|

市场调查报告书

商品编码

1871161

mRNA疗法市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)mRNA Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

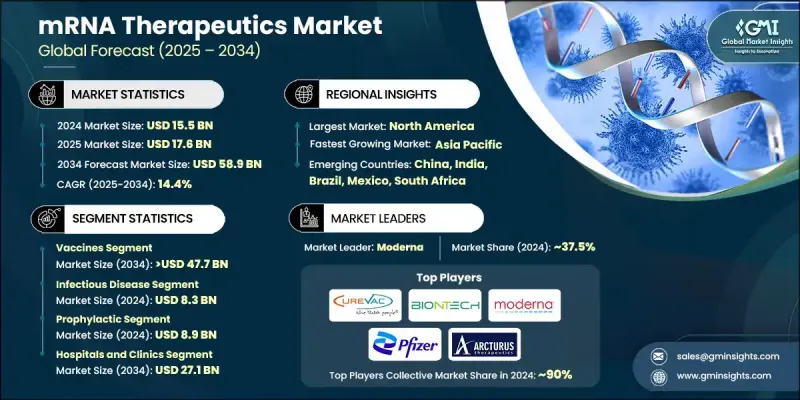

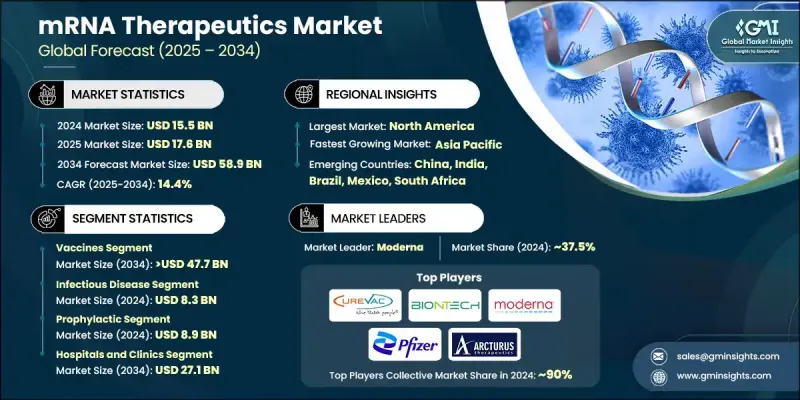

2024 年全球 mRNA 疗法市场价值为 155 亿美元,预计到 2034 年将以 14.4% 的复合年增长率增长至 589 亿美元。

信使RNA (mRNA) 平台的技术突破以及医疗专业人员和监管机构对其临床潜力的日益增长的信心,推动了mRNA疗法的快速增长。近年来,mRNA已被证明能够实现可扩展、灵活且高效的药物研发流程。脂质奈米颗粒 (LNP) 递送系统的重大进步,透过解决降解和免疫反应方面的挑战,进一步提高了mRNA分子的精准性、安全性和生物利用度。 mRNA技术最初专注于预防传染病,如今正越来越多地应用于治疗慢性复杂疾病,包括心血管疾病、自体免疫疾病和罕见遗传性疾病。其独特的编码体内特定蛋白质的能力,使得标靶和个人化治疗成为可能,从而重塑了现代医学的未来。这种变革性的方法使mRNA疗法成为生物技术领域成长最快的领域之一,加速了全球製药和生物製药产业的创新进程。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 589亿美元 |

| 复合年增长率 | 14.4% |

2024年,疫苗领域占据81.9%的市场份额,预计到2034年将达到477亿美元,2025年至2034年间的复合年增长率(CAGR)为14.3%。无细胞合成技术的高效性推动了该领域的扩张,与传统疫苗相比,该技术缩短了生产时间。 mRNA疫苗能够快速调整配方以应对新出现的变异株或病原体,使其具有高度的通用性。模组化生产装置和脂质奈米颗粒系统的持续创新进一步提升了产品的稳定性、可扩展性和成本效益,从而增强了其全球可及性。

到2034年,mRNA治疗领域将以14.6%的复合年增长率成长,这主要得益于mRNA技术在癌症、自体免疫疾病和遗传性疾病治疗中日益广泛的应用。与传统生物製剂不同,基于mRNA的药物无需改变患者的DNA即可暂时表达治疗性蛋白,从而提高了安全性和灵活性。研究和临床试验资金的增加拓宽了mRNA疗法的研发管线,吸引了许多渴望利用这一前景广阔的平台的製药和生物技术公司。

2024年,北美mRNA疗法市场占42.4%的份额。该地区的领先地位归功于其先进的研发能力、强大的生物技术基础设施以及众多拥有庞大生产和临床试验能力的全球主要企业。北美完善的医疗保健生态系统,包括领先的医院、诊所和学术研究中心,为mRNA产品的生产和应用提供了强有力的支持。对个人化医疗的大力投入、先进的冷链物流以及广泛的监管支持,进一步巩固了该地区的市场主导地位和持续成长。

全球mRNA疗法市场的主要参与者包括Moderna、辉瑞、BioNTech、葛兰素史克、CureVac、阿斯特捷利康、Translate Bio、赛诺菲、Arcturus Therapeutics、Ethris、Chimeron Bio、Tiba Biotech、VaxEquity、Immorna Biotech和StemiRNA Therapeutics。这些企业正致力于扩大产能、推动递送技术并加强全球供应链。製药公司和生物技术公司之间的策略合作正在加速研究成果转化并扩大临床试验的发展。各公司正大力投资下一代脂质奈米颗粒系统,以提高递送精度并降低免疫原性。产品线多角化,拓展至肿瘤、心血管和罕见疾病领域,也是实现长期成长的核心策略。许多企业正在采用模组化和自动化生产工艺,以降低成本并提高规模化生产能力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 配送技术的进步

- 拓展疫苗以外的应用

- 对生物技术研发的投资不断成长

- 更快、可扩展的製造

- 产业陷阱与挑战

- 免疫原性和安全性问题

- 製造和可扩展性问题

- 市场机会

- 拓展至蛋白质替代疗法领域

- 与人工智慧和基因组学的整合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 临床试验分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 药物

- 治疗性mRNA蛋白

- 其他基于mRNA的药物

- 疫苗

- 自扩增mRNA疫苗

- 传统非扩增型mRNA疫苗

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 传染病

- 肿瘤学

- 罕见遗传疾病

- 呼吸系统疾病

- 其他应用

第七章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 预防

- 治疗

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 製药公司

- 研究机构

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- CureVac

- BioNtech

- Ethris

- Moderna

- Pfizer

- GlaxoSmithKline

- Translate Bio

- Arcturus Therapeutics

- Sanofi

- AstraZeneca

- Chimeron Bio

- Tiba Biotech

- VaxEquity

- StemiRNA Therapeutics

- Immorna Biotech

The Global mRNA Therapeutics Market was valued at USD 15.5 Billion in 2024 and is estimated to grow at a CAGR of 14.4% to reach USD 58.9 Billion by 2034.

The surge in growth is driven by technological breakthroughs in messenger RNA (mRNA) platforms and the increasing confidence among healthcare professionals and regulators in their clinical potential. Recent years have proven mRNA's ability to enable scalable, flexible, and highly efficient drug development processes. Major advancements in lipid nanoparticle (LNP) delivery systems have further enhanced the precision, safety, and bioavailability of mRNA molecules by addressing degradation and immune response challenges. mRNA technology, once focused on preventing infectious diseases, is now being increasingly applied to treat chronic and complex conditions, including cardiovascular, autoimmune, and rare genetic disorders. Its unique capacity to encode specific proteins inside the body allows for targeted and personalized therapies, reshaping the future of modern medicine. This transformative approach positions mRNA therapeutics as one of the fastest-growing domains in biotechnology, accelerating innovation pipelines across pharmaceutical and biopharmaceutical industries worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $58.9 Billion |

| CAGR | 14.4% |

The vaccines segment held 81.9% share in 2024 and is projected to reach USD 47.7 Billion by 2034, registering a CAGR of 14.3% during 2025-2034. The segment's expansion is supported by the efficiency of cell-free synthesis, which shortens production time compared to traditional vaccines. The ability to rapidly adapt formulations for emerging variants or pathogens makes mRNA vaccines highly versatile. Continuous innovations in modular production setups and lipid nanoparticle systems are further enhancing product stability, scalability, and cost-effectiveness, strengthening their global accessibility.

The therapeutics segment will grow at a CAGR of 14.6% through 2034, driven by mRNA technology's expanding role in the treatment of cancer, autoimmune diseases, and genetic disorders. Unlike conventional biologics, mRNA-based drugs enable temporary expression of therapeutic proteins without modifying the patient's DNA, offering improved safety and flexibility. Increased funding in research and clinical trials has widened the development pipeline for mRNA therapeutics, attracting pharmaceutical and biotech companies eager to capitalize on this promising platform.

North America mRNA Therapeutics Market held a 42.4% share in 2024. The region's leadership is attributed to its advanced R&D capabilities, strong biotech infrastructure, and presence of major global players with extensive manufacturing and clinical trial capacities. North America's robust healthcare ecosystem, which includes leading hospitals, clinics, and academic research centers, supports both the production and administration of mRNA-based products. High investment in personalized medicine, advanced logistics for cold chain maintenance, and widespread regulatory support have further reinforced the region's dominant position and continuous market growth.

Prominent companies active in the Global mRNA Therapeutics Market include Moderna, Pfizer, BioNTech, GlaxoSmithKline, CureVac, AstraZeneca, Translate Bio, Sanofi, Arcturus Therapeutics, Ethris, Chimeron Bio, Tiba Biotech, VaxEquity, Immorna Biotech, and StemiRNA Therapeutics. Key players in the mRNA Therapeutics Market are focusing on expanding production capacity, advancing delivery technologies, and strengthening global supply chains. Strategic partnerships between pharmaceutical and biotech firms are enabling faster research translation and broader clinical trial execution. Companies are heavily investing in next-generation lipid nanoparticle systems to improve delivery precision and reduce immunogenicity. Diversification of product pipelines toward oncology, cardiovascular, and rare diseases is also a central strategy for long-term growth. Many players are adopting modular and automated manufacturing processes to lower costs and enhance scalability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in delivery technologies

- 3.2.1.2 Expanding applications beyond vaccines

- 3.2.1.3 Growing investment in biotechnology research and development

- 3.2.1.4 Faster and scalable manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Immunogenicity and safety concerns

- 3.2.2.2 Manufacturing and scalability issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into protein replacement therapies

- 3.2.3.2 Integration with AI and genomics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Drugs

- 5.2.1 Therapeutic mRNA proteins

- 5.2.2 Other mRNA-based drugs

- 5.3 Vaccines

- 5.3.1 Self-amplifying mRNA vaccines

- 5.3.2 Conventional non-amplifying mRNA vaccines

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Infectious disease

- 6.3 Oncology

- 6.4 Rare genetic disorders

- 6.5 Respiratory disease

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Prophylactic

- 7.3 Therapeutic

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Pharmaceutical companies

- 8.4 Research institutes

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 CureVac

- 10.2 BioNtech

- 10.3 Ethris

- 10.4 Moderna

- 10.5 Pfizer

- 10.6 GlaxoSmithKline

- 10.7 Translate Bio

- 10.8 Arcturus Therapeutics

- 10.9 Sanofi

- 10.10 AstraZeneca

- 10.11 Chimeron Bio

- 10.12 Tiba Biotech

- 10.13 VaxEquity

- 10.14 StemiRNA Therapeutics

- 10.15 Immorna Biotech