|

市场调查报告书

商品编码

1871182

超豪华智慧家庭市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Ultra-Luxury Home Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

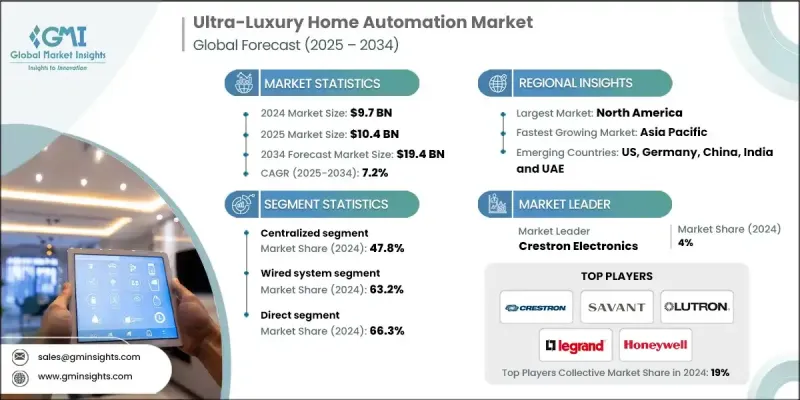

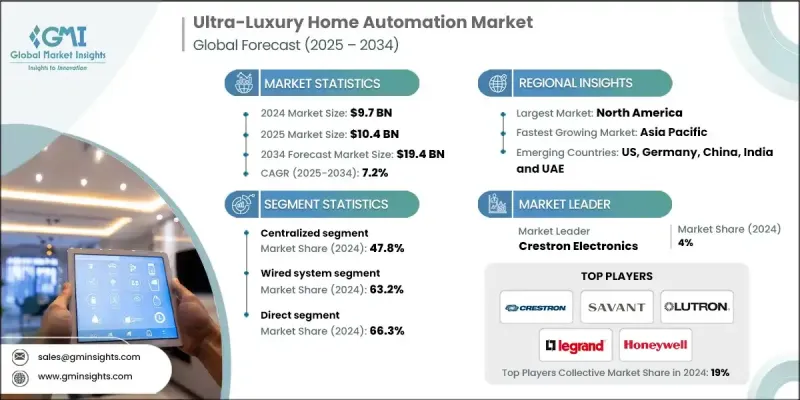

2024 年全球超豪华家庭自动化市场价值为 97 亿美元,预计到 2034 年将以 7.2% 的复合年增长率增长至 194 亿美元。

随着富裕消费者日益追求智慧互联和高度个人化的生活体验,市场正呈现强劲成长动能。科技创新,尤其是在人工智慧、物联网和节能自动化领域的创新,正在重塑高端住宅业主与家居空间的互动方式。各大品牌强调永续性、卓越舒适性和无缝控制,同时融入精緻美学,提升便利性和风格。对直觉控制、更高安全性和能源优化的需求持续推动着专为高端住宅环境设计的尖端系统的应用。生态系统内的合作、技术供应商之间的整合以及不断拓展的数位化零售管道,使得智慧家庭产品能够实现更高的客製化程度和更广泛的应用。连接性和用户介面技术的进步正在重新定义高端住宅业主管理其环境的方式,推动市场蓬勃发展,并加剧全球市场的竞争。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 97亿美元 |

| 预测值 | 194亿美元 |

| 复合年增长率 | 7.2% |

2024年,集中式自动化市占率达到47.8%,预计2025年至2034年将以7.3%的复合年增长率成长。集中式系统仍然占据主导地位,因为它们透过一个统一的介面,对照明、温度控制、娱乐和安防等核心家居功能进行全面控制。其一致性、可靠性和可扩展性使其成为需要精准自动化的高端住宅的理想选择。这些系统能够提供个人化且安全的体验,满足豪华住宅业主轻鬆管理复杂房产的需求。

2024年,有线系统市占率达到63.2%,预计到2034年将以6.6%的复合年增长率成长。有线配置因其卓越的可靠性、强大的性能和高资料频宽容量而备受青睐。在超豪华住宅领域,有线基础设施可确保不间断的连接和精准的控制,这对于管理庞大的自动化网路至关重要。这些系统因其长期耐用性、低干扰程度以及在多个设备间实现稳定运作的能力而备受推崇,为业主提供可靠安全的自动化体验。

2024年,美国超豪华智慧家庭市场占77.2%的市场份额,市场规模达31亿美元。北美地区凭藉着强劲的经济实力、先进的技术基础设施和较高的可支配收入水平,继续在全球市场占据主导地位。豪华房地产市场的稳定成长,以及消费者对便利性和安全性的日益增长的需求,持续推动智慧家居技术的普及。美国市场受益于成熟的製造商、系统整合商和高度重视尖端创新和生活方式自动化的消费者生态系统。

全球超豪华智慧家居市场的主要参与者包括施耐德电气、Savant Systems、Honeywell、ABB、Bang & Olufsen、Integrated AV、Ecobee、Aurum HomeTech、Vivint、罗格朗、江森自控、路创电子、Snap One、快思聪电子和Heyo Smart。这些市场领导者正透过创新、策略合作和技术整合来巩固其市场地位。许多企业正在投资人工智慧驱动的自动化系统、节能技术和云端平台,以增强个人化控制和永续性。设备製造商和软体开发商之间的合作正在提高互通性和无缝系统整合。此外,各公司也正在拓展产品组合,推出可扩展的高端解决方案,以满足高端住宅专案的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对智慧互联住宅的需求不断增长

- 提高富裕消费者的可支配收入

- 奢华生活方式和家居个性化的趋势日益增长

- 产业陷阱与挑战

- 较高的初始投资和安装成本

- 复杂的系统整合和互通性问题

- 机会

- 与豪华房地产开发商和建筑师合作

- 整合人工智慧驱动的自动化和生物辨识安全等尖端技术

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按自动化类型

- 监理框架

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 照明设备

- 墙内模组/智慧灯泡

- 智慧开关

- 智慧插座

- 其他(智慧型调光器等)

- 智慧安防设备

- 运动/到达感应器

- 门窗感应器

- 警报

- 智慧无线铃

- 智慧门锁

- 其他(监视器等)

- 娱乐装置

- 扬声器/音讯分配

- 影片分发

- 其他(虚拟私人助理等)

- 保护感测器

- 洪水/火灾感测器

- 紫外线感测器

- 其他(湿度感测器等)

- 其他(气候控制装置等)

第六章:市场估算与预测:依自动化类型划分,2021-2034年

- 主要趋势

- 分散式

- 集中

- 杂交种

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 有线系统

- 无线系统

- 无线上网

- 蓝牙

- ZigBee

- 其他(Z-Wave 等)

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ABB

- Aurum HomeTech

- Bang & Olufsen

- Crestron Electronics

- Ecobee

- Heyo Smart

- Honeywell

- Integrated AV

- Johnson Controls

- Legrand

- Lutron Electronics

- Savant Systems

- Schneider Electric

- Snap One

- Vivint

The Global Ultra-Luxury Home Automation Market was valued at USD 9.7 Billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 19.4 Billion by 2034.

The market is witnessing strong momentum as affluent consumers increasingly seek intelligent, connected, and highly personalized living experiences. Technological innovation, particularly in AI, IoT, and energy-efficient automation, is reshaping how luxury homeowners interact with their spaces. Brands are emphasizing sustainability, superior comfort, and seamless control while incorporating refined aesthetics that enhance both convenience and sophistication. Demand for intuitive control, heightened security, and energy optimization continues to drive the adoption of cutting-edge systems designed for premium residential settings. Partnerships across the ecosystem, integration among technology providers, and expanding digital retail channels are enabling greater customization and availability of home automation products. Advances in connectivity and user interface technologies are redefining how luxury homeowners manage their environments, fueling exceptional growth and intensifying competition in the global marketplace.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.7 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 7.2% |

The centralized automation segment held 47.8% share in 2024 and is anticipated to grow at a CAGR of 7.3% from 2025 to 2034. Centralized systems remain dominant as they provide unified control over core household functions such as lighting, climate management, entertainment, and security through one cohesive interface. Their ability to deliver consistency, reliability, and scalability makes them ideal for high-end residences requiring precise automation. These systems enable a personalized and secure experience that aligns with the expectations of luxury homeowners seeking effortless management of complex estates.

In 2024, the wired systems segment held 63.2% share and is expected to grow at a CAGR of 6.6% through 2034. Wired configurations are preferred for their superior reliability, robust performance, and high data bandwidth capacity. In the ultra-luxury housing sector, wired infrastructure ensures uninterrupted connectivity and precise control, which are critical for managing extensive automation networks. These systems are valued for their long-term durability, low interference levels, and ability to deliver consistent operation across multiple devices, providing homeowners with dependable and secure automation experiences.

United States Ultra-Luxury Home Automation Market held 77.2% share in 2024, generating USD 3.1 Billion. North America continues to dominate globally, supported by strong economic conditions, advanced technological infrastructure, and high disposable income levels. The steady growth of the luxury real estate segment, coupled with increasing demand for convenience and safety, continues to boost the adoption of smart home technologies. The US market benefits from a mature ecosystem of manufacturers, system integrators, and highly aware consumers who value cutting-edge innovation and lifestyle automation.

Key companies active in the Global Ultra-Luxury Home Automation Market include Schneider Electric, Savant Systems, Honeywell, ABB, Bang & Olufsen, Integrated AV, Ecobee, Aurum HomeTech, Vivint, Legrand, Johnson Controls, Lutron Electronics, Snap One, Crestron Electronics, and Heyo Smart. Leading players in the Ultra-Luxury Home Automation Market are strengthening their market foothold through innovation, strategic collaborations, and technology integration. Many are investing in AI-driven automation systems, energy-efficient technologies, and cloud-based platforms to enhance personalized control and sustainability. Partnerships between device manufacturers and software developers are improving interoperability and seamless system integration. Companies are also expanding their product portfolios with scalable, high-end solutions designed to cater to exclusive residential projects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Automation type

- 2.2.4 Technology type

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart and connected homes

- 3.2.1.2 Increasing disposable incomes of affluent consumers

- 3.2.1.3 Growing trend of luxury lifestyle and home personalization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and installation costs

- 3.2.2.2 Complex system integration and interoperability issues

- 3.2.3 Opportunities

- 3.2.3.1 Partnership with luxury real estate developers and architects

- 3.2.3.2 Integration of cutting-edge technologies like AI-driven automation and biometric security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By automation type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Lighting devices

- 5.2.1 In-wall modules/ smart bulbs

- 5.2.2 Smart switches

- 5.2.3 Smart plugs

- 5.2.4 Others (smart dimmer etc.)

- 5.3 Smart security devices

- 5.3.1 Motion/arrival sensor

- 5.3.2 Door/window sensor

- 5.3.3 Alarms

- 5.3.4 Smart wireless bells

- 5.3.5 Smart door locks

- 5.3.6 Others (security cameras etc.)

- 5.4 Entertainment devices

- 5.4.1 Speakers/ audio distribution

- 5.4.2 Video distribution

- 5.4.3 Others (virtual personal assistant etc.)

- 5.5 Protection sensors

- 5.5.1 Flood/fire sensors

- 5.5.2 UV sensors

- 5.5.3 Others (humidity sensors etc.)

- 5.6 Others (climate control devices etc.)

Chapter 6 Market Estimates & Forecast, By Automation Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Distributed

- 6.3 Centralized

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Wired system

- 7.3 Wireless system

- 7.3.1 Wi-Fi

- 7.3.2 Bluetooth

- 7.3.3 ZigBee

- 7.3.4 Others (Z-Wave etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.1.1 Direct

- 8.1.2 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Aurum HomeTech

- 10.3 Bang & Olufsen

- 10.4 Crestron Electronics

- 10.5 Ecobee

- 10.6 Heyo Smart

- 10.7 Honeywell

- 10.8 Integrated AV

- 10.9 Johnson Controls

- 10.10 Legrand

- 10.11 Lutron Electronics

- 10.12 Savant Systems

- 10.13 Schneider Electric

- 10.14 Snap One

- 10.15 Vivint