|

市场调查报告书

商品编码

1871171

紧凑型重合闸市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Compact Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

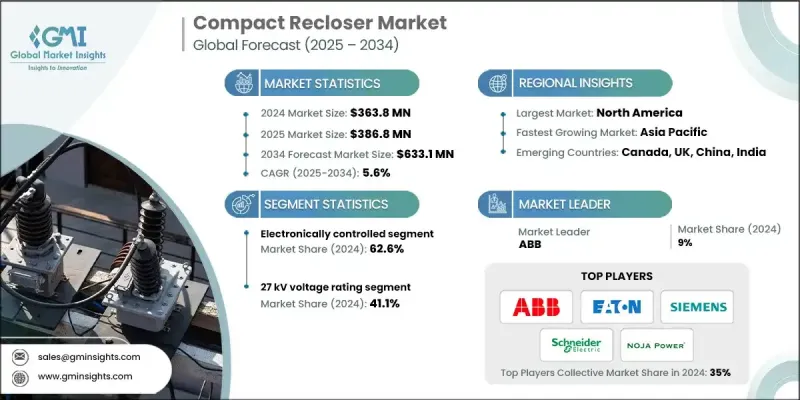

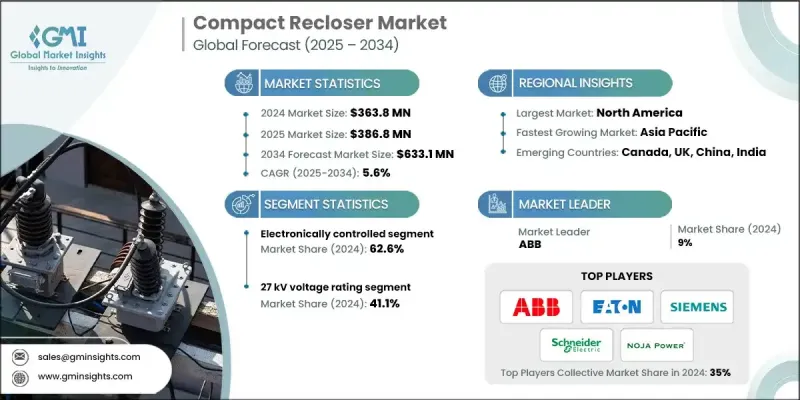

2024 年全球紧凑型重合闸市场价值为 3.638 亿美元,预计到 2034 年将以 5.6% 的复合年增长率增长至 6.331 亿美元。

老旧电网的快速现代化改造和再生能源的广泛应用是推动这个市场的主要动力。随着电力公司向智慧化、高弹性电网系统转型,紧凑型重合闸因其能够自动检测、隔离和恢復故障而变得不可或缺。这些系统有助于最大限度地减少停电,提高电力可靠性,使其成为现代电网运作的关键组成部分。其小巧灵活的设计使得电力公司无需对现有基础设施进行大规模改造即可将其整合到现有系统中。此外,全球能源政策和电力公司的大规模投资也越来越倾向于采用能够增强远端监控、电网灵活性和系统弹性的技术,而紧凑型重合闸恰好能够有效地实现这些功能。持续向再生能源发电转型也加剧了对快速反应的故障管理工具的需求。紧凑型重合闸有助于稳定受波动能量流影响的电网,维持分散式系统的平稳电力分配,并确保中断后快速恢復供电。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.638亿美元 |

| 预测值 | 6.331亿美元 |

| 复合年增长率 | 5.6% |

2024年,电子控制紧凑型重合器市占率达到62.6%,预计到2034年将以6.2%的复合年增长率成长。数位通讯技术的日益普及、智慧感测器的整合以及对模组化和空间高效设备的需求,是推动该细分市场成长的主要因素。先进的电子重合器目前支援IEC 61850、Modbus和DNP3等通讯标准,可与数位化变电站和集中监控系统进行即时互动。整合感测器可提供电压、电流和故障事件的连续资料,从而提高态势感知能力,并增强电网性能和安全性。

预计到2034年,15 kV紧凑型重合器市场将以5.6%的复合年增长率成长。城市配电网路优化日益受到重视,以及新兴地区单相繫统的普及,正加速15 kV重合器的应用。这些重合器非常适合密集的城市电网和郊区环境,其紧凑的设计和简化的安装是关键优势。它们的高效性和适应性使其成为低压、空间受限应用的理想选择。

美国小型重合闸市场占58.1%的市场份额,预计2024年市场规模将达8,380万美元。该地区电网现代化进程正在快速推进,这主要得益于用智慧自动化重合闸系统取代老旧基础设施。小型重合闸正被广泛应用,以提高供电可靠性、减少停机时间并优化电网整体性能。美国和加拿大的电力公司正优先推进数位化升级,以实现更快的故障隔离、更短的恢復时间和更长远的成本效益。

全球小型重合器市场的主要参与者包括ABB、西门子、伊顿、施耐德电气、S&C电气公司、NOJA Power Switchgear Pty Ltd、Tavrida Electric、G&W Electric、ENTEC Electric & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Poman Electric & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd. Electric、温州瑞纳电气有限公司、浙江法拉第电力科技有限公司、重庆蓝杰科技有限公司和浙江格雅电气有限公司。为了巩固其市场地位,紧凑型重合器市场的企业正致力于一系列策略性倡议。这些倡议包括持续投资产品创新、整合基于物联网和人工智慧的监控功能,以及开发专为下一代智慧电网量身定制的紧凑型免维护设计。与公用事业公司和区域分销商建立策略合作伙伴关係有助于扩大地域覆盖范围,而併购则加速了技术进步。许多公司也将研发作为优先事项,以提高故障检测精度和通讯互通性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略倡议

- 竞争性标竿分析

- 战略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依控制方式划分,2021-2034年

- 主要趋势

- 电子的

- 油压

第六章:市场规模与预测:依中断类型划分,2021-2034年

- 主要趋势

- 油

- 真空

第七章:市场规模及预测:依电压等级划分,2021-2034年

- 主要趋势

- 15千伏

- 27千伏

- 38千伏

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- ABB

- Arteche Group

- Camlin Group

- Chongqing Blue Jay Technology Co., Ltd

- Eaton

- ENTEC Electric & Electronic Co., Ltd

- G&W Electric

- Hubbell Power Systems

- Hughes Power System

- NOJA Power Switchgear Pty Ltd

- Pomanique Electric

- Rockwill Electric Group

- S&C Electric Company

- Schneider Electric

- Siemens

- Sriwin Electric

- Tavrida Electric

- Wenzhou Rena Electric Co., Ltd

- Zhejiang Farady Powertech Co., Ltd

- Zhejiang Geya Electrical Co., Ltd

The Global Compact Recloser Market was valued at USD 363.8 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 633.1 million by 2034.

The rapid modernization of outdated electrical networks and the widespread integration of renewable power sources are the primary forces driving this market. As utilities move toward intelligent, highly resilient grid systems, compact reclosers have become indispensable for their ability to automate fault detection, isolation, and restoration. These systems help minimize outages and improve power reliability, making them essential for modern grid operations. Their small, flexible design allows utilities to retrofit them into existing setups without the need for extensive infrastructure modifications. In addition, global energy policies and large-scale utility investments are increasingly directed toward technologies that enhance remote monitoring, grid flexibility, and system resilience capabilities that compact reclosers deliver efficiently. The ongoing shift toward renewable energy generation has also intensified the need for responsive fault management tools. Compact reclosers help stabilize grids impacted by variable energy flows, maintaining smooth power distribution across decentralized systems and ensuring quick recovery after disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $363.8 Million |

| Forecast Value | $633.1 Million |

| CAGR | 5.6% |

The electronically controlled compact reclosers segment held 62.6% share in 2024 and is expected to grow at a CAGR of 6.2% through 2034. The growing adoption of digital communication technologies, integration of smart sensors, and demand for modular and space-efficient equipment are fueling this segment's growth. Advanced electronic reclosers now support communication standards such as IEC 61850, Modbus, and DNP3, which enable real-time interaction with digital substations and centralized monitoring systems. Integrated sensors provide continuous data on voltage, current, and fault events, improving situational awareness and enhancing grid performance and safety.

The 15 kV compact recloser segment is forecasted to grow at a CAGR of 5.6% through 2034. Increasing focus on urban power distribution network optimization and the expansion of single-phase systems across emerging regions are accelerating the adoption of 15 kV units. These reclosers are well-suited for dense city grids and suburban environments where compact design and simplified installation are key advantages. Their efficiency and adaptability make them a preferred choice for managing low-voltage, space-limited applications.

United States Compact Recloser Market held 58.1% share, generating USD 83.8 million in 2024. The region is experiencing rapid advancements in grid modernization, driven by the replacement of outdated infrastructure with intelligent, automated recloser systems. Compact reclosers are being implemented widely to enhance service reliability, reduce downtime, and optimize overall grid performance. Utilities across the U.S. and Canada are prioritizing digital upgrades that allow faster fault isolation, improved restoration times, and long-term cost efficiency.

Leading players in the Global Compact Recloser Market include ABB, Siemens, Eaton, Schneider Electric, S&C Electric Company, NOJA Power Switchgear Pty Ltd, Tavrida Electric, G&W Electric, ENTEC Electric & Electronic Co., Ltd, Arteche Group, Hubbell Power Systems, Camlin Group, Pomanique Electric, Rockwill Electric Group, Hughes Power System, Sriwin Electric, Wenzhou Rena Electric Co., Ltd, Zhejiang Farady Powertech Co., Ltd, Chongqing Blue Jay Technology Co., Ltd, and Zhejiang Geya Electrical Co., Ltd. To strengthen their position, companies in the Compact Recloser Market are focusing on a combination of strategic initiatives. These include continuous investment in product innovation, integration of IoT and AI-based monitoring capabilities, and development of compact, maintenance-free designs tailored for next-generation smart grids. Strategic partnerships with utilities and regional distributors help expand geographic presence, while mergers and acquisitions accelerate technological advancement. Many firms are also prioritizing R&D to enhance fault detection accuracy and communication interoperability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Control trends

- 2.1.3 Interruption trends

- 2.1.4 Voltage trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Control, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Electronic

- 5.3 Hydraulic

Chapter 6 Market Size and Forecast, By Interruption, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Arteche Group

- 9.3 Camlin Group

- 9.4 Chongqing Blue Jay Technology Co., Ltd

- 9.5 Eaton

- 9.6 ENTEC Electric & Electronic Co., Ltd

- 9.7 G&W Electric

- 9.8 Hubbell Power Systems

- 9.9 Hughes Power System

- 9.10 NOJA Power Switchgear Pty Ltd

- 9.11 Pomanique Electric

- 9.12 Rockwill Electric Group

- 9.13 S&C Electric Company

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Sriwin Electric

- 9.17 Tavrida Electric

- 9.18 Wenzhou Rena Electric Co., Ltd

- 9.19 Zhejiang Farady Powertech Co., Ltd

- 9.20 Zhejiang Geya Electrical Co., Ltd