|

市场调查报告书

商品编码

1871144

机器人导管导航系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Robotic Catheter Navigation System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

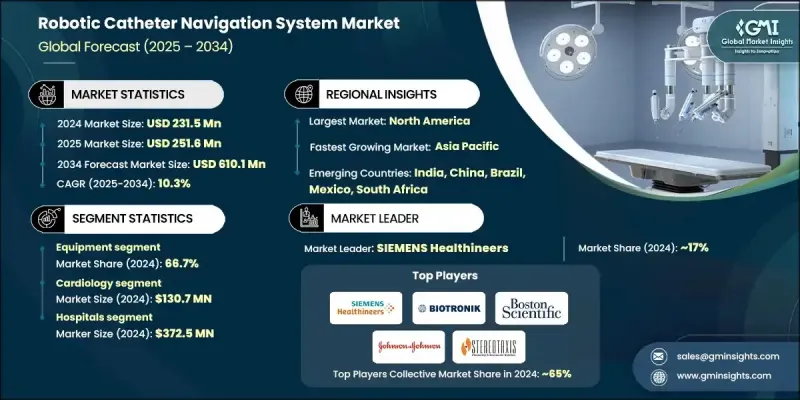

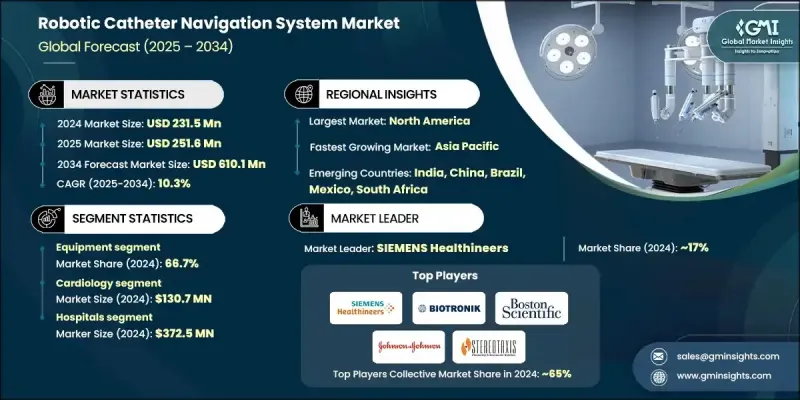

2024 年全球机器人导管导航系统市场价值为 2.315 亿美元,预计到 2034 年将以 10.3% 的复合年增长率增长至 6.101 亿美元。

由于微创手术的日益普及、机器人技术的进步以及心血管和神经系统疾病发病率的上升,市场正蓬勃发展。对介入治疗更高精度、安全性和效率的需求不断增长,也推动了市场成长。机器人导管导航系统使医生能够在复杂手术过程中,利用机械手臂或先进的机电和磁导航系统,以极高的精度远端控制导管。这些技术增强了在复杂解剖路径中导航时的稳定性和精确度。人工智慧、3D视觉化、触觉回馈和即时成像的整合进一步提升了系统的性能,从而改善了手术效果。混合机器人系统的日益普及、在心臟和电生理学领域的应用不断扩展,以及医院与设备製造商之间的合作,都在加速市场渗透。此外,对高性价比医疗保健和先进影像及标测解决方案的关注,也持续影响市场在多个医学领域的演变和应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.315亿美元 |

| 预测值 | 6.101亿美元 |

| 复合年增长率 | 10.3% |

2024年,设备领域占了66.7%的市场。这一主导地位与机器人导航技术的持续进步、微创手术的日益普及以及对精准成像和定位技术的日益依赖密切相关。製造商不断升级机器人平台,以增强导管的操控性、灵活性和即时反应能力,从而改善手术效果和成功率,尤其是在复杂的血管环境中。

2024年,心臟病学应用领域的市场规模为1.307亿美元,预计2025年至2034年间将以10.4%的复合年增长率成长。由于全球范围内心律不整及相关疾病的盛行率不断上升,心臟病学领域占据了最大的市场份额。机器人导管系统在消融治疗中展现出卓越的精准度,确保导管的准确定位,减少治疗误差,并改善患者预后。治疗心律不整精准度的提升促使这些系统在介入性心臟病学领域得到更广泛的临床应用。

2024年,美国机器人导管导航系统市场规模预估为9,030万美元。美国拥有先进的医疗基础设施、广泛的机器人辅助系统应用,以及许多科研机构和专科医院,这些优势使其在医疗领域中占有优势。这些医疗机构配备了高端的影像、定位和导航工具,能够更精准、更安全地完成复杂的介入手术。医院能力的不断提升以及患者对先进机器人治疗日益增长的需求,进一步推动了该地区的市场扩张。

全球机器人导管导航系统市场的主要参与者包括强生、波士顿科学、Stereotaxis、西门子医疗、百多力、微创医疗、Robocath、泰尔茂、直觉外科、Catheter Precision、MAGNETECS 和 ClearPoint Neuro。这些市场领导者正透过创新、策略联盟和产品组合拓展等方式巩固其市场地位。持续的研发投入推动了先进机器人系统的研发,这些系统具有更高的精度、更强大的影像整合能力和基于人工智慧的导航功能。各公司正与医院和研究中心合作,测试并推广针对心臟病学和神经病学应用优化的下一代系统。策略併购和技术合作正帮助企业拓展其全球业务版图和产品线。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 心血管疾病盛行率不断上升

- 对微创手术的需求不断增长

- 机器人引导系统的技术进步

- 在电生理学和介入性心臟病学领域日益普及

- 产业陷阱与挑战

- 机器人导航系统成本高

- 复杂的安装和整合要求

- 市场机会

- 新兴国家的采用率不断提高

- 神经病学和肿瘤学干预措施的扩展

- 成长驱动因素

- 成长潜力分析

- 报销方案

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 消费者洞察

- 未来市场趋势

- 价值链分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 装置

- 磁导航系统

- 机电导航系统

- 配件

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 心臟病学

- 神经病学

- 泌尿科

- 胃肠病学

- 其他应用

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- BIOTRONIK

- Boston Scientific

- Catheter Precision

- ClearPoint Neuro

- Intuitive Surgical

- Johnson & Johnson

- MAGNETECS

- MicroPort

- Robocath

- SIEMENS Healthineers

- STEREOTAXIS

- TERUMO

The Global Robotic Catheter Navigation System Market was valued at USD 231.5 million in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 610.1 million by 2034.

The market is gaining momentum due to the rising preference for minimally invasive surgical procedures, advancements in robotic technologies, and growing incidences of cardiovascular and neurological conditions. The increasing demand for higher precision, safety, and efficiency in interventional treatments is also propelling market growth. Robotic catheter navigation systems enable physicians to remotely control catheters with exceptional accuracy during complex procedures, using robotic arms or advanced electromechanical and magnetic guidance systems. These technologies enhance stability and precision when navigating intricate anatomical pathways. Integration of artificial intelligence, 3D visualization, haptic feedback, and real-time imaging has further elevated the system's capabilities, leading to improved procedural outcomes. The growing adoption of hybrid robotic systems, expanding use in cardiac and electrophysiology applications, and collaborations between hospitals and device manufacturers are accelerating market penetration. Moreover, the focus on cost-effective healthcare and advanced imaging and mapping solutions continues to shape the market's evolution and adoption across multiple medical disciplines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $231.5 Million |

| Forecast Value | $610.1 Million |

| CAGR | 10.3% |

In 2024, the equipment segment held 66.7% share. This dominance is linked to the continuous technological progress in robotic navigation, increased usage of minimally invasive procedures, and growing reliance on precise imaging and mapping technologies. Manufacturers are consistently upgrading robotic platforms to enhance catheter maneuverability, flexibility, and real-time response capabilities, which in turn improve procedural outcomes and success rates, especially in challenging vascular environments.

The cardiology application segment was valued at USD 130.7 million in 2024, and is projected to grow at a CAGR of 10.4% during 2025-2034. Cardiology represents the largest share due to the increasing prevalence of cardiac arrhythmias and related disorders worldwide. Robotic catheter systems offer exceptional precision during ablation therapies, ensuring accurate positioning of catheters, reducing treatment errors, and improving patient outcomes. The enhanced accuracy in treating arrhythmias has led to broader clinical adoption of these systems in interventional cardiology.

United States Robotic Catheter Navigation System Market was valued at USD 90.3 million in 2024. The country benefits from advanced healthcare infrastructure, extensive adoption of robotic-assisted systems, and strong presence of research institutions and specialty hospitals. These facilities integrate high-end imaging, mapping, and navigation tools, which facilitate complex interventional procedures with improved precision and patient safety. The continuous upgrade of hospital capabilities and increased patient preference for advanced robotic treatments are further contributing to market expansion across the region.

Key companies active in the Global Robotic Catheter Navigation System Market include Johnson & Johnson, Boston Scientific, Stereotaxis, Siemens Healthineers, BIOTRONIK, MicroPort, Robocath, Terumo, Intuitive Surgical, Catheter Precision, MAGNETECS, and ClearPoint Neuro. Leading players in the Robotic Catheter Navigation System Market are adopting a combination of innovation, strategic alliances, and portfolio expansion to strengthen their market position. Continuous investments in research and development are driving the creation of advanced robotic systems with enhanced precision, imaging integration, and AI-based navigation capabilities. Companies are collaborating with hospitals and research centers to test and commercialize next-generation systems optimized for cardiology and neurology applications. Strategic mergers, acquisitions, and technology partnerships are helping firms expand their global footprint and product offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular disorders

- 3.2.1.2 Rising demand for minimally invasive surgeries

- 3.2.1.3 Technological advancements in robotic guidance systems

- 3.2.1.4 Growing adoption in electrophysiology and interventional cardiology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of robotic navigation systems

- 3.2.2.2 Complex installation and integration requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in emerging countries

- 3.2.3.2 Expansion in neurology and oncology interventions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Value chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.2.1 Magnetic navigation systems

- 5.2.2 Electromechanical navigation systems

- 5.3 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiology

- 6.3 Neurology

- 6.4 Urology

- 6.5 Gastroenterology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BIOTRONIK

- 9.2 Boston Scientific

- 9.3 Catheter Precision

- 9.4 ClearPoint Neuro

- 9.5 Intuitive Surgical

- 9.6 Johnson & Johnson

- 9.7 MAGNETECS

- 9.8 MicroPort

- 9.9 Robocath

- 9.10 SIEMENS Healthineers

- 9.11 STEREOTAXIS

- 9.12 TERUMO