|

市场调查报告书

商品编码

1871192

氢燃料电池汽车冷却系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Hydrogen Fuel Cell Vehicle Cooling System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

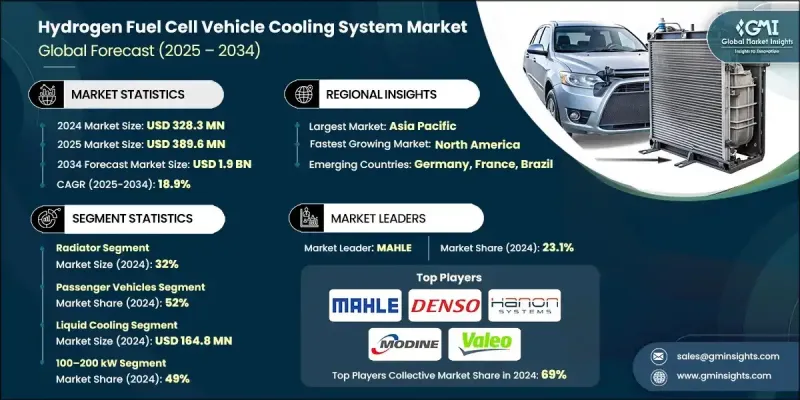

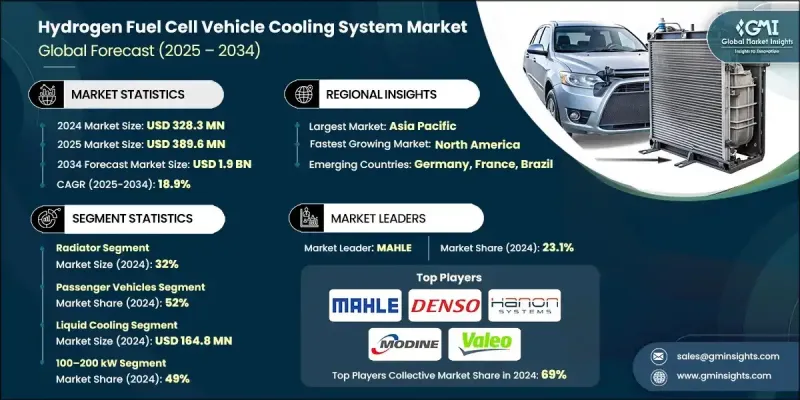

2024 年全球氢燃料电池汽车冷却系统市值为 3.283 亿美元,预计到 2034 年将以 18.9% 的复合年增长率增长至 19 亿美元。

氢燃料电池汽车的日益普及、对永续交通的日益关注以及对能够提升性能和耐久性的高效热管理系统的需求不断增长,共同推动了氢燃料电池市场的显着扩张。冷却技术、材料和系统设计的持续进步也为市场发展提供了支持,使製造商能够生产出稳健、可扩展且节能的解决方案。这些创新对于维持氢动力汽车的热平衡、提高整体可靠性以及确保符合全球安全和排放法规至关重要。随着商用车队的电气化和氢能交通基础设施的快速发展,对高效能冷却系统的需求持续成长。汽车製造商和零件供应商正着力研发人工智慧驱动的轻量化热管理技术,以打造面向未来交通生态系统的、兼具永续性、高效能和高性能的下一代燃料电池车。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.283亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 18.9% |

氢燃料电池汽车的冷却系统,包括散热器、热交换器、冷却液泵、电子控制单元和导热界面材料,在维持电力电子元件、电池和燃料电池的理想工作温度方面发挥着至关重要的作用。高效率的热管理不仅能确保稳定的功率输出和延长零件寿命,还能最大限度地降低过热和机械性能下降的风险。市场的快速成长与技术进步、日益严格的环境法规以及向零排放交通解决方案加速转型密切相关。

2024年,散热器市占率占比达32%,预计2025年至2034年间将以20.1%的复合年增长率成长。此细分市场占据主导地位,是因为其在稳定关键车辆系统温度、确保能量平稳流动和实现最佳性能方面发挥着至关重要的作用。领先的原始设备製造商 (OEM) 和一级供应商已广泛采用散热器,用于商用和乘用氢燃料电池汽车。采用混合式和液冷技术的先进散热器设计具有卓越的散热性能、更高的运行可靠性和更长的车辆使用寿命,使其成为氢能出行领域的首选。

2024年,乘用车市占率达到52%,预计到2034年将以18.4%的复合年增长率成长。此细分市场的主导地位归功于全球对高效能、低排放汽车日益增长的需求,以及先进冷却架构在氢动力乘用车中的应用。这些系统优化了电池和燃料电池的性能,从而提高了可靠性、安全性和车辆耐用性。消费者对环保汽车的需求以及政府主导的永续发展政策,持续推动该细分市场的强劲成长。

中国氢燃料电池汽车冷却系统市场占41%的份额,市场规模达9,970万美元。中国在该领域的领先地位得益于氢动力车队的快速普及以及旨在推动清洁出行解决方案的强有力政策激励。亚太地区庞大的汽车製造基地以及对下一代汽车技术不断增长的投资进一步巩固了其市场主导地位。亚太地区仍然是氢燃料汽车发展的关键中心,这得益于其大规模的生产能力、不断扩展的基础设施以及先进冷却系统在商用和乘用车队中的广泛应用。

全球氢燃料电池汽车冷却系统市场的主要参与者包括博世、宝马、电装、韩昂系统、现代汽车、大陆集团、马勒、莫迪恩、丰田汽车和法雷奥。为了巩固市场地位,领先的製造商正积极推行一系列策略性倡议,并专注于创新、合作和产能扩张。各公司正大力投资研发,以推动热管理材料的研发,提高冷却效率,并改善氢动力汽车的系统整合。他们正与汽车原始设备製造商 (OEM) 和技术开发商建立合作关係,以加速产品开发并优化系统相容性。许多企业强调轻量化材料和数位化热控制解决方案,以满足能源效率标准和永续发展目标。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 氢燃料电池汽车的普及率不断提高

- 冷却系统的技术进步

- 严格的监管要求

- 车队电气化和商用车部署

- 产业陷阱与挑战

- 高昂的系统成本

- 基础设施和供应链有限

- 市场机会

- 与连网汽车技术的集成

- 拓展至商业和重型应用领域

- 燃料电池汽车的日益普及

- 热管理技术进步

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 国际标准框架

- 区域监理框架

- 安全与性能标准

- 认证和测试协议

- 未来监理演变

- 政府补贴和激励措施对技术采纳的影响

- 各地区的氢燃料补贴和税收抵免

- 基础设施投资和部署激励措施

- 对冷却系统规格及研发的影响

- 透过激励措施加速产量成长

- 供应商选择标准受政策影响

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术评估

- 技术准备度评估

- 创新生态系分析

- 专利格局与智慧财产权

- 未来创新路线图

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 保护关键冷却技术的关键专利

- 专利到期路线图与研发机会

- 市场空白识别与创新差距

- 许可和交叉许可安排

- 新兴专利持有者和颠覆性技术

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 风险评估框架

- 最佳情况

- 氢燃料电池系统热行为与产热曲线

- 不同运转条件下的热量产生

- 热循环效应

- 系统回应时间和效率指标

- 与电池热管理系统集成

- 双热负载管理

- 混合燃料电池-电池架构

- 跨系统热交换策略

- 控制整合与优化

- 冷启动和极端气候性能

- 耐久性测试标准与验证规程

- 製造製程创新与生产规模化

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 散热器

- 冷却液帮浦

- 热交换器

- 散热风扇

- 阀门和感测器

- 其他的

第六章:市场估算与预测:依冷冻技术划分,2021-2034年

- 主要趋势

- 液冷

- 混合冷却

- 空气冷却

第七章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- SUV

- 轿车

- 掀背车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 特种车辆

第八章:市场估计与预测:依发电量划分,2021-2034年

- 主要趋势

- 100-200千瓦

- 低于100千瓦

- 200度以上

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 私人交通

- 大众运输

- 工业的

- 军事与国防

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十一章:公司简介

- 全球参与者

- BMW

- Daimler

- Ford Motor

- General Motors

- Honda Motor

- Hyundai Motor

- Mercedes-Benz

- Stellantis

- Toyota Motor

- Volvo

- 区域玩家

- Aisin

- Bosch

- Continental

- Cummins

- Denso

- Hanon Systems

- MAHLE

- Modine

- Plug Power

- Valeo

- 新兴玩家

- Eberspacher

- Hanon Systems

- Sanden

- Scania

- Webasto

The Global Hydrogen Fuel Cell Vehicle Cooling System Market was valued at USD 328.3 million in 2024 and is estimated to grow at a CAGR of 18.9% to reach USD 1.9 Billion by 2034.

The significant expansion is fueled by the growing adoption of hydrogen fuel cell vehicles, the rising focus on sustainable transportation, and the increasing need for high-efficiency thermal management systems that boost performance and durability. The market's development is being supported by continuous advancements in cooling technologies, materials, and system designs, enabling manufacturers to produce robust, scalable, and energy-efficient solutions. These innovations are essential for maintaining the thermal balance of hydrogen-powered vehicles, improving overall reliability, and ensuring compliance with global safety and emission regulations. The demand for effective cooling systems continues to rise alongside the electrification of commercial fleets and the rapid evolution of hydrogen mobility infrastructure. Automakers and component suppliers are emphasizing AI-driven and lightweight thermal management technologies to deliver next-generation fuel cell vehicles designed for sustainability, efficiency, and performance in future transportation ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $328.3 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 18.9% |

Hydrogen fuel cell vehicle cooling systems, which include radiators, heat exchangers, coolant pumps, electronic control units, and thermal interface materials, play a crucial role in maintaining the ideal operating temperature of power electronics, batteries, and fuel cells. Efficient thermal management not only ensures steady power delivery and component longevity but also minimizes the risk of overheating and mechanical degradation. The market's rapid growth is closely linked to technological advancements, stricter environmental mandates, and the accelerating transition toward zero-emission transportation solutions.

The radiator segment accounted for a 32% share in 2024 and is projected to grow at a CAGR of 20.1% between 2025 and 2034. This segment dominates due to its vital role in stabilizing the temperature of key vehicle systems, ensuring smooth energy flow, and optimal performance. Radiators are widely adopted by leading OEMs and Tier-1 suppliers for both commercial and passenger hydrogen fuel cell vehicles. Advanced radiator designs featuring hybrid and liquid-cooled technologies offer superior heat dissipation, increased operational reliability, and improved vehicle longevity, making them the preferred choice in the hydrogen mobility landscape.

The passenger vehicle segment held a 52% share in 2024 and is expected to grow at a CAGR of 18.4% through 2034. This segment's dominance is attributed to rising global interest in efficient, low-emission vehicles and the integration of advanced cooling architectures into hydrogen-powered passenger cars. These systems optimize the performance of batteries and fuel cells, providing greater reliability, enhanced safety, and improved vehicle durability. The combination of consumer demand for environmentally responsible vehicles and government-driven sustainability policies continues to support strong growth in this category.

China Hydrogen Fuel Cell Vehicle Cooling System Market held a 41% share, generating USD 99.7 million. The country's leadership is driven by the rapid adoption of hydrogen-powered fleets and strong policy incentives that promote cleaner mobility solutions. The region's vast automotive manufacturing base and growing investments in next-generation vehicle technologies further strengthen its dominance. Asia Pacific remains a key hub for hydrogen vehicle development, supported by large-scale production capabilities, infrastructure expansion, and widespread deployment of advanced cooling systems across both commercial and passenger fleets.

Major companies operating in the Global Hydrogen Fuel Cell Vehicle Cooling System Market include Bosch, BMW, Denso, Hanon Systems, Hyundai Motor, Continental, MAHLE, Modine, Toyota Motor, and Valeo. To reinforce their market position, leading manufacturers are pursuing a combination of strategic initiatives focused on innovation, collaboration, and capacity expansion. Companies are investing heavily in research and development to advance thermal management materials, enhance cooling efficiency, and improve system integration for hydrogen-powered vehicles. Partnerships with automotive OEMs and technology developers are being established to accelerate product development and optimize system compatibility. Many players emphasize lightweight materials and digital thermal control solutions to meet efficiency standards and sustainability targets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Cooling technology

- 2.2.4 Vehicle

- 2.2.5 Power output

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of hydrogen fuel cell vehicles

- 3.2.1.2 Technological advancements in cooling systems

- 3.2.1.3 Stringent regulatory mandates

- 3.2.1.4 Fleet electrification and commercial vehicle deployment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs

- 3.2.2.2 Limited infrastructure and supply chain

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with connected vehicle technologies

- 3.2.3.2 Expansion into commercial and heavy-duty applications

- 3.2.3.3 Growing adoption of fuel cell vehicles

- 3.2.3.4 Technological advancements in thermal management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 International standards framework

- 3.4.2 Regional regulatory frameworks

- 3.4.3 Safety & performance standards

- 3.4.4 Certification & testing protocols

- 3.4.5 Future regulatory evolution

- 3.4.6 Government subsidies and incentive impact on technology adoption

- 3.4.6.1 Hydrogen fuel subsidies and tax credits by region

- 3.4.6.2 Infrastructure investment and deployment incentives

- 3.4.6.3 Impact on cooling system specifications and R&D

- 3.4.6.4 Production volume acceleration from incentives

- 3.4.6.5 Supplier selection criteria influenced by policy

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technology assessment

- 3.7.2 Technology readiness assessment

- 3.7.3 Innovation ecosystem analysis

- 3.7.4 Patent landscape & intellectual property

- 3.7.5 Future innovation roadmap

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.11.1 Critical patents protecting key cooling technologies

- 3.11.2 Patent expiration roadmap and R&D opportunities

- 3.11.3 White space identification and innovation gaps

- 3.11.4 Licensing and cross-licensing arrangements

- 3.11.5 Emerging patent holders and disruptive technologies

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk assessment framework

- 3.14 Best case scenarios

- 3.15 Hydrogen fuel cell system thermal behavior and heat generation profiles

- 3.15.1 Heat generation at different operating conditions

- 3.15.2 Thermal cycling effects

- 3.15.3 System response times and efficiency metrics

- 3.16 Integration with battery thermal management systems

- 3.16.1 Dual thermal load management

- 3.16.2 Hybrid fuel cell-battery architectures

- 3.16.3 Cross-system heat exchange strategies

- 3.16.4 Control integration and optimization

- 3.17 Cold start and extreme climate performance

- 3.18 Durability testing standards and validation protocols

- 3.19 Manufacturing process innovations and production scalability

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Radiator

- 5.3 Coolant pump

- 5.4 Heat exchanger

- 5.5 Cooling fans

- 5.6 Valves and sensors

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Cooling Technology, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Liquid cooling

- 6.3 Hybrid cooling

- 6.4 Air cooling

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

- 7.4 Specialized Vehicles

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 100-200 kW

- 8.3 Below 100 kW

- 8.4 Above 200 kW

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Private transportation

- 9.3 Public transportation

- 9.4 Industrial

- 9.5 Military & defense

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Key trends

- 10.3 North America

- 10.3.1 US

- 10.3.2 Canada

- 10.4 Europe

- 10.4.1 UK

- 10.4.2 Germany

- 10.4.3 France

- 10.4.4 Italy

- 10.4.5 Spain

- 10.4.6 Belgium

- 10.4.7 Netherlands

- 10.4.8 Sweden

- 10.5 Asia Pacific

- 10.5.1 China

- 10.5.2 India

- 10.5.3 Japan

- 10.5.4 Australia

- 10.5.5 Singapore

- 10.5.6 South Korea

- 10.5.7 Vietnam

- 10.5.8 Indonesia

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Mexico

- 10.6.3 Argentina

- 10.7 MEA

- 10.7.1 UAE

- 10.7.2 South Africa

- 10.7.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 BMW

- 11.1.2 Daimler

- 11.1.3 Ford Motor

- 11.1.4 General Motors

- 11.1.5 Honda Motor

- 11.1.6 Hyundai Motor

- 11.1.7 Mercedes-Benz

- 11.1.8 Stellantis

- 11.1.9 Toyota Motor

- 11.1.10 Volvo

- 11.2 Regional players

- 11.2.1 Aisin

- 11.2.2 Bosch

- 11.2.3 Continental

- 11.2.4 Cummins

- 11.2.5 Denso

- 11.2.6 Hanon Systems

- 11.2.7 MAHLE

- 11.2.8 Modine

- 11.2.9 Plug Power

- 11.2.10 Valeo

- 11.3 Emerging players

- 11.3.1 Eberspacher

- 11.3.2 Hanon Systems

- 11.3.3 Sanden

- 11.3.4 Scania

- 11.3.5 Webasto