|

市场调查报告书

商品编码

1871135

生物降解电子产品包装市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Biodegradable Electronics for Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

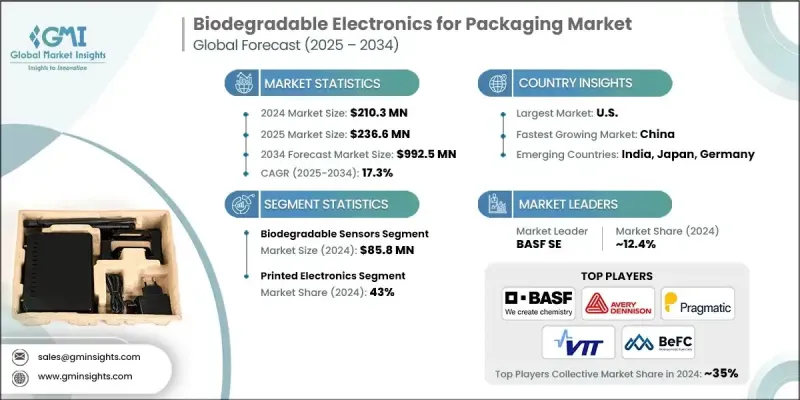

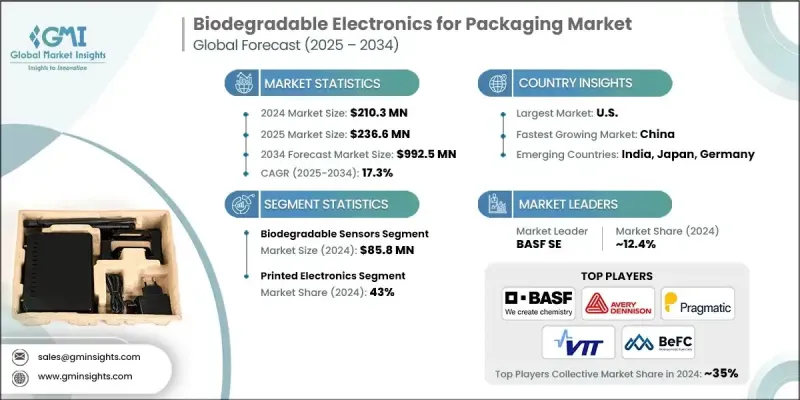

2024 年全球可生物降解电子产品包装市场价值为 2.103 亿美元,预计到 2034 年将以 17.3% 的复合年增长率增长至 9.925 亿美元。

该市场代表环保材料、先进电子技术和永续发展驱动创新的突破性融合,其发展动力源于严格的监管要求和企业减少环境影响的承诺。可生物降解电子产品采用有机半导体、生物基材和瞬态元件,这些材料在使用寿命结束后可自然分解,从而有效应对包装中日益严重的电子垃圾问题。丝蛋白、纤维素薄膜和有机光伏电池等核心材料可在数週至数月内生物降解,同时保持其功能性。该市场拥有一个充满活力的生态系统,由新创公司、材料公司、电子产品製造商和包装公司组成,它们跨领域合作。新兴技术路径包括可根据环境条件调整性能和降解时间的自组装系统,展现了智慧、永续包装解决方案的巨大潜力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.103亿美元 |

| 预测值 | 9.925亿美元 |

| 复合年增长率 | 17.3% |

2024年,可生物降解感测器市场规模达到8,580万美元,预计到2034年将以17.3%的复合年增长率成长。这些感测器被广泛应用于各行各业,用于监测易腐烂和敏感商品的温度、湿度、新鲜度和污染情况等。由于其使用后可自然降解,无需收集或回收,因此非常适合一次性包装,并使其成为可生物降解电子产品生态系统中最具商业化规模的组件。

预计到2024年,印刷电子产品市场规模将达到9,030万美元,占市场份额的43%。印刷电子产品与可生物降解基材结合使用时,可提供经济高效且可扩展的解决方案。喷墨、丝网或凹版印刷等技术使製造商能够直接在纤维素薄膜等可堆肥的柔性材料上生产电路,从而降低组装复杂性并减少材料浪费。 2024年,印刷电子产品因其与高通量生产的兼容性以及满足日益增长的可持续包装解决方案需求,成为优先发展领域。

2024年美国可生物降解包装电子产品市场规模为3,660万美元,预计2025年至2034年将以18.1%的复合年增长率成长。美国强劲的需求主要得益于各项旨在促进永续材料管理和减少包装废弃物的措施。由于回收率停滞不前且垃圾掩埋量居高不下,监管策略鼓励采用可堆肥和可回收的包装解决方案,包括整合电子产品。可生物降解的感测器和RFID标籤有助于减少对环境的影响,同时增强包装功能,从而符合国家永续发展目标。

用于包装的生物降解电子产品市场的主要参与者包括BeFC、斯道拉恩索、艾利丹尼森公司、大日本印刷株式会社、LG化学、英飞凌科技与Jiva Materials、PulpaTronics、汉高公司、EcoCortec、巴斯夫公司、PragmatIC Semiconductor、VTT技术研究中心、Emed Electronics Ltd.这些公司正采用创新驱动和协作策略来巩固其市场地位。他们大力投资研发,以开发先进的有机半导体、生物降解基材和自降解电子系统。与包装公司和电子产品製造商的合作有助于整合整个供应链的解决方案。各公司专注于可扩展的製造技术,例如印刷电子技术,以优化成本效益和产量。永续性认证和遵守环境法规是他们优先考虑的事项,以提升信誉和市场认可。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 2024年定价分析

- 按区域和组件

- 原料成本

- 未来市场趋势

- 风险评估与缓解

- 监理合规风险

- 材料约束影响分析

- 技术转型风险

- 价格波动和成本上涨风险

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 可生物降解感测器

- 可生物降解的RFID/NFC标籤

- 可生物降解印刷电子产品

- 可生物降解的能源

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 印刷电子

- 有机电子集成

- 混合无机-有机体系

第七章:市场估计与预测:依材料划分,2021-2034年

- 主要趋势

- 聚合物基材

- 导电材料

- 封装材料

- 功能材料

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 食品和饮料

- 医药和医疗保健

- 消费品

- 电子商务与物流

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十一章:公司简介

- Avery Dennison Corporation

- BASF SE

- BeFC

- Dai Nippon Printing

- Eastman Chemical Company

- EcoCortec

- Empa

- Henkel AG

- Infineon Technologies & Jiva Materials

- LG Chem

- PragmatIC Semiconductor

- Printed Electronics Ltd

- PulpaTronics

- Stora Enso

- VTT Technical Research

The Global Biodegradable Electronics for Packaging Market was valued at USD 210.3 million in 2024 and is estimated to grow at a CAGR of 17.3% to reach USD 992.5 million by 2034.

The market represents a groundbreaking fusion of eco-friendly materials, advanced electronics, and sustainability-driven innovation, fueled by stringent regulatory mandates and corporate commitments to reduce environmental impact. Biodegradable electronics utilize organic semiconductors, bio-based substrates, and transient components that naturally decompose after their operational life, tackling the mounting challenge of electronic waste in packaging. Core materials such as silk proteins, cellulose-based films, and organic photovoltaic cells retain functionality while biodegrading within weeks to months. The market features a dynamic ecosystem of startups, materials firms, electronics manufacturers, and packaging companies collaborating across sectors. Emerging technological pathways include self-assembling systems that adapt performance and degradation timing based on environmental conditions, showcasing the potential of intelligent, sustainable packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $210.3 Million |

| Forecast Value | $992.5 Million |

| CAGR | 17.3% |

In 2024, the biodegradable sensors segment generated USD 85.8 million and is expected to grow at a CAGR of 17.3% through 2034. These sensors are widely adopted across industries for monitoring conditions like temperature, humidity, freshness, and contamination in perishable and sensitive goods. Their ability to naturally degrade after use eliminates the need for collection or recycling, making them ideal for single-use packaging and positioning them as the most commercially scalable component of the biodegradable electronics ecosystem.

The printed electronics segment reached USD 90.3 million, representing a 43% share in 2024. Printed electronics provide cost-effective and scalable solutions when integrated with biodegradable substrates. Techniques such as inkjet, screen, or gravure printing allow manufacturers to directly produce circuits on compostable, flexible materials like cellulose films, reducing assembly complexity and material waste. In 2024, printed electronics were prioritized for their compatibility with high-throughput production while meeting the growing demand for sustainable packaging solutions.

U.S. Biodegradable Electronics for Packaging Market was valued at USD 36.6 million in 2024 and is anticipated to grow at a CAGR of 18.1% from 2025 to 2034. The strong U.S. demand is driven by initiatives promoting sustainable materials management and reducing packaging waste. With stagnant recycling rates and high landfill contributions, regulatory strategies encourage the adoption of compostable and recyclable packaging solutions, including integrated electronics. Biodegradable sensors and RFID tags help reduce environmental impact while enhancing packaging functionality, aligning with national sustainability goals.

Key players in the Biodegradable Electronics for Packaging Market include BeFC, Stora Enso, Avery Dennison Corporation, Dai Nippon Printing, LG Chem, Infineon Technologies & Jiva Materials, PulpaTronics, Henkel AG, EcoCortec, BASF SE, PragmatIC Semiconductor, VTT Technical Research, Printed Electronics Ltd, Eastman Chemical Company, and Empa. Companies in the Biodegradable Electronics for Packaging Market are employing innovation-driven and collaborative strategies to strengthen their market position. They are investing heavily in R&D to develop advanced organic semiconductors, biodegradable substrates, and self-degrading electronic systems. Partnerships with packaging firms and electronics manufacturers facilitate integration of solutions across supply chains. Firms focus on scalable manufacturing techniques like printed electronics to optimize cost-efficiency and throughput. Sustainability certifications and compliance with environmental regulations are prioritized to enhance credibility and market acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Technology trends

- 2.2.3 Material trends

- 2.2.4 End Use Industry trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 Risk-adjusted ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 By region and component

- 3.4.2 Raw material cost

- 3.5 Future market trends

- 3.6 Risk assessment and mitigation

- 3.6.1 Regulatory compliance risks

- 3.6.2 Material constraint impact analysis

- 3.6.3 Technology transition risks

- 3.6.4 Pricing volatility and cost escalation risks

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Biodegradable sensors

- 5.3 Biodegradable RFID/NFC tags

- 5.4 Biodegradable printed electronics

- 5.5 Biodegradable power sources

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Printed electronics

- 6.3 Organic electronics integration

- 6.4 Hybrid inorganic-organic systems

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Polymer substrate materials

- 7.3 Conductive materials

- 7.4 Encapsulation materials

- 7.5 Functional materials

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceutical and healthcare

- 8.4 Consumer goods

- 8.5 E-commerce & logistics

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Avery Dennison Corporation

- 11.2 BASF SE

- 11.3 BeFC

- 11.4 Dai Nippon Printing

- 11.5 Eastman Chemical Company

- 11.6 EcoCortec

- 11.7 Empa

- 11.8 Henkel AG

- 11.9 Infineon Technologies & Jiva Materials

- 11.10 LG Chem

- 11.11 PragmatIC Semiconductor

- 11.12 Printed Electronics Ltd

- 11.13 PulpaTronics

- 11.14 Stora Enso

- 11.15 VTT Technical Research