|

市场调查报告书

商品编码

1871210

智慧家庭产品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Smart Home Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

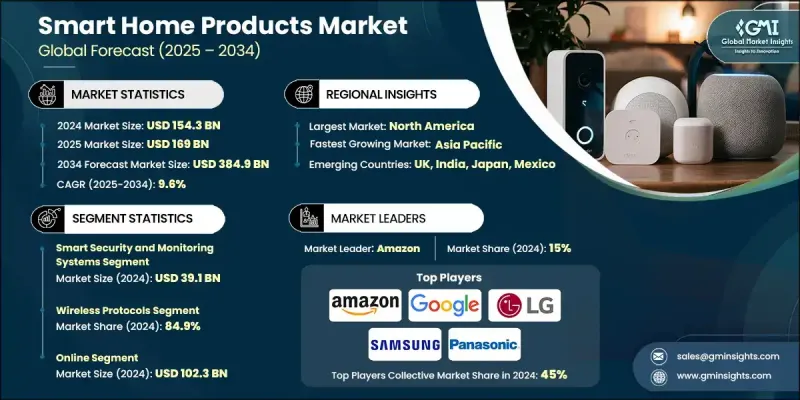

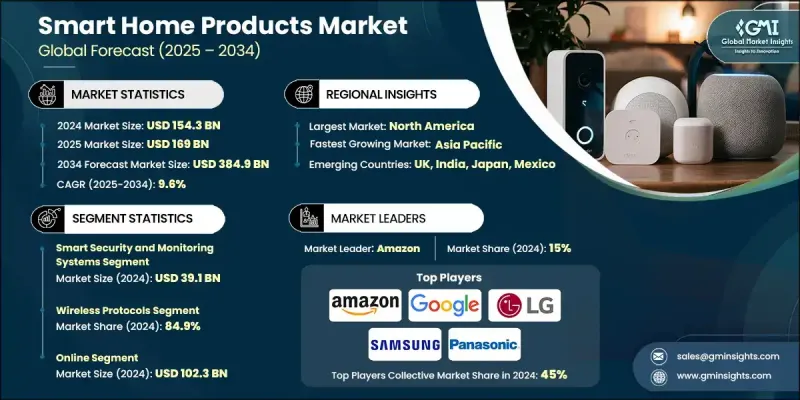

2024年全球智慧家庭产品市场价值为1,543亿美元,预计到2034年将以9.6%的复合年增长率成长至3,849亿美元。

随着家庭越来越倾向于使用旨在提升舒适度、能源效率和永续性的互联技术,市场正在经历快速转型。推动这一领域发展的一大趋势是将再生能源系统(尤其是太阳能)与智慧家庭设备结合。政府激励措施,例如美国联邦太阳能税收抵免政策(安装可享有30%的补贴),正在加速太阳能相容型智慧解决方案的普及。向环保生活方式的转变促使製造商设计符合全球绿色建筑标准的设备。根据美国绿色建筑委员会估计,住宅空间中的节能技术可将能源消耗降低高达30%。市场上的公司正在利用尖端材料和人工智慧来提升产品的性能和功能。智慧恆温器、智慧空气清净机和人工智慧机器人设备正成为永续智慧生活的重要组成部分,兼顾便利性和环保责任。日益增强的环保意识和自动化技术的进步将继续推动全球智慧家庭技术的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1543亿美元 |

| 预测值 | 3849亿美元 |

| 复合年增长率 | 9.6% |

2024年,智慧安防监控系统市场规模预计将达391亿美元。家庭安全解决方案需求的激增以及物联网整合度的提高推动了这一成长。根据美国能源部统计,智慧家居产业正以每年20%的速度成长,这主要得益于政府为促进节能和先进安防而推出的各项措施。製造商们积极回应,开发出不仅能提升安全性,还能优化能源消耗的智慧系统。专注于永续和节能安防系统的公司正积极响应政策激励措施支持的绿色家居倡议,这进一步促进了已开发地区对智慧家庭的普及。

到了2024年,无线协定领域占84.9%的市场。 Zigbee、Wi-Fi和Z-Wave等技术仍然是智慧家庭物联网连接的基石,它们具有简单、可靠和灵活等优点。云端平台和行动应用程式的广泛应用正促使消费者投资购买无线设备。无线系统使用户能够远端控制照明、温度和家电,从而提高便利性并减少能源浪费。这些系统还支援无缝升级和互通性,满足了消费者对互联节能生活环境日益增长的需求。便捷易用的安装方式正持续推动无线技术在智慧家庭生态系统中占据主导地位。

2024年,美国智慧家庭产品市占率达到77.2%,并持续维持该地区领先地位。强劲的经济情势、不断提升的消费者购买力以及智慧家庭系统日益普及,巩固了美国作为产业成长关键驱动力的地位。美国消费者越来越青睐高端、技术先进的产品,这些产品能够提供更佳的能源管理、永续性和舒适性。众多全球知名品牌进驻美国市场,进一步增强了其影响力。这些公司致力于创新、整合和智慧基础设施建设,以满足消费者不断变化的生活方式需求。

全球智慧家居产品市场的主要参与者包括LG、亚马逊、戴森、三星、霍尼韦尔、谷歌、博世、iRobot、Ecobee、Ring、松下、施耐德电气、西门子、Sonos和小米。为了巩固市场地位,领先企业正致力于创新、合作和产品多元化。许多企业正透过人工智慧驱动的自动化、云端整合以及与再生能源系统的兼容性来扩展其智慧生态系统。与技术提供者和绿色能源公司的合作正在提升产品的功能性和永续性。各公司也在加大研发投入,以开发具有更高能源效率和无缝互通性的设备。策略性併购以及向新兴市场的扩张有助于品牌赢得更大的客户群。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对能源效率日益增长的需求

- 物联网和无线连接扩展

- 安全问题

- 产业陷阱与挑战

- 资料隐私与网路安全风险

- 高昂的初始成本和分散的生态系统

- 机会

- 新兴市场的成长

- 与健康和医疗保健的融合

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 风险评估

- 差距分析

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 智慧安防监控系统

- 监视器

- 婴儿监视器

- 智慧门锁

- 其他(智慧型烟雾侦测器等)

- 智慧照明和电气系统

- 智慧灯泡

- 智慧灯开关

- 智慧灯具

- 其他(智慧配电盘等)

- 智慧气候控制与暖通空调系统

- 智慧型恆温器

- 智慧暖通空调控制器

- 智慧型空气清净机

- 智慧加湿器和除湿器

- 其他(智慧空气品质监测器等)

- 智慧娱乐与媒体系统

- 智慧音箱

- 智慧型串流媒体设备

- 智慧投影仪

- 智慧型游戏机

- 其他(智慧VR/AR系统等)

- 智慧厨房和家电系统

- 智慧冰箱

- 智慧型烤箱和炉具

- 智慧洗碗机

- 智慧咖啡机

- 其他(智慧搅拌机等)

- 智慧洗衣和清洁系统

- 智慧型洗衣机

- 智慧型烘干机

- 智慧机器人吸尘器

- 其他(智慧窗户清洁器等)

- 智慧户外及花园系统

- 智慧洒水控制器

- 智慧滴灌

- 智慧割草机

- 其他(智慧气象站等)

- 智慧健康与保健系统

- 智慧空气品质监测器

- 智慧睡眠监测器

- 智慧药品发放器

- 其他(智慧跌倒侦测系统等)

- 智慧能源与公用事业系统

- 智慧电錶

- 智慧太阳能係统

- 智慧电池储存

- 其他(智慧型负载控制器等)

- 其他(智慧连接与控制系统等)

第六章:市场估算与预测:以连结方式划分,2021-2034年

- 主要趋势

- 无线协定

- ZigBee

- 无线上网

- 蓝牙

- Z-Wave

- 其他的

- 有线协议

- 乙太网路

- 电力线路通讯(PLC)

- 杂交种。

第七章:市场估计与预测:依价格划分,2021-2034年

- 主要趋势

- 低价(低于 500 美元)

- 中等(500 美元至 1000 美元之间)

- 高价(1000 美元以上)

第八章:市场估算与预测:依安装量划分,2021-2034年

- 主要趋势

- 新建工程

- 改造

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 在线的

- 离线

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Amazon

- Bosch

- Dyson

- Ecobee

- Honeywell

- iRobot

- LG

- Panasonic

- Ring

- Samsung

- Schneider Electric

- Siemens

- Sonos

- Xiaomi

The Global Smart Home Products Market was valued at USD 154.3 Billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 384.9 Billion by 2034.

The market is undergoing rapid transformation as households increasingly embrace connected technologies designed to improve comfort, energy efficiency, and sustainability. A growing trend shaping this sector is the integration of renewable energy systems, particularly solar power, with smart home devices. Government incentives such as the U.S. federal solar tax credit, which provides a 30% rebate on installation, are accelerating the adoption of solar-compatible smart solutions. The shift toward eco-friendly living has prompted manufacturers to design devices that align with global green building standards. Energy-efficient technologies in residential spaces are estimated to reduce energy usage by up to thirty percent, according to the United States Green Building Council. Companies across the market are leveraging cutting-edge materials and artificial intelligence to elevate product performance and functionality. Smart thermostats, intelligent air purifiers, and AI-enabled robotic devices are becoming key components in sustainable smart living, catering to both convenience and environmental responsibility. Growing environmental awareness and advances in automation continue to shape the evolution of smart home technologies globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $154.3 Billion |

| Forecast Value | $384.9 Billion |

| CAGR | 9.6% |

The smart security and monitoring systems segment generated USD 39.1 Billion in 2024. The surge in demand for home safety solutions and increased IoT integration has fueled this growth. According to the U.S. Department of Energy, the smart home sector is expanding at an annual rate of 20%, largely driven by government initiatives that promote energy conservation and advanced security. Manufacturers are responding by developing intelligent systems that not only enhance safety but also optimize energy consumption. Companies focusing on sustainable and energy-saving security systems are aligning with green home initiatives supported by policy incentives, which is reinforcing adoption across developed regions.

The wireless protocols segment held 84.9% share in 2024. Technologies such as Zigbee, Wi-Fi, and Z-Wave remain the backbone of IoT connectivity in smart homes, offering simplicity, reliability, and flexibility. The widespread adoption of cloud platforms and mobile apps is encouraging consumers to invest in wireless-enabled devices. Wireless systems enable homeowners to control lighting, temperature, and appliances remotely, improving convenience and reducing energy waste. These systems also allow for seamless upgrades and interoperability, matching the growing consumer demand for connected and energy-efficient living environments. The trend toward hassle-free, user-friendly installations continues to drive wireless technology's dominance across the smart home ecosystem.

United States Smart Home Products Market held a 77.2% share in 2024, maintaining a leading position in the region. Strong economic conditions, rising consumer purchasing power, and the growing popularity of home automation systems have solidified the U.S. as a key driver of industry growth. American consumers are increasingly drawn to premium, technologically advanced products that offer enhanced energy management, sustainability, and comfort. The presence of major global brands in the U.S. further strengthens its influence, with companies focusing on innovation, integration, and smart infrastructure development to support the evolving lifestyle needs of consumers.

Key players active in the Global Smart Home Products Market include LG, Amazon, Dyson, Samsung, Honeywell, Google, Bosch, iRobot, Ecobee, Ring, Panasonic, Schneider Electric, Siemens, Sonos, and Xiaomi. To strengthen their presence, leading companies are focusing on innovation, partnerships, and product diversification. Many are expanding their smart ecosystems through AI-driven automation, cloud integration, and compatibility with renewable energy systems. Collaborations with technology providers and green energy firms are enhancing product functionality and sustainability. Companies are also investing in R&D to develop devices with improved energy efficiency and seamless interoperability. Strategic mergers, acquisitions, and expansion into emerging markets help brands capture a larger customer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Connectivity

- 2.2.4 Price range

- 2.2.5 Installation

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy-efficiency

- 3.2.1.2 IoT and wireless connectivity expansion

- 3.2.1.3 Security and safety concerns

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and cybersecurity risks

- 3.2.2.2 High initial costs and fragmented ecosystems

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging markets

- 3.2.3.2 Integration with wellness and healthcare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Risk Assessment

- 3.9 Gap Analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behaviour

- 3.12.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Smart security & monitoring systems

- 5.2.1 Security cameras

- 5.2.2 Baby monitors

- 5.2.3 Smart door locks

- 5.2.4 Others (smart smoke detectors etc.)

- 5.3 Smart lighting & electrical systems

- 5.3.1 Smart light bulbs

- 5.3.2 Smart light switches

- 5.3.3 Smart light fixtures

- 5.3.4 Others (smart electrical panels etc.)

- 5.4 Smart climate control & HVAC systems

- 5.4.1 Smart thermostats

- 5.4.2 Smart HVAC controllers

- 5.4.3 Smart air purifiers

- 5.4.4 Smart humidifiers & dehumidifiers

- 5.4.5 Others (smart air quality monitors etc.)

- 5.5 Smart entertainment & media systems

- 5.5.1 Smart speakers

- 5.5.2 Smart streaming devices

- 5.5.3 Smart projectors

- 5.5.4 Smart gaming consoles

- 5.5.5 Others (smart VR/AR systems etc.)

- 5.6 Smart kitchen & appliance systems

- 5.6.1 Smart refrigerators

- 5.6.2 Smart ovens & ranges

- 5.6.3 Smart dishwashers

- 5.6.4 Smart coffee makers

- 5.6.5 Others (smart blenders etc.)

- 5.7 Smart laundry & cleaning systems

- 5.7.1 Smart washing machines

- 5.7.2 Smart dryers

- 5.7.3 Smart robotic vacuums

- 5.7.4 Others (smart window cleaners etc.)

- 5.8 Smart outdoor & garden systems

- 5.8.1 Smart sprinkler controllers

- 5.8.2 Smart drip irrigation

- 5.8.3 Smart lawn mowers

- 5.8.4 Others (smart weather stations etc.)

- 5.9 Smart health & wellness system

- 5.9.1 Smart air quality monitors

- 5.9.2 Smart sleep monitors

- 5.9.3 Smart medicine dispensers

- 5.9.4 Others (smart fall detection systems etc.)

- 5.10 Smart energy & utility systems

- 5.10.1 Smart meters

- 5.10.2 Smart solar systems

- 5.10.3 Smart battery storage

- 5.10.4 Others (smart load controllers etc.)

- 5.11 Others (smart connectivity & control systems etc.)

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Wireless protocols

- 6.2.1 ZigBee

- 6.2.2 Wi-Fi

- 6.2.3 Bluetooth

- 6.2.4 Z Wave

- 6.2.5 Others

- 6.3 Wired protocols

- 6.3.1 Ethernet

- 6.3.2 Powerline communication (PLC)

- 6.4 Hybrid.

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low (below USD 500)

- 7.3 Medium (between USD 500 and USD 1,000)

- 7.4 High (above USD 1,000)

Chapter 8 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 New construction

- 8.3 Retrofit

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amazon

- 11.2 Bosch

- 11.3 Dyson

- 11.4 Ecobee

- 11.5 Google

- 11.6 Honeywell

- 11.7 iRobot

- 11.8 LG

- 11.9 Panasonic

- 11.10 Ring

- 11.11 Samsung

- 11.12 Schneider Electric

- 11.13 Siemens

- 11.14 Sonos

- 11.15 Xiaomi