|

市场调查报告书

商品编码

1871159

奈米材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Nanomaterials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

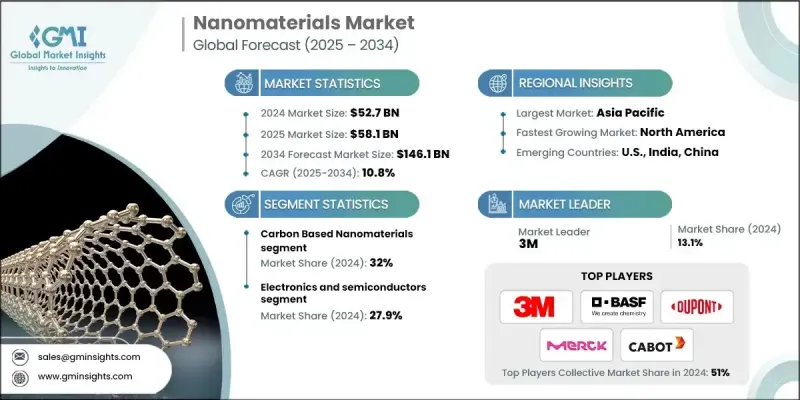

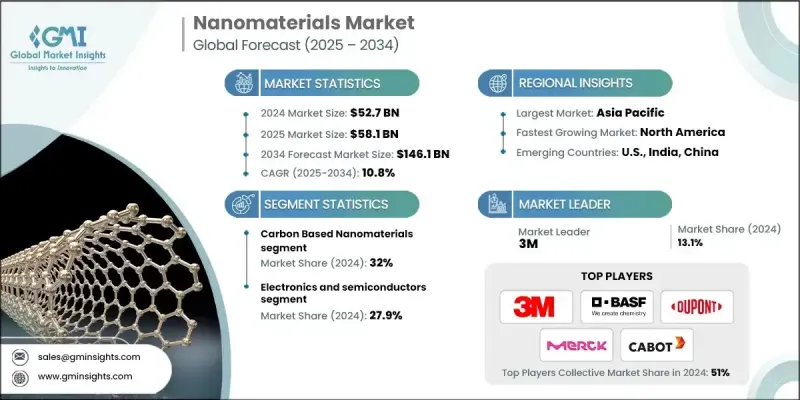

2024年全球奈米材料市场价值为527亿美元,预计2034年将以10.8%的复合年增长率成长至1,461亿美元。

电子、能源、医疗保健和环境技术等各领域对奈米材料的需求激增,正推动奈米材料市场的强劲成长。这些先进材料正在革新产品设计和性能,其优势往往远远超出成本和认证方面的挑战。奈米材料在关键基础设施、再生能源系统和先进疗法中的应用日益广泛,进一步拓展了其商业潜力。随着各种应用不断涌现,预计整个产业对生产能力的投资将保持强劲势头。监管方面的进展,尤其是在医疗保健和医疗应用领域,有望加速奈米材料的应用。此外,碳基材料和量子材料的突破性进展正在推动大规模商业化,试点计画正逐步过渡到全面生产。总而言之,材料创新提升了多个行业的性能、永续性和功能性,从而推动了市场的演进。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 527亿美元 |

| 预测值 | 1461亿美元 |

| 复合年增长率 | 10.8% |

奈米材料与5G网路、人工智慧和高密度物联网(IoT)生态系统等先进技术的融合正在重塑产业格局。这些材料对于提升下一代装置的载子迁移率、导电性和热管理至关重要。它们在高温下高效运作的能力有助于半导体尺寸缩小和散热技术的进步。在医疗保健领域,奈米材料越来越多地用于靶向药物递送,透过将治疗药物直接输送到受影响的细胞或组织,实现精准医疗。这些优势正推动奈米材料在肿瘤学、免疫学和传染病治疗领域的应用日益广泛。

预计到2024年,碳基奈米材料市占率将达到32%。这些材料在半导体製造、复合材料和储能係统等领域有广泛的应用。化学气相沉积、取向控制和纯化等製程技术的进步显着提升了材料的电学和热学性能,同时降低了生产成本和缺陷率。因此,碳奈米材料在电子和工业製造领域的应用日益广泛。

2024年,电子和半导体领域占据了27.9%的市场。由于对更小、更快、更节能的电子元件的需求不断增长,其应用也持续扩大。奈米材料对于电路的小型化和导电性提升至关重要,尤其是在5G、边缘运算和人工智慧设备领域。这些材料并非取代传统的铜或硅,而是透过解决互连电阻、散热瓶颈和柔性等对下一代电子设备至关重要的因素,来增强现有架构。

2024年美国奈米材料市场规模为125亿美元,预计2034年将达346亿美元。这一增长势头得益于政府透过国家倡议进行的强有力的协调,以及促进产业规模化生产的活跃资本市场。该地区在奈米医学、半导体和先进材料研发领域的领先地位,加速了从实验室创新到大规模商业化的转化。在加拿大,重点仍然是支持清洁能源和环境应用的可持续奈米材料解决方案,这反映了向生态高效技术发展的更广泛趋势。

全球奈米材料市场的主要参与者包括巴斯夫、3M、杜邦、卡博特、默克、Nanoco Technologies 和 Nanosys。为了巩固市场地位,奈米材料产业的公司正在采取多种策略措施。他们优先考虑大规模研发投资,以提高产品效率、降低生产成本,并满足电子、医疗保健和能源等终端用户产业不断变化的需求。各公司正与技术提供者和研究机构建立策略合作伙伴关係和合作,以加速产品创新和商业化。此外,对永续性和合规性的关注度也日益提高,推动了环保材料和更安全生产方法的发展。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依产品类型划分,2021-2034年

- 主要趋势

- 碳基奈米材料

- 单壁奈米碳管

- 多壁碳奈米管

- 石墨烯及石墨烯衍生物

- 富勒烯和碳奈米球

- 碳奈米纤维

- 金属氧化物奈米颗粒

- 二氧化钛(TiO2)奈米颗粒

- 氧化锌(ZnO)奈米颗粒

- 二氧化硅(SiO2)奈米颗粒

- 氧化铈(CeO2)奈米颗粒

- 氧化铁奈米颗粒

- 量子点和半导体奈米晶体

- 聚合物奈米粒子

- 基于脂质的奈米颗粒

- 零价金属奈米粒子

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 电子与半导体

- 导电油墨和涂料

- 储存设备和资料存储

- 感测器和探测器

- 显示技术

- 医疗保健和生物医学

- 药物输送系统

- 医学影像与诊断

- 再生医学

- 抗菌应用

- 化妆品及个人护理

- 紫外线防护与防晒霜

- 抗老与护肤

- 彩妆

- 能源与环境

- 太阳能电池和光伏电池

- 储能係统

- 催化剂和燃料电池

- 水处理与净化

- 涂层和表面处理

- 保护涂层

- 自清洁表面

- 抗菌涂层

- 纺织品和布料

- 功能性纺织品

- 智慧布料

- 防护服

第七章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 化学製造

- 特种化学品

- 工业化学品

- 催化剂和添加剂

- 电子与电脑製造

- 半导体製造

- 电子元件

- 印刷电路板

- 製药与生物技术

- 药物製剂与递送

- 医疗器材製造

- 诊断系统

- 汽车与运输

- 轻质材料

- 涂层和表面处理

- 感测器和电子元件

- 建筑材料

- 混凝土和水泥添加剂

- 绝缘材料

- 保护涂层

- 研究与开发服务

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- 3M

- BASF

- DuPont de Nemours

- Merck

- Cabot Corporation

- Nanosys

- Nanoco Technologies

- OCSiAl Group

- Advanced Nano Products

- Strem Chemicals

- UbiQD

- NN-Labs

- Particular Materials

The Global Nanomaterials Market was valued at USD 52.7 Billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 146.1 Billion by 2034.

The surging demand for nanoscale materials across sectors such as electronics, energy, healthcare, and environmental technology is fueling robust market growth. These advanced materials are revolutionizing product design and performance, with benefits that often outweigh the challenges associated with cost and certification. The growing use of nanomaterials in critical infrastructure, renewable energy systems, and advanced therapeutics is broadening their commercial potential. As diverse applications continue to emerge, investment in production capabilities is expected to remain strong across the industry. Regulatory progress, especially in healthcare and medical applications, is likely to accelerate the adoption of nanomaterials. Additionally, breakthroughs in carbon-based and quantum materials are driving mass-scale commercialization as pilot programs transition into full-scale manufacturing. Overall, the market's evolution is supported by material innovations that enhance performance, sustainability, and functionality across multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.7 Billion |

| Forecast Value | $146.1 Billion |

| CAGR | 10.8% |

The convergence of nanomaterials with advanced technologies such as 5G networks, artificial intelligence, and dense Internet of Things (IoT) ecosystems is reshaping the industry landscape. These materials are essential for improving carrier mobility, conductivity, and thermal management in next-generation devices. Their ability to operate efficiently at high temperatures supports advancements in semiconductor scaling and heat dissipation. In healthcare, nanomaterials are increasingly used in targeted drug delivery, enabling precision medicine by transporting therapeutic agents directly to affected cells or tissues. Such capabilities are driving their growing adoption in oncology, immunology, and infectious disease treatment.

The carbon-based nanomaterials segment held a 32% share in 2024. These materials are finding widespread applications in semiconductor fabrication, composites, and energy storage systems. Technological advances in processes such as chemical vapor deposition, alignment control, and purification are significantly improving electrical and thermal properties while reducing production costs and defect rates. As a result, carbon nanomaterials are increasingly being utilized for high-volume electronic and industrial manufacturing.

The electronics and semiconductor segment held a 27.9% share in 2024. Their adoption continues to rise due to the demand for smaller, faster, and more energy-efficient electronic components. Nanomaterials are vital to the miniaturization and improved conductivity of circuits, particularly in 5G, edge computing, and AI-based devices. Rather than replacing traditional copper or silicon, these materials enhance existing architectures by addressing limitations in interconnect resistance, thermal bottlenecks, and flexibility factors critical to next-generation electronic devices.

U.S. Nanomaterials Market was valued at USD 12.5 Billion in 2024 and is estimated to reach USD 34.6 Billion by 2034. This momentum is supported by strong government coordination through national initiatives and an active capital market that promotes industrial scale-up. The region's leadership in nanomedicine, semiconductors, and advanced material R&D has accelerated the transition from laboratory innovation to large-scale commercial production. In Canada, the focus remains on sustainable nanomaterial solutions that support clean energy and environmental applications, reflecting a broader trend toward eco-efficient technologies.

Leading players in the Global Nanomaterials Market include BASF, 3M, DuPont de Nemours, Cabot Corporation, Merck, Nanoco Technologies, and Nanosys. To strengthen their market position, companies in the nanomaterials industry are employing several strategic approaches. They are prioritizing large-scale R&D investments to enhance product efficiency, reduce production costs, and meet the evolving requirements of end-use industries such as electronics, healthcare, and energy. Firms are entering strategic partnerships and collaborations with technology providers and research institutions to accelerate product innovation and commercialization. The focus on sustainability and regulatory compliance has also intensified, prompting the development of eco-friendly materials and safer production methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Application

- 2.2.3 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Carbon-based nanomaterials

- 5.2.1 Single-walled carbon nanotubes

- 5.2.2 Multi-walled carbon nanotubes

- 5.2.3 Graphene & graphene derivatives

- 5.2.4 Fullerenes & carbon nanospheres

- 5.2.5 Carbon nanofibers

- 5.3 Metal oxide nanoparticles

- 5.3.1 Titanium dioxide (TiO2) nanoparticles

- 5.3.2 Zinc oxide (ZnO) nanoparticles

- 5.3.3 Silicon dioxide (SiO2) nanoparticles

- 5.3.4 Cerium oxide (CeO2) nanoparticles

- 5.3.5 Iron oxide nanoparticles

- 5.4 Quantum dots & semiconductor nanocrystals

- 5.5 Polymeric nanoparticles

- 5.6 Lipid-based nanoparticles

- 5.7 Zero-valent metal nanoparticles

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Electronics & semiconductors

- 6.2.1 Conductive inks & coatings

- 6.2.2 Memory devices & data storage

- 6.2.3 Sensors & detectors

- 6.2.4 Display technologies

- 6.3 Healthcare & biomedical

- 6.3.1 Drug delivery systems

- 6.3.2 Medical imaging & diagnostics

- 6.3.3 Regenerative medicine

- 6.3.4 Antimicrobial applications

- 6.4 Cosmetics & personal care

- 6.4.1 UV protection & sunscreens

- 6.4.2 Anti-aging & skin care

- 6.4.3 Color cosmetics

- 6.5 Energy & environment

- 6.5.1 Solar cells & photovoltaics

- 6.5.2 Energy storage systems

- 6.5.3 Catalysts & fuel cells

- 6.5.4 Water treatment & purification

- 6.6 Coatings & surface treatments

- 6.6.1 Protective coatings

- 6.6.2 Self-cleaning surfaces

- 6.6.3 Antimicrobial coatings

- 6.7 Textiles & fabrics

- 6.7.1 Functional textiles

- 6.7.2 Smart fabrics

- 6.7.3 Protective clothing

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Chemical manufacturing

- 7.2.1 Specialty chemicals

- 7.2.2 Industrial chemicals

- 7.2.3 Catalysts & additives

- 7.3 Electronics & computer manufacturing

- 7.3.1 Semiconductor fabrication

- 7.3.2 Electronic components

- 7.3.3 Printed circuit boards

- 7.4 Pharmaceutical & biotechnology

- 7.4.1 Drug formulation & delivery

- 7.4.2 Medical device manufacturing

- 7.4.3 Diagnostic systems

- 7.5 Automotive & transportation

- 7.5.1 Lightweight materials

- 7.5.2 Coatings & surface treatments

- 7.5.3 Sensors & electronics

- 7.6 Construction & building materials

- 7.6.1 Concrete & cement additives

- 7.6.2 Insulation materials

- 7.6.3 Protective coatings

- 7.7 Research & development services

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 BASF

- 9.3 DuPont de Nemours

- 9.4 Merck

- 9.5 Cabot Corporation

- 9.6 Nanosys

- 9.7 Nanoco Technologies

- 9.8 OCSiAl Group

- 9.9 Advanced Nano Products

- 9.10 Strem Chemicals

- 9.11 UbiQD

- 9.12 NN-Labs

- 9.13 Particular Materials