|

市场调查报告书

商品编码

1871186

汽车空中下载 (OTA) 更新硬体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Automotive Over-the-Air (OTA) Update Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

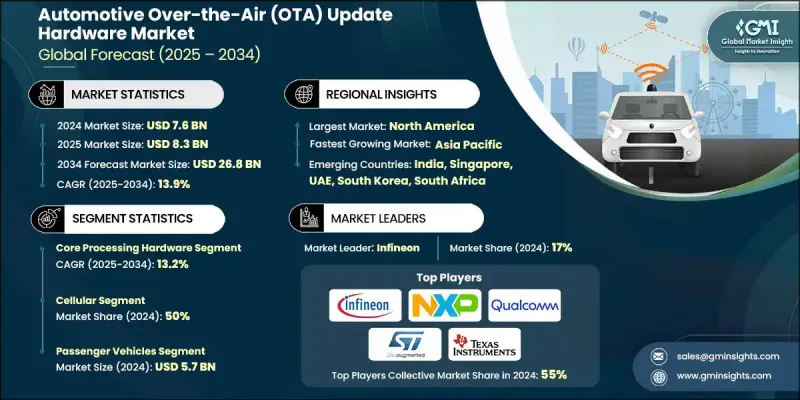

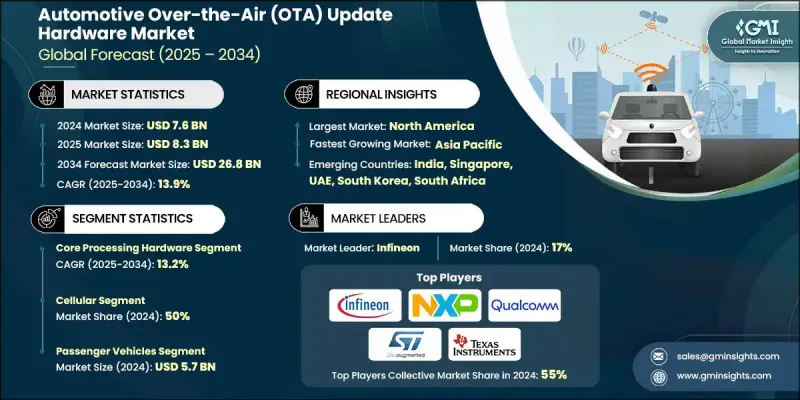

2024 年全球汽车空中升级 (OTA) 硬体市场价值为 76 亿美元,预计到 2034 年将以 13.9% 的复合年增长率增长至 268 亿美元。

汽车产业正迅速向软体定义汽车 (SDV) 转型,这催生了对强大的 OTA 硬体基础设施的强劲需求。该市场涵盖核心处理器、记忆体和储存模组、连接硬体、安全晶片以及监控和诊断系统等关键组件。这些组件支援车队的 OTA 软体更新、软体功能启动和网路安全性修补程式。互联汽车生态系统的兴起、汽车软体日益复杂以及对不间断客户体验的需求,都在加速 OTA 硬体的普及应用。新冠疫情凸显了 OTA 功能的重要性,强调了远端更新和减少对实体服务中心依赖的必要性。随着製造商致力于提升车辆生命週期管理水准并减少维护停机时间,OTA 硬体正成为全球汽车製造商的关键投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 268亿美元 |

| 复合年增长率 | 13.9% |

市场正在快速整合先进的连接解决方案,包括 5G 蜂窝网路、Wi-Fi 6/6E、卫星通讯和低功耗广域网路 (LPWAN) 技术。这些网路提供更快、更可靠的空中下载 (OTA) 更新,并支援即时车联网 (V2X) 通讯。配备多射频连接硬体的车辆可以根据讯号强度、频宽需求和营运成本智慧地在不同网路之间切换,从而确保更新和诊断的通讯稳定可靠。

核心处理硬体细分市场占据35%的市场份额,预计2025年至2034年将以13.2%的复合年增长率成长。此细分市场包括高性能汽车处理器、微控制器、系统级晶片 (SoC) 平台以及专为车辆应用设计的专用运算单元。强大的处理能力对于管理复杂的软体更新、验证网路安全性以及高效协调各种系统功能至关重要。同时,受可靠、高频宽网路的需求驱动,蜂窝网路连线预计将以15.1%的复合年增长率成长,占据49.4%的市场份额,这些网路能够支援关键任务的OTA功能。蜂窝技术提供营运商级的可靠性、全球覆盖范围以及安全可靠的关键更新部署方案。

亚太地区汽车空中下载(OTA)升级硬体市场预计在2024年将占据41%的市场份额,并将以15.1%的复合年增长率成长。该地区受益于大规模的汽车生产、电动车的快速普及以及政府推动互联汽车技术的政策。监管要求,例如中国即将出台的标准,正促使汽车製造商在新车中全面部署OTA硬体功能,这为OTA硬体供应商创造了巨大的发展机会。

汽车空中下载 (OTA) 更新硬体市场的主要参与者包括英特尔、博通、高通、英飞凌、恩智浦半导体、意法半导体、德州仪器、松下、村田製作所和北欧半导体。各公司正致力于处理和连接硬体的创新,以满足日益软体化的汽车的需求。许多公司正在投资多无线通讯解决方案、安全处理器和整合系统晶片设计,以提升 OTA 效能和网路安全。与汽车製造商和一级供应商的策略合作正在加速产品应用和全球分销。区域扩张,尤其是在亚太地区的扩张,确保了企业能够进入高销售汽车市场并掌握监管驱动的机会。各公司也正在投资下一代 5G 和卫星通讯技术的研发,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- SoC供应商

- 微控制器(MCU)製造商

- 连接和网路模组供应商

- 半导体代工厂

- OTA软体平台供应商

- 成本结构

- 利润率

- 每个阶段的价值增加

- 影响供应链的因素

- 颠覆者

- 供应商格局

- 对力的影响

- 成长驱动因素

- 汽车产业数位转型

- 物联网设备激增与联邦网路安全指令

- 边缘人工智慧整合和小晶片架构采用

- 5G网路部署和增强型连接基础设施

- 产业陷阱与挑战

- 半导体供应链集中度与地缘政治风险

- 监管复杂性和多司法管辖区合规挑战

- 市场机会

- 智慧城市基础建设现代化

- 农村连接解决方案和基于卫星的OTA传输

- 成长驱动因素

- 技术趋势与创新生态系统

- 目前技术

- 基于晶片的OTA系统及异构集成

- 3D封装与先进互连技术

- 用于智慧更新的神经形态计算集成

- 抗量子安全硬体实现

- 新兴技术

- 6G网路准备和超低延迟更新

- 卫星星座整合实现全球覆盖

- 用于安全更新的Li-Fi和光无线通信

- 网状网路和点对点更新分发

- 目前技术

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 专利分析

- 成本細項分析

- 价格趋势

- 硬体元件定价动态

- 总拥有成本模型

- 基于价值的定价策略

- 成本优化机会

- 投资与融资

- 政府投资计划

- 私募股权和创投趋势

- 企业投资与策略伙伴关係

- 研发经费

- 风险评估与缓解

- 过时风险与技术转型管理

- 供应链中断和零件短缺风险

- 货币波动与国际交易风险

- 韧体完整性和安全启动实现

- 网路安全和资料隐私方面的考虑

- 信任根实施和硬体安全模组

- 端对端加密和安全通讯通道

- 匿名化与假名化技术

- ISO 27001 及一般准则认证要求

- 消费者行为与终端用户洞察

- 早期采用者的特质与技术热情

- 更新通知偏好设定和通讯管道

- 事件回应和危机沟通效率

- 购买影响力与决策权映射

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 核心处理硬体

- 微控制器(MCU)和系统单晶片(SoC)

- 域和中央计算单元

- 连接与通讯硬体

- 连接模组

- 车载资讯控制单元(TCU)

- 通讯网关和边缘节点

- 储存和电源硬体

- 非挥发性记忆体和储存组件

- 电源管理和介面硬体

- 安全与资料保护硬体

- 诊断与开发硬体

- 其他的

- 核心处理硬体

第六章:市场估算与预测:以连结方式划分,2021-2034年

- 主要趋势

- 细胞

- 无线上网

- 卫星

- 低功耗广域网

- 其他的

第七章:市场估算与预测:依更新时间,2021-2034年

- 主要趋势

- 韧体更新

- 应用程式/软体更新

- 安全性补丁更新

- 配置和校准更新

- 功能解锁/订阅式更新

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车辆

- 轻型商用车

- 中型商用车

- 重型商用车

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Analog Devices

- Broadcom

- Infineon

- Intel

- Murata Manufacturing

- Nordic Semiconductor

- NXP Semiconductors

- Panasonic

- Qualcomm

- Rolling Wireless

- STMicroelectronics

- Texas Instruments

- 区域玩家

- Renesas Electronics

- ON Semiconductor

- Micron Technology

- Robert Bosch

- Toshiba Electronic Devices & Storage

- ROHM Semiconductor

- 新兴玩家

- Microchip Technology

- Nexperia

- Wolfspeed

- Vishay Intertechnology

- Teltonika

- Queclink

The Global Automotive Over-the-Air (OTA) Update Hardware Market was valued at USD 7.6 Billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 26.8 Billion by 2034.

The automotive sector is rapidly transitioning toward software-defined vehicles (SDVs), creating strong demand for robust OTA hardware infrastructure. This market includes essential components such as core processing units, memory and storage modules, connectivity hardware, security chips, and monitoring and diagnostic systems. These elements enable OTA software updates, software feature activations, and cybersecurity patches for fleets of vehicles. The rise of connected vehicle ecosystems, increasing complexity of automotive software, and the necessity for uninterrupted customer experiences are accelerating the adoption of OTA hardware. COVID-19 emphasized the importance of OTA capabilities by highlighting the need for remote updates and minimizing reliance on physical service centers. As manufacturers aim to enhance vehicle lifecycle management and reduce maintenance downtime, OTA hardware is emerging as a critical investment for automakers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $26.8 Billion |

| CAGR | 13.9% |

The market is rapidly integrating advanced connectivity solutions, including 5G cellular networks, Wi-Fi 6/6E, satellite communications, and Low Power Wide Area Network (LPWAN) technologies. These networks provide faster, more reliable OTA updates and support real-time vehicle-to-everything (V2X) communications. Vehicles equipped with multi-radio connectivity hardware can intelligently switch between networks based on signal strength, bandwidth requirements, and operational costs, ensuring consistent communication for updates and diagnostics.

The core processing hardware segment held a 35% share and is expected to grow at a CAGR of 13.2% from 2025 to 2034. This segment includes high-performance automotive processors, microcontrollers, system-on-chip (SoC) platforms, and specialized computing units designed for vehicle applications. Strong processing capability is essential to manage complex software updates, verify cybersecurity, and orchestrate various system functions efficiently. Meanwhile, cellular connectivity is projected to grow at a 15.1% CAGR and account for 49.4% of the market, driven by the need for reliable, high-bandwidth networks capable of supporting mission-critical OTA functions. Cellular technology offers carrier-grade reliability, global coverage, and secure implementation for critical updates.

Asia Pacific Automotive Over-the-Air (OTA) Update Hardware Market held a 41% share in 2024 and is expected to grow at a 15.1% CAGR. The region benefits from large-scale automotive production, rapid electric vehicle adoption, and government mandates promoting connected vehicle technologies. Regulatory requirements, such as upcoming standards in China, are compelling automakers to implement full OTA hardware capabilities in new vehicles, creating a significant opportunity for OTA hardware suppliers.

Key players in the Automotive Over-the-Air (OTA) Update Hardware Market include Intel, Broadcom, Qualcomm, Infineon, NXP Semiconductors, STMicroelectronics, Texas Instruments, Panasonic, Murata Manufacturing, and Nordic Semiconductor. Companies are focusing on innovation in processing and connectivity hardware to meet the demands of increasingly software-defined vehicles. Many are investing in multi-radio communication solutions, secure processors, and integrated system-on-chip designs to enhance OTA performance and cybersecurity. Strategic collaborations with automakers and Tier 1 suppliers are helping accelerate product adoption and global distribution. Regional expansion, especially in Asia Pacific, ensures access to high-volume automotive markets and regulatory-driven opportunities. Firms are also investing in research and development for next-generation 5G and satellite communication technologies to maintain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Connectivity

- 2.2.4 Update

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 SoC providers

- 3.1.1.2 Microcontroller (MCU) manufacturers

- 3.1.1.3 Connectivity & networking module suppliers

- 3.1.1.4 Semiconductor foundries

- 3.1.1.5 OTA software platform providers

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automotive industry digital transformation

- 3.2.1.2 IoT Device proliferation & federal cybersecurity mandates

- 3.2.1.3 Edge AI integration & chiplet architecture adoption

- 3.2.1.4 5G network deployment & enhanced connectivity infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Semiconductor supply chain concentration & geopolitical risks

- 3.2.2.2 Regulatory complexity & multi-jurisdictional compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Smart cities infrastructure modernization

- 3.2.3.2 Rural connectivity solutions & satellite-based OTA delivery

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Chiplet-based OTA systems & heterogeneous integration

- 3.3.1.2 3D packaging & advanced interconnect technologies

- 3.3.1.3 Neuromorphic computing integration for intelligent updates

- 3.3.1.4 Quantum-resistant security hardware implementation

- 3.3.2 Emerging technologies

- 3.3.2.1 6G network preparation & ultra-low latency updates

- 3.3.2.2 Satellite constellation integration for global coverage

- 3.3.2.3 Li-Fi & optical wireless communication for secure updates

- 3.3.2.4 Mesh networking & peer-to-peer update distribution

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Hardware component pricing dynamics

- 3.10.2 Total cost of ownership models

- 3.10.3 Value-based pricing strategies

- 3.10.4 Cost optimization opportunities

- 3.11 Investment & Funding

- 3.11.1 Government investment programs

- 3.11.2 Private equity & venture capital trends

- 3.11.3 Corporate investment & strategic partnerships

- 3.11.4 Research & development funding

- 3.12 Risk assessment & mitigation

- 3.12.1 Obsolescence risk & technology transition management

- 3.12.2 Supply chain disruption & component shortage risks

- 3.12.3 Currency fluctuation & international transaction risks

- 3.12.4 Firmware integrity & secure boot implementation

- 3.13 Cybersecurity & data privacy considerations

- 3.13.1 Root of trust implementation & hardware security modules

- 3.13.2 End-to-end encryption & secure communication channels

- 3.13.3 Anonymization & pseudonymization techniques

- 3.13.4 ISO 27001 & common criteria certification requirements

- 3.14 Consumer behavior & End use insights

- 3.14.1 Early adopter characteristics & technology enthusiasm

- 3.14.2 Update notification preferences & communication channels

- 3.14.3 Incident response & crisis communication effectiveness

- 3.14.4 Purchasing influence & decision-making authority mapping

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.1.1 Core Processing Hardware

- 5.1.1.1 Microcontrollers (MCUs) and System-on-Chip (SoC)

- 5.1.1.2 Domain & Central Compute Units

- 5.1.2 Connectivity & Communication Hardware

- 5.1.2.1 Connectivity Modules

- 5.1.2.2 Telematics Control Units (TCU)

- 5.1.2.3 Communication Gateways & Edge Nodes

- 5.1.3 Storage & Power Hardware

- 5.1.3.1 Non-volatile Memory & Storage Components

- 5.1.3.2 Power Management & Interface Hardware

- 5.1.4 Security & Data Protection Hardware

- 5.1.5 Diagnostic & Development Hardware

- 5.1.6 Others

- 5.1.1 Core Processing Hardware

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Cellular

- 6.3 Wi-Fi

- 6.4 Satellite

- 6.5 LPWAN

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Update, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Firmware Updates

- 7.3 Application / Software Updates

- 7.4 Security Patch Updates

- 7.5 Configuration & Calibration Updates

- 7.6 Feature Unlocks / Subscription-Based Updates

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Vehicle

- 8.2.1 Sedan

- 8.2.2 Hatchback

- 8.2.3 SUV

- 8.3 Commercial Vehicle

- 8.3.1 Light commercial vehicle

- 8.3.2 Medium commercial vehicle

- 8.3.3 Heavy commercial vehicle

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 North America

- 9.1.1 US

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Belgium

- 9.2.7 Netherlands

- 9.2.8 Sweden

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 Singapore

- 9.3.6 South Korea

- 9.3.7 Vietnam

- 9.3.8 Indonesia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 South Africa

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 Analog Devices

- 10.1.2 Broadcom

- 10.1.3 Infineon

- 10.1.4 Intel

- 10.1.5 Murata Manufacturing

- 10.1.6 Nordic Semiconductor

- 10.1.7 NXP Semiconductors

- 10.1.8 Panasonic

- 10.1.9 Qualcomm

- 10.1.10 Rolling Wireless

- 10.1.11 STMicroelectronics

- 10.1.12 Texas Instruments

- 10.2 Regional players

- 10.2.1 Renesas Electronics

- 10.2.2 ON Semiconductor

- 10.2.3 Micron Technology

- 10.2.4 Robert Bosch

- 10.2.5 Toshiba Electronic Devices & Storage

- 10.2.6 ROHM Semiconductor

- 10.3 Emerging players

- 10.3.1 Microchip Technology

- 10.3.2 Nexperia

- 10.3.3 Wolfspeed

- 10.3.4 Vishay Intertechnology

- 10.3.5 Teltonika

- 10.3.6 Queclink