|

市场调查报告书

商品编码

1871146

消费性电子充电线市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Consumer Electronics Charging Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

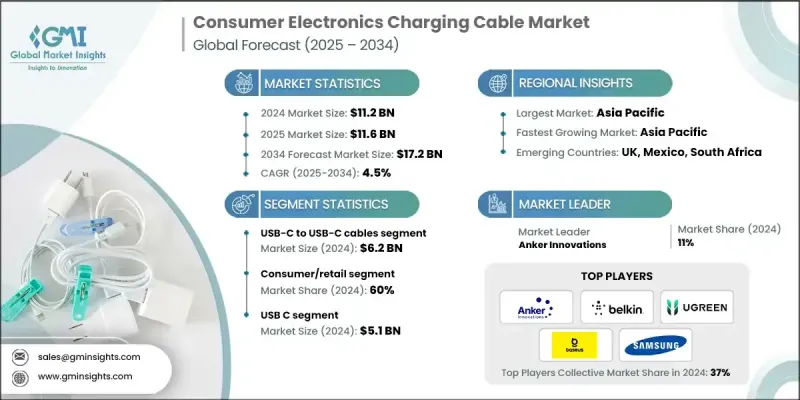

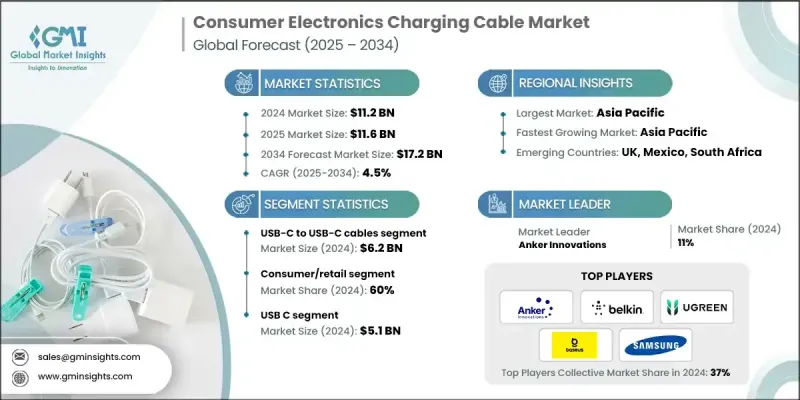

2024 年全球消费性电子充电线市场价值为 112 亿美元,预计到 2034 年将以 4.5% 的复合年增长率增长至 172 亿美元。

随着消费者对智慧型手机、平板电脑、笔记型电脑和穿戴式装置等智慧型装置的依赖日益加深,市场正在快速发展。使用者现在需要快速、耐用且功能多样的充电解决方案,这促使製造商不断创新,例如采用加固型连接器、编织外壳和USB-C相容性等功能。日益增强的环保意识正在影响产品设计,鼓励品牌使用可回收材料,并透过减少包装和去除不必要的配件来减少浪费。为了解决消费者对产品寿命短和线堆积过多的不满,企业正在推出多功能充电解决方案并提供保固服务。智慧型手机普及率高的地区,例如亚太地区和北美,需求强劲,而新兴市场正在迅速追赶。电子商务的兴起正在重塑消费者的购买习惯,网路评论和网红推荐的角色日益重要。便利性和明智的购买决策正成为市场动态的核心,推动创新和差异化竞争。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 112亿美元 |

| 预测值 | 172亿美元 |

| 复合年增长率 | 4.5% |

2024年,消费/零售领域占60%的市场。该领域受益于智慧型手机普及率的提高、电子产品的广泛应用以及充电基础设施的不断改进。它涵盖消费性电子产品、零售以及平板电脑、笔记型电脑、游戏设备和音讯配件等设备的售后替换市场。

预计到2024年,USB-C介面市场规模将达51亿美元。 USB-C因其通用相容性、正反可插设计、增强的供电能力和多功能连接性而备受青睐。监管机构为实现标准化所做的努力,以及消费者对简化充电解决方案的需求,预计将进一步推动USB-C的普及和利润成长。

2024年,美国消费性电子充电线市场占74.7%的市场份额,市场规模达24亿美元。消费者对高端产品的高支付意愿以及对新型充电技术的快速接受,巩固了北美作为成长引擎的地位。在美国,市场对快速充电线、多功能解决方案以及相容于不同设备生态系统的高阶配件的需求强劲,凸显了该地区在全球趋势塑造中的作用。

全球消费性电子充电线市场的主要参与者包括 Belkin International、Native Union、Mophie Inc.、Apple Inc.、Cable Matters、三星电子、Anker Innovations、RAVPower、UGREEN、Baseus、JSAUX、Satechi Corporation、Aukey Technology 和小米集团。这些企业正透过加大研发投入,开发耐用、多功能且支援快速充电的充电线,进而巩固其市场地位。与设备製造商和电商平台建立策略合作伙伴关係,有助于扩大分销管道并提升品牌知名度。此外,各公司也积极进行以永续性、优质材料和便利性为核心的行销活动。丰富产品组合以满足不同设备生态系统的需求、提供保固服务以及确保符合监管要求,都有助于增强客户信任。同时,连接器、编织设计以及 USB-C 标准化的技术创新,也有助于企业在全球脱颖而出,保持竞争优势。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 互联设备生态系的扩展

- 对快速充电解决方案的需求

- USB-C 标准在各种装置上已广泛应用

- 产业陷阱与挑战

- 耐用性有限,电缆故障频繁

- 市场上充斥着假冒伪劣产品

- 机会

- 开发环保可回收电缆解决方案

- 充电线整合智慧功能

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- USB-C 转 USB-C 连接线

- USB-A 转 USB-C 连接线

- USB-C 转 Lightning 线

- USB-A 转 Lightning 线

- Micro-USB 线

第六章:市场估算与预测:依连接器类型划分,2021-2034年

- 主要趋势

- USB C

- 闪电

- Micro USB

- 所有权

第七章:市场估算与预测:依功率输出能力划分,2021-2034年

- 主要趋势

- 标准功率(<15W)

- 快速充电(15W 至 <60W)

- 高功率(60W 至 <100W)

- 扩展功率范围(100W 至 240W)

第八章:市场估算与预测:依资料传输能力划分,2021-2034年

- 主要趋势

- 仅供充电的线缆

- USB 2.0资料

- USB 3.x资料

- USB4/雷电线缆

第九章:市场估计与预测:按应用领域划分 2021-2034 年

- 主要趋势

- 智慧型手机充电

- 平板电脑和电子阅读器充电

- 笔记型电脑充电

- 相机充电

- 耳机充电

- 游戏机充电

- 音讯设备充电

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 消费品/零售

- 汽车产业

- 医疗保健产业

- 教育产业

- 饭店及旅游业

- 企业/公司

第十一章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 线上零售通路

- 电子产品专卖店

- 行动网路营运商

- 一般零售通路

- OEM捆绑销售

第十二章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Anker Innovations

- Belkin International

- Samsung Electronics

- UGREEN

- Baseus

- Apple Inc.

- Native Union

- Satechi Corporation

- Aukey Technology

- Mophie Inc.

- JSAUX

- Xiaomi Corporation

- Cable Matters

- Sony Corporation

- RAVPower

The Global Consumer Electronics Charging Cable Market was valued at USD 11.2 Billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 17.2 Billion by 2034.

The market is rapidly evolving as consumers increasingly rely on smart devices, including smartphones, tablets, laptops, and wearables. Users now demand fast, durable, and versatile charging solutions, prompting manufacturers to innovate with features such as reinforced connectors, braided exteriors, and USB-C compatibility. Growing environmental awareness is influencing product design, encouraging brands to use recyclable materials and reduce waste by minimizing packaging and eliminating unnecessary accessories. To address consumer frustrations with short-lived products and excessive cable accumulation, companies are introducing multifunction charging solutions and offering warranties. Regions with high smartphone penetration, such as Asia-Pacific and North America, show strong demand, while emerging markets are quickly catching up. The rise of e-commerce is reshaping consumer purchasing habits, with online reviews and influencer recommendations playing an increasingly important role. Convenience and informed buying decisions are becoming central to market dynamics, driving both innovation and competitive differentiation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $17.2 Billion |

| CAGR | 4.5% |

In 2024, the consumer/retail segment held 60% share in 2024. This segment benefits from growing smartphone adoption, widespread electronics use, and the expanding availability of charging infrastructure. It encompasses consumer electronics, retail, and aftermarket replacements for devices including tablets, laptops, gaming devices, and audio accessories.

The USB-C connectors segment generated USD 5.1 Billion in 2024. USB-C is favored for its universal compatibility, reversible design, enhanced power delivery, and multipurpose connectivity. Regulatory efforts toward standardization, combined with consumer demand for simplified charging solutions, are expected to further boost USB-C adoption and margins.

U.S. Consumer Electronics Charging Cable Market held 74.7% share and generated USD 2.4 Billion in 2024. High consumer willingness to pay for premium products and rapid adoption of new charging technologies reinforce North America's position as a growth driver. In the U.S., there is strong demand for fast-charging cables, multifunction solutions, and premium accessories compatible with diverse device ecosystems, underscoring the region's role in shaping global trends.

Key players in the Global Consumer Electronics Charging Cable Market include Belkin International, Native Union, Mophie Inc., Apple Inc., Cable Matters, Samsung Electronics, Anker Innovations, RAVPower, UGREEN, Baseus, JSAUX, Satechi Corporation, Aukey Technology, and Xiaomi Corporation. Companies in the Consumer Electronics Charging Cable Market are strengthening their foothold through strategies such as investing in R&D to develop durable, multifunctional, and fast-charging cables. Strategic partnerships with device manufacturers and e-commerce platforms expand distribution and brand visibility. Firms are also leveraging marketing campaigns focused on sustainability, premium materials, and consumer convenience. Diversifying product portfolios to cater to multiple device ecosystems, offering warranties, and ensuring regulatory compliance enhance customer trust. Additionally, technological innovation in connectors, braided designs, and USB-C standardization helps companies differentiate and maintain a competitive edge globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Connector type

- 2.2.4 Power delivery capability

- 2.2.5 Data transfer capability

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of connected device ecosystem

- 3.2.1.2 Demand for fast-charging solutions

- 3.2.1.3 Widespread USB-C standardization across devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Limited durability and frequent cable failures

- 3.2.2.2 Market saturation with counterfeit and low-quality products

- 3.2.3 Opportunities

- 3.2.3.1 Development of eco-friendly and recyclable cable solutions

- 3.2.3.2 Integration of smart features in charging cables

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 USB-C to USB-C Cables

- 5.3 USB-A to USB-C Cables

- 5.4 USB-C to Lightning Cables

- 5.5 USB-A to Lightning Cables

- 5.6 Micro-USB Cables

Chapter 6 Market Estimates and Forecast, By Connector Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 USB C

- 6.3 Lightning

- 6.4 Micro USB

- 6.5 Proprietary

Chapter 7 Market Estimates and Forecast, By Power Delivery Capability, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Standard power (<15W)

- 7.3 Fast charging (15W to <60W)

- 7.4 High power (60W to <100W)

- 7.5 Extended power range (100W to 240W)

Chapter 8 Market Estimates and Forecast, By Data Transfer Capability, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Charging-only cables

- 8.3 USB 2.0 data cables

- 8.4 USB 3.x data cables

- 8.5 USB4/thunderbolt cables

Chapter 9 Market Estimates and Forecast, By Application 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Smartphone charging

- 9.3 Tablet & e-reader charging

- 9.4 Laptop charging

- 9.5 Camera charging

- 9.6 Earbud charging

- 9.7 Gaming console charging

- 9.8 Audio device charging

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Consumer/retail

- 10.3 Automotive industry

- 10.4 Healthcare industry

- 10.5 Education industry

- 10.6 Hospitality & travel industry

- 10.7 Corporate/enterprise

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online retail channel

- 11.3 Electronics specialty stores

- 11.4 Mobile network operators

- 11.5 General retail channels

- 11.6 OEM bundled sales

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Anker Innovations

- 13.2 Belkin International

- 13.3 Samsung Electronics

- 13.4 UGREEN

- 13.5 Baseus

- 13.6 Apple Inc.

- 13.7 Native Union

- 13.8 Satechi Corporation

- 13.9 Aukey Technology

- 13.10 Mophie Inc.

- 13.11 JSAUX

- 13.12 Xiaomi Corporation

- 13.13 Cable Matters

- 13.14 Sony Corporation

- 13.15 RAVPower