|

市场调查报告书

商品编码

1871166

农业机械维护服务市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Agricultural Machinery Maintenance Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

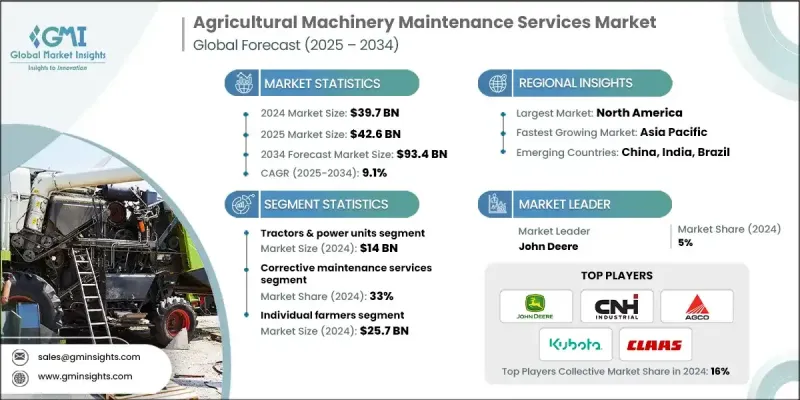

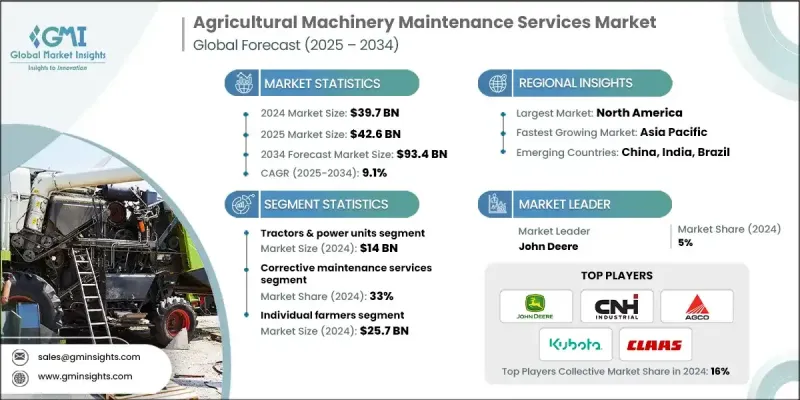

2024 年全球农业机械维护服务市场价值为 397 亿美元,预计到 2034 年将以 9.1% 的复合年增长率成长至 934 亿美元。

随着机械化在劳动密集型农业活动中日益重要,农业机械产业正在迅速扩张。农民高度依赖机械来提高生产力,因此定期维护已成为现代农业生产的关键环节。该行业正朝着预测性和预防性维护模式转型,智慧感测器、数位监控和远端控制系统帮助农民在故障发生前识别潜在的设备问题。这种积极主动的方法最大限度地减少了农业高峰期的昂贵停机时间,并提高了整体营运效率。发展中地区农机具的日益普及为维护服务提供者带来了新的机会。随着农民用拖拉机、收割机和灌溉系统取代人工,数位化平台促进了维修安排、备件采购和远端技术支援。然而,农村地区仍存在挑战,小农户往往缺乏先进维护工具的资源,寻找熟练的技术人员并非易事。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 397亿美元 |

| 预测值 | 934亿美元 |

| 复合年增长率 | 9.1% |

到 2024 年,拖拉机和动力装置领域创造了 140 亿美元的收入。这些机器仍然是农业生产的核心,而精准农业技术的应用进一步增加了它们的复杂性和重要性。

预计到2024年,纠正性维护服务市占率将达到33%,成为市占率最大的部分,主要归因于设备故障时对维修服务的迫切需求。儘管预防性解决方案日益普及,但纠正性维护仍然至关重要,尤其是在农业生产旺季。

北美农业机械维护服务市场占据77%的市场份额,预计2024年市场规模将达到121亿美元。北美市场的领先地位得益于先进的机械化水准、完善的服务基础设施以及精准农业的广泛应用。该地区农业机械维护市场受益于设备的持续升级以及美加之间的牢固贸易关係。

全球农业机械维护服务市场的主要参与者包括CLAAS集团、约翰迪尔、CNH Industrial NV、SDF集团、久保田株式会社、马恆达集团、Autonomous Tractor Corporation、洋马控股、JCB、Precision Planting、FarmWise、Escorts Kubota Limited、Stara和Iron Ox。各公司正透过整合物联网、感测器和远端监控技术,强调预防性和预测性维护解决方案,以减少设备停机时间。在农村和新兴市场拓展服务网络有助于赢得新的客户群并提高服务可近性。各公司正投资于培训项目,以提升技术人员的技能,从而确保提供高品质的维护支援。与机械製造商和经销商建立策略合作伙伴关係,能够提供捆绑式服务,从而增强客户忠诚度。用于安排维修、订购备件和远端诊断的数位化平台提高了营运效率和客户体验。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 个人化和精选吸引力

- 电子商务和直接面向消费者模式的成长

- 企业经常性收入模式

- 产业陷阱与挑战

- 客户流失率高

- 物流与履行复杂性

- 机会

- 注重永续性的包装和产品

- 拓展至细分市场

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依设备类型划分,2021-2034年

- 主要趋势

- 拖拉机和动力装置

- 收割机

- 耕作和土壤准备设备

- 种植和播种设备

- 灌溉系统

- 喷涂和施用设备

第六章:市场估算与预测:依所有权划分,2021-2034年

- 主要趋势

- 个体农户

- 企业农场

第七章:市场估算与预测:依营运规模划分,2021-2034年

- 主要趋势

- 小规模作业

- 中型农场

- 大型农场

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 农作物

- 家畜

第九章:市场估算与预测:依服务类型划分,2021-2034年

- 主要趋势

- 预防性维护服务

- 纠正性维护服务

- 预测性维护服务

- 基于状态的维护服务

- 紧急维修服务

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- John Deere

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- Mahindra & Mahindra

- Escorts Kubota Limited

- SDF Group

- JCB

- Yanmar Holdings

- Stara

- Autonomous Tractor Corporation

- FarmWise

- Iron Ox

- Precision Planting

The Global Agricultural Machinery Maintenance Services Market was valued at USD 39.7 Billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 93.4 Billion by 2034.

The industry is expanding rapidly as mechanization becomes increasingly essential in labor-intensive agricultural activities. Farmers are heavily relying on machinery to boost productivity, making regular maintenance a critical part of modern farming operations. The sector is shifting toward predictive and preventive maintenance models, with smart sensors, digital monitoring, and remote-control systems helping farmers identify potential equipment issues before failures occur. This proactive approach minimizes costly downtime during peak farming periods and enhances overall operational efficiency. The growing use of farm machinery in developing regions has opened new opportunities for maintenance service providers. As farmers replace manual labor with tractors, harvesters, and irrigation systems, digital platforms facilitate repair scheduling, spare part procurement, and remote technical support. However, challenges persist in rural areas, where smallholders often lack resources for advanced maintenance tools, and finding skilled technicians can be difficult.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39.7 Billion |

| Forecast Value | $93.4 billion |

| CAGR | 9.1% |

The tractors and power units segment generated USD 14 Billion in 2024. These machines remain central to agricultural operations, and the adoption of precision agriculture technology has further increased their complexity and importance.

The corrective maintenance services segment held a 33% share in 2024, holding the largest share due to the critical need for repair services during equipment failures. Despite the shift toward preventive solutions, corrective maintenance remains essential, especially during peak agricultural seasons.

North America Agricultural Machinery Maintenance Services Market held 77% share and generated USD 12.1 Billion in 2024. North America's dominance is driven by advanced mechanization, robust service infrastructure, and widespread adoption of precision agriculture. The region's agricultural machinery maintenance market benefits from continuous equipment upgrades and strong trade relations between the United States and Canada.

Key players in the Global Agricultural Machinery Maintenance Services Market include CLAAS Group, John Deere, CNH Industrial N.V., SDF Group, Kubota Corporation, Mahindra & Mahindra, Autonomous Tractor Corporation, Yanmar Holdings, JCB, Precision Planting, FarmWise, Escorts Kubota Limited, Stara, and Iron Ox. Firms are emphasizing preventive and predictive maintenance solutions by integrating IoT, sensors, and remote monitoring to reduce equipment downtime. Expanding service networks in rural and emerging markets helps capture new customer bases and improve accessibility. Companies are investing in training programs to upskill technicians, ensuring high-quality maintenance support. Strategic partnerships with machinery manufacturers and distributors enable bundled service offerings that strengthen customer loyalty. Digital platforms for scheduling repairs, ordering spare parts, and remote diagnostics improve operational efficiency and customer experience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Ownership

- 2.2.4 Operational size

- 2.2.5 Application

- 2.2.6 Service type

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Personalization and curation appeal

- 3.2.1.2 Growth of e-commerce and direct-to-consumer models

- 3.2.1.3 Recurring revenue model for businesses

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High customer churn rates

- 3.2.2.2 Logistics and fulfilment complexity

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability-focused packaging and products

- 3.2.3.2 Expansion into niche segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Tractors & power units

- 5.3 Harvester

- 5.4 Tillage & soil preparation equipment

- 5.5 Planting & seeding equipment

- 5.6 Irrigation systems

- 5.7 Spraying & application equipment

Chapter 6 Market Estimates and Forecast, By Ownership, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Individual farmers

- 6.3 Corporate farms

Chapter 7 Market Estimates and Forecast, By Operational Size, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Small-scale operations

- 7.3 Medium-sized farms

- 7.4 Large sized farms

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Crops

- 8.3 Livestock

Chapter 9 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 Preventive maintenance services

- 9.3 Corrective maintenance services

- 9.4 Predictive maintenance services

- 9.5 Condition-based maintenance services

- 9.6 Emergency maintenance services

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 John Deere

- 11.2 CNH Industrial N.V.

- 11.3 AGCO Corporation

- 11.4 Kubota Corporation

- 11.5 CLAAS Group

- 11.6 Mahindra & Mahindra

- 11.7 Escorts Kubota Limited

- 11.8 SDF Group

- 11.9 JCB

- 11.10 Yanmar Holdings

- 11.11 Stara

- 11.12 Autonomous Tractor Corporation

- 11.13 FarmWise

- 11.14 Iron Ox

- 11.15 Precision Planting