabilized tetragonal zirconia

- 5.2.3 Modified zirconia with aliovalent dopants

- 5.3 Ferroelectric shape memory ceramics

- 5.3.1 Lead zirconate titanate (PZT)

- 5.3.2 Lead-free ferroelectric ceramics

- 5.3.3 Hafnium oxide (HfO2) thin film

- 5.4 Composite shape memory ceramics

- 5.4.1 Metal matrix composites

- 5.4.2 Zirconia-toughened alumina (ZTA)

- 5.4.3 Hybrid organic-inorganic composites

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Precision positioning actuators

- 6.2.1 Nanometer-scale optical positioning systems

- 6.2.2 MEMS & microactuator applications

- 6.2.3 Fast-steering mirrors & optical pointing

- 6.3 High-temperature actuators

- 6.3.1 Aerospace engine control systems

- 6.3.2 Deep borehole & extreme environment applications

- 6.3.3 Industrial high-temperature process control

- 6.4 RF & microwave actuators

- 6.4.1 Reconfigurable antenna systems

- 6.4.2 Metamaterial & metasurface applications

- 6.4.3 CubeSat & space communication systems

- 6.5 Microfluidic & lab-on-chip actuators

- 6.5.1 Microvalves & micropump systems

- 6.5.2 Microrobotic applications

- 6.5.3 Biomedical device integration

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace & defense

- 7.2.1 Aircraft morphing wing structures

- 7.2.2 Spacecraft deployable mechanisms

- 7.2.3 Military precision optical systems

- 7.3 Automotive

- 7.3.1 Engine thermal management systems

- 7.3.2 Adaptive suspension & vibration control

- 7.3.3 Battery thermal management

- 7.4 Industrial automation & robotics

- 7.4.1 Precision manufacturing equipment

- 7.4.2 Robotic system actuators

- 7.4.3 Process control & flow management

- 7.5 Electronics & semiconductors

- 7.5.1 MEMS & microelectromechanical systems

- 7.5.2 Optical switching & fiber positioning

- 7.5.3 Semiconductor processing equipment

- 7.6 Medical & biomedical

- 7.6.1 Surgical instrument actuators

- 7.6.2 Lab-on-chip diagnostic devices

- 7.6.3 Biocompatible actuation systems

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Advanced Ceramic Material

- 9.2 CeramTec Group

- 9.3 CTS Corporation

- 9.4 FUJI CERAMICS CORPORATION

- 9.5 Kyocera Corporation

- 9.6 Morgan Advanced Materials

- 9.7 NGK Insulators

- 9.8 Niterra Co., Ltd.

- 9.9 PI Ceramic

- 9.10 Piezo Direct

- 9.11 TAIYO YUDEN CO., LTD.

- 9.12 Tosoh Corporation