|

市场调查报告书

商品编码

1871141

基于忆阻器的汽车记忆体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Memristor-Based Automotive Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

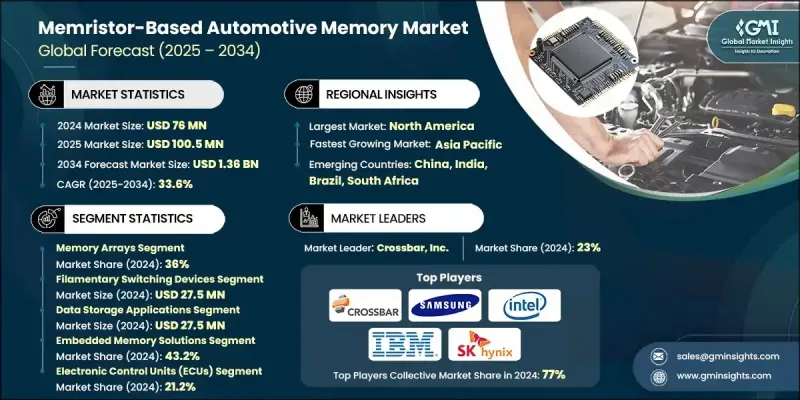

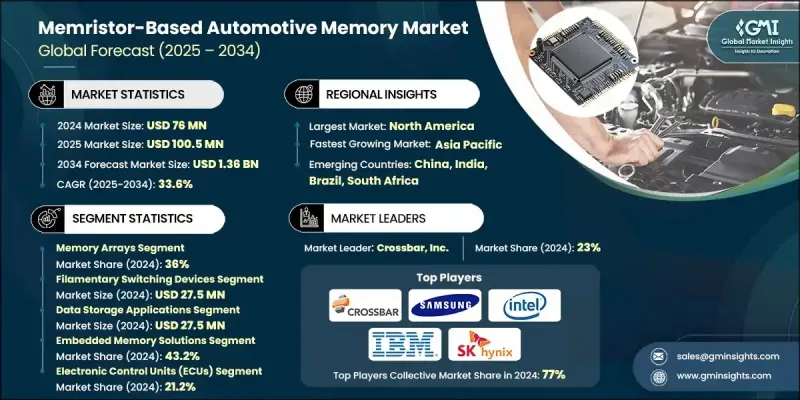

2024 年全球基于忆阻器的汽车记忆体市值为 7,600 万美元,预计到 2034 年将以 33.6% 的复合年增长率增长至 13.6 亿美元。

忆阻器技术和材料的持续进步正在重塑汽车记忆体的格局。电阻开关材料的进步,包括创新的金属氧化物和自旋电子结构,显着提升了忆阻器的性能、耐久性和可扩展性,使其远胜于传统记忆体技术。新的製造流程使得忆阻器能够无缝整合到微控制器和系统单晶片 (SoC) 架构中,从而实现更快的处理速度和更低的延迟。模拟忆阻器的研究进展也使得车辆内部更有效率的即时人工智慧处理成为可能。这些创新正在拓展忆阻器的应用范围,使其从传统的车载系统扩展到先进的自主导航和人工智慧驱动的运算领域,并使其成为下一代汽车记忆体的基石。高级驾驶辅助系统 (ADAS) 和自动驾驶技术的兴起,正在加速快速、节能且非挥发性储存组件的需求。由于这些系统依赖对大量感测器资料的即时分析,忆阻器卓越的速度和低能耗特性使其成为感知、规划和预测系统最佳化等即时决策任务的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7600万美元 |

| 预测值 | 13.6亿美元 |

| 复合年增长率 | 33.6% |

预计到2024年,储存阵列市占率将达到36%,并呈现强劲成长势头,因为连网汽车对紧凑、节能且高容量的资料储存解决方案的需求日益增长。这些储存阵列对于支援现代汽车网路中的资讯娱乐、进阶驾驶辅助系统(ADAS)和边缘运算功能至关重要。製造商正致力于开发可扩展且耐用的阵列,使其在极端温度条件下保持稳定的性能,同时满足严格的汽车可靠性标准。

2024年,丝状开关装置市场规模预计将达2,750万美元。这类装置的快速切换能力、高能源效率和高可靠性是其应用日益广泛的驱动力,使其成为下一代智慧汽车系统的理想选择。丝状开关元件能够实现更快的资料传输、更低的延迟和更高的可靠性,尤其适用于需要即时运算和安全保障的关键车辆应用。其可扩展性和耐久性使其成为未来注重性能和可持续性的汽车电子架构的首选。

2024年,北美忆阻器汽车记忆体市占率达到34.2%。该地区强劲的市场地位得益于自动驾驶和互联汽车的广泛应用、先进的汽车电子产品以及完善的研发基础设施。面向高级驾驶辅助系统(ADAS)、资讯娱乐系统和自动驾驶平台的记忆体技术创新正在推动北美市场的成长。有利的政府政策、完善的基础设施以及消费者对先进汽车技术的早期接受,为忆阻器汽车记忆体解决方案的进一步拓展创造了有利环境。

活跃于忆阻器汽车记忆体市场的主要公司包括英特尔公司、Crossbar公司、富士通有限公司、IBM公司、美光科技公司、SK海力士公司、东芝公司、eMemory Technology公司、索尼公司、瑞萨电子公司、松下控股公司、Weebit Nanom、三星电子有限公司、Rambus Technologies公司、惠普企业(HPE Technologies)公司、三星公司和美国部门。忆阻器汽车记忆体市场的领导者正透过持续的技术创新、产能扩张和策略合作来巩固其市场地位。许多公司正大力投资研发以提升忆阻器的效能,重点在于提高其可扩展性、开关速度和耐久性。与半导体製造商和汽车OEM厂商建立的策略联盟和合作伙伴关係,正帮助他们将忆阻器技术整合到下一代汽车系统中。多家厂商正在开发针对自动驾驶汽车和电动车优化的客製化、节能型记忆体架构。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 忆阻器技术与材料的进步

- 对ADAS和自动驾驶汽车的需求日益增长

- 日益关注能源效率和热管理

- 将边缘运算和物联网技术整合到连网汽车中

- 产业陷阱与挑战

- 高昂的研发和製造成本

- 标准化程度有限,相容性问题

- 市场机会

- 混合记忆体架构的开发

- 针对特定汽车功能的客製化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 记忆体控制器

- 记忆体阵列

- 神经形态处理器

- 安全模组

- 其他的

第六章:市场估算与预测:依技术架构划分,2021-2034年

- 主要趋势

- 丝状开关装置

- 相变记忆体(PCM)

- 磁隧道接面(MTJ)装置

- 铁电储存装置

第七章:市场估计与预测:依功能应用划分,2021-2034年

- 主要趋势

- 资料储存应用程式

- 记忆体计算应用

- 安全性和身份验证应用程式

第八章:市场估算与预测:依整合方法,2021-2034年

- 主要趋势

- 嵌入式储存解决方案

- 离散储存组件

- 混合系统解决方案

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 电子控制单元(ECU)

- 高级驾驶辅助系统(ADAS)

- 自动驾驶系统

- 资讯娱乐系统

- 动力总成控制系统

- 安全系统

- 车身控制系统

- 互联/远端资讯处理系统

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Crossbar, Inc.

- eMemory Technology Inc.

- Everspin Technologies, Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Intel Corporation

- Knowm Inc.

- Micron Technology, Inc.

- Panasonic Holdings Corporation

- Rambus Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics NV

- Toshiba Corporation

- Weebit Nano Ltd.

- Western Digital Corporation

The Global Memristor-Based Automotive Memory Market was valued at USD 76 million in 2024 and is estimated to grow at a CAGR of 33.6% to reach USD 1.36 Billion by 2034.

Continuous advancements in memristor technologies and materials are reshaping the automotive memory landscape. Progress in resistive switching materials, including innovative metal oxides and spintronic structures, has enhanced performance, durability, and scalability, making memristors far more capable than conventional memory technologies. New manufacturing approaches allow seamless integration of memristors into microcontrollers and system-on-chip (SoC) architectures, achieving faster processing and lower latency. Research developments in analog memristors are also enabling more efficient real-time AI processing within vehicles. These innovations are expanding the applications of memristors from traditional in-vehicle systems to advanced autonomous navigation and AI-driven computing, positioning them as a cornerstone of next-generation automotive memory. The rise of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies is accelerating demand for fast, power-efficient, and non-volatile memory components. Since these systems depend on instant analysis of large volumes of sensor data, memristors' superior speed and low energy usage are ideal for real-time decision-making tasks such as perception, planning, and predictive system optimization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76 Million |

| Forecast Value | $1.36 Billion |

| CAGR | 33.6% |

The memory arrays segment held a 36% share in 2024 and is experiencing robust growth as connected vehicles increasingly require compact, energy-saving, and high-capacity data storage solutions. These memory arrays are essential for supporting infotainment, ADAS, and edge computing functions within modern automotive networks. Manufacturers are focusing on developing scalable and durable arrays that maintain consistent performance in extreme temperature conditions while meeting stringent automotive reliability standards.

The filamentary switching devices segment generated USD 27.5 million in 2024. Growing adoption of these devices is driven by their rapid switching capability, energy efficiency, and resilience, which make them ideal for next-generation intelligent automotive systems. Filamentary switching devices enable quicker data transmission, lower latency, and higher reliability in critical vehicle applications, particularly in systems that demand real-time computation and safety assurance. Their scalability and endurance are making them a preferred choice for future automotive electronic architectures focused on performance and sustainability.

North America Memristor-Based Automotive Memory Market held a 34.2% share in 2024. The region's strong presence is supported by widespread adoption of autonomous and connected vehicles, advanced automotive electronics, and extensive R&D infrastructure. Growth opportunities across North America are being fueled by innovation in memory technologies designed for ADAS, infotainment, and autonomous mobility platforms. Favorable government programs, developed infrastructure, and early consumer acceptance of advanced vehicle technologies are creating a fertile environment for further expansion of memristor-based automotive memory solutions.

Major companies active in the Memristor-Based Automotive Memory Market include Intel Corporation, Crossbar, Inc., Fujitsu Ltd., IBM Corporation, Micron Technology, Inc., SK Hynix, Inc., Toshiba Corporation, eMemory Technology Inc., Sony Corporation, Renesas Electronics Corporation, Panasonic Holdings Corporation, Weebit Nano Ltd., Samsung Electronics Co., Ltd., Rambus Inc., Hewlett Packard Enterprise (HPE), STMicroelectronics N.V., Everspin Technologies, Inc., Knowm Inc., and Western Digital Corporation. Leading participants in the Memristor-Based Automotive Memory Market are strengthening their market position through continuous technological innovation, capacity expansion, and strategic collaboration. Many companies are investing heavily in R&D to enhance memristor performance, focusing on improving scalability, switching speed, and endurance. Strategic alliances and partnerships with semiconductor manufacturers and automotive OEMs are helping them integrate memristor technology into next-generation vehicle systems. Several players are developing customized, energy-efficient memory architectures optimized for autonomous and electric vehicles.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vector trends

- 2.2.3 Delivery method trends

- 2.2.4 Gene type trends

- 2.2.5 Indication trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in memristor technology and materials

- 3.2.1.2 Growing demand for ADAS and autonomous vehicles

- 3.2.1.3 Rising focus on energy efficiency and thermal management

- 3.2.1.4 Integration of edge computing and IoT in connected vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Limited standardization and compatibility issues

- 3.2.3 Market opportunities

- 3.2.3.1 Development of hybrid memory architectures

- 3.2.3.2 Customization for specific automotive functions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Memory controllers

- 5.3 Memory arrays

- 5.4 Neuromorphic processors

- 5.5 Security modules

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology Architecture, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Filamentary switching devices

- 6.3 Phase Change Memory (PCM)

- 6.4 Magnetic Tunnel Junction (MTJ) devices

- 6.5 Ferroelectric memory devices

Chapter 7 Market Estimates and Forecast, By Functional Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Data storage applications

- 7.3 In-memory computing applications

- 7.4 Security and authentication applications

Chapter 8 Market Estimates and Forecast, By Integration Approach, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Embedded memory solutions

- 8.3 Discrete memory components

- 8.4 Hybrid system solutions

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Electronic Control Units (ECUs)

- 9.3 Advanced Driver Assistance Systems (ADAS)

- 9.4 Autonomous driving systems

- 9.5 Infotainment systems

- 9.6 Powertrain control systems

- 9.7 Safety systems

- 9.8 Body control systems

- 9.9 Connectivity/telematics systems

- 9.10 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Crossbar, Inc.

- 11.2 eMemory Technology Inc.

- 11.3 Everspin Technologies, Inc.

- 11.4 Fujitsu Ltd.

- 11.5 Hewlett Packard Enterprise (HPE)

- 11.6 IBM Corporation

- 11.7 Intel Corporation

- 11.8 Knowm Inc.

- 11.9 Micron Technology, Inc.

- 11.10 Panasonic Holdings Corporation

- 11.11 Rambus Inc.

- 11.12 Renesas Electronics Corporation

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 SK Hynix, Inc.

- 11.15 Sony Corporation

- 11.16 STMicroelectronics N.V.

- 11.17 Toshiba Corporation

- 11.18 Weebit Nano Ltd.

- 11.19 Western Digital Corporation