|

市场调查报告书

商品编码

1871163

航太低温阀市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cryogenic Valve for Aerospace Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

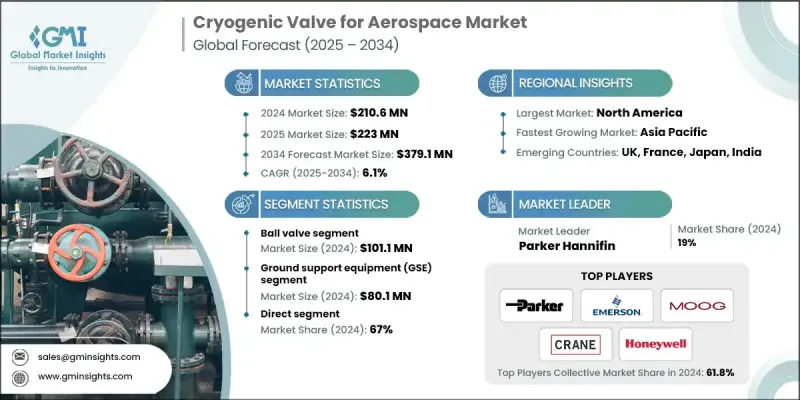

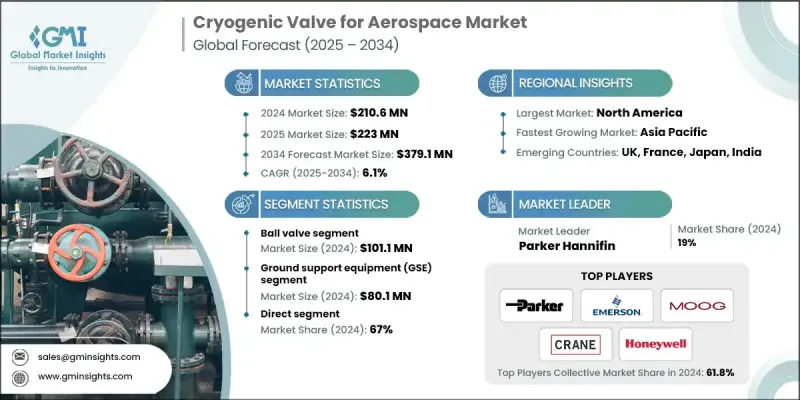

2024 年全球航太低温阀市场价值为 2.106 亿美元,预计到 2034 年将以 6.1% 的复合年增长率增长至 3.791 亿美元。

太空探索任务的持续成长以及液态氧、液态氢等低温燃料的日益普及,是推动专用低温阀门需求成长的关键因素。这些阀门在安全且有效率地处理极低温流体方面发挥着至关重要的作用,确保了航太发射和推进过程中的精度和可靠性。随着航太技术的不断发展,低温阀门系统也在不断改进,以在高应力条件下提供更佳的控制性能、运行安全性和耐久性。材料、设计和自动化技术的进步提升了其性能,使其能够在轨道和地面航太应用中实现精确的流量控制和无洩漏运行。商业航太专案、卫星部署和深空探索专案日益增长的需求,持续推动产品研发。此外,将智慧感测器和监控系统整合到低温阀门中,透过实现即时追踪和预测性维护,显着提升了运作效率,这对于全球关键任务型航太运作至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.106亿美元 |

| 预测值 | 3.791亿美元 |

| 复合年增长率 | 6.1% |

2024年,球阀市场规模达1.011亿美元。该市场领先地位主要归功于其强大的密封性能和对航太严苛环境的适应性。球阀尤其因其在极端温度变化、振动和压力波动下仍能保持稳定性能而备受青睐。其可靠性使其成为推进系统、燃油管路和低温储罐等对流量控制要求极高的应用中不可或缺的部件。此外,业界也不断致力于研发可在低温下防止冻结或开裂的特殊合金和材料,进一步推动了球阀在航太系统中的应用。

2024年,地面支援设备(GSE)产业创造了8,010万美元的产值。该行业透过加油、排气和冷却程序,为发射和维护作业提供至关重要的支援。 GSE系统的效率直接影响航太任务的发射频率和周转时间。 GSE设计和性能的持续升级显着提高了航太专案的运作准备度和安全性。它们有助于减少发射前准备週期,从而巩固了其作为现代航太基础设施关键组成部分的地位,并增强了可靠性和任务一致性。

2024年,美国航太低温阀门市占率高达87.5%。这一领先地位得益于美国先进的航太能力、对低温系统的持续投资以及众多主要製造企业的存在。美国之所以保持竞争优势,在于其对研发、技术创新以及商业和政府航太专案的持续拓展的高度重视。强大的国内供应链,加上完善的低温燃料处理监管框架和基础设施,进一步巩固了美国在区域和全球市场成长中的领先地位。

航太低温阀门市场的主要企业包括伍德沃德(Woodward)、福斯(Flowserve)、穆格(Moog)、派克汉尼汾(Parker Hannifin)、贝克休斯(Baker Hughes)、精密流体控制(Precision Fluid Controls)、赫罗斯(Herose)、SAMSON、Cryofab, Inc.、国际( 航太标准)、克莱兹公司(Bryofab, Inc.Ary) Company)、BAC阀门、Honeywell(Honeywell)和艾默生(Emerson)。这些主要企业采取的关键策略着重于创新、策略合作和技术进步。行业领导者正投资于先进材料和智慧阀门技术,以提高极端条件下的可靠性和即时性能监控。与航太机构和私人航太企业的合作有助于为推进和燃料管理等高精度应用客製化解决方案。此外,各公司也正在扩大全球製造能力,以满足日益增长的低温系统需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 太空探索和发射计画的成长

- 商用航太和卫星部署的兴起

- 低温技术的进步

- 产业陷阱与挑战

- 极端运转条件

- 高成本和长开发週期

- 机会

- 氢动力飞机研发

- 高成本和长开发週期

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按阀门类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依阀门类型划分,2021-2034年

- 主要趋势

- 球阀

- 球阀

- 闸阀

- 止回阀

- 蝶阀

- 其他的

第六章:市场估算与预测:依阀门尺寸划分,2021-2034年

- 主要趋势

- 小阀门(≤2英吋)

- 中型阀门(2-6吋)

- 大阀门(6-12吋)

- 特大号阀门(>12吋)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 飞机系统

- 地面支援设备(GSE)

- 航太製造与测试

- 国防和军事应用

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Baker Hughes

- Bray International

- BAC Valves

- Crane Company

- Cryofab, Inc.

- Emerson

- Flowserve

- Honeywell

- Herose

- Kitz

- SAMSON

- Moog

- Parker Hannifin

- Precision Fluid Controls

- Woodward

The Global Cryogenic Valve for Aerospace Market was valued at USD 210.6 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 379.1 million by 2034.

The continuous rise in space exploration missions and the increasing use of cryogenic fuels such as liquid oxygen and hydrogen are key drivers boosting the need for specialized cryogenic valves. These valves play a vital role in handling extremely low-temperature fluids safely and efficiently, ensuring precision and reliability during space launches and propulsion processes. As aerospace technology evolves, cryogenic valve systems are being refined to deliver enhanced control, operational safety, and durability under high-stress conditions. Advancements in materials, design, and automation have improved their performance, enabling precise flow control and leak-free operation across both orbital and terrestrial aerospace applications. Growing demand from commercial space programs, satellite deployments, and deep-space exploration projects continues to fuel product development. Furthermore, the integration of smart sensors and monitoring systems into cryogenic valves is transforming operational efficiency by enabling real-time tracking and predictive maintenance, which are essential for mission-critical aerospace operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $210.6 Million |

| Forecast Value | $379.1 Million |

| CAGR | 6.1% |

The ball valve segment generated USD 101.1 million in 2024. The segment's leadership can be attributed to its robust sealing capabilities and adaptability to the demanding conditions of aerospace environments. Ball valves are particularly valued for their ability to maintain stable performance under extreme temperature shifts, vibration, and pressure variations. Their reliability makes them indispensable in propulsion systems, fuel lines, and cryogenic storage tanks where consistent flow regulation is crucial. Additionally, the industry's ongoing efforts to develop specialized alloys and materials that prevent freezing or cracking under cryogenic temperatures further enhance the adoption of ball valves in aerospace systems.

The ground support equipment (GSE) segment generated USD 80.1 million in 2024. This segment is integral to supporting launch and maintenance operations through refueling, venting, and cooling procedures. The efficiency of GSE systems directly impacts launch frequency and turnaround times for aerospace missions. Continuous upgrades in GSE design and performance have significantly improved operational readiness and safety in space programs. Their contribution to reducing pre-launch cycles has strengthened their role as an essential component of modern aerospace infrastructure, enhancing reliability and mission consistency.

United States Cryogenic Valve for Aerospace Market held an 87.5% share in 2024. This leadership is driven by the country's advanced aerospace capabilities, ongoing investment in cryogenic systems, and the presence of major manufacturing players. The U.S. maintains a competitive advantage due to its strong focus on research, technological innovation, and the continuous expansion of both commercial and government space programs. The robust domestic supply chain, combined with an established regulatory framework and infrastructure for cryogenic fuel handling, reinforces the country's leading role in regional and global market growth.

Prominent companies operating in the Cryogenic Valve for Aerospace Market include Woodward, Flowserve, Moog, Parker Hannifin, Baker Hughes, Precision Fluid Controls, Herose, SAMSON, Cryofab, Inc., Bray International, Kitz, Crane Company, BAC Valves, Honeywell, and Emerson. Key strategies adopted by major companies in the Cryogenic Valve for Aerospace Market focus on innovation, strategic partnerships, and technological advancement. Industry leaders are investing in advanced materials and smart valve technologies to enhance reliability and real-time performance monitoring under extreme conditions. Collaborations with aerospace agencies and private space enterprises are helping tailor solutions for high-precision applications like propulsion and fuel management. Companies are also expanding global manufacturing capabilities to meet the increasing demand for cryogenic systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in space exploration & launch programs

- 3.2.1.2 Rise of commercial aerospace & satellite deployment

- 3.2.1.3 Advancements in cryogenic technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Extreme operating conditions

- 3.2.2.2 High cost & long development cycles

- 3.2.3 Opportunities

- 3.2.3.1 Hydrogen-powered aircraft development

- 3.2.3.2 High cost & long development cycles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valves

- 5.3 Globe valves

- 5.4 Gate valves

- 5.5 Check valves

- 5.6 Butterfly valves

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Small Valves (≤2 inches)

- 6.3 Medium Valves (2-6 inches)

- 6.4 Large Valves (6-12 inches)

- 6.5 Extra-Large Valves (>12 inches)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Aircraft systems

- 7.3 Ground support equipment (GSE)

- 7.4 Aerospace manufacturing and testing

- 7.5 Defense and military applications

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baker Hughes

- 10.2 Bray International

- 10.3 BAC Valves

- 10.4 Crane Company

- 10.5 Cryofab, Inc.

- 10.6 Emerson

- 10.7 Flowserve

- 10.8 Honeywell

- 10.9 Herose

- 10.10 Kitz

- 10.11 SAMSON

- 10.12 Moog

- 10.13 Parker Hannifin

- 10.14 Precision Fluid Controls

- 10.15 Woodward