|

市场调查报告书

商品编码

1871211

精准诊断及医疗市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Precision Diagnostics and Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

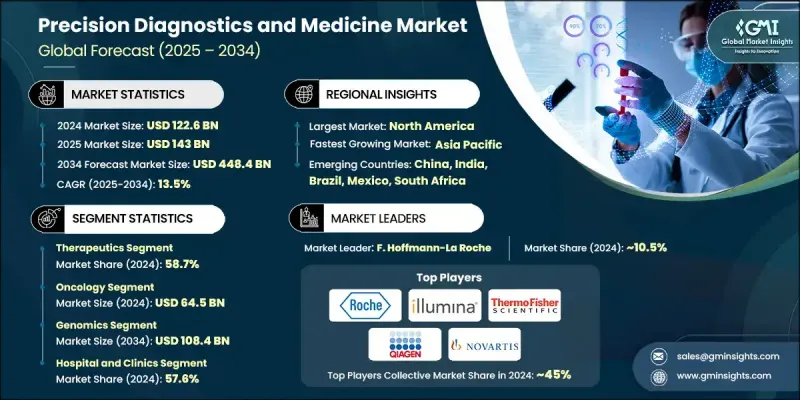

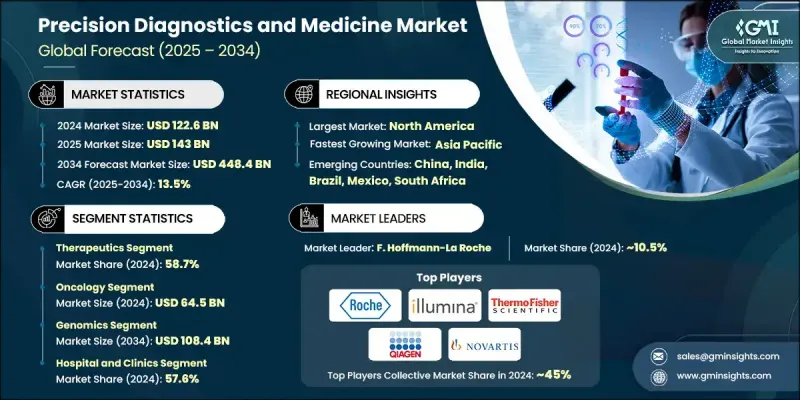

2024 年全球精准诊断和医疗市场价值为 1,226 亿美元,预计到 2034 年将以 13.5% 的复合年增长率增长至 4,484 亿美元。

精准医疗正在变革医疗保健,它将治疗模式从标准化转向基于个人基因谱、生活方式和环境的高度客製化方案。这种方法着重于个人化策略而非通用方案,进而改善多种疾病的治疗效果。数据驱动诊断技术的快速发展,以及对标靶治疗日益增长的需求,持续推动市场的发展。多组学平台的整合正在加速创新,为临床医生和研究人员提供对复杂生物系统的深入洞察。随着精准疗法的普及和监管框架的完善,全球范围内的精准医疗应用有望进一步扩大。医疗机构和生物製药公司正在携手合作,支持临床整合,而数位技术和伴随诊断则进一步强化了个人化治疗方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1226亿美元 |

| 预测值 | 4484亿美元 |

| 复合年增长率 | 13.5% |

2024年,治疗领域市占率达到58.7%,预计到2034年将以13.3%的复合年增长率成长。专注于设计针对个别患者情况的客製化疗法是推动这一增长的主要动力。细胞疗法、基因疗法和免疫标靶药物的进步正在重塑治疗方案,尤其是在复杂或罕见疾病方面。高昂的研发成本和高昂的药品定价仍然是该领域价值成长的主要驱动力。

预计到2034年,基因组学市场规模将达到1,084亿美元。基因组技术在理解特定基因变异如何影响疾病进展和治疗反应方面发挥着至关重要的作用。诸如新一代定序和全基因组分析等技术能够精确识别可标靶的突变。这显着提升了基因组学在药物研发和个人化治疗策略中的作用,并巩固了其在临床诊断和研究应用中的重要性。

2024年,北美精准诊断和医疗市场占43.5%的份额。该地区凭藉强大的医疗基础设施、高额的研发投入以及众多顶尖製药和生物技术公司,继续保持领先地位。有利的监管框架和大量的政府支出进一步推动了个人化医疗的创新。此外,伴随诊断的广泛应用和先进的基因组检测技术也巩固了该地区的市场地位。

引领精准诊断和医疗市场发展的领导企业包括Illumina、诺华、Cepheid(丹纳赫公司)、Qiagen、武田药品工业株式会社、辉瑞、罗氏、美国实验室控股公司(Labcorp)、赛默飞世尔科技、百时美施贵宝公司、葛兰素史克、安捷伦科技、阿斯潘特、安捷伦科技、阿斯特西古、安捷兰素史克、安捷伦科技、阿斯特西古、 Diagnostics、生物梅里埃、Natera、礼来公司、雅培和艾伯维。为了扩大市场份额,精准诊断和医疗市场的关键企业正致力于策略合作、伙伴关係和收购,以增强其产品线并实现技术能力的多元化。各公司正大力投资多组学平台、人工智慧驱动的资料分析和先进的基因组解决方案,以提高诊断的准确性和治疗的个人化。透过数据驱动模型提高临床试验的精确度并加快监管审批也是其核心策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 基因组学和生物技术的进步

- 慢性病和遗传性疾病盛行率不断上升

- 增加政府措施和资金投入

- 伴随诊断的普及应用

- 产业陷阱与挑战

- 个人化治疗和诊断成本高昂

- 有限的报销政策

- 复杂的调控通路

- 市场机会

- 迅速扩展到非肿瘤领域

- 新兴市场的成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 诊断

- 基因检测

- 基于生物标记的检测

- 神秘测试

- 其他诊断测试

- 疗法

- 抑制剂类药物

- 单株抗体

- 细胞和基因治疗

- 抗病毒药物和抗逆转录病毒药物

- 其他疗法

第六章:市场估算与预测:依指示剂划分,2021-2034年

- 主要趋势

- 肿瘤学

- 神经病学

- 传染病

- 免疫学

- 罕见疾病和遗传性疾病

- 心臟病学

- 其他迹象

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 基因组学

- 生物资讯学

- 巨量资料分析

- 生物标记检测

- 高通量筛选

- 其他技术

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 诊断实验室

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Agilent Technologies

- Abbott

- AbbVie

- AstraZeneca

- bioMerieux

- Bristol-Myers Squibb Company

- Cepheid (Danaher Corporation)

- Eli Lilly & Company

- F. Hoffmann-La Roche

- GlaxoSmithKline

- Illumina

- Laboratory Corporation of America Holdings (Labcorp)

- Myriad Genetics

- Novartis

- Natera

- Pfizer

- Qiagen

- Quest Diagnostics

- Takeda Pharmaceutical Company Limited

- Thermo Fisher Scientific

The Global Precision Diagnostics and Medicine Market was valued at USD 122.6 Billion in 2024 and is estimated to grow at a CAGR of 13.5% to reach USD 448.4 Billion by 2034.

Precision medicine is transforming healthcare by shifting from standardized treatments to highly tailored approaches based on an individual's genetic profile, lifestyle, and environment. This approach focuses on personalized strategies rather than generalized protocols, driving improved outcomes across various diseases. Rapid advancements in data-driven diagnostics, coupled with growing demand for targeted treatments, continue to shape the evolution of the market. Integration of multi-omics platforms is accelerating innovation, providing clinicians and researchers with detailed insights into complex biological systems. As precision therapies become more accessible and regulatory frameworks evolve to support quicker approval of innovative treatments, global adoption is poised to increase. Healthcare providers and biopharma companies are aligning efforts to support clinical integration, while digital technologies and companion diagnostics strengthen personalized treatment plans.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $122.6 Billion |

| Forecast Value | $448.4 Billion |

| CAGR | 13.5% |

In 2024, the therapeutics segment held 58.7% share and is forecasted to grow at a CAGR of 13.3% through 2034. The focus on designing therapies tailored to individual patient profiles is fueling this growth. Advances in cellular therapies, gene-based solutions, and immune-targeted drugs are reshaping treatment protocols, especially for complex or rare diseases. High development costs and premium drug pricing continue to drive value across this segment.

The genomics segment is anticipated to hit USD 108.4 Billion by 2034. Genomic technologies play a critical role in understanding how specific genetic variations affect disease progression and treatment response. Techniques such as next-generation sequencing and full genome analysis allow for precise identification of actionable mutations. This has significantly elevated the role of genomics in both drug development and personalized therapeutic strategies, reinforcing its significance in clinical diagnostics and research applications.

North America Precision Diagnostics and Medicine Market held 43.5% share in 2024. The region continues to lead the way, supported by robust healthcare infrastructure, high R&D investment, and the presence of top-tier pharmaceutical and biotech companies. Favorable regulatory frameworks and substantial government spending further support innovation in personalized healthcare. Additionally, the widespread availability of companion diagnostics and the presence of sophisticated genomic testing technologies contribute to the region's strong market position.

Leading companies shaping the Precision Diagnostics and Medicine Market include Illumina, Novartis, Cepheid (Danaher Corporation), Qiagen, Takeda Pharmaceutical Company Limited, Pfizer, F. Hoffmann-La Roche, Laboratory Corporation of America Holdings (Labcorp), Thermo Fisher Scientific, Bristol-Myers Squibb Company, GlaxoSmithKline, Agilent Technologies, Myriad Genetics, AstraZeneca, Quest Diagnostics, bioMerieux, Natera, Eli Lilly & Company, Abbott, and AbbVie. To expand their footprint, key players in the Precision Diagnostics and Medicine Market are focusing on strategic collaborations, partnerships, and acquisitions to enhance their product pipelines and diversify technological capabilities. Companies are investing heavily in multi-omics platforms, AI-powered data analytics, and advanced genomic solutions to improve the accuracy of diagnostics and personalization of treatments. Enhancing clinical trial precision and speeding regulatory approvals through data-driven models are also core strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Indication trends

- 2.2.4 Technology trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in genomics and biotechnology

- 3.2.1.2 Rising prevalence of chronic and genetic diseases

- 3.2.1.3 Increasing government initiatives and funding

- 3.2.1.4 Increased adoption of companion diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of personalized therapies and diagnostics

- 3.2.2.2 Limited reimbursement policies

- 3.2.2.3 Complex regulatory pathways

- 3.2.3 Market opportunities

- 3.2.3.1 Rapid expansion into non-oncology fields

- 3.2.3.2 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics

- 5.2.1 Genetic tests

- 5.2.2 Biomarker-based tests

- 5.2.3 Esoteric tests

- 5.2.4 Other diagnostic tests

- 5.3 Therapeutics

- 5.3.1 Inhibitor drugs

- 5.3.2 Monoclonal antibodies

- 5.3.3 Cell and gene therapy

- 5.3.4 Antiviral and anti-retroviral drugs

- 5.3.5 Other therapeutics

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Neurology

- 6.4 Infectious diseases

- 6.5 Immunology

- 6.6 Rare and genetic disorders

- 6.7 Cardiology

- 6.8 Other indications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Genomics

- 7.3 Bioinformatics

- 7.4 Big data analytics

- 7.5 Biomarker detection

- 7.6 High-throughput screening

- 7.7 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Abbott

- 10.3 AbbVie

- 10.4 AstraZeneca

- 10.5 bioMerieux

- 10.6 Bristol-Myers Squibb Company

- 10.7 Cepheid (Danaher Corporation)

- 10.8 Eli Lilly & Company

- 10.9 F. Hoffmann-La Roche

- 10.10 GlaxoSmithKline

- 10.11 Illumina

- 10.12 Laboratory Corporation of America Holdings (Labcorp)

- 10.13 Myriad Genetics

- 10.14 Novartis

- 10.15 Natera

- 10.16 Pfizer

- 10.17 Qiagen

- 10.18 Quest Diagnostics

- 10.19 Takeda Pharmaceutical Company Limited

- 10.20 Thermo Fisher Scientific