|

市场调查报告书

商品编码

1871193

连续热监测市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Continuous Thermal Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

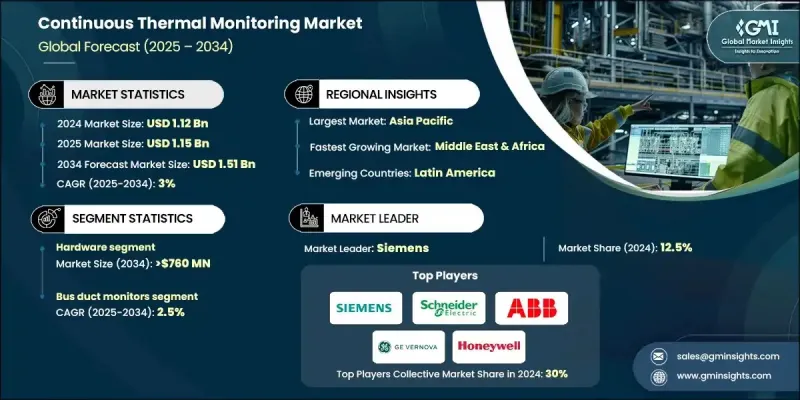

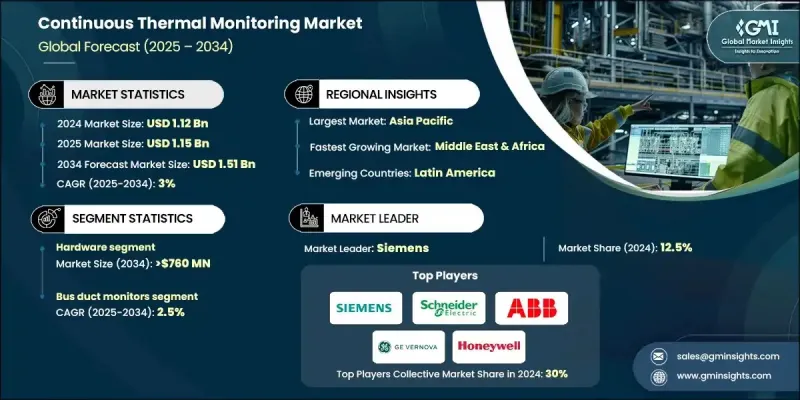

2024 年全球连续热监测市场价值为 11.2 亿美元,预计到 2034 年将以 3% 的复合年增长率增长至 15.1 亿美元。

市场成长的主要驱动力是各行各业对预测性维护和营运安全的日益重视。能源、製造和资料中心等行业正越来越多地部署连续热监测 (CTM) 系统,以便在潜在问题升级为严重故障之前识别它们。日益增长的安全法规和标准合规需求也促使企业实施连续热追踪解决方案。即时监控温度变化使企业能够最大限度地降低火灾风险,保持稳定的营运效率,并达到安全基准。人工智慧 (AI)、物联网 (IoT) 和边缘运算等新一代技术的整合彻底革新了 CTM 系统,使其拥有更快的处理速度、更高的精度和更强大的预测能力。这些技术进步使 CTM 解决方案更加智慧、经济高效且适应性更强,尤其适用于高风险和偏远的工业环境,在这些环境中,早期检测和快速反应至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11.2亿美元 |

| 预测值 | 15.1亿美元 |

| 复合年增长率 | 3% |

预计到2034年,硬体领域市场规模将达到7.6亿美元,因为热感测器、监控设备及相关硬体对于在各个领域收集即时温度资料仍然至关重要。由于其在确保精确温度检测、快速资料传输和可靠运行方面发挥核心作用,该领域占据了连续热监测市场最大的份额。随着连续热监测技术在医疗保健、工业自动化和安防系统中的应用日益广泛,硬体组件仍然是高性能热监测应用的基础,这些应用对精度和耐用性都有极高的要求。

预计到2034年,母线槽监测市场将以2.5%的复合年增长率成长。母线槽是工业、商业和公用事业营运中大型配电系统不可或缺的一部分,因为它们负责在电力网路中传输大量的电力负载。对母线槽进行持续监测,能够帮助操作人员识别导体、接头或连接处的异常发热或绝缘劣化,从而防止代价高昂的故障和非计划性停机。该市场的扩张反映了整个行业向预测性维护和增强复杂电力系统安全性的转变,而这些系统负责关键基础设施的运作。

2024年,美国连续热监测市场规模预估为2.5884亿美元。该国市场的成长得益于技术创新和小型化无线热监测解决方案的日益普及。感测器性能、连接性和价格优势的提升,使得连续热监测在工业设施、医疗保健和住宅环境中更加实用和普及。

全球连续热监测市场的主要参与者包括:Teledyne FLIR LLC、Ellab A/S、施耐德电气、Doble Engineering Company、Dynamic Ratings、霍尼韦尔国际公司、Microchip Technologies、西门子、ABB、Optris、Calex Electronics Limited、Vertiv Group Corp.、GEnova、Pocoan、德尔格公司、欧龙会公司、欧龙会公司、Campers、amak00000,000 株。这些企业正透过创新、合作和技术整合来巩固其市场地位。许多企业正大力投资研发,利用人工智慧和物联网解决方案来提升系统的精确度、连线性和自动化程度。与工业和能源领域的企业进行策略合作,有助于扩大市场覆盖范围,并实现客製化监测系统的交付。製造商正在升级感测器技术,以在关键应用中提供更快的反应速度和更高的可靠性。拓展产品组合,涵盖无线、穿戴式和远端监测解决方案,已成为关键的竞争策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化与物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准描述

- 战略仪錶板

- 创新与技术格局

第五章:连续热监测市场规模及预测:依产品类型划分,2021-2034年

- 主要趋势

- 硬体

- 软体

- 服务

第六章:连续热监测市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 母线槽监视器

- 开关设备监控

- 运动控制中心

- 干式变压器

- 低压变压器

- 其他的

第七章:连续热监测市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 资料中心

- 石油和天然气

- 后勤

- 公用事业

- 製造业

- 卫生保健

- 零售

- 电信

- 其他的

第八章:连续热监测市场规模及预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Advanced Energy

- Calex Electronics Limited

- Dragerwerk AG & Co. KGaA

- Doble Engineering Company

- Dynamic Ratings

- Ellab A/S

- Exertherm

- GE Vernova

- Honeywell International, Inc.

- Microchip Technologies

- OMRON Corporation

- Optris

- Powell Industries

- Schneider Electric

- Siemens

- Teledyne FLIR LLC

- Vaisala

- Vertiv Group Corp.

- WIKA Alexander Wiegand SE & Co.KG.

The Global Continuous Thermal Monitoring Market was valued at USD 1.12 Billion in 2024 and is estimated to grow at a CAGR of 3% to reach USD 1.51 Billion by 2034.

Market growth is driven primarily by the rising focus on predictive maintenance and operational safety across multiple industries. Sectors such as energy, manufacturing, and data centers are increasingly deploying continuous thermal monitoring (CTM) systems to identify potential issues before they escalate into critical failures. The growing need to comply with safety regulations and standards is also driving organizations to implement continuous thermal tracking solutions. Real-time monitoring of temperature variations enables businesses to minimize fire hazards, maintain consistent operational efficiency, and meet safety benchmarks. The integration of next-generation technologies like artificial intelligence (AI), Internet of Things (IoT), and edge computing has revolutionized CTM systems, offering faster processing, enhanced accuracy, and predictive insights. These technological advancements are making CTM solutions more intelligent, cost-efficient, and adaptable, especially for high-risk and remote industrial environments where early detection and quick response are crucial.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.12 Billion |

| Forecast Value | $1.51 Billion |

| CAGR | 3% |

The hardware segment is projected to reach USD 760 million by 2034, as thermal sensors, monitoring devices, and related hardware remain vital for collecting real-time temperature data across diverse sectors. This segment accounts for the largest share of the continuous thermal monitoring market because of its core role in ensuring precise temperature detection, rapid data transmission, and dependable operation. With the increasing adoption of CTM in healthcare, industrial automation, and security systems, hardware components remain the foundation for high-performance thermal monitoring applications that demand accuracy and durability.

The bus duct monitoring segment is forecasted to grow at a CAGR of 2.5% through 2034. Bus ducts are integral to large-scale electrical distribution systems in industrial, commercial, and utility operations, as they transfer significant electrical loads across power networks. Continuous monitoring of bus ducts enables operators to identify abnormal heat buildup or insulation deterioration in conductors, joints, or connections, preventing costly failures and unplanned downtime. The expansion of this segment reflects a broader industry shift toward predictive maintenance and enhanced safety in complex power systems that handle critical infrastructure operations.

United States Continuous Thermal Monitoring Market was valued at USD 258.84 million in 2024. The country's market growth is supported by technological innovation and increasing adoption of miniaturized, wireless thermal monitoring solutions. Advances in sensor performance, connectivity, and affordability have made continuous thermal monitoring more practical and accessible for industrial facilities as well as healthcare and residential environments.

Prominent companies active in the Global Continuous Thermal Monitoring Market include Teledyne FLIR LLC, Ellab A/S, Schneider Electric, Doble Engineering Company, Dynamic Ratings, Honeywell International, Inc., Microchip Technologies, Siemens, ABB, Optris, Calex Electronics Limited, Vertiv Group Corp., GE Vernova, Powell Industries, Dragerwerk AG & Co. KGaA, OMRON Corporation, Exertherm, Advanced Energy, and Vaisala. Companies operating in the Global Continuous Thermal Monitoring Market are strengthening their positions through innovation, partnerships, and technology integration. Many are investing heavily in research and development to enhance system accuracy, connectivity, and automation using AI and IoT-enabled solutions. Strategic collaborations with industrial and energy players are expanding their market reach and enabling the delivery of customized monitoring systems. Manufacturers are upgrading sensor technology to provide faster response times and improved reliability across critical applications. Expanding product portfolios to include wireless, wearable, and remote monitoring solutions has become a key competitive strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by Region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Continuous Thermal Monitoring Market Size and Forecast, By Offering, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Service

Chapter 6 Continuous Thermal Monitoring Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Bus duct monitors

- 6.3 Switchgear monitoring

- 6.4 Motor control centers

- 6.5 Dry transformers

- 6.6 Low voltage transformers

- 6.7 Others

Chapter 7 Continuous Thermal Monitoring Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Data Centers

- 7.3 Oil & Gas

- 7.4 Logistics

- 7.5 Utilities

- 7.6 Manufacturing

- 7.7 Healthcare

- 7.8 Retail

- 7.9 Telecommunications

- 7.10 Others

Chapter 8 Continuous Thermal Monitoring Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.1.3 Mexico

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 France

- 8.2.3 Germany

- 8.2.4 Italy

- 8.2.5 Russia

- 8.2.6 Spain

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 Australia

- 8.3.3 India

- 8.3.4 Japan

- 8.3.5 South Korea

- 8.4 Middle East & Africa

- 8.4.1 Saudi Arabia

- 8.4.2 UAE

- 8.4.3 Turkey

- 8.4.4 South Africa

- 8.4.5 Egypt

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Advanced Energy

- 9.3 Calex Electronics Limited

- 9.4 Dragerwerk AG & Co. KGaA

- 9.5 Doble Engineering Company

- 9.6 Dynamic Ratings

- 9.7 Ellab A/S

- 9.8 Exertherm

- 9.9 GE Vernova

- 9.10 Honeywell International, Inc.

- 9.11 Microchip Technologies

- 9.12 OMRON Corporation

- 9.13 Optris

- 9.14 Powell Industries

- 9.15 Schneider Electric

- 9.16 Siemens

- 9.17 Teledyne FLIR LLC

- 9.18 Vaisala

- 9.19 Vertiv Group Corp.

- 9.20 WIKA Alexander Wiegand SE & Co.KG.